Bitcoin (BTC) continues to be trending up since mid-This summer, even though the current climbing funnel formation holds $21,100 support. This pattern continues to be holding for 45 days and may potentially drive BTC towards $26,000 by late August.

Based on Bitcoin derivatives data, investors are prices greater likelihood of a downturn, but recent enhancements in global economic perspective usually takes the bears unexpectedly.

The correlation to traditional assets may be the primary supply of investors’ distrust, particularly when prices in recession risks and tensions between your U . s . States and China in front of House Speaker Nancy Pelosi’s trip to Taiwan. Based on CNBC, Chinese officials threatened to do this if Pelosi moved on.

The U.S. Federal Reserve’s recent rate of interest hikes to curb inflation introduced further uncertainty for risk assets, restricting crypto cost recovery. Investors are betting on the “soft landing,” meaning the central bank can progressively revoke its stimulus activities without causing significant unemployment or recession.

The correlation metric varies from an adverse 1, meaning select markets relocate opposite directions, to some positive 1, which reflects an ideal and symmetrical movement. A disparity or too little relationship backward and forward assets could be symbolized by .

As displayed above, the S&P 500 and Bitcoin 40-day correlation presently is .72, that has been standard within the last four several weeks.

On-chain analysis corroborates longer-term bear market

Blockchain analytics firm Glassnode’s “A Few Days On Chain” report from August. 1 highlighted Bitcoin’s weak transaction and also the interest in block space resembling the 2018–19 bear market. Case study suggests a pattern-breaking pattern could be needed to signal new investor intake:

“Active Addresses [fourteen days moving average] breaking above 950k would signal an uptick in on-chain activity, suggesting potential market strength and demand recovery.”

While blockchain metrics and flows are essential, traders also needs to track how whales and market markers are situated within the futures and options markets.

Bitcoin derivatives metrics show no indications of “fear” from pro traders

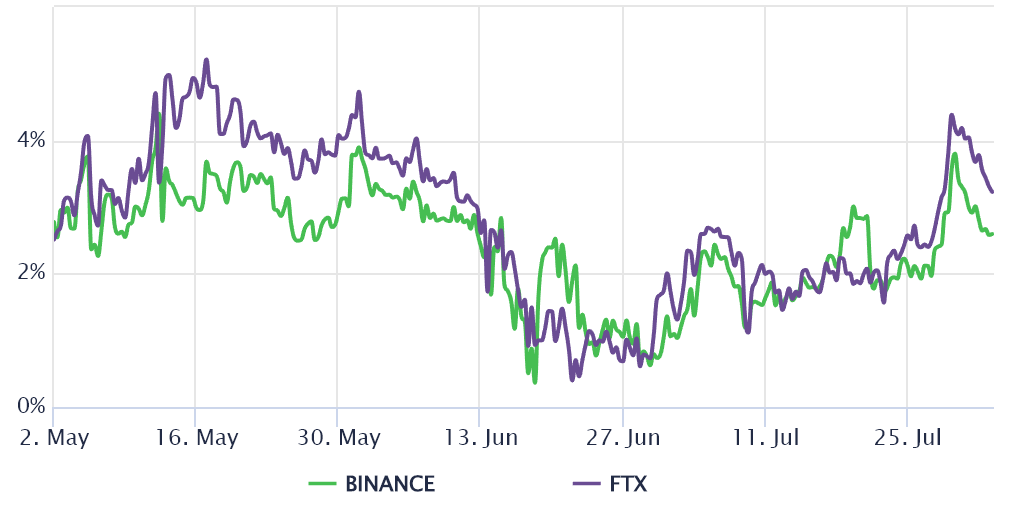

Retail traders usually avoid monthly futures because of their fixed settlement date and cost difference from place markets. However, arbitrage desks and professional traders go for monthly contracts because of the insufficient a fluctuating funding rate.

These fixed-month contracts usually trade in a slight premium to regular place markets as sellers require more money to withhold settlement longer. Technically referred to as “contango,” this case isn’t only at crypto markets.

In healthy markets, futures should trade in a 4% to eightPercent annualized premium, enough to pay for that risks plus the price of capital. However, based on the above data, Bitcoin’s futures premium continues to be below 4% since June 1. The studying isn’t particularly concerning considering that BTC is lower 52% year-to-date.

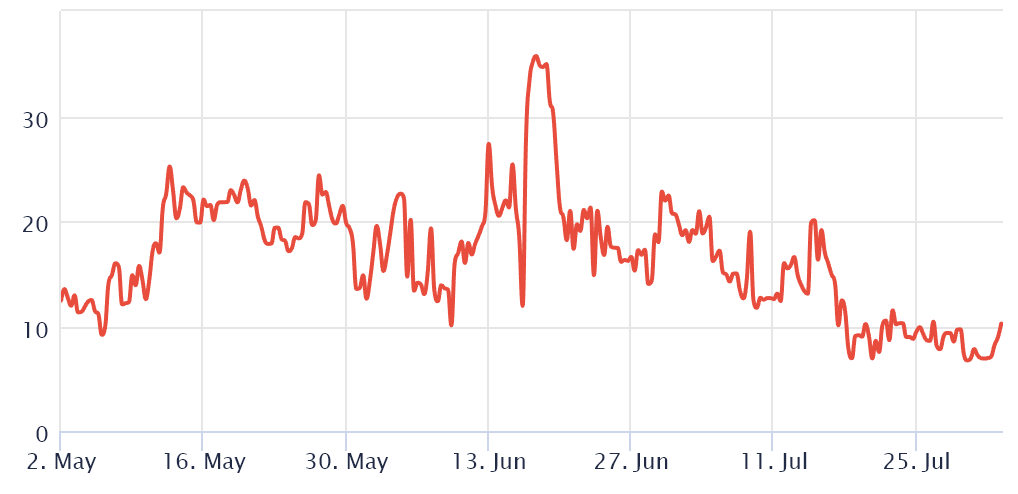

To exclude externalities specific towards the futures instrument, traders should also evaluate Bitcoin options markets. For example, the 25% delta skew signals when Bitcoin whales and market makers are overcharging for upside or downside protection.

If option investors fear a Bitcoin cost crash, the skew indicator would move above 12%. However, generalized excitement reflects an adverse 12% skew.

The skew indicator continues to be below 12% since This summer 17, considered an unbiased area. Consequently, options traders are prices similar risks for bullish and bearish options. Not really the retest from the $20,750 support on This summer 26 was enough to instill “fear” in derivatives traders.

Bitcoin derivatives metrics remain neutral regardless of the rally toward $24,500 on This summer 30, suggesting that professional traders aren’t positive about a sustainable upward trend. Thus, data implies that an unpredicted move above $25,000 would take professional traders unexpectedly. Going for a bullish bet might appear contrarian at this time, but concurrently, it makes a fascinating risk-reward situation.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision