The atmosphere over the cryptocurrency ecosystem is noticeably better on This summer 22 following a week of gains helped traders place the occasions of history two several weeks in it and appear toward an optimistic future.

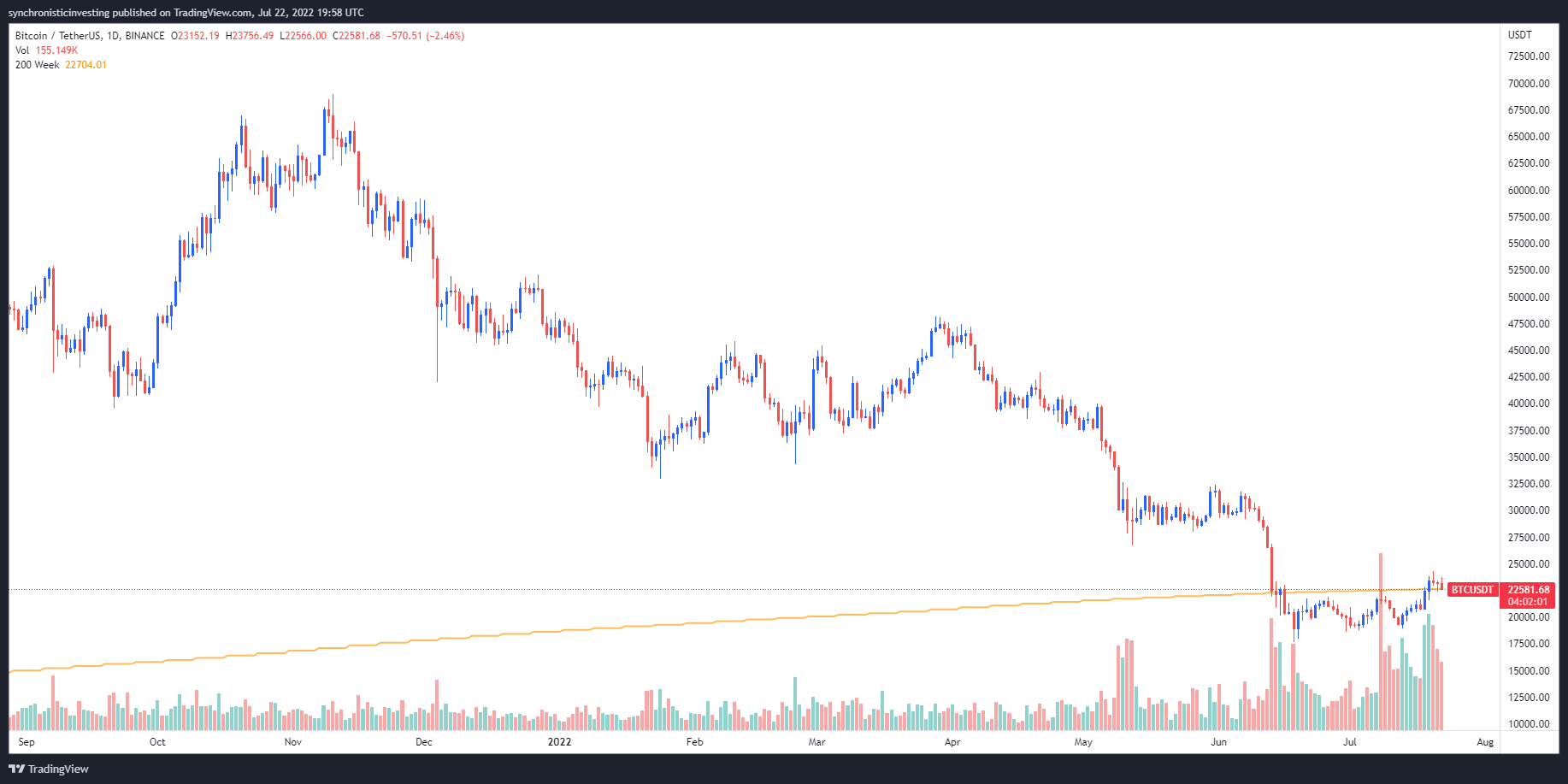

Data from Cointelegraph Markets Pro and TradingView implies that the cost of Bitcoin (BTC) continues to be oscillating around support at $23,000 in the last day or two and is constantly on the hold slightly above its 200-week moving average (MA), that has been a dependable indicator of bear market bottoms previously.

Because the debate concerning the market’s direction is constantly on the rage, listed here are the key levels to look at heading in to the weekend, based on analysts.

Bitcoin needs weekly close above $22,800

The value of Bitcoin buying and selling above its 200-week MA was noted by independent market analyst Michaël van de Poppe, who published the next chart highlighting the main support and resistance zones:

Based on van de Poppe, Bitcoin is “facing crucial resistance again” at $23,500, and just what happens next determines if it is cost heads greater or pulls to support at $21,500. He described:

“If that breaks at $23.8K, I am presuming we’ll continue after which $28K is around the tables, but we have a obvious breakout over the 200-Week MA confirmed.”

The significance of BTC holding over the 200-week MA was further addressed by market analyst Rekt Capital, who highlighted the requirement for Bitcoin to determine an every week close above $22,800:

#BTC is see-sawing round the 200-week MA all week

The most crucial factor would be the confirmation in accordance with the 200-week MA by means of an every week Candle Close

The 200-week MA represents the cost reason for $22800$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) This summer 22, 2022

Anticipating a large move

The current cost action is an indication that “a big move for #BTC will happen soon,” based on crypto trader and pseudonymous Twitter user CryptoGodJohn, who provided the next chart outlining two possible pathways Bitcoin might take:

CryptoGodJohn stated:

“Break above and hold $24,200. I believe we squeeze to $27K–$28K fairly rapidly. When we start accepting into the range, I’m searching for any flush lower to $20K. Pretty easy invalidation on, stay safe.”

Related: Pro Bitcoin traders are uncomfortable with bullish positions

The potential of moving either in direction seemed to be noted through the Twitter user Mayne, who published the next chart addressing the “potential range break out” for Bitcoin.

They further described: “Upside might be juicy when we holds above $22.5k/range high. Lose the number high, it was likely a deviation. The move above range high becomes your risk while you target shorts into the range.”

Ensure that is stays simple

For individuals who will probably accumulate and hodl instead of focusing at the time-to-day cost movements of Bitcoin, market analyst Caleb Franzen offered the next insight to when it might be a great time to dollar-cost average:

#Bitcoin analysis with monthly candle lights & the 12-month Johnson%R Oscillator.

Once the W%R becomes “oversold” on the 1-year basis, it signals a build up zone. If this crosses over the oversold threshold, the bull market stampedes.

We are within the accumulation zone since May’22. pic.twitter.com/kBrk23PA9F

— Caleb Franzen (@CalebFranzen) This summer 22, 2022

The general cryptocurrency market cap now is $1.048 trillion and Bitcoin’s dominance rates are 42%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.