Bitcoin (BTC) rallied on the rear of the U . s . States stock market’s 3.4% gains on March. 28, using the S&P 500 index rising to the greatest level in 44 days. Additionally, lately released data demonstrated that inflation may be slowing lower, which gave investors hope the Fed might break its pattern of 75 basis-point rate hikes after its November meeting.

In September, the U.S. core personal consumption expenses cost index rose .5% in the previous month. Although still a rise, it had been consistent with expectations. This information is the government Reserve’s primary inflation measure for rate of interest modeling.

Additional positive news originated from tech giant Apple, which reported weak iPhone revenues on March. 27 but beat Wall Street estimates for quarterly earnings and margin. Furthermore, Apple chief financial officer Luca Maestri stated services would grow year-over-year within the 4th quarter.

Bitcoin futures data shows reluctant buyers

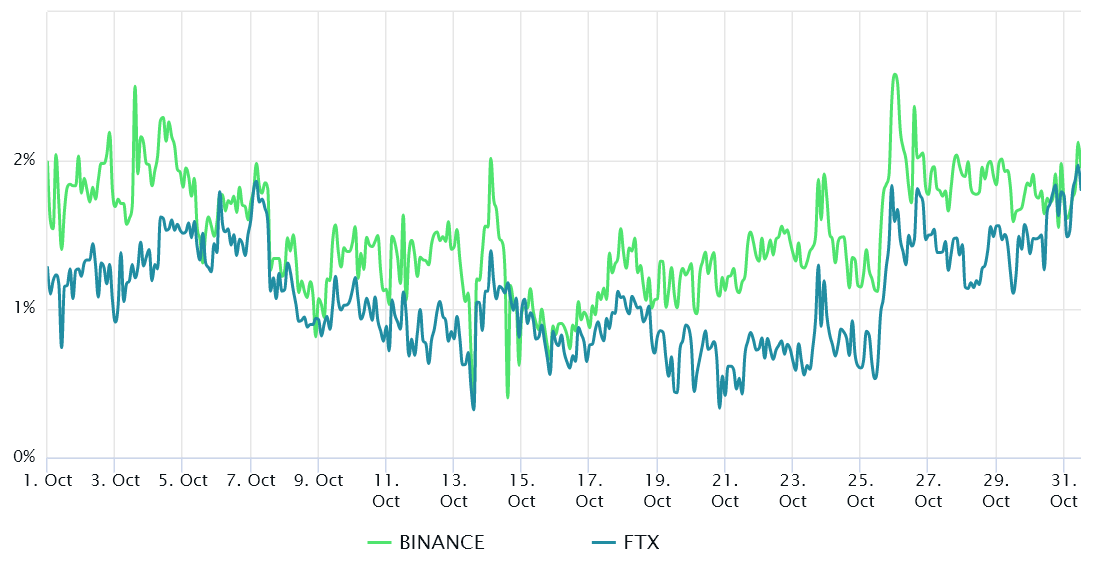

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Still, they’re professional traders’ preferred instruments simply because they avoid the perpetual fluctuation of contracts’ funding rates.

These fixed-month contracts usually trade in a slight premium to place markets because investors require more money to withhold the settlement. However this scenario is not only at crypto markets, so futures should trade in a 4%–10% annualized premium in healthy markets.

Bitcoin’s futures premium has was below 2% within the last thirty days, signaling an entire insufficient interest from leverage buyers. In addition, there wasn’t any significant step up from March. 29 as BTC rallied toward the $21,000 resistance.

The bottom line is, derivatives traders are not even close to positive about Bitcoin’s cost regardless of the inexpensive of adding bullish positions. Still, you have to also evaluate the BTC margin markets to exclude externalities specific towards the futures instrument.

Derivative traders are reluctant to put bullish bets

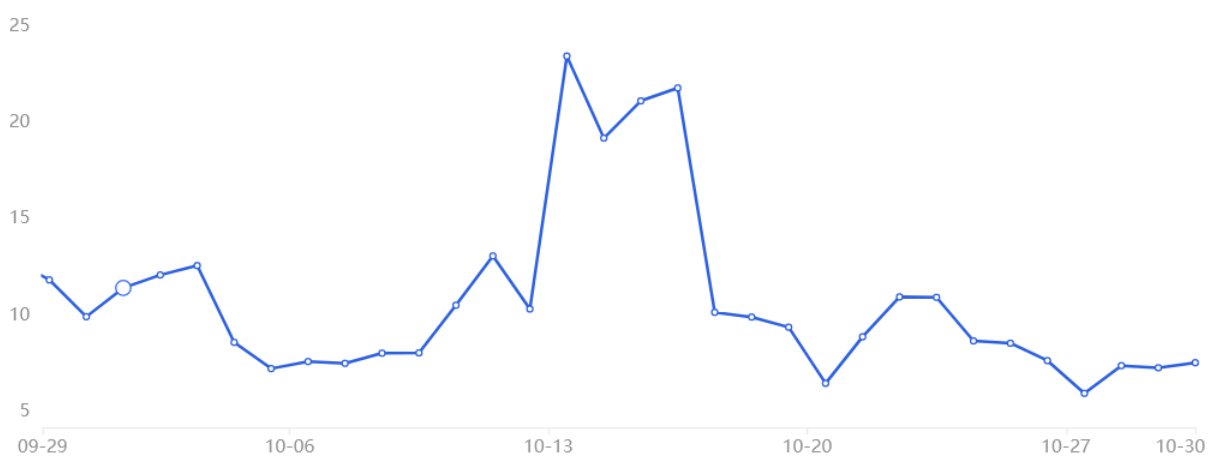

Margin buying and selling enables investors to gain access to cryptocurrency to leverage their buying and selling position, potentially growing their returns. For instance, it’s possible to buy Bitcoin by borrowing Tether (USDT), thus growing their crypto exposure. However, borrowing Bitcoin are only able to be employed to short it — betting around the cost decrease.

Unlike futures contracts, the total amount between margin longs and shorts isn’t always matched. Once the margin lending ratio is high, it signifies the marketplace is bullish — the alternative, a minimal lending ratio, signals the marketplace is bearish.

The chart above implies that investors’ morale capped on March. 13 because the ratio arrived at 23.5, that is rarely sustainable for extended-term periods. From there forward, OKX traders presented less interest in borrowing Tether, solely accustomed to bet around the cost upward trend.

Still, the ratio presently is 7.5, leaning bullish in absolute terms, because it favors stablecoin borrowing with a wide margin. It’s worth highlighting that no sentiment change happened despite Bitcoin’s 7.5% weekly rally between March. 24 and March. 31.

Too little excitement does not necessarily mean bearishness

Derivatives data shows no demand from buyers even while Bitcoin flirted with $21,000 on March. 29. Unlike retail traders, these experienced whales have a tendency to anticipate movements by keeping their conviction even if markets slowly move the other way.

The above mentioned data shows that traders expecting Bitcoin to interrupt above $21,000 for the short term will probably be disappointed. However, on the positive note, there’s been no manifestation of bears getting good confident, as both futures and margin markets remain neutral to bullish.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.