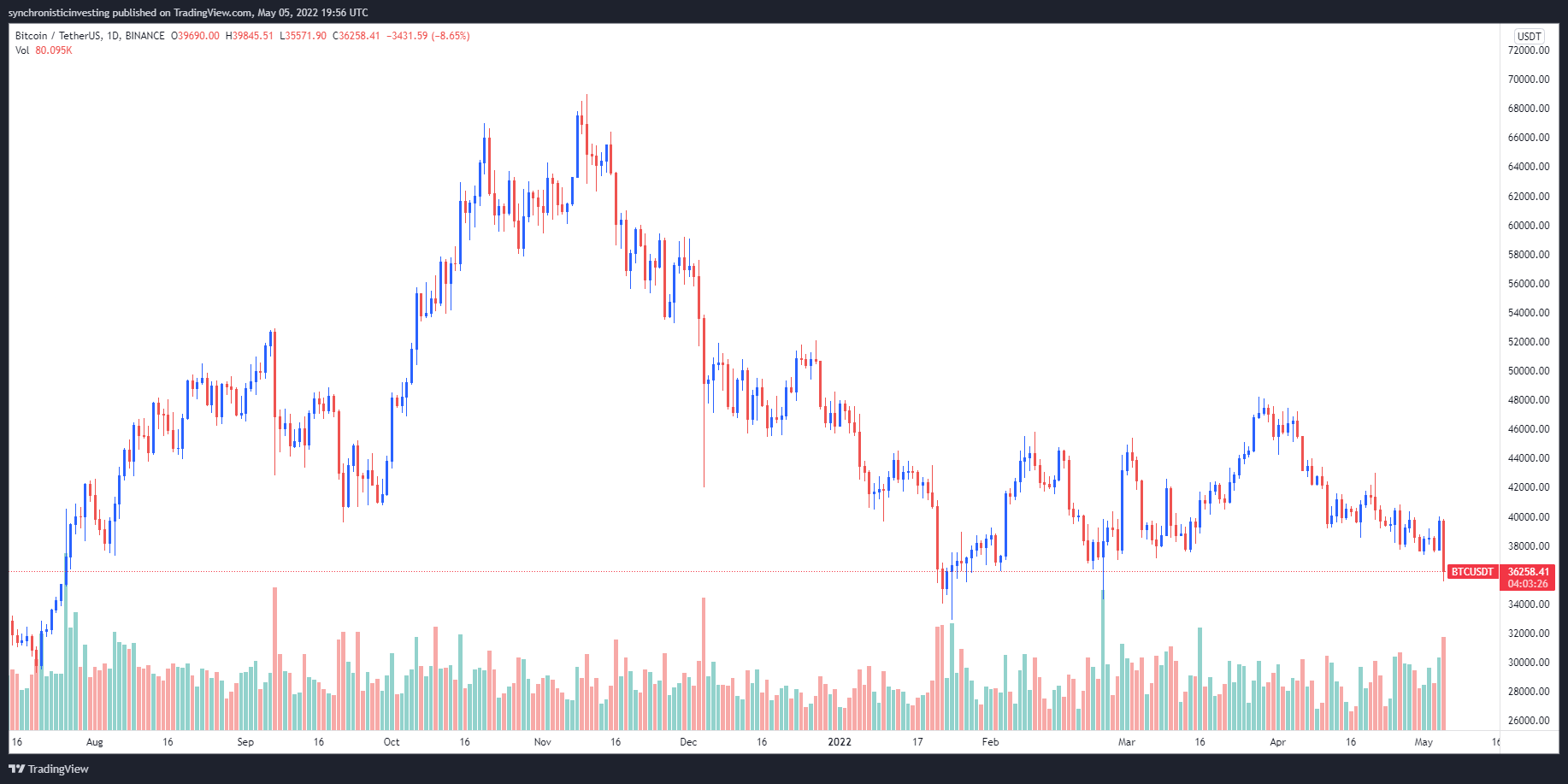

Global markets stepped into disarray on May 5 as the Dow jones Johnson saw single,063 point drop and Bitcoin (BTC) cost plummeted to $35,571 on Binance.

The prevalent weakness may come as traders have experienced additional time to digest the current half-point rate of interest hike through the Fed, the biggest hike since 2000, that was done so that they can corral record high inflation.

Data from Cointelegraph Markets Pro and TradingView implies that the mid-day dump within the cost of BTC coincided having a sell-off within the tech sector, which escalated in to the close from the traditional markets.

Here’s a glance at what market analysts say about May 5’s market rout and just what levels Bitcoin cost could drop to soon.

Bears rule until $37,500 is reclaimed

Based on independent market analyst Michaël van de Poppe, the zone that defines bulls and bears is really a close below or above $37,500.

Van de Poppe stated,

“Then I am presuming we’ll test $39,000 again as there is a big gap among. Under $37,500, nothing to say of bullish perspectives.”

Analysts say your investment daily and concentrate on the weekly

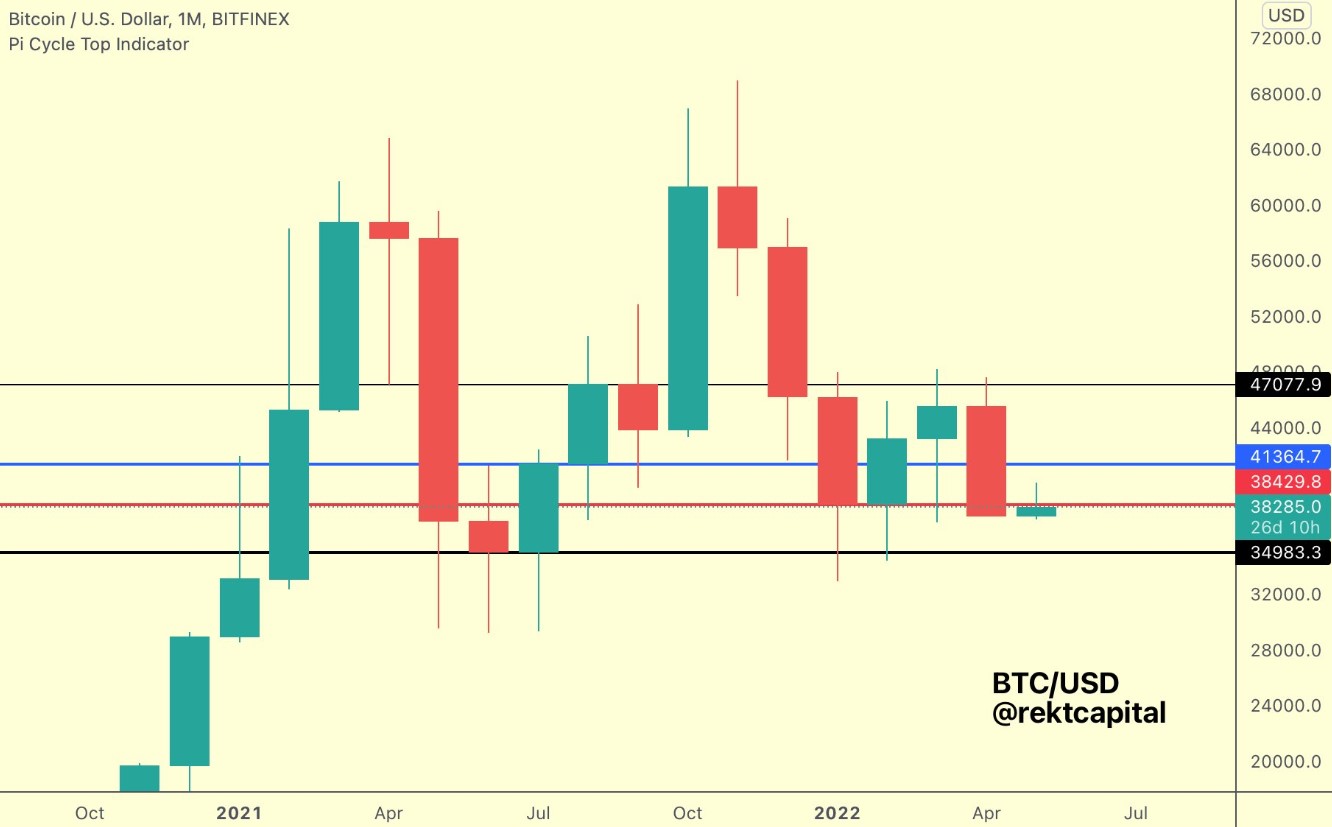

Understanding of how Bitcoin is faring around the monthly chart was supplied by market analyst and pseudonymous Twitter user Rekt Captial, who published the next chart identifying $38,400 because the new level of resistance for bulls.

Rekt Capital stated,

“Wouldn’t be amazed to determine volatility around red throughout May. Monthly Close above red is what’s most significant to verify a reclaim of red as support.”

Related: Bitcoin cost hits 10-week lows as $40K spike becomes ‘nasty bull trap’

Will whales contain the this key support level?

Data about how Bitcoin whales happen to be behaving throughout the recent market volatility was discussed by Whalemap, an on-chain data firm, which recommended that the “previous whale inflows at $46,551 were becoming a precise resistance along with a temporary mid-term top for Bitcoin’s range.”

Whalemap stated,

“Now an identical resistance has made an appearance at $44,355 as a result of similar sized whale wallet. This ought to be our mid-term resistance if BTC will get there.”

The general cryptocurrency market cap now is $1.66 trillion and Bitcoin’s dominance rates are 41.5%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.