Bitcoin (BTC) battled to recuperate its latest losses on May 21 after Wall Street buying and selling provided zero respite.

BTC cost reflects drab stocks performance

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD buying and selling at dipping below $28,700 in to the weekend, subsequently adding around $500.

Lower 4.7% in the previous day’s $30,700 highs, the happy couple looked firmly rangebound during the time of writing after U . s . States stocks indices saw an unpredictable final buying and selling day.

The S&P 500, were able to reverse after initially falling in the open, nevertheless confirmed bear market habits, buying and selling at 20% below its highs from this past year.

The S&P 500 has formally joined a bear market pic.twitter.com/N1lrcBdziT

— Fintwit (@fintwit_news) May 20, 2022

“Another crazy day in the stock exchange. Dow jones Johnson -500 in the morning, then recovers everything and closes +8,” popular Twitter account Blockchain Backers commented about broader U.S. market performance.

As Cointelegraph reported, various sources had known as for Bitcoin to fall once more inside a manner much like last week’s capitulation event.

Ongoing the conservative macro outlook, fellow Twitter commentator PlanC contended that exterior shifts could still bring Bitcoin lower considerably from current levels.

“When the Crypto market is at a bubble I’d say 25k to 27.5k may be the Bitcoin bottom, but there’s a good probability that macro factors drag us lower to 22-24k. Significant black swan, 15-20k turns into a possibility,” a part of a tweet at the time read.

Beyond stocks, the U.S. dollar index (DXY) was consolidating following a strong retracement from twenty-year highs.

May competes with 2021 for worst on record

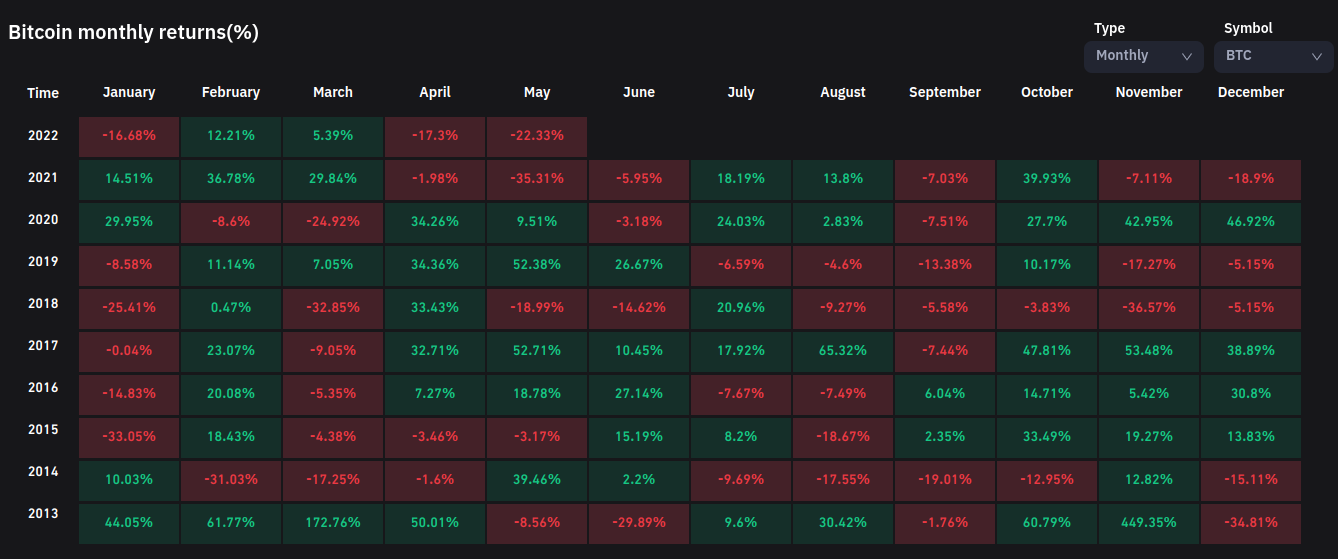

With 10 days left before the finish from the month, BTC/USD risked May 2022 to be the worst when it comes to returns in the history.

Related: Bitcoin must defend these cost levels to prevent ‘much deeper’ fall: Analysis

Data from on-chain analytics resource Coinglass demonstrated month-to-date returns presently totaling -22% for Bitcoin, the biggest retreat associated with a year except 2021’s -35%.

2022, the collective figures confirmed, seemed to be the worst performing first five several weeks of the season for Bitcoin since 2018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.