As Bitcoin (BTC) and also the broader crypto market are attempting to recover after diving below crucial levels earlier this weekend, analysts are digging into data, attempting to find out the next steps on the market.

“The selloff over the past weekend can be viewed as to possess stepped profitability and investors right into a in the past significant amount of financial discomfort,” crypto analytics firm Glassnode stated within their report today.

Based on them, with forced sellers appearing they are driving a lot of the current sell-side, the marketplace might start to eye whether signals of seller exhaustion are emerging within the coming days and several weeks.

“Because of the tighter correlation between traditional markets such as the New york stock exchange, the Nasdaq, and also the crypto markets, I do not think the [BTC] bottom is within. I believe a couple of things have to happen for that bottom hitting: 1. Inflation must ease, 2. Unemployment must stabilize and three. Less strong US dollar,” Shayne Higdon, Co-Founder and Chief executive officer from the HBAR Foundation, stated within an emailed comment.

On Monday at 16:01 UTC, bitcoin traded at USD 20,786, up 4% within the last 24 hrs and lower 22% within the last seven days. Simultaneously, ethereum (ETH) was at USD 1,132, up 6% during the day and lower almost 22% for that week.

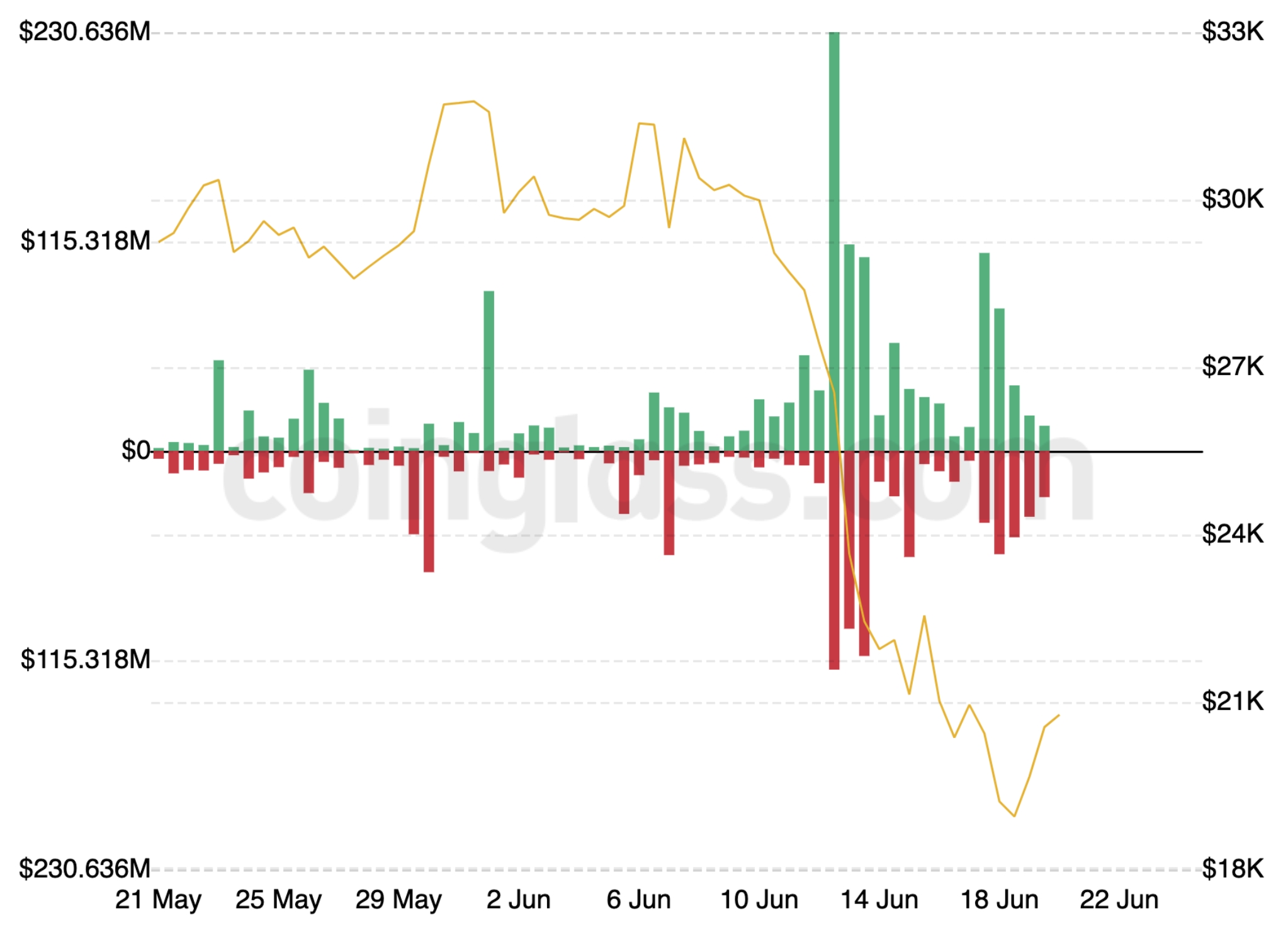

Although bitcoin continued to be in positive territory within the last 24 hrs, the low prices earlier within the weekend caused relatively large liquidations of leveraged traders who have been lengthy. According to data from Coinglass, near to USD 109m were liquidated within the 12 hrs between night time and noon on Saturday within the bitcoin market alone.

Particularly, however, the liquidations remained as smaller sized compared to massive lengthy liquidations seen on June 13, when BTC fell from USD 26,000 close to the USD 22,000 level.

Marcus Sotiriou, an analyst at digital asset broker GlobalBlock, noticed that many altcoins haven’t seen liquidations in the same higher level as BTC and ETH, with a few altcoins even showing strength.

“This happens because bitcoin and ethereum would be the primary purposes of collateral for leveraged positions, and also the fact we are able to see on-chain the different liquidation prices implies that a cascade lower could be premeditated,” Sotiriou authored inside a market commentary today.

He further added that this may be grounds why big buyers haven’t yet walked up to benefit from the low prices in BTC and ETH, saying “major buyers can easily see other peoples’ liquidation levels.”

Particularly, liquidations over the past weekend also brought to some historic loss for bitcoin holders, based on Sotiriou. Citing on-chain data from Glassnode, the analyst stated this liquidation cascade brought towards the largest recognized reduction in USD terms in Bitcoin’s history, with more than USD 7.325bn in losses recognized by investors.

He added that on-chain data also implies that BTC holders with 1-year-old coins “capitulated” over the past weekend.

Meanwhile, the lengthy-term holder (LTH) supply has declined by BTC 178,000 during the last week, equal to 1.31% of the total holdings, Glassnode stated, noting the current spending behavior by LTHs taking losses coincides with March 2020 however is not as severe because the 2015 or 2018 bear market lows.

Miners pressurized

On-chain data a few days ago also established that Bitcoin miners came under a great deal larger pressure which many have selected to show business machines.

The bitcoin on-chain analyst Will Clemente from the mining and equipment provider Blockware Solutions commented around the data and stated the mixture of a lesser BTC cost, greater difficulty, and greater energy costs “have put serious pressure on miners’ margins.”

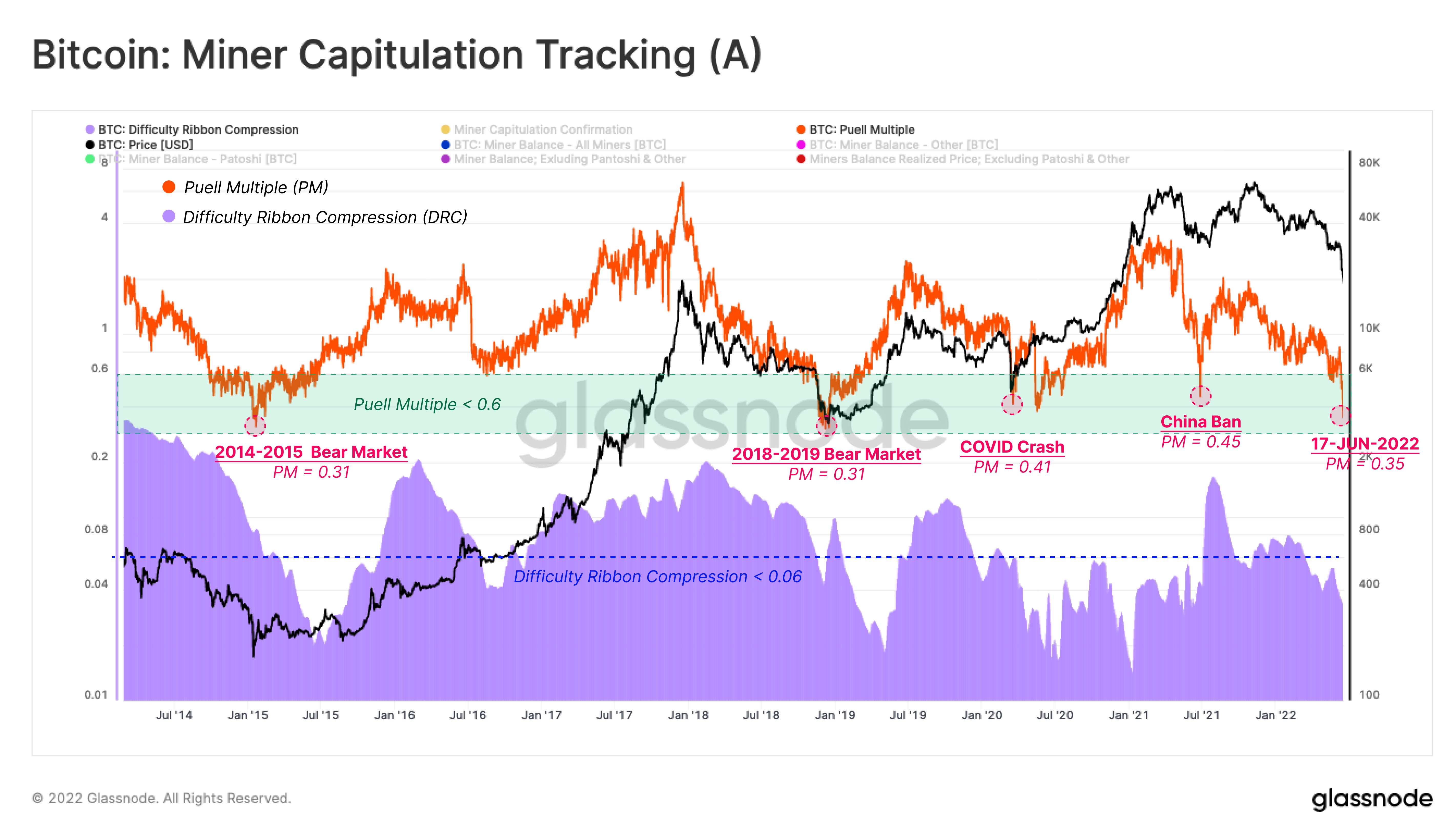

Glassnode added that miner capitulation has become “happening in tangible-time”:

“Miners are actually under significant financial pressure, with BTC buying and selling close to the believed price of production, incomes well below their yearly average, and hash-rate noticeably coming off [all-time highs].”

While using Puell Multiple, an oscillator tracking miner USD denominated earnings, and also the Difficulty Ribbon Compression model, Glassnode figured that the contraction in miner earnings is worse than “Great Migration in May-This summer 2021,” when miners left China carrying out a ban there.

Still, “miners have faced worse days in 2018-2019 and 2014-2015 bear markets, in which the Puell Multiple arrived at .31,” Glassnode stated.

BTC funds see inflows

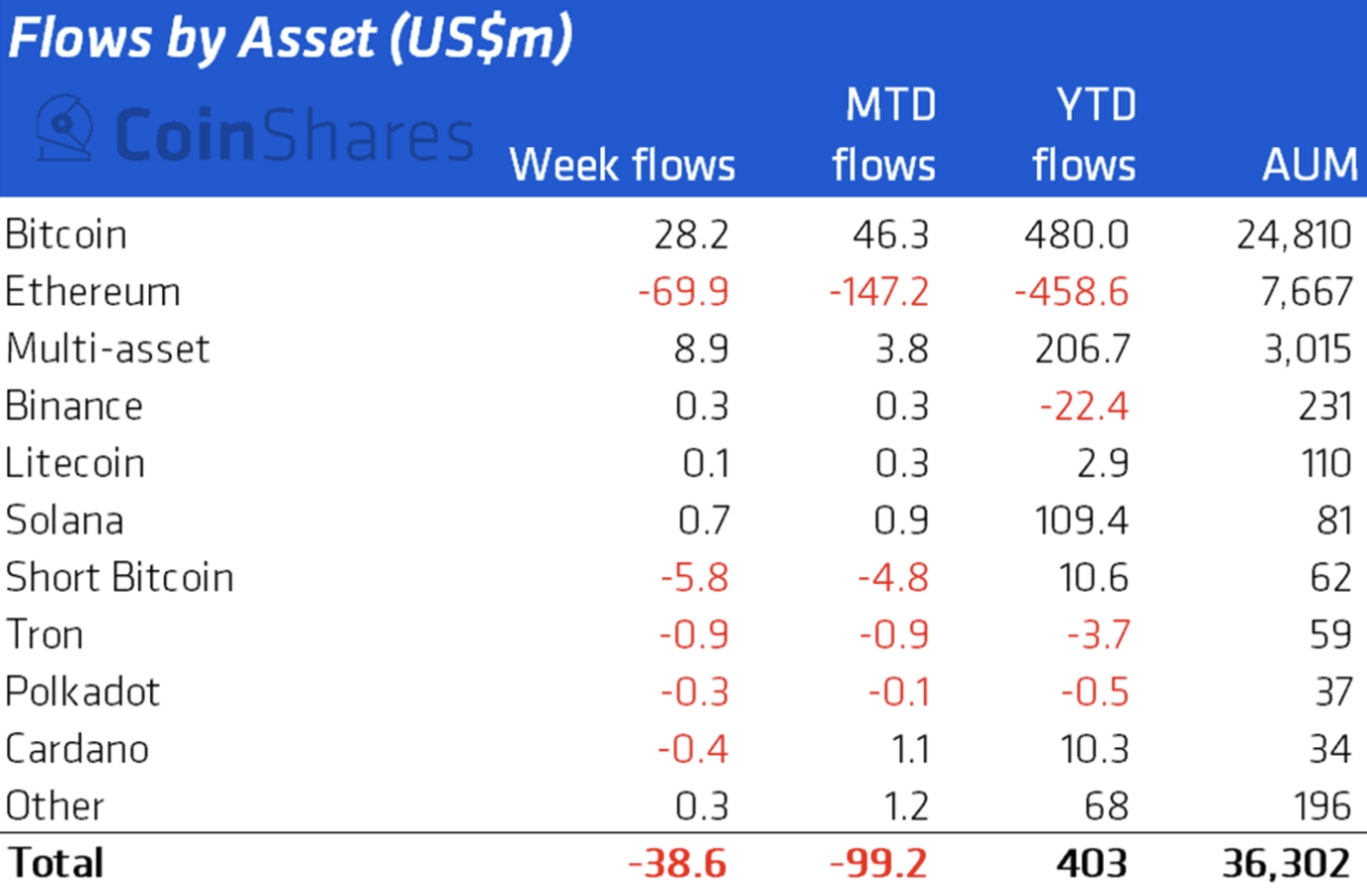

Meanwhile, the most recent data from CoinShares once more demonstrated outflows from controlled crypto-backed investment funds.

Overall, USD 38.6m left crypto investment funds a week ago, with USD 69.9m departing ETH-backed funds alone. Still, the general figure improved because of inflows in BTC-backed funds in excess of USD 28m, additionally to smaller sized inflows into multi-asset crypto funds.

The inflows a week ago mark a reversal in the week prior when USD 102m were brought out of crypto-backed funds and USD 57m left BTC-backed funds.

Hunting for a bottom

Commenting around the broader outlook for that market on Monday, Jason Choi, an angel investor and former general partner at crypto hedge fund Spartan Group, hinted the crypto market might have arrived at peak bearishness.

“Not saying it has happened to but peak sentiment such as this frequently setup hated rallies,” Choi authored on Twitter, suggesting that funds which are now located on losses have to take part in potential rallies to be able to remain in business.

An identical sentiment may be observed in your comments ought to from crypto trader Alex Krüger, who authored that the dip underneath the USD 20,000 level for BTC and USD 1,000 level for ETH would for a lot of now represent buying possibilities.

This marks a shift from a week ago whenever a dip underneath the same levels would only cause further selling from “panic sellers, forced sellers and breakout sellers,” Krüger authored on Twitter.

He added that the amount of stop-losses underneath the USD 20,000 for bitcoin is “very small in accordance with what it really was before.”

“Many traders much like me shorted 20k and will not be shorting 20k again because the reduced existence of stops makes shorting significantly less attractive,” the crypto trader authored.

Lastly, Nik Bhatia, a finance professor in the College of Los Angeles and author from the bitcoin book Layered Money, advised his e-newsletter readers this is way from the very first time that bitcoin encounters a selloff of the magnitude.

“Bitcoin has faced 12 drawdowns of the same magnitude in the history, but it’s still here,” Bhatia authored inside a e-newsletter.

He added that although bitcoin might not be behaving just like a safe-haven asset now, still it remains a secure haven from “central bank cronyism, authoritarian transaction controls, and currency debasement.”

____

Find out more:

– US Given the reason for Downturn, Large Crypto Players Have Responsibility Toward Ecosystem – FTX Chief executive officer

– Bitcoin Better at Tackling Rate Hikes than Ethereum, Stocks – Report

– Bancor Pauses Protection Mechanism Because of ‘Hostile Market Conditions’

– BlockFi, Crypto.com, yet others Come Forward as Three Arrows Hires Advisors, Babel Finance Pauses Withdrawals

– Insufficient Liquidity for Celsius to market Staked Ethereum in Open Market – Analyst

– Another Elon Musk-fueled DOGE Rally Ends Having a Dump

– ‘The Reckoning’ & ‘The Best Time’ to go in Bitcoin Mining as Firms Diversify Among Bear Market

– Ethereum Steps on Another Delay Explosive device