The bitcoin (BTC) and crypto market received heavy selling pressure on Monday, fueled by fears in almost all global risk markets associated with high inflation and just what the US Fed (Given) might do in order to tame it. Simultaneously, the drama surrounding crypto lending platform Celsius (CEL) is adding fuel towards the fire.

At 10:12 UTC, bitcoin (BTC) was lower 12% in the last 24 hrs and 19% in the last seven days to USD 24,140, or even the level last observed in December 2020. Simultaneously, ethereum (ETH) was at USD 1,246, lower 15% during the day and 31% for that week, revisiting its lows observed in The month of january 2021.

BTC past fourteen days:

The crash within the crypto market came as global stocks also offered off heavily, with stocks in Japan closing lower 3% on Monday, and S&P 500 index futures during the time of writing pointing for an opening cost on Wall Street 2.3% below Friday’s close.

Coinciding using the crypto selloff today was news from Celsius the platform had stopped all crypto withdrawals for clients. This news uses rumors had circulated online to have an longer timeframe that the organization is facing problems and could be unable to meet its customer obligations.

During the time of writing, the platform’s token CEL is lower by near to 54% within the last 24 hrs alone, buying and selling in a cost of USD .193. In the last year, the token has become lower an astonishing 97%, per CoinGecko data.

Given fears

Meanwhile, another answer to fears which have taken your hands on global markets now’s the presently high inflation in america, that has proven no indications of reaching an optimum yet. On Friday a week ago, US inflation for May hit 8.6%, greater compared to 8.3% analysts had expected.

Using the Given set to announce its next rate of interest adjustment on Wednesday now, traders are more and more nervous the central bank will hike rates by 75 basis points as opposed to the 50 points which was broadly expected.

Writing in the latest e-newsletter from Sunday, Nik Bhatia, a finance professor in the College of Los Angeles and author from the popular bitcoin book Layered Money, described the 2-year Treasury yield still signifies the Given will keep a number of 50 basis point hikes this summer time.

However, there’s also signs that some traders are speculating on “75 basis point hikes throughout the summer time,” Bhatia authored.

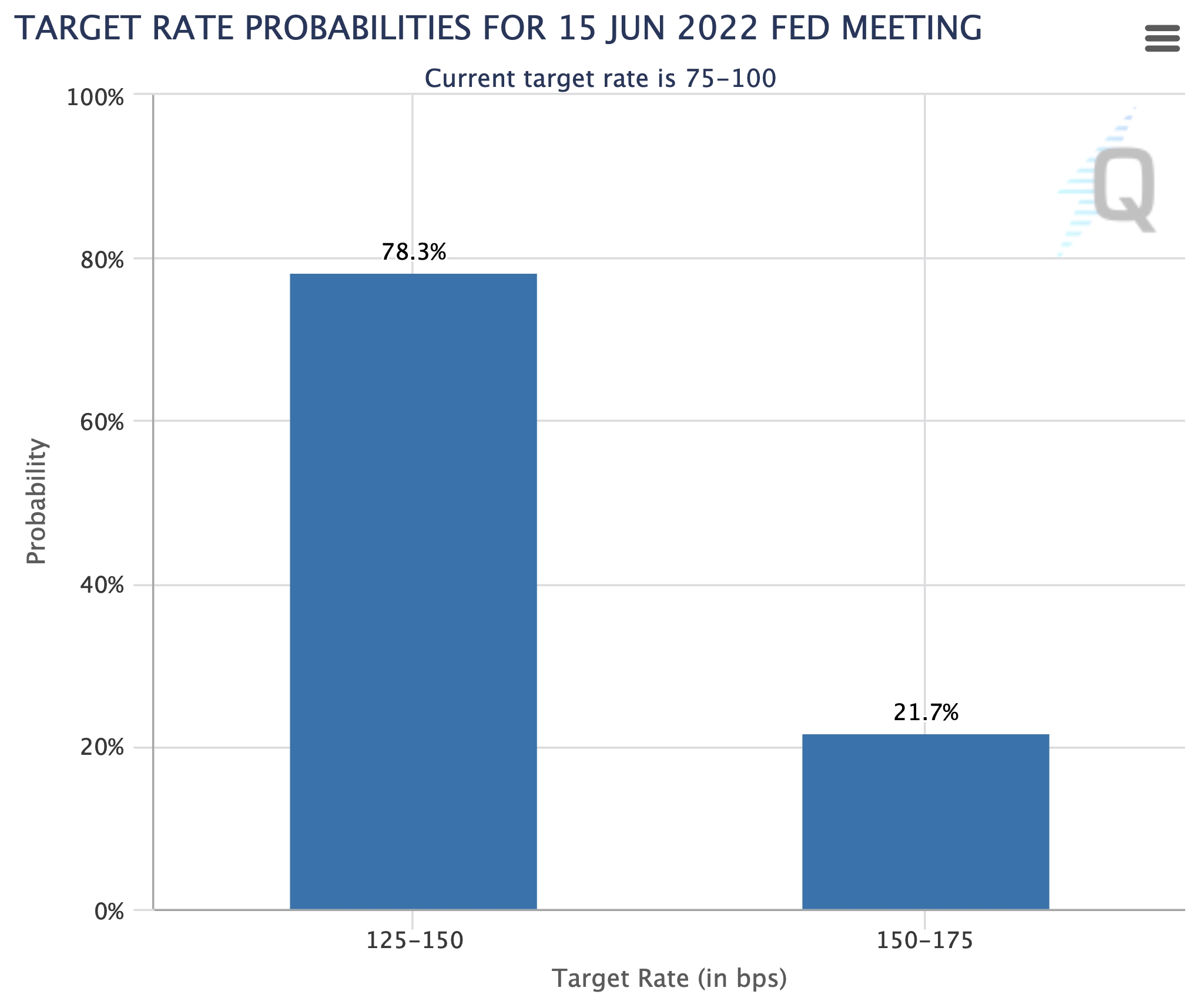

The growing risk for any 75-basis point rate hike now may also be observed in buying and selling data from derivatives exchange CME Group, which during the time of writing indicated a 21.7% possibility of a 75-basis point hike, versus a 78.3% possibility of a 50-point hike.

Knowing from screenshots published to Twitter, however, the risk of a 75 basis point hike has already been lower from greater than 40% on Sunday.

Still light in the finish from the tunnel

Still, there’s light within the tunnel for individuals awaiting the Given to pause its rate hikes, even though it may appear a long way away, Goldman Sachs strategists stated inside a recent note.

“At some time, financial conditions will tighten enough and/or growth will weaken enough so that the Given can pause from hiking. But we still appear far from there, which implies upside risks to bond yields, ongoing pressure on dangerous assets, and sure broad US dollar strength for the time being,” the note was quoted by Bloomberg as saying.

Meanwhile, leading voices from the crypto community on Twitter will work to help keep the spirit up by discussing their very own positive assumes the lengthy-term outlook for Bitcoin and crypto.

“However lengthy this bear market lasts, I believe we are able to still rely on bitcoin rallying early and strongly as a result of the following big USD/EUR stimulus program,” authored Tuur Demeester, a well known early Bitcoin proponent. He added he believes BTC adoption again will spike “once the brand new economic crisis results in bank runs, capital controls, bail-ins.”

“During inflation bitcoin’s scarcity shines—during deflation its censorship resistance,” Demeester authored.

Others used technical analysis tools like the Directional Movement Index (DMI), a stride of strength in cost trends, to predict the downside momentum for BTC and ETH continues to be “exhausted” and “almost finished.”

However, right after, both BTC and ETH went even lower, breaching important levels on the way.

Alex Krüger, a well known crypto trader and economist, stressed the crypto selloff has more details on panic across global risk assets than anything specific to crypto.

“Realize how little this crypto dump is due to Celsius and also the stETH [staked ETH] drama and all sorts of related to the prevalent panic in risk assets (equities and crypto alike) and damaged charts,” Krüger authored.

“Everybody which makes it about Celsius. Watch the press tomorrow. But without Friday’s [inflation] figures and equities collapsing this will not have happened,” the crypto trader stated.

An identical sentiment seemed to be shared by others, with, for example, Jim Bianco, President of Bianco Research, saying “When markets go south, everything goes bad at the same time.”

Others also shared an identical sentiment:

_____

Find out more:

– Bitcoin Historic Performance isn’t any Guide for future years in 2022

– USD 25K-USD 27K per Bitcoin Is ‘This Cycle’s Bottom’ – Arthur Hayes

– For This Reason Given Might Attack Inflation More Strongly

– Given Has ‘Limited Firepower’ for Rate Hikes, Current Expectations Already Priced set for Bitcoin – CoinShares

– As inflation ‘Mellows Out’, a Bottom in Crypto is probably in ‘The Back 1 / 2 of 2022’ – VC Investor

– Bitcoin Undervalued, Crypto Now Much Better Than Property – JPMorgan

– Crypto & Stocks ‘Decoupling’ Conjecture Flops there is however Still Hope

– Bitcoin Midway to Next Halving – So What Can History Educate Us?