Bitcoin (BTC) exchanges have experienced huge volumes this month as cost declines result in restored curiosity about buying and selling.

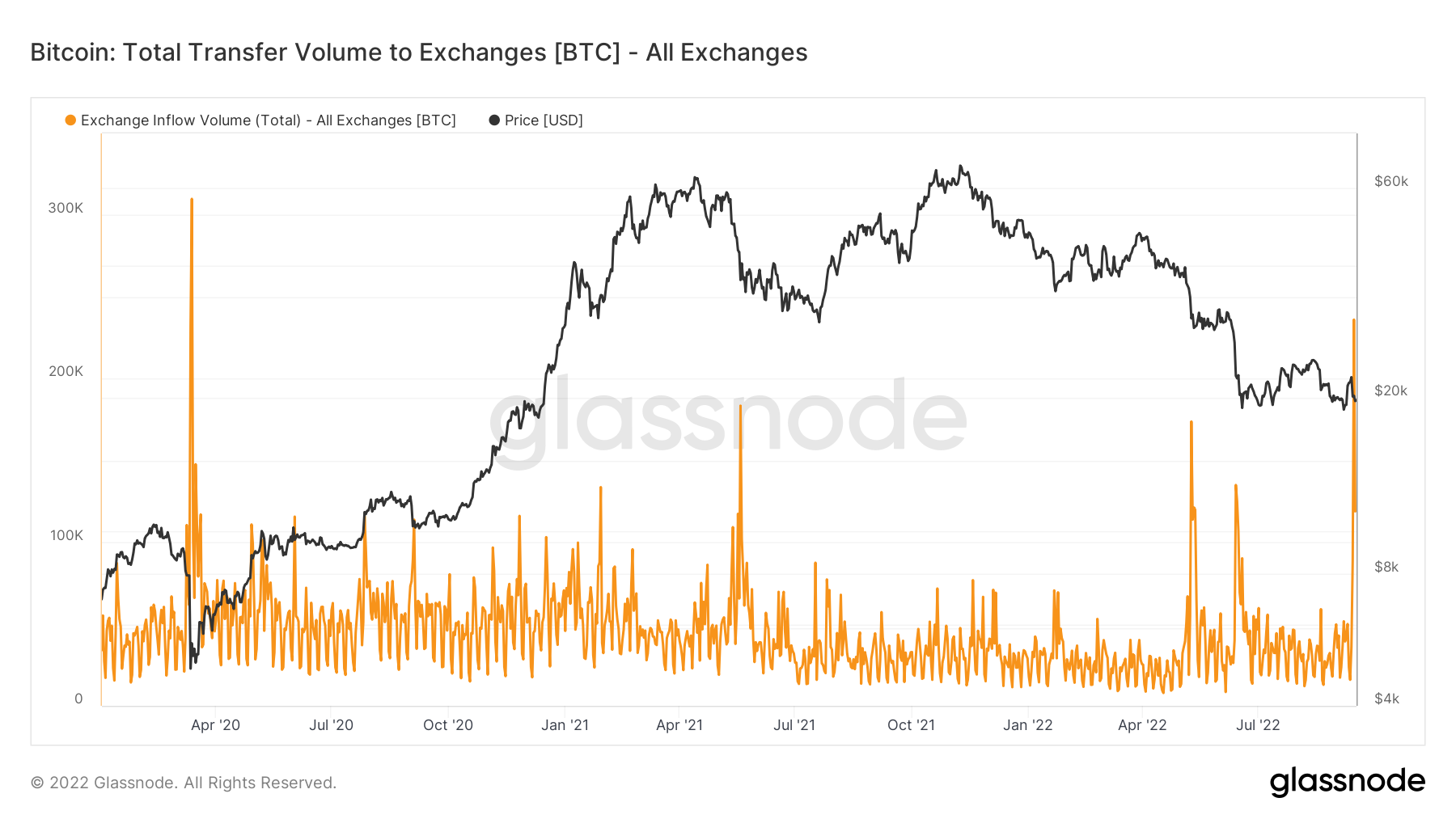

Data from sources including on-chain analytics firm Glassnode shows exchange inflows hitting their greatest since March 2020.

“The scent of volatility is incorporated in the air”

On Sept. 14, over 236,000 BTC made its method to the fir major exchanges tracked by Glassnode.

It was the biggest single-day spike because the chaos that encircled Bitcoin’s dip to simply $3,600 in March 2020.

The sell-offs in May 2021 and could and June this season unsuccessful to complement the tally, suggesting that a lot of Bitcoin investor is made of presently planning to reduce exposure.

Separate data from analytics firm Santiment covering both centralized and decentralized exchanges place the total inflow figure for that week through Sept. 13 at 1.69 million BTC.

“This was the greatest quantity of $BTC moved since October, 2021,” it put in Twitter comments.

As BTC/USD dipped to close $19,600 now, meanwhile, some “unusual” signals were originating from interactions with exchanges from both bigger and smaller sized hodlers, based on commentator David P. Ellis.

Orcas vomited 11.8K coins but Minnows came back through the thousands, presumably because alts are starting to crumble. Exchange flows were tame today for the very first day in three, but volume was still being well excellent. The scent of volatility is incorporated in the air.

Go #BTC . pic.twitter.com/ltSWkrb2QK

— David P. Ellis (@DavidPBitcoin) September 16, 2022

The experience follows the curious movement of lengthy-dormant coins at the beginning of September, a celebration initially related to the now-defunct exchange Mt. Gox.

Miners slow BTC sales

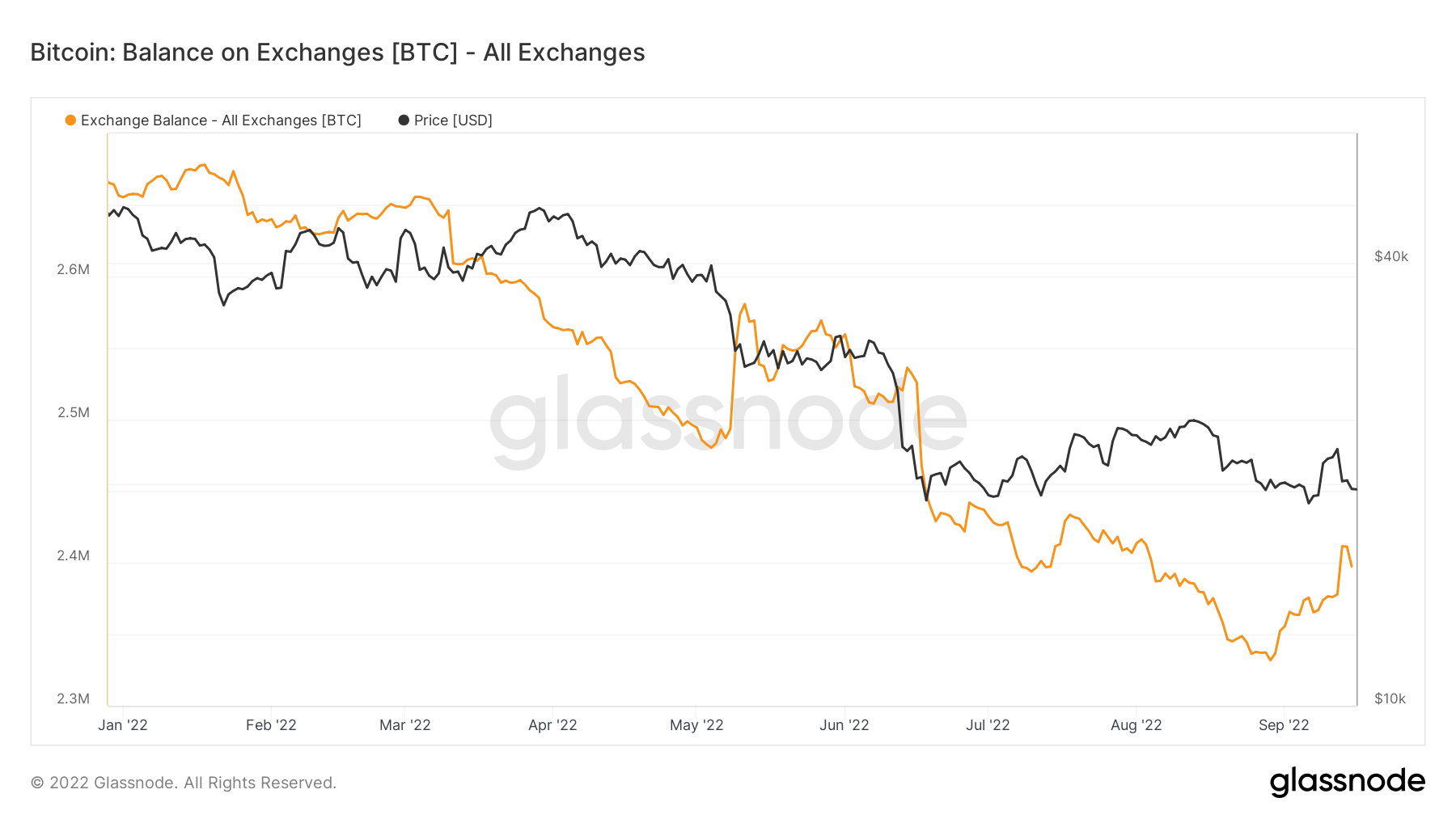

Coming back to buying and selling platforms themselves, Glassnode signifies that exchange balances have elevated by roughly 80,000 BTC because the finish of August.

Related: Bitcoin cost threatens $19.6K as Ray Dalio predicts 30% stocks crash

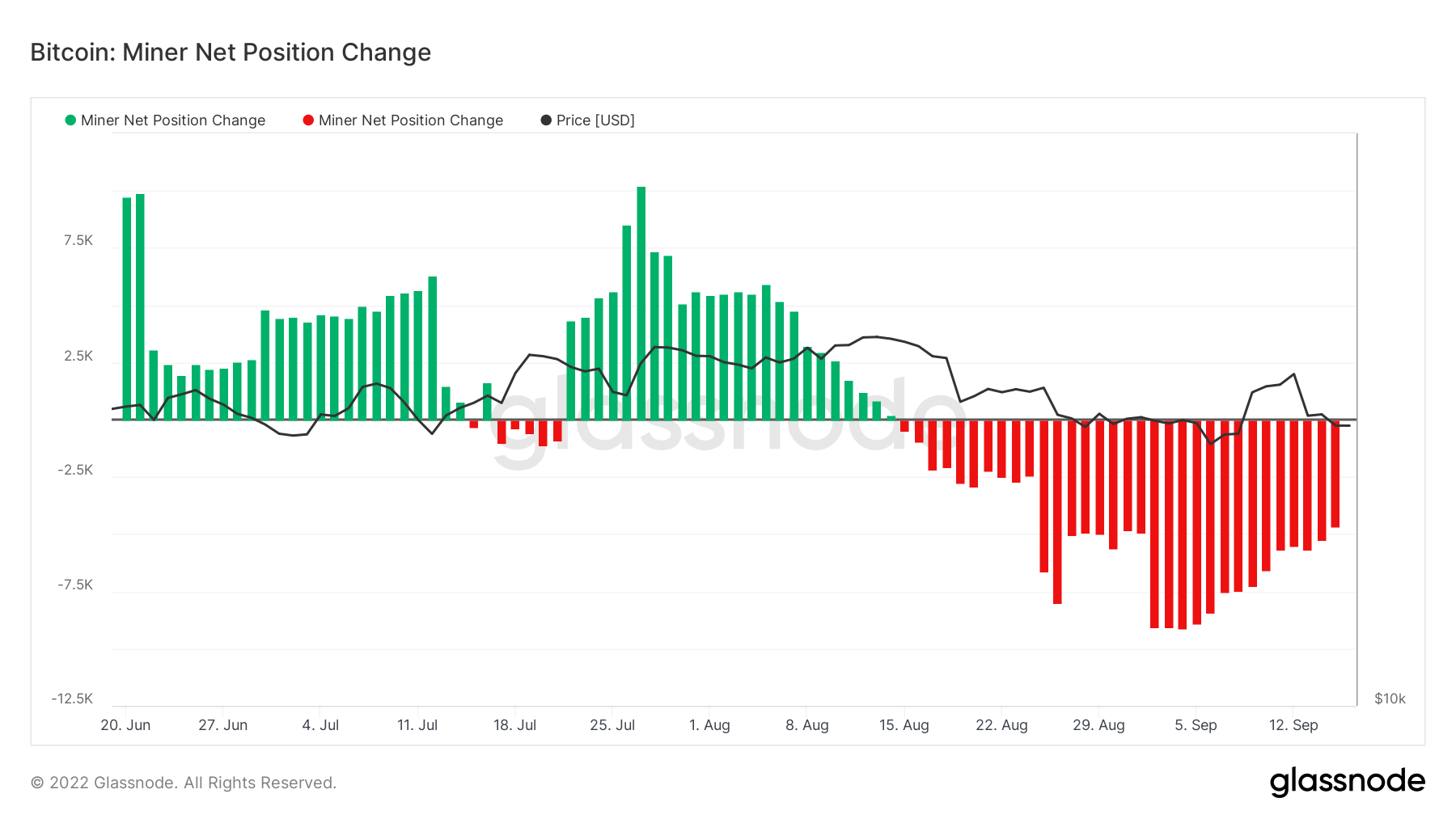

Miners, which in August finished a “capitulation” period inside a typically bullish sign for that market, also have ongoing to market holdings throughout recent days.

The popularity, however, is toward miners coming back to internet hodling BTC they earn.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.