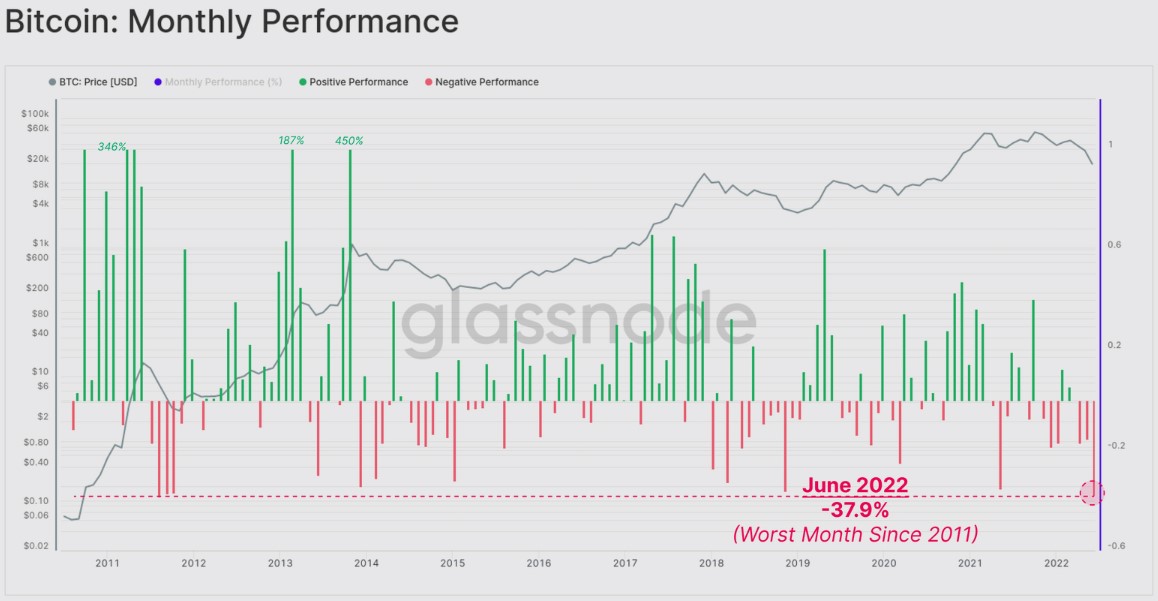

Bear markets in cryptocurrency are recognized to hurt, however the month of June was especially trying for that crypto faithful like a confluence of things led to the cost of Bitcoin (BTC) falling 37.9%, its worst monthly performance since 2011.

Because of the ongoing prevalent weakness, most the so-known as Bitcoin “tourists” have finally exited the area, departing just the most dedicated holders remaining, based on blockchain analytics firm Glassnode.

Despite Bitcoin’s ongoing struggles cheap crypto traders are presently experiencing and enjoying the worst bear market within the sector’s history, several metrics claim that the outlook isn’t as dire as many are predicting which the hodler lower crypto market remains strong.

Dedicated hodlers rise in number

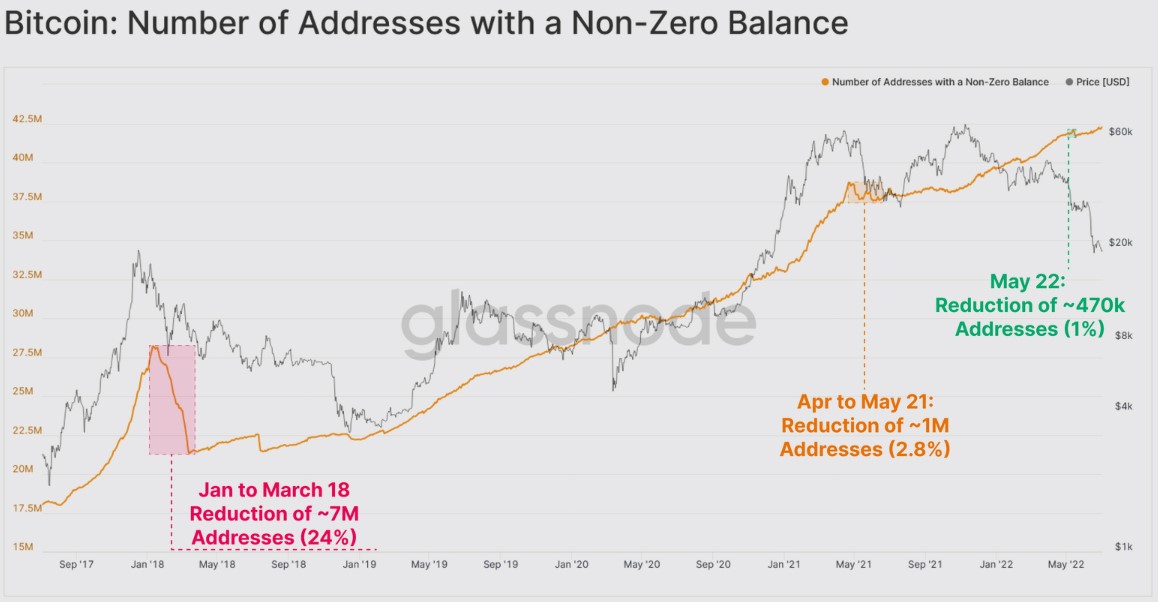

A substantial purge of active Bitcoin wallets is a very common occurrence during major sell-off occasions plus early bear markets, based on Glassnode. However, the seriousness of the exodus continues to be diminishing because the bear market of 2018, indicating that “there is definitely an growing degree of resolve among the typical Bitcoin participant,” Glassnode stated.

During the newest decrease in the amount of addresses having a non-zero balance, only onePercent from the Bitcoin addresses purged their holdings entirely when compared with 2.8% between April and could 2021, and also the whopping 24% that did exactly the same between The month of january to March of 2018.

During-chain activity for Bitcoin remains muted and solidly in bear-market territory, probably the most dedicated Bitcoin holders still contain the line, and can likely continue doing so before the market turmoil subsides along with a floor within the BTC cost is made.

Coming back to best Bitcoin practices

The ethos of “not your keys, not your crypto” is once more gaining traction within the crypto community as traders happen to be withdrawing their tokens from exchanges in a frantic pace. The collapse from the Terra ecosystem, potential insolvency of Celsius and also the implosion of Three Arrows Capital have offered like a stark indication that crypto will probably be kept in cold storage.

Since March 2020, the amount of Bitcoin held on exchanges has declined from three.15 million to two.4 million. This is a total output of 750,00 BTC with 142,500 of this total occurring previously three several weeks.

With platforms like Celsius halting withdrawals and smaller sized exchanges starting to put limits around the amount that users can remove, the need to get back personal charge of crypto assets has turned into a top concern for holders.

This could really be seen as an positive for prices within the lengthy-term as the probability of further capitulation decreases when tokens are kept in cold storage and never easily available to market on exchanges.

Related: Using the bear market entirely throttle, crypto derivatives retain their recognition

Retail begins to gain interest

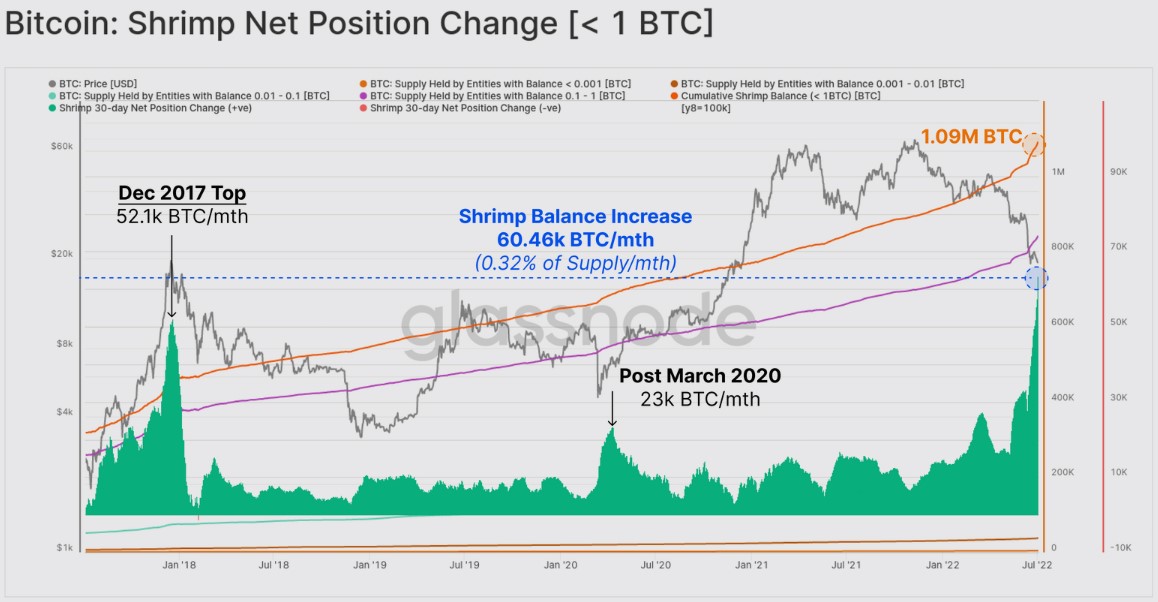

Another encouraging development among the worst month in Bitcoin history is definitely an growing interest from wallets holding under 1 BTC, which are more inclined to represent the retail cohort from the crypto market.

These so-known as “shrimp” wallets happen to be eagerly scooping up low-priced Bitcoin towards the tune of 60,460 BTC monthly based on Glassnode, that is “the most aggressive rate ever.Inches

Despite crypto inside a bear market, several underlying metrics, together with a dedicated cohort of crypto hodlers and rising interest from smaller sized retail buyers. claim that requires the dying of Bitcoin are once more premature.

Oh, look, #bitcoin balance on exchanges still shedding…

Many people realize that there’ll only be 21 million $BTC. They’re getting their bit of the cake. pic.twitter.com/NSVBJicjZo

— Lark Davis (@TheCryptoLark) This summer 5, 2022

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.