Bitcoin (BTC) exchanges might have just seen the biggest exodus of user funds ever, data suggests.

Data from on-chain analytics firm Glassnode implies that on November. 23, major exchanges were lower almost 179,000 BTC in monthly withdrawals.

Major exchanges see record BTC withdrawals

With FTX contagion still in mid-air, exchange users happen to be busy withdrawing funds to noncustodial wallets.

As Cointelegraph reported, $3 billion price of cryptocurrency left major platforms within the immediate aftermath of FTX imploding.

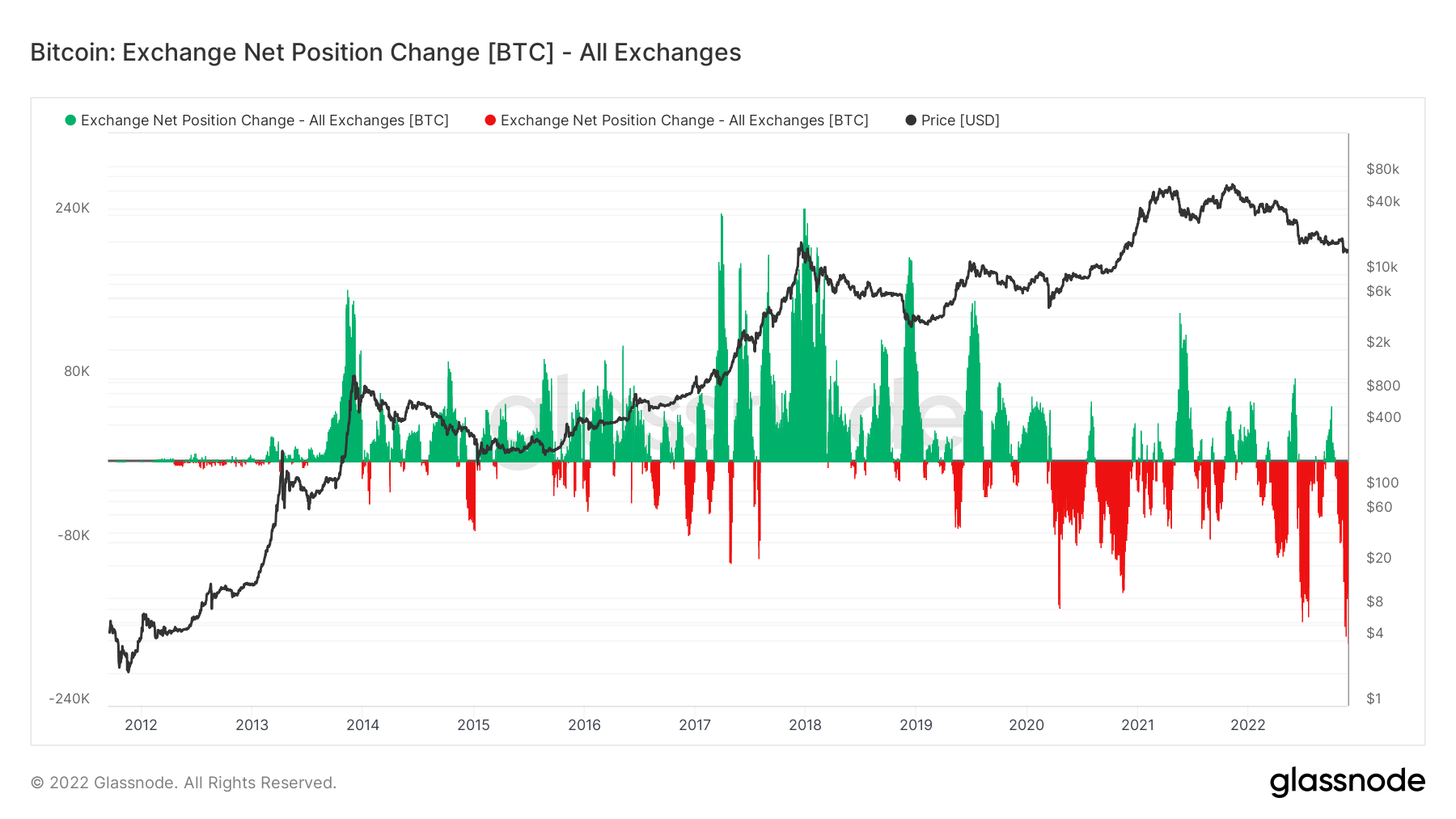

That trend is ongoing, Glassnode shows, using its data recording the biggest-ever reduction in exchange BTC reserves for that thirty days to November. 23.

Glassnode’s Exchange Internet Position Change metric puts the 30-day change from the BTC supply locked in exchange wallets at -178,683 BTC. The metric covers 20 exchanges, including FTX.

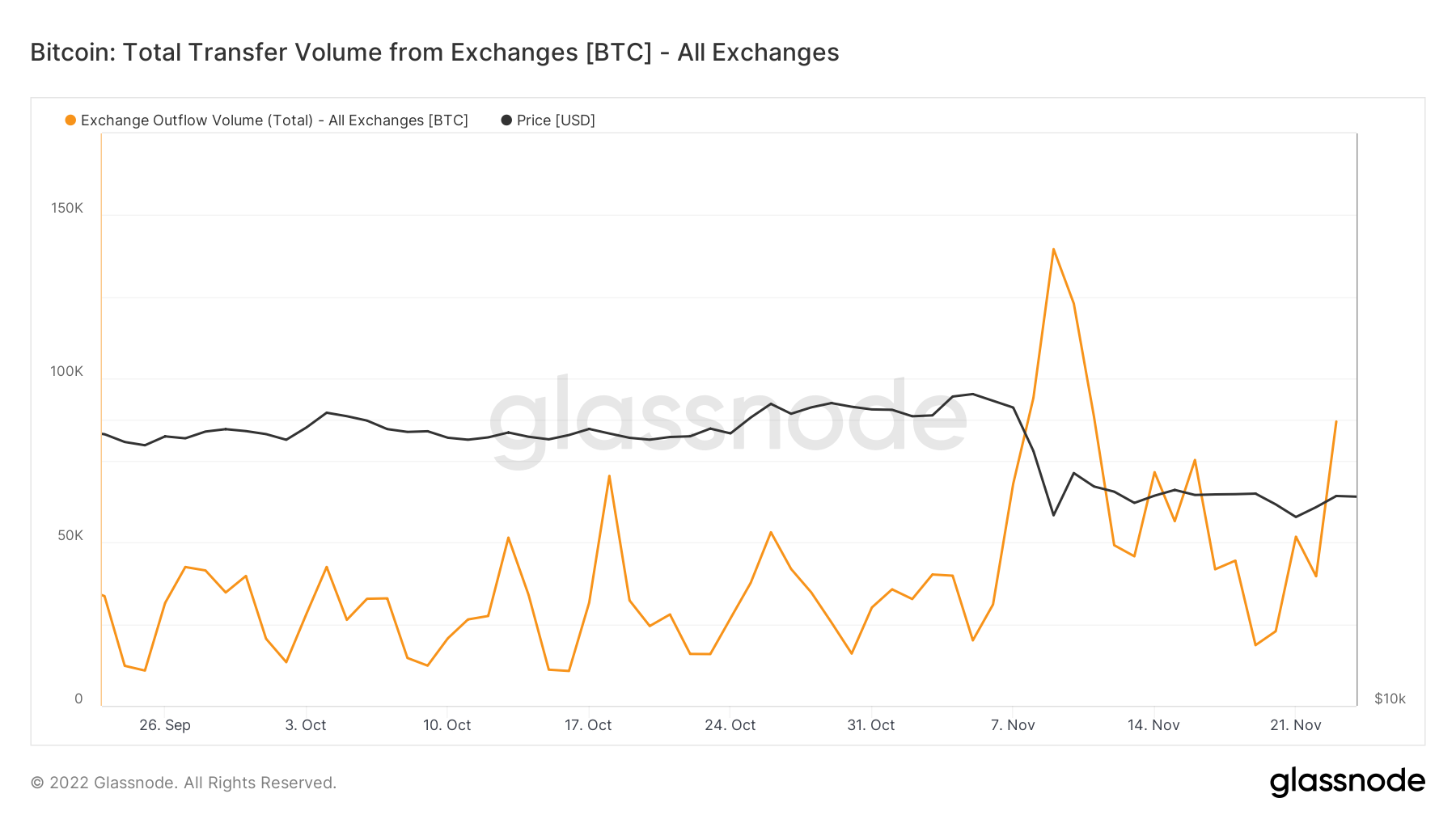

On the day-to-day basis, exchange user habits remain volatile. Having seen nearly 140,000 BTC in daily outflows on November. 9 alone, exchanges processed less in withdrawals, having a local low of under 19,000 BTC recorded for November. 19.

Since that time, however, the popularity has reversed, and November. 23 outflows totaled greater than 86,000 BTC, based on Glassnode.

HitBTC will get Mt. Gox hack deposit

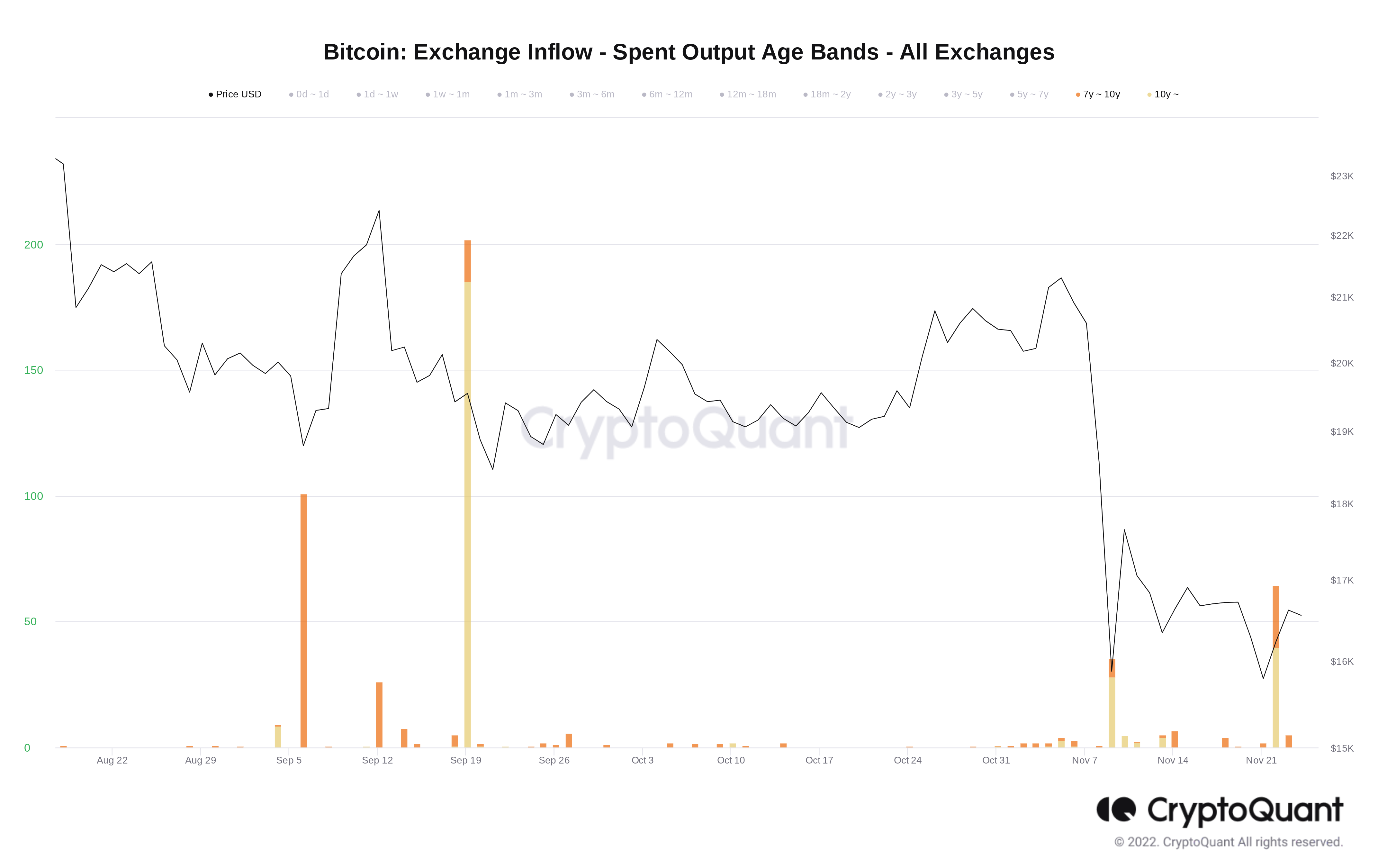

Elsewhere, fellow on-chain analytics platform CryptoQuant elevated the alarm in regards to a major tranche of BTC in the 2014 hack of exchange Mt. Gox.

Related: Crypto has survived worse than nov FTX: Chainalysis

Based on Chief executive officer, Ki Youthful Ju, the stolen BTC is on the go, with 65 BTC delivered to exchange HitBTC.

“7-year-old 10,000 $BTC moved today. No real surprise, it’s from crooks, like the majority of the old Bitcoins. It is the BTC-e exchange wallet associated with the 2014 Mt. Gox hack. They sent 65 BTC to hitbtc a couple of hrs ago, therefore it is not really a gov auction or something like that,” he tweeted.

Ki known as on HitBTC to freeze funds in the incoming wallet.

Separate research from Chainalysis meanwhile noted mass processing of Mt. Gox coins connected with exchange BTC-e, which itself shut lower in 2017.

Several exchanges, together with private wallets yet others, have obtained BTC-e bitcoins in recent days, it described inside a blog publish on November. 23.

As Cointelegraph reported, movement of old coins in September also sparked panic, because the Mt. Gox rehabilitation process came for an finish.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.