Bitcoin (BTC) hit daily lows around the This summer 5 Wall Street open because the U.S. dollar saw a violent surge greater.

USD sets another 20-year record

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD retreating to $19,281 on Bitstamp because the Independence Day lengthy weekend concluded having a bump.

The pair saw last-minute gains your day prior, these fizzling because the return of Wall Street buying and selling was supported by USD strength lounging waste to gains across risk assets and safe havens.

Bitcoin traded lower $1,000 at the time, while place gold shed over 2% and U.S. equities markets also fell. The S&P 500 was lower 2.2% during the time of writing, as the Nasdaq Composite Index lost 1.7%.

The U.S. dollar index (DXY), on the other hand, hit 106.59, an amount not seen since December 2002 and above previous breakouts from Q2 this season.

Bitcoin analysts thus anxiously waited for indications of a pattern reversal to supply some respite to crypto markets.

Awaiting Dollar Crash $DXY pic.twitter.com/HaKXIM3OFB

— Trader_J (@Trader_Jibon) This summer 5, 2022

“Euro hitting record levels, $1.033 at this time. Last observed in time 2002–2003 and DXY, obviously, shooting up just like a rocket,” Cointelegraph contributor Michaël van de Poppe commented, noting the euro was heading towards USD parity.

In commentary, Caleb Franzen, senior market analyst at Cubic Analytics, pointed to the way the DXY reveal investor sentiment over the healthiness of the economy.

“In the last week, yields are falling however the dollar carries on growing. This dynamic proves that investors are hurrying to safety, with increased fears of recession,” a part of a tweet read.

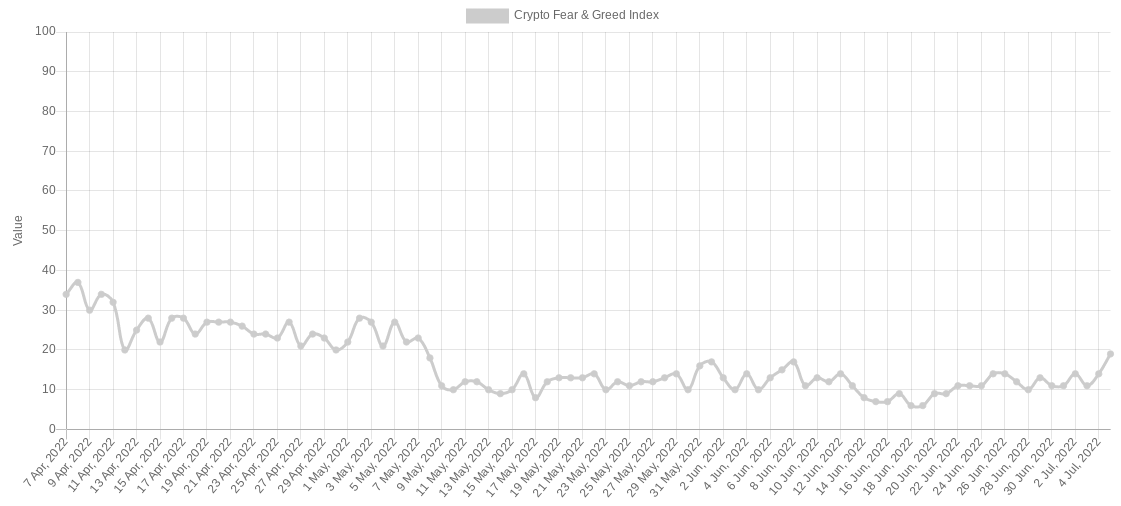

Crypto Fear & Avarice Index hits 2-month high

While volatility edged back to crypto markets, sentiment was yet to mirror the outcome of the rampant dollar.

Related: ‘Wild ride’ lower for BTC? 5 items to know in Bitcoin now

The Crypto Fear & Avarice Index was at 19/100 at the time, still suggestive of “extreme fear” but nevertheless its greatest studying since prior to the Terra LUNA debacle in May.

As Cointelegraph furthermore reported, investment manager ARK Invest revealed it had become still “neutral to positive” on BTC under current conditions.

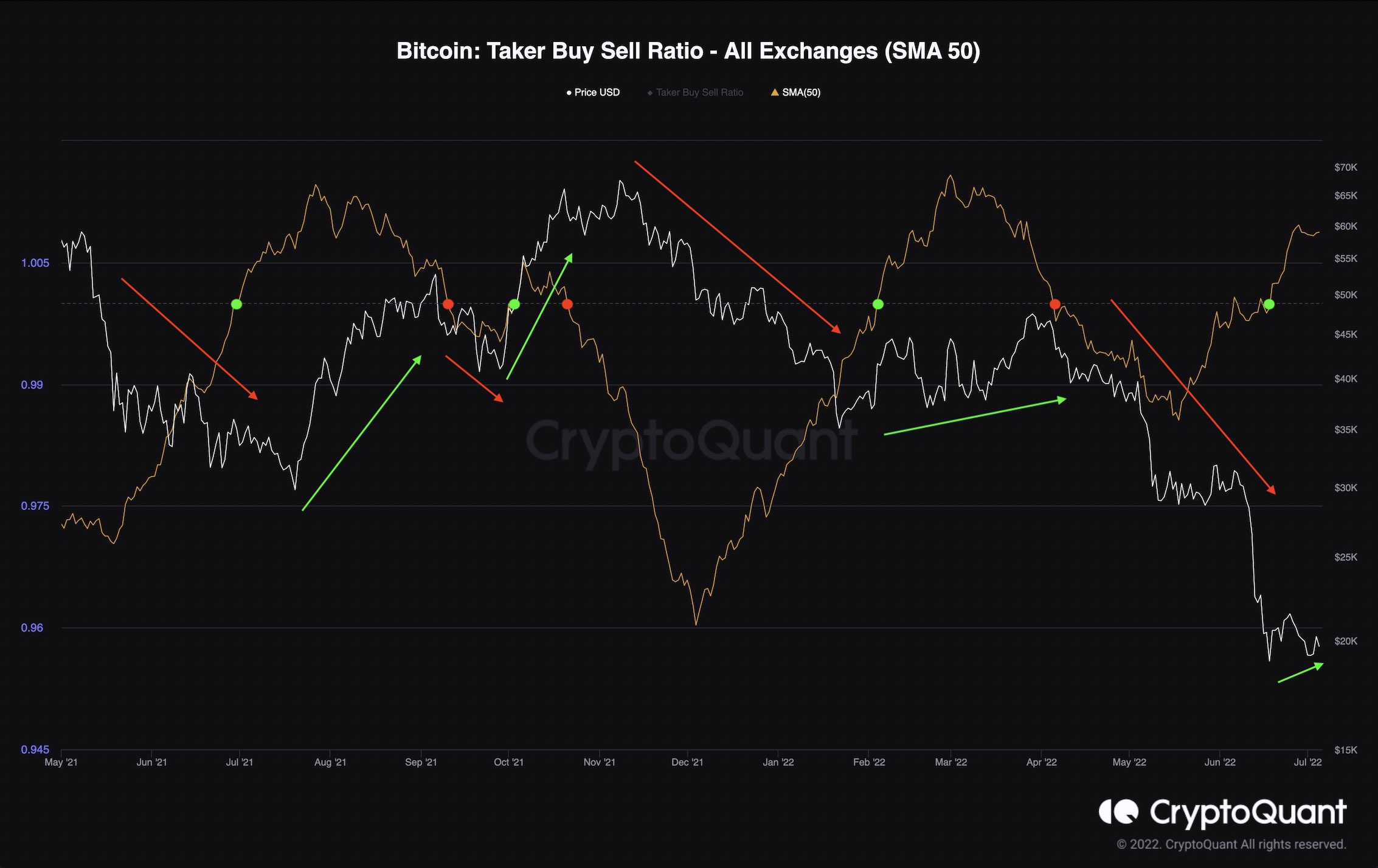

Analyzing Bitcoin futures market sentiment, meanwhile, Edris, a cause of on-chain analytics platform CryptoQuant, voiced caution about creating conclusions over any kind of recovery.

The taker buy/ sell ratio, which signifies whether buyers or sellers have been in control, saw some respite at the time, Edris demonstrated, however the move ought to be taken having a pinch of salt.

“However, observe that it might just be a consolidation or perhaps a bullish pullback before another continuation lower,” your blog publish read.

“So, a number of other factors should be thought about carefully within the coming days to be able to determine whether a bullish reversal or any other bull trap might be expected.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.