Because the very coldest times of the crypto winter occur, investors’ speculative curiosity about the crypto market has fallen to pre-2021 levels, impairing the risk of a considerable directional cost move. However, there is a chance of a bear market rally similar to the This summer through August 2022 upward trend.

The marketplace enters a condition of limbo

The FTX implosion impacted over 5 million users globally and adversely affected numerous crypto firms that were uncovered into it. The is presently in recovery mode, as U.S.-based crypto market broker Cumberland lately echoed inside a tweet. The firm noted that “a large number of crypto information mill either seriously curtailed or bankrupt, and also the industry’s future is really as cloudy as always.”

Data shows that creating a sustainable bullish move is going to be challenging since the marketplace is pressed to a minimal liquidity and volatility regime.

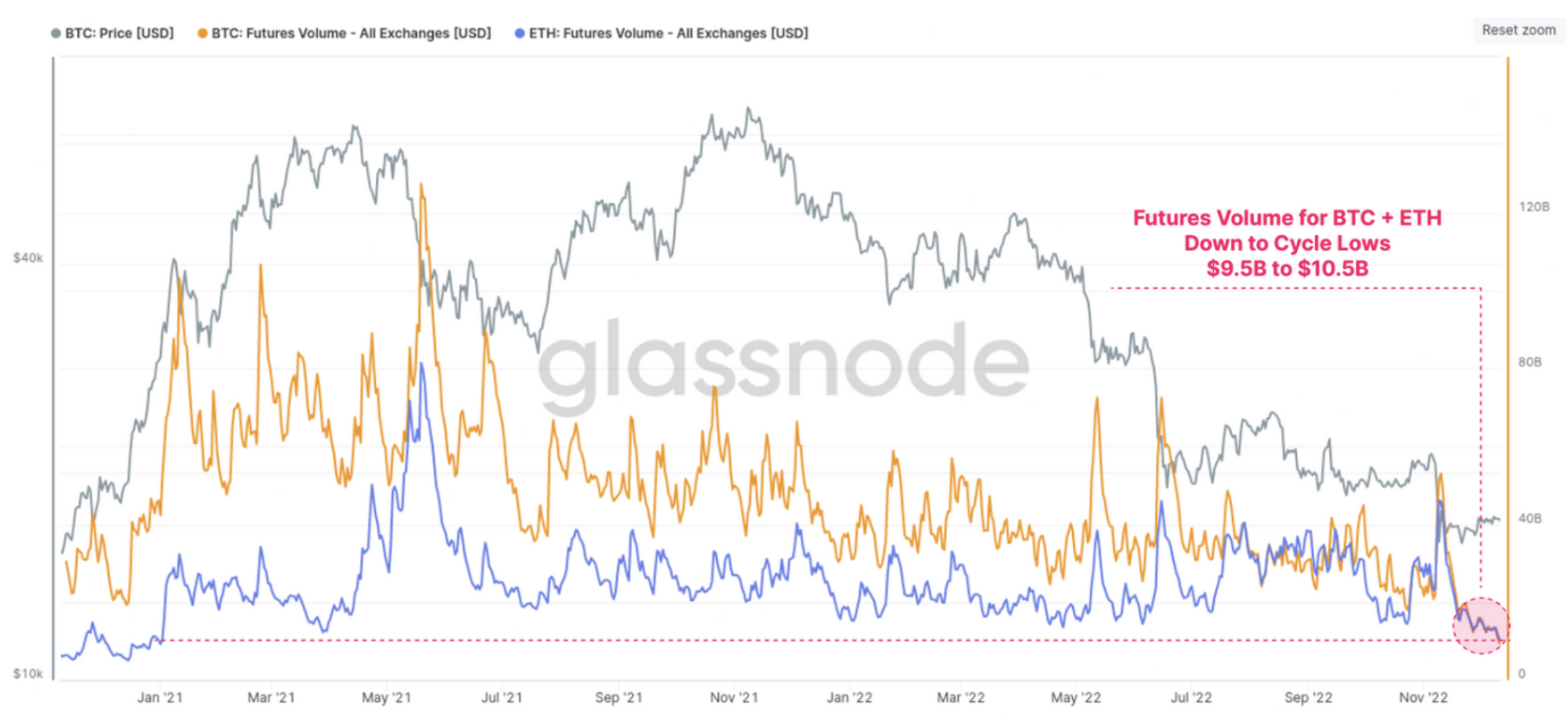

Crypto analytics firm Glassnode reported “depressing” futures volumes for Bitcoin (BTC) and Ether (ETH), tracing to pre-2021 levels when Bitcoin’s cost surpassed $20,000 the very first time.

Outdoors interest amount of Bitcoin and Ether futures has dropped considerably toward mid-2022 levels, that was following the collapse of Luna-UST. The BTC and ETH leverage ratio indicator, which measures the ratio between open interest volume, is presently lower to two.5% and three.1%.

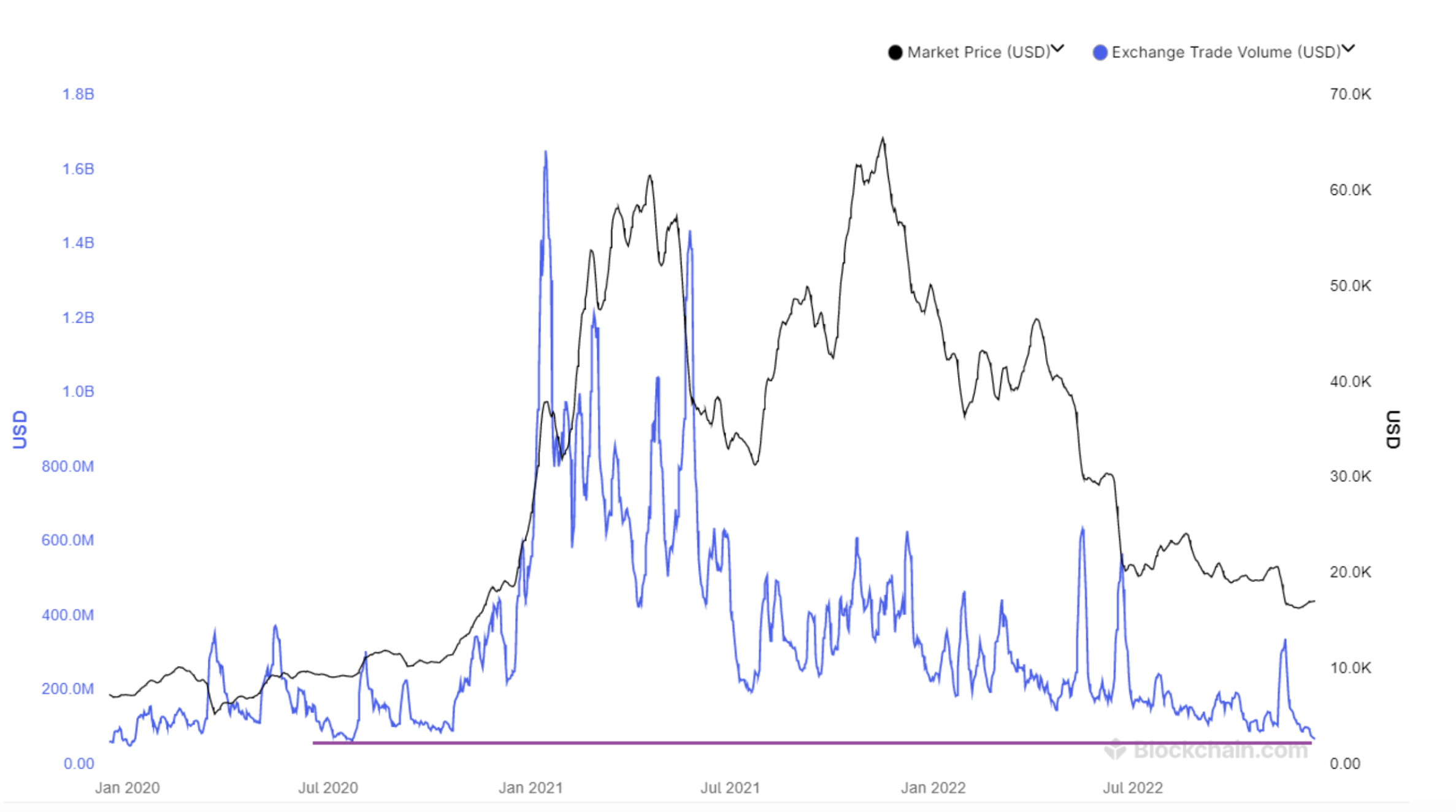

Bitcoin’s place buying and selling volumes on crypto exchanges also have dipped considerably toward 2020 lows. Data from Blockchain.com shows the seven-day moving average of exchange buying and selling volume has dropped to $67 million, when compared with $1.4 billion close to the peak from the 2021 bull market.

Because of low liquidity along with a cloud of uncertainty within the market, there is a strong possibility the bear marketplace is not even close to over. The recognized volatility of Bitcoin has additionally dropped toward two-year lows of twenty-twoPercent (1 week) and 28% (two days).

Continuing to move forward, volatility may remain dull, with increased sideways or slow downside cost action. However, there’s still an opportunity of a brief-term bear market rally.

Is really a Bitcoin cost pump and dump in play?

November’s FTX-caused shakeout looked like the LUNA-UST implosion observed in June, which occasions usually cause panic selling, making a good thing appealing to bargain hunters searching to purchase right into a capitulation.

Consequently, a brief-term bull rally becomes effective that could serve you for a couple of days or days, which is exactly what happened in This summer through August when Bitcoin’s cost surged toward $25,000. In line with the shakeout levels from November and indications of institutional buying, Bitcoin may be having a similar bear market rally.

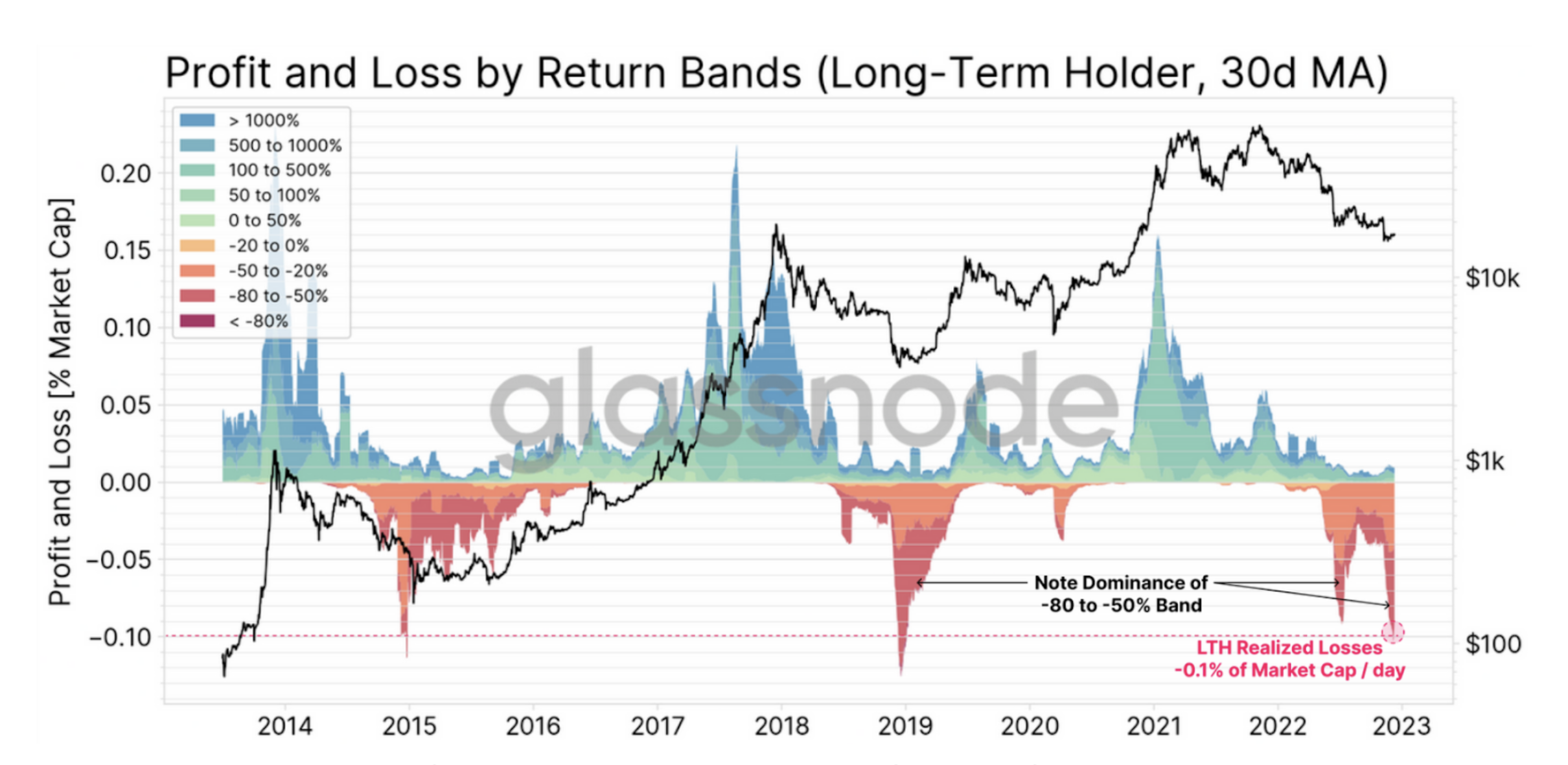

The recognized profit and loss metric of lengthy-term holders dropped toward all-time lows, indicating possible oversold conditions. The lengthy-term holder recognized losses had arrived at comparable levels only throughout the 2015 and 2018 bottom.

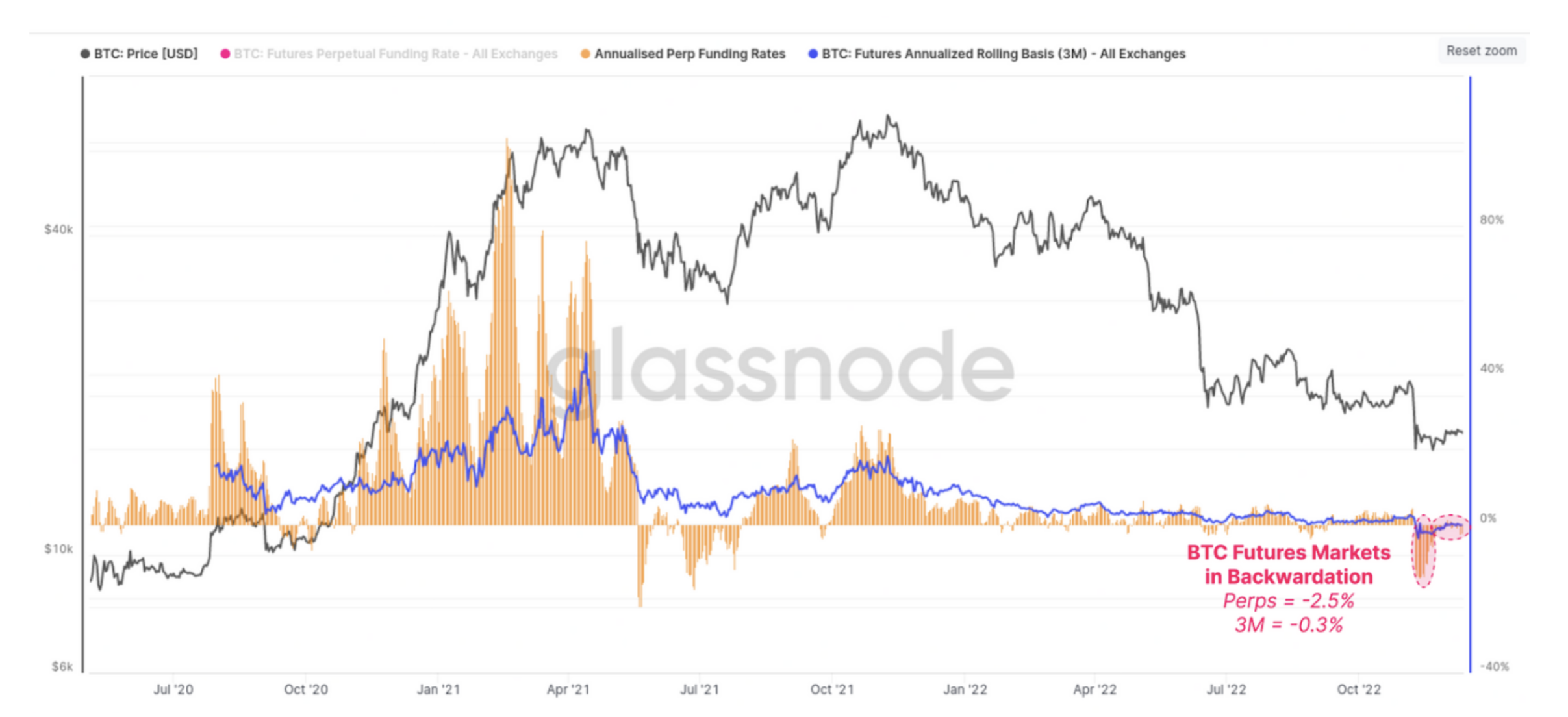

Furthermore, the futures marketplace is presently in backwardation, meaning there are other open short positions than lengthy. Throughout Bitcoin’s history, similar conditions have lasted for brief periods only and wound up inside a short-term pump to squeeze rapid orders.

The buildup trend among institutions and whales, this was negative for many of the year, switched positive in mid-November. A rise in holdings of those investor cohorts provided a tailwind for that bear market rally within the third quarter of the year.

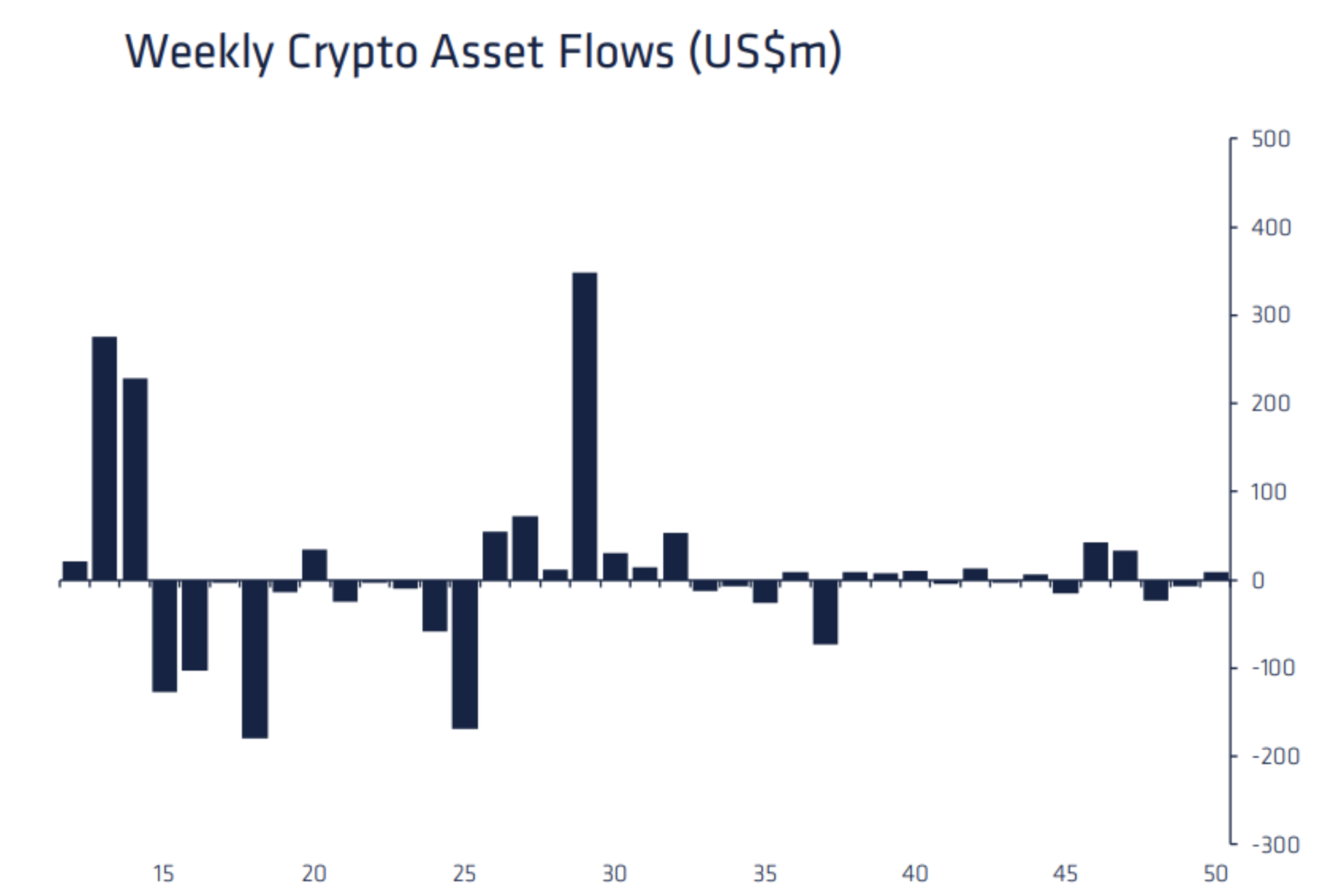

CoinShares reported that institutional Bitcoin investment vehicles saw inflows totaling $108 million following the FTX implosion, with $17 million added a week ago. Particularly, the current inflows are considerably less than days 25 and 35 this season, which caused the upward trend toward $25,000.

On-chain data from Glassnode also shows positive accumulation among Bitcoin whales, recognized as addresses holding more than or comparable to 100 BTC (worth around $1.seven million at current prices).

As the holdings of those whales has elevated from the yearly lows similarly observed in This summer to August, BTC cost has yet to mirror this positive addition.

Technically, the support and resistance quantity of a previous buying and selling range from $18,700 and $22,000 could make up the local top quantity of a current rally. On the other hand, if BTC builds support above $22,000, the bear market rally turn into more significant having a ongoing upward trend.

However, the likelihood of a bullish rally above $22,000 are feeble because of low liquidity and also the cloud of uncertainty which will motivate selling as prices rise. Still, discounting a brief-term bear market rally can punish late sellers.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.