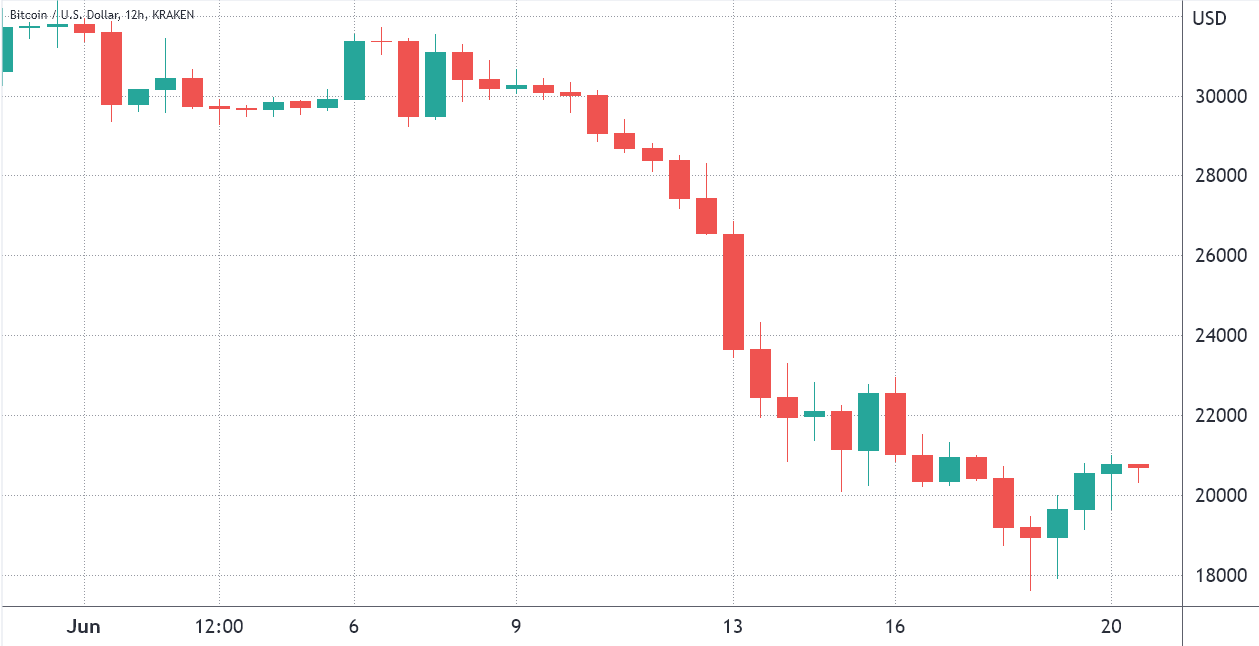

Bitcoin’s (BTC) month-to-date chart is extremely bearish, and also the sub-$18,000 level seen over the past weekend was the cheapest cost seen since December 2020. Bulls’ current hope depends upon turning $20,000 to aid, but derivatives metrics tell a totally different story as professional traders continue to be very skeptical.

It’s remember this the S&P 500 index dropped 11% in June, as well as multi-big the likes of Netflix, PayPal and Caesars Entertainment have remedied with 71%, 61% and 57% losses, correspondingly.

The U.S. Federal Open Market Committee elevated its benchmark rate of interest by 75 basis points on June 15, and Fed Chairman Jerome Powell hinted more aggressive tightening might be available because the financial authority is constantly on the find it difficult to curb inflation. However, investors and analysts fear this move will raise the recession risk. Based on a financial institution of the usa note to clients issued on Next Month:

“Our worst fears round the Given happen to be confirmed: they fell way behind the bend and therefore are now playing a harmful bet on get caught up.”

In addition, based on analysts at global investment bank JPMorgan Chase, the record-high total stablecoin share of the market within crypto is “pointing to oversold conditions and significant upside for crypto markets came from here.” Based on the analysts, the low number of stablecoins within the total crypto market capital is connected having a limited crypto potential.

Presently, crypto investors face mixed sentiment between recession fears and optimism toward the $20,000 support gaining strength, as stablecoins may ultimately flow into Bitcoin along with other cryptocurrencies. Because of this, analysis of derivatives information is useful for understanding whether investors are prices greater likelihood of a downturn.

The Bitcoin futures premium turns negative the very first time each year

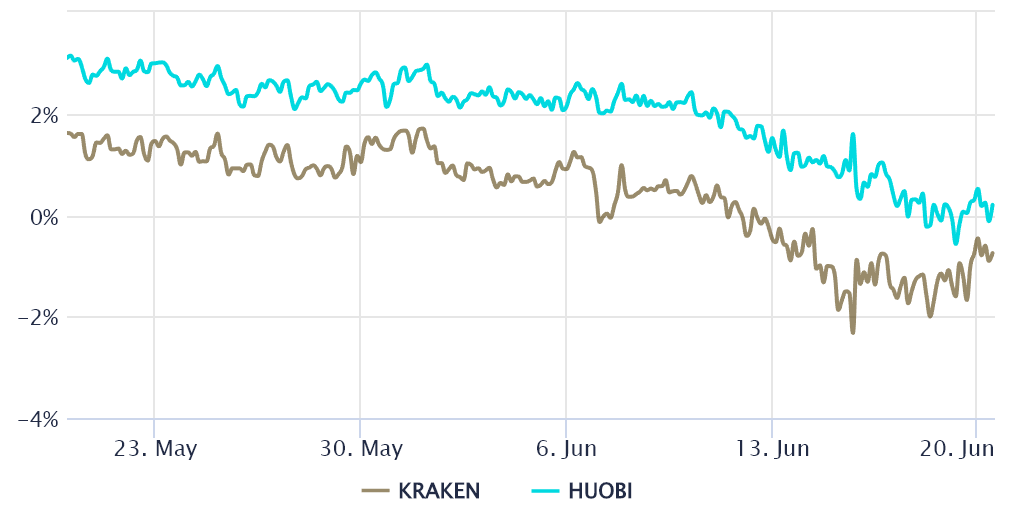

Retail traders usually avoid quarterly futures because of their cost difference from place markets, but they’re professional traders’ preferred instruments simply because they steer clear of the perpetual fluctuation of contracts’ funding rate.

These fixed-month contracts usually trade in a slight premium to place markets because investors require more money to withhold the settlement. This case isn’t only at crypto markets. Consequently, futures should trade in a 5%-to-12% annualized premium in healthy markets.

Bitcoin’s futures premium unsuccessful to interrupt over the 5% neutral threshold, as the Bitcoin cost firmly held the $29,000 support until June 11. Whenever this indicator fades or turns negative, it is really an alarming, bearish warning sign signaling a scenario is called backwardation.

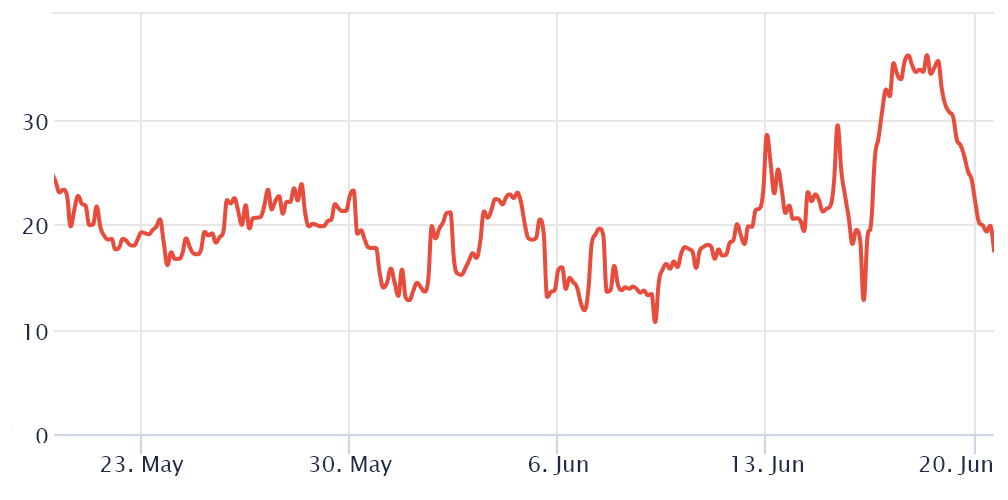

To exclude externalities specific towards the futures instrument, traders should also evaluate the Bitcoin options markets. For instance, the 25% delta skew shows when Bitcoin market makers and arbitrage desks are overcharging for upside or downside protection.

In bullish markets, options investors give greater odds for any cost pump, resulting in the skew indicator to fall below -12%. However, a market’s generalized panic induces a 12% or greater positive skew.

The 30-day delta skew peaked at 36% on June 18, the greatest-ever record and usual for very bearish markets. Apparently, the 18% Bitcoin cost increase because the $17,580 bottom was sufficient enough to reinstall some confidence in derivatives traders. As the 25% skew indicator remains unfavorable for prices downside risks, a minimum of n’t i longer sits in the levels which reflect extreme aversion.

Analysts expect “maximum damage” ahead

Some metrics claim that Bitcoin might have bottomed on June 18, especially because the $20,000 support has acquired strength. However, market analyst Mike Alfred managed to get obvious that, in the opinion, “Bitcoin isn’t done liquidating large players. They’ll go lower to an amount which will make the maximum harm to probably the most overexposed players like Celsius.”

Until traders possess a better look at the contagion risk in the Terra ecosystem implosion, the potential insolvency of Celsius and also the liquidity issues being faced by Three Arrows Capital, the chances of some other Bitcoin cost crash are high.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.