Probably the most popular topics of dialogue inside the crypto community involves the Bitcoin (BTC) four-year halving cycle and also the effect it’s around the lengthy-term cost from the top cryptocurrency.

Bitcoin cost unsuccessful hitting the lengthy-predicted $100,000 level in 2021 and lots of crypto analysts now end up curious about the outlook for the following six to twelve several weeks.

Presently, BTC cost trades below $40,000 as well as other technical analysis metrics claim that further bad thing is much more likely that the recovery towards the $40,000 to $45,000 range. Let us check out what analysts’ views take presctiption Bitcoin’s longer-term prospects.

Bitcoin could bottom in November or December

An over-all summary of the four-year cycle theory was discussed inside a Twitter thread by crypto analyst and pseudonymous Twitter user ‘Wolves of Crypto’, whose analysis signifies that “the most probable bear market bottom for Bitcoin will occur in November/December 2022.”

This projection assumes the peak BTC cost of $68,789 back on November 10, 2021 marked our prime from the last cycle which the marketplace is presently within the corrective phase typically seen following a cycle top.

The analyst stated,

“The 200 week SMA continues to be the lengthy-tested bear market bottom indicator for Bitcoin, and therefore the underside will probably be placed at ~$24,000.”

If this should model engage in, the cost of BTC will breakout above its previous all-time high sometime around August or September of 2023.

Bitcoin “seems a little undervalued here”

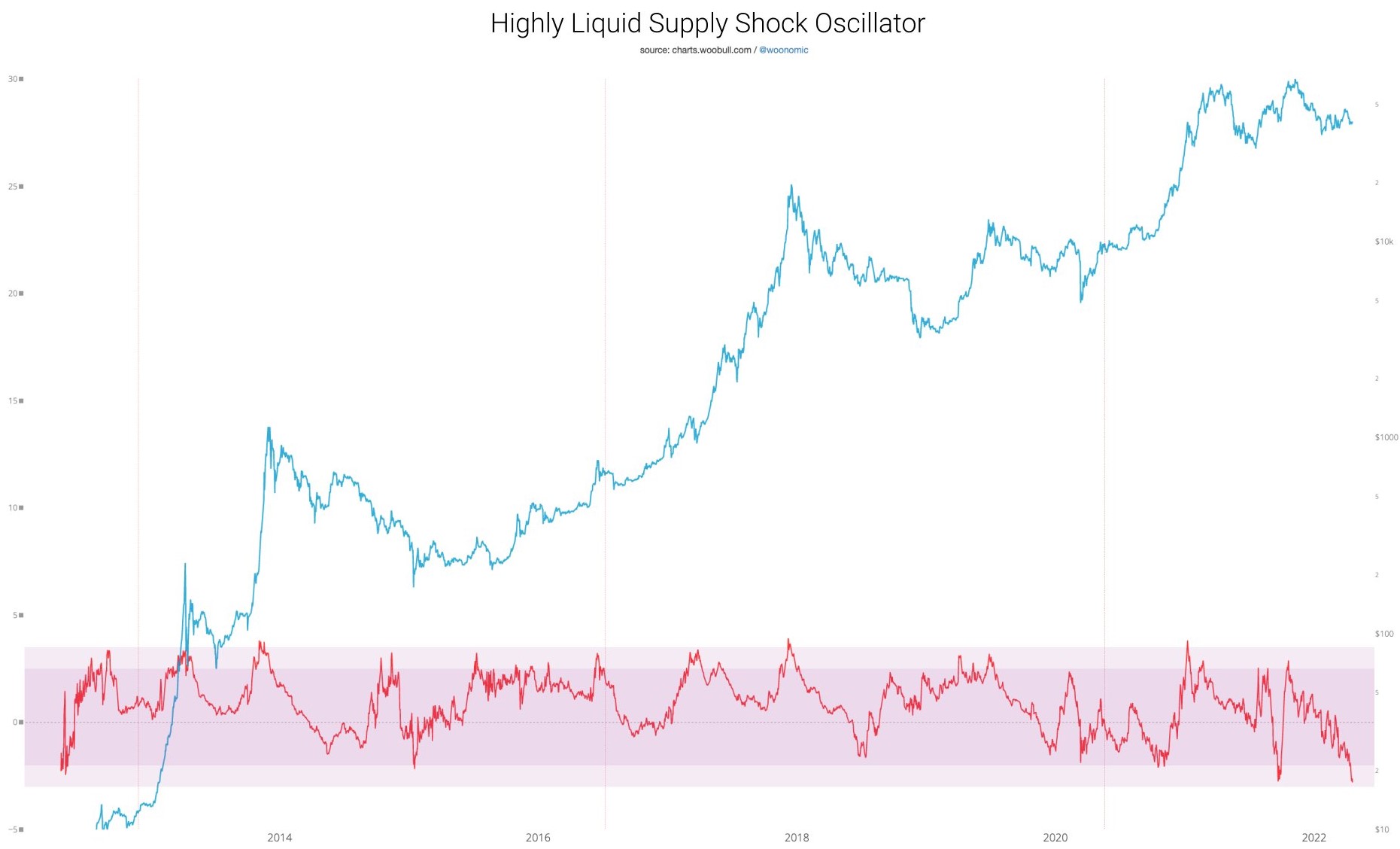

The chance that the underside in BTC could come prior to the finish of 2022 was hinted at by Willy Woo, a completely independent market analyst who published the next chart suggesting the “Orange gold coin appears a little undervalued here.”

The “Highly Liquid Supply Shock” metric quantifies on-chain supply and demand and shows its relative movement in standard deviations in the lengthy-term average.

As proven around the chart above, every time the oscillator dipped as little as the present studying, the cost of BTC joined a clear, crisp rally shortly after that.

Woo stated,

“Not a poor here we are at investors to wait for a law of mean reversion to experience out.”

Related: Bitcoin is 40%+ lower from the ATH, but on-chain analysts say it’s ‘starting to bottom out’

Bitcoin cost reaches a mid-term low

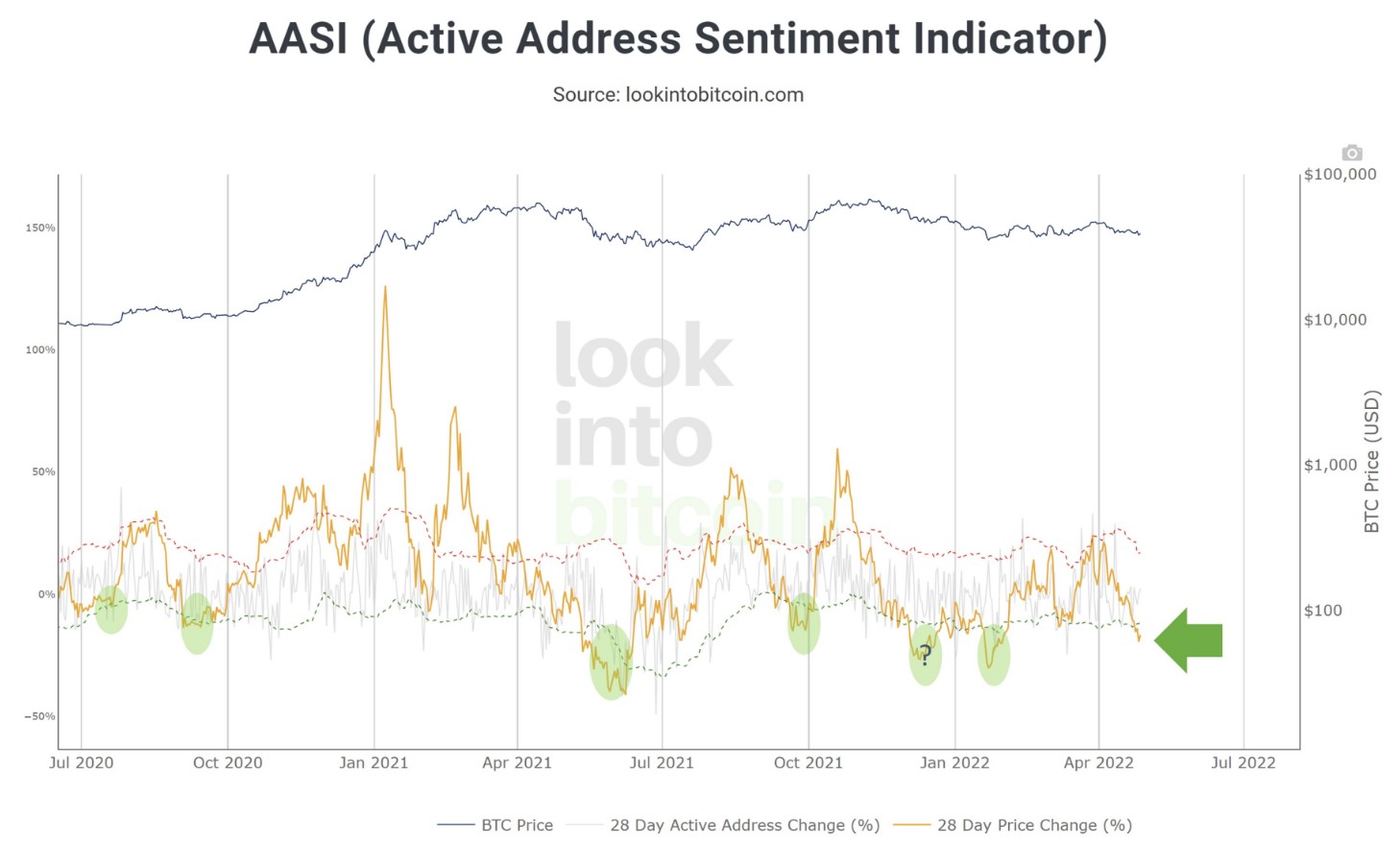

Many analysts think that BTC might be within an optimal accumulation range, a place discussed by crypto market analyst Philip Quick. Based on Quick, the active address sentiment indicator (AASI) shows that BTC is within a buy zone.

Based on Quick, the AASI is presently “back within the eco-friendly zone” which implies the “Bitcoin cost change reaches a smart level in accordance with active address change.”

Quick stated,

“This tool includes a good hit rate across bull and bear markets for signaling a mid-term low.”

Indeed, market research from the previous instances in which the AASI hit levels much like its current studying implies that the cost of BTC hit its low point around the same time frame and began to climb greater within the following days and several weeks.

Generally, it seems as if Bitcoin’s cost action is keeping in-line using the formerly established 4-year cycle, although to some lesser percentage increase than expected.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.