Bitcoin’s (BTC) month-lengthy choppy cost action came for an finish on June 13 following a deep market sell-off pressed the very best cryptocurrency underneath the $29,000 support. The move required place as equities markets also offered off dramatically, hitting their cheapest quantity of a year.

Data from Cointelegraph Markets Pro and TradingView implies that the Bitcoin sell-off started late within the day on June 12 and escalated into mid-day on June 13, when BTC hit a minimal of $22,592.

Here’s a glance at what several market analysts say about Bitcoin’s drop and whether this is actually the final capitulation event prior to the lengthy-anticipated cost bottom.

Can there be solid support at $23,000?

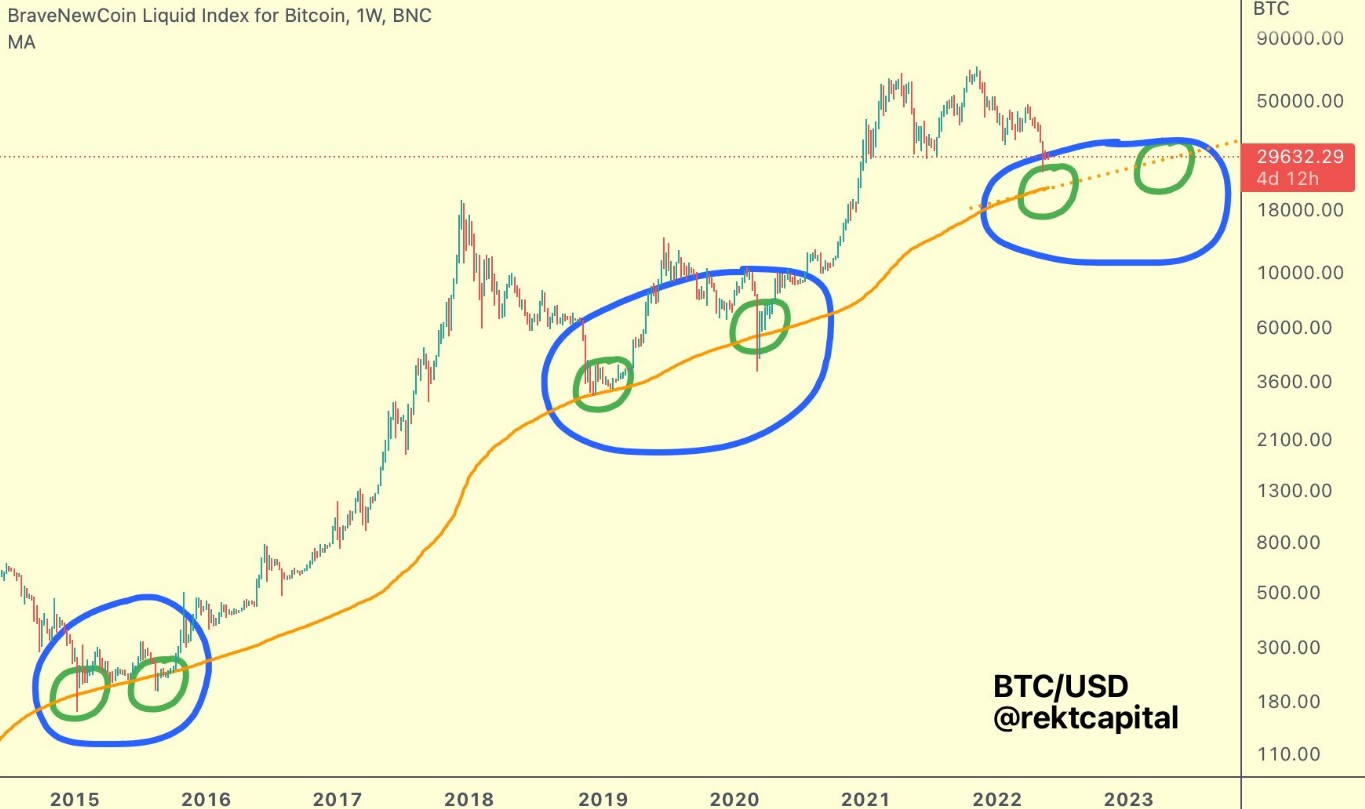

Previous cases of bear market capitulation have experienced a good degree of support at Bitcoin’s 200-week moving average, as proven within the following chart published by market analyst and pseudonymous Twitter user “Rekt Capital.”

In line with the trend in the latter cycles, Rekt Capital recommended it’s entirely possible that BTC often see a “macro double bottom in the 200-week moving average” continuing to move forward when the cost action plays out similarly.

Rekt Capital stated,

“If so, then $BTC is not far from developing its first Macro Bottom in the 200-week MA at ~$23,000. The 2nd Macro Bottom could form within two years’ time in a cost reason for ~$41,000.”

Analysts say “max pain” reaches $13,330

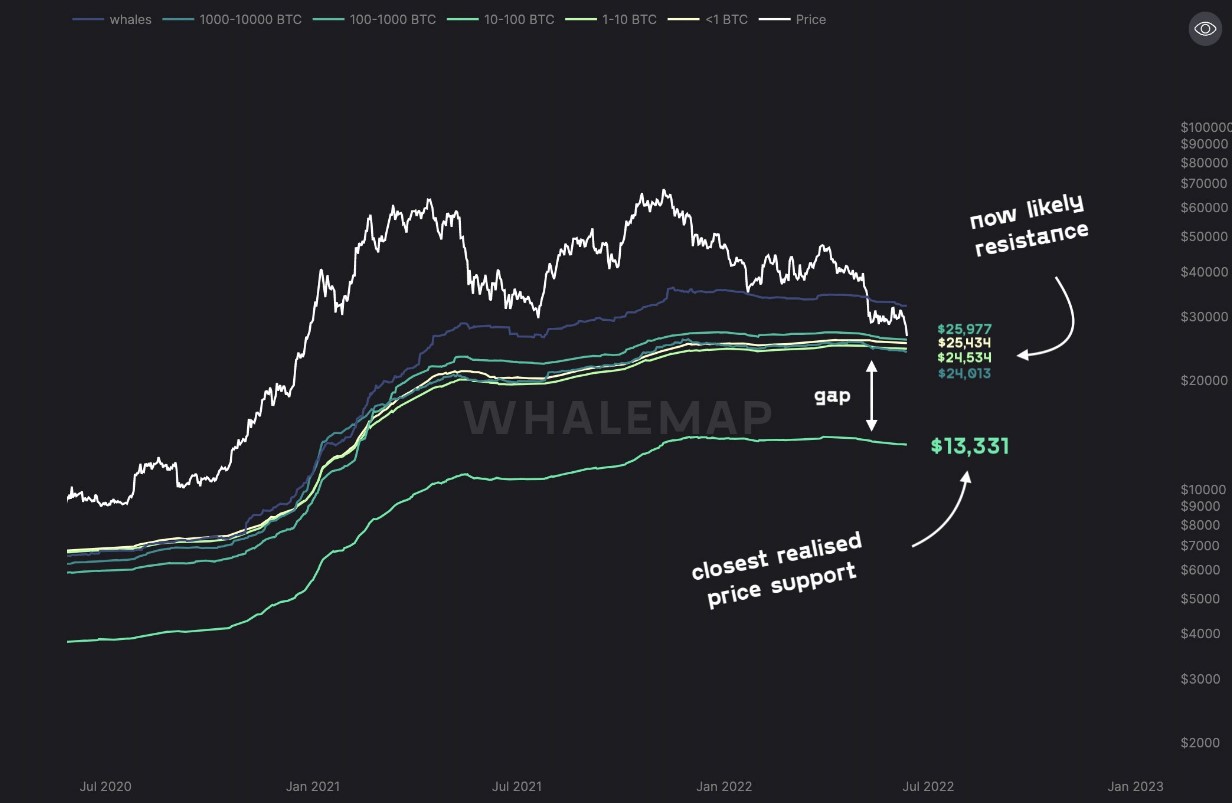

Understanding of where Bitcoin may potentially be headed should it still break underneath the established support levels was supplied by data from pseudonymous analyst “Whalemap,“ who published the next chart highlighting the formerly established support levels that may now switch to resistance.

Whalemap stated,

“#Bitcoin has damaged through key realized cost supports where they’ll likely become our new resistances. $13,331 may be the ultimate max discomfort bottom.”

Within an extreme, Bitcoin could withdraw to $8,000

Based on Francis Search, an industry analyst sometimes known underneath the pseudonym “The Market Sniper,” Bitcoin cost could drop to as low at $8,000 before hitting a genuine bottom.

Search stated,

“The accumulation points could be $17,000 to $18,000. This $15,000 comes without warning, mind and shoulders, there, that might be a fairly nasty downturn, and there’s a bear flag target, rather less strong around the bear flag target at $12,000, along with a full round-trip will give you to our funnel at $8,000 to $10,000.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.