Bitcoin (BTC) tried to reclaim $20,000 as support on June 19 as bulls faced a $7,000 weekly red candle.

$16,000 eyed for possible next move

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rising from lows of $17,592 on Bitstamp prior to being firmly rejected at $20,000.

Low-liquidity buying and selling conditions had designed for a harsh weekend for hodlers because the largest cryptocurrency fell to levels not seen since November 2020.

While recovering some losses, a feeling of deja vu pervaded the marketplace at the time. $20,000 had came back as resistance, this getting created an exciting-time high for Bitcoin for 3 years from December 2017 to December 2020.

It had been also the very first time that BTC/USD had retreated within previous halving cycle’s all-time high.

There is a first first everything. This is actually the very first time Bitcoin has traded below prior cycle highs. I believe it’s fair to state situations are different now.

— Charles Edwards (@caprioleio) June 18, 2022

Although some panicked, however, seasoned market participants continued to be broadly knowledge of recent cost action, which still corresponded with historic bear market patterns.

“To place things into perspective: A Bitcoin crash of 74% as at the moment is certainly not unusual,” markets commentator Holger Zschaepitz acknowledged.

“Ever, there happen to be 4 collapses where the leading cryptocurrency went from peak to trough by >80%.”

When it comes to what could like ahead, attention centered on $17,000 like a potential short-term target. A brief squeeze greater, as popular Twitter account Credible Crypto noted, wasn’t around the menu.

Appears like no squeeze first. Well, let us rip the bandaid off and obtain this over and done with! https://t.co/xliurgtPrO

— CrediBULL Crypto (@CredibleCrypto) June 18, 2022

Fellow trader and analyst Rekt Capital meanwhile added that Bitcoin’s 200-week moving average (MA), a key support line in bear markets, was still being functioning as before.

Regardless of how a lot of a serious time this appears to become for #BTC

In the past $BTC has a tendency to wick between -14% to -28% underneath the 200-week MA

BTC has wicked -21% underneath the 200 MA to date, still inside the historic range & not unusual due to that#Crypto #Bitcoin pic.twitter.com/cJm5A9yYYO

— Rekt Capital (@rektcapital) June 19, 2022

Sellers offload coins in a record loss

Around $7,000, however, the week’s red candle was set is the among the largest in Bitcoin’s history in dollar terms.

Related: GBTC premium hits -34% all-time little as crypto funds ‘puke out’ tokens

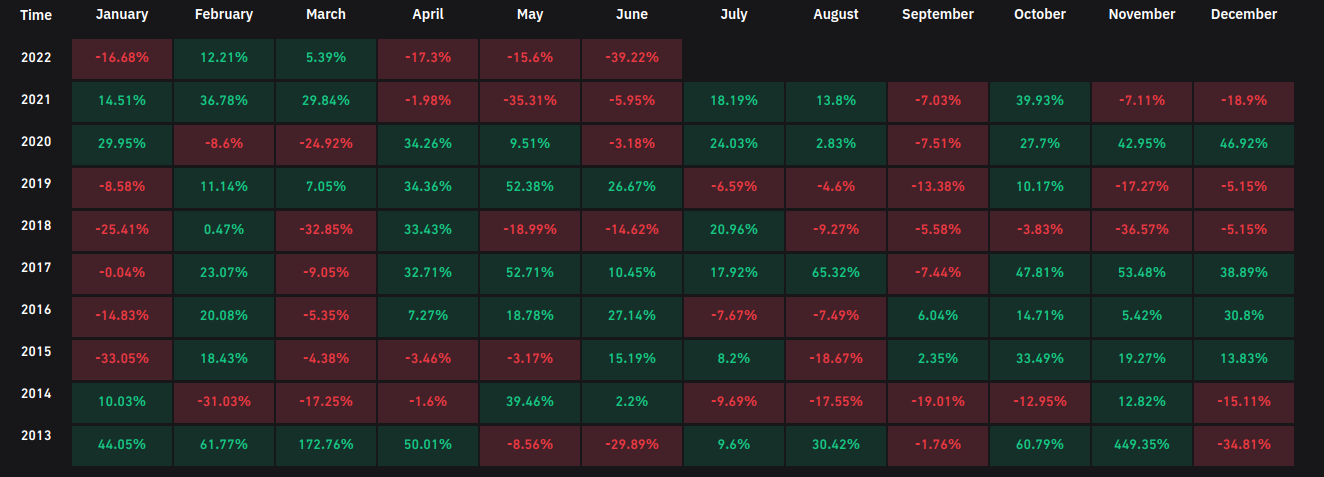

Data from on-chain analytics platform Coinglass added that June 2022 was shaping up is the worst on record, beating even 2013 when it comes to losses.

The final three consecutive days happen to be the biggest USD denominated Recognized Reduction in #Bitcoin history.

Over $7.325B in $BTC losses happen to be kept in by investors spending coins which were accrued at greater prices.

A thread exploring this in greater detail

1/9 pic.twitter.com/O7DjSK2rEQ— glassnode (@glassnode) June 19, 2022

As an indication of investor pressure caused by place cost performance, more BTC was offered baffled within the 72 hours to June 19 than at every other time, based on figures from on-chain analytics firm Glassnode.

Additional concerns centered on the financial buoyancy of Bitcoin miners. Not everybody, however, agreed that network participants were feeling the pinch towards the extent that capitulation would result.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.