Now, the $20,000 resistance is showing to become more powerful than expected which after Bitcoin (BTC) cost rejected this level on Sept. 27, BTC bulls have reasons not to stop.

Based on the four-month-lengthy climbing down triangular, as lengthy because the $18,500 support holds, Bitcoin cost has until late October to find out if the downtrend continues.

Bitcoin bulls may have been disappointed through the lackluster cost performance as BTC has unsuccessful multiple occasions to interrupt above $20,000, but macroeconomic occasions might trigger a rally earlier than expected.

Some analysts indicate the U . s . Kingdom’s unpredicted intervention within the bond market because the breaking reason for the government’s debt credibility. On Sept. 28, the financial institution of England announced it would begin the temporary acquisition of lengthy-dated bonds to calm investors following a sharp yield increase, the greatest since 1957.

To warrant the intervention, the financial institution of England mentioned, “were disorder within this sell to continue or worsen, there will be a material risk to U.K. financial stability.” Using this is through diametrically the alternative from the promise to market $85 billion in bond holdings within 12 several weeks. In a nutshell, the government’s credibility has been asked and for that reason, investors are demanding much greater returns to carry U.K. debt.

The outcome from the government’s efforts to curb inflation are starting to impair corporate revenues and based on Bloomberg, Apple lately backed off intends to increase production on Sept. 27. Amazon . com, the earth’s greatest store, can also be believed to possess shuttered intends to open 42 facilities, according to MWPVL Worldwide Corporation.

That’s the reason the $2.2 billion Bitcoin (BTC) monthly options expiry on Sept. 30 will put lots of cost pressure around the bulls, despite the fact that thebears appear slightly better positioned as Bitcoin tries to keep $19,000.

The majority of the bullish bets were placed above $21,000

Bitcoin’s rally toward the $22,500 resistance on Sept. 12 gave the bulls the signal to anticipate a continuation from the upward trend. This becomes apparent since 15% from the call (buy) choices for Sept. 30 happen to be placed at $21,000 or lower. What this means is Bitcoin bears be more effective positioned for that expiry from the $2.2 billion in monthly options.

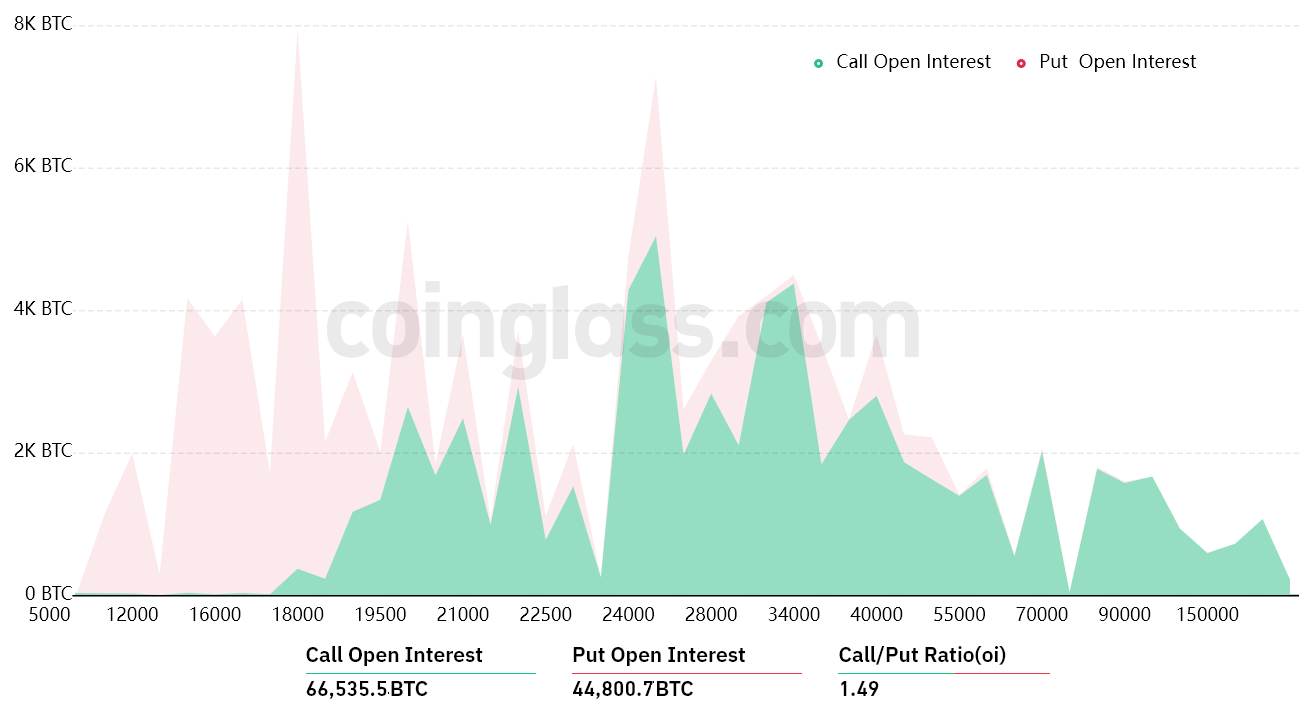

A wider view while using 1.49 call-to-put ratio shows a skewed situation with bullish bets (calls) open interest at $1.26 billion in comparison to the $850 million put (sell) options. Nonetheless, as Bitcoin presently stands near $19,000 and bears possess a dominant position.

If Bitcoin cost remains below $20,000 at 8:00 am UTC on Sept. 30, only $37 million price of these call (buy) options is going to be available. This difference is really because there’s no use within the authority to buy Bitcoin at $20,000 or $21,000 whether it trades below that much cla on expiry.

Bears could pocket a $350 million profit

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on Sept. 30 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $18,000 and $19,000: 500 calls versus. 19,800 puts. The internet result favors bears by $350 million.

- Between $19,000 and $20,000: 2,000 calls versus. 16,000 puts. The internet result favors bearish bets by $270 million.

- Between $20,000 and $21,000: 5,900 calls versus. 12,700 puts. The internet result favors bears by $135 million.

- Between $21,000 and $22,000: 10,100 calls versus. 11,300 puts. The internet outcome is balanced between bulls and bears.

This crude estimate views the phone call options utilized in bullish bets and also the put options solely in neutral-to-bearish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

Regulatory pressure could complicate things for Bitcoin bulls

Bitcoin bulls have to push the cost above $21,000 on Sept. 30 to balance the scales and steer clear of a possible $350 million loss. However, Bitcoin bulls appear at a complete loss because the U.S. Fed chairman known as for “crypto activities” regulation on Sept. 27, alerting “very significant structural issues around the possible lack of transparency.”

If bears dominate the September monthly options expiry, which will likely add firepower for more bets around the downside for Bitcoin cost. But, right now, there’s no indication that bulls can change the tables and steer clear of pressure in the four-month-lengthy climbing down triangular.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.