Bitcoin held near to yearly highs just beneath $25,000 on Monday, using the world’s largest cryptocurrency by market capital greater by a couple of.% at the time after rebounding strongly from the brief dip back under $24,000 earlier within the session. Bitcoin’s rebound in the $21,000s a week ago and continuing resilience has surprised many analysts.

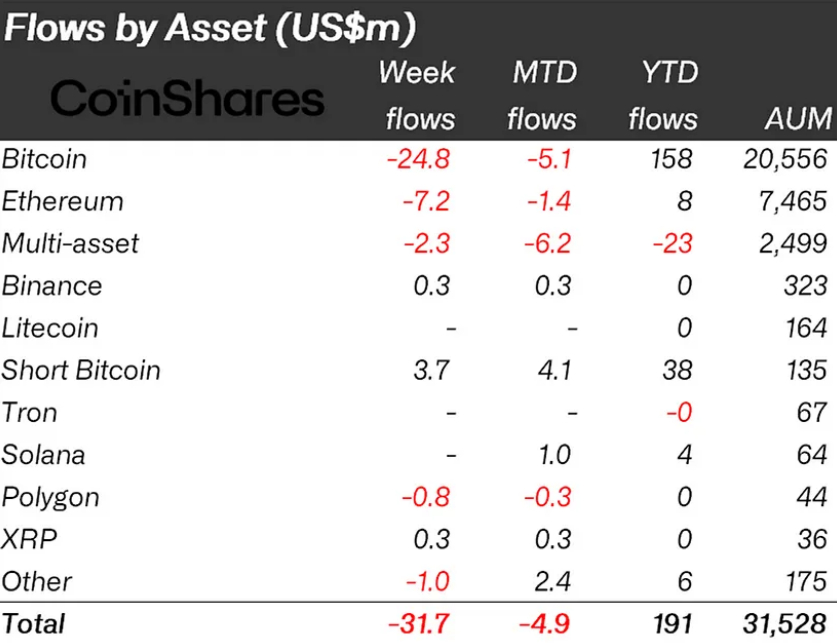

Many have been predicting extra time from the recent pullback from yearly highs, given ongoing strength in america dollar, upside in US yields and downside in US equities as traders drove up Given tightening bets, and given worries a good escalating US regulatory attack on crypto firms. That pessimism led to Bitcoin struggling with significant investor outflows a week ago, based on the latest CoinShares weekly funds flow report.

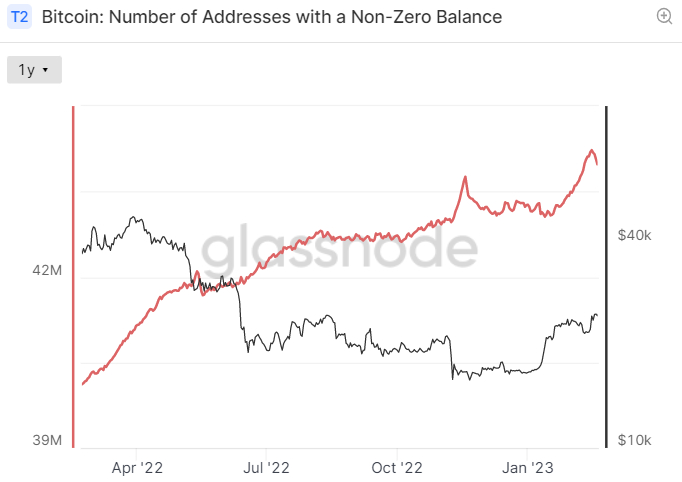

Based on the report, Bitcoin investment products saw an output of just shy of $25 million, taking month-to-date flows to negative $5.a million. Meanwhile, a week ago also saw a stable loss of the amount of wallet addresses around the network that hold a non-zero balance. Based on data presented by crypto analytics firm Glassnode, the amount of non-zero balance addresses fell from the record a lot of 44.226 million on Wednesday to simply under 44 million on Sunday.

That marked a decline close to 140,000 around the week, with declines observed over the major address cohorts. Addresses that hold a minimum of .1 BTC dropped from the record a lot of around 4.231 million on Tuesday close to 4.225 million by Sunday. Meanwhile, the amount of addresses holding a minimum of 1 BTC fell close to 1,500 between Tuesday and Sunday.

Outflows from Bitcoin investment products normally happen in times of exacerbated selling and downside pressure around the BTC cost. Falling non-zero wallet address figures also normally occur at occasions once the BTC cost is falling, with small investors presumably capitulating. Regardless of this, Bitcoin still ended a few days up over 11% and also at current levels within the $24,700s, expires around 7% around the month.

Bitcoin’s resilience when confronted with these headwinds shows that demand remains sufficiently strong enough to absorb-sell pressure from investors trying to spend in wake of the year’s positive cost run. For reference, Bitcoin is presently up just shy of fiftyPercent around the year.

But New Address Momentum Remains Positive

Analysts most likely won’t read an excessive amount of in to the recent stop by non-zero balance addresses, because this never just rises inside a straight line constantly, even if Bitcoin’s cost has been doing well, as it’s been lately.

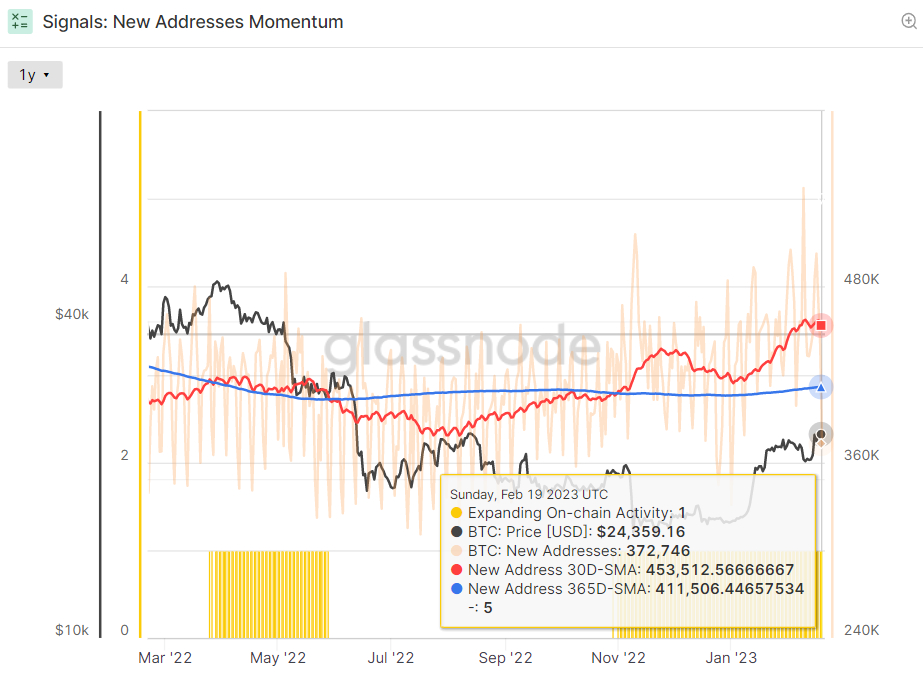

Glassnode’s New Address Momentum indicator, which tracks the 30 and 365-day moving averages (DMA) of recent addresses (this provides you with a greater conviction signal) is constantly on the claim that the address trend within the Bitcoin network remains positive.

The 30DMA of recent addresses entered over the 365DMA at the begining of Q4 2022 and it has ongoing to maneuver greater since. “Healthy network adoption is frequently characterised by an uptick in daily active users, more transaction throughput, and elevated interest in block space (and vice-versa)”, explains Glassnode.

Once the monthly (30DMA) is over the yearly (365DMA), this “indicates an expansion in on-chain activity, usual for improving network fundamentals, and growing network utilization”. Consequently, it possibly isn’t surprising to determine that Bitcoin bull markets frequently coincide with periods in which the 30DMA of recent addresses is both rising and above its 365DMA, the situation at this time.

Here’s In which the BTC Cost May Go Next

Some analysts have put Bitcoin’s recent strong performance when confronted with US regulatory and macro concerns lower to optimism about recent developments in Asia. Namely, since departing from the questionable and economically stifling zero Covid-19 policy this past year, China continues to be pumping liquidity into its markets this season. The PBoC just injected an enormous 835 billion CNY via reverse repos into its banking system, the biggest relocate more than a year.

And individuals aren’t just looking towards easing liquidity conditions in Asia. Hong Kong has freely expressed its desire to become global crypto hub and, on Monday, suggested new legislation that will let retail investors trade blue nick cryptocurrencies on licensed exchanges. That’s in stark contrast to China, where all retail crypto investment is banned.

Analysts happen to be theorizing that China is applying Hong Kong like a petri-dish to test out crypto, before potentially easing off by itself ban. Meanwhile, Hong Kong could behave as a gateway for Chinese capital to go in global crypto markets. “My working thesis atm (right now) would be that the next bull run will begin in the East,” Gemini co-founder Cameron Winklevoss announced on Twitter over the past weekend.

Easing Asian liquidity conditions and hopes that regulatory easing in Hong Kong might facilitate Chinese flows into crypto will continue to cushion prices dads and moms and days ahead, even when approaching US macro data does indicate a still-hot economy, potentially producing a further ramp-from Given tightening bets.

Searching at BTC/USD around the four-hour candle sticks, the cryptocurrency seems to become developing an climbing triangular. These typically advise a build-from buying pressure and frequently form in front of a bullish breakout. If Bitcoin ended up being to break above resistance within the low $25,000s, the road perfectly into a quick rally towards $28,000 (the late May 2022 low) could be unlocked. That will mark an additional than 13% rally from current levels, and would take Bitcoin’s on-the-year gains to shut to 7.%.