The cryptocurrency market has experienced another rollercoaster week that saw Ether (ETH) cost drop below $3,000 and Bitcoin (BTC) cost hit a brand new multi-month low at $37,700. Equities markets also suffered a clear, crisp sell-off mainly because of investor fear over potential changes to how big the government Reserve’s next rate hike.

Up to now, Bitcoin cost fell 41.72% lower from the $69,000 all-time high even though the cost may be with what some describe to become a bear market, a much deeper dive into various on-chain and derivatives data implies that a stop by inflows and thepivot from institutional investors would be the primary factors impacting BTC cost action.

Perpetual futures dominate trade volumes

A great deal has altered within the crypto market since 2017 once the Bitcoin market was covered with place buying and selling and derivatives markets composed just a part of buying and selling volume.

Based on a current report from on-chain market intelligence firm Glassnode, Bitcoin derivatives “now represent the dominant venue for cost discovery” using the “future trade volume now representing multiples of place market volume.”

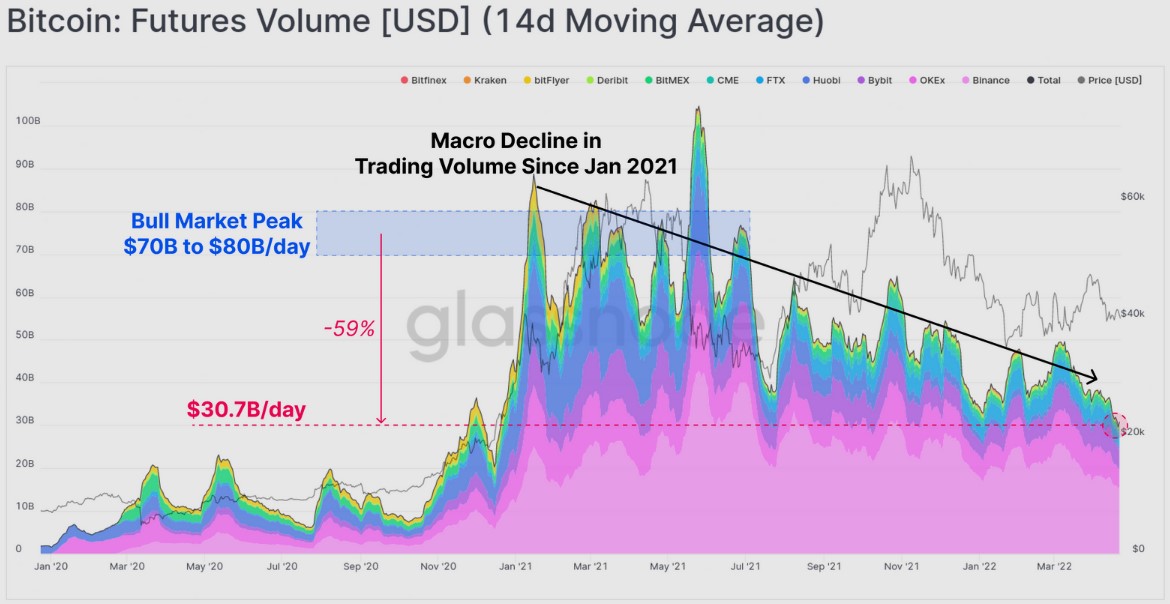

It has important implications for that current cost action for BTC because thefutures trade volume continues to be declining since The month of january 2021. The metric is lower greater than 59% from the a lot of $80 billion each day throughout the first 1 / 2 of 2021 to the current amount of $30.7 billion each day.

In that same period of time, perpetual futures have surpassed traditional calendar futures because the preferred instrument for buying and selling simply because they more carefully match the place index cost and also the costs connected with taking delivery of BTC are significantly less than with traditional goods.

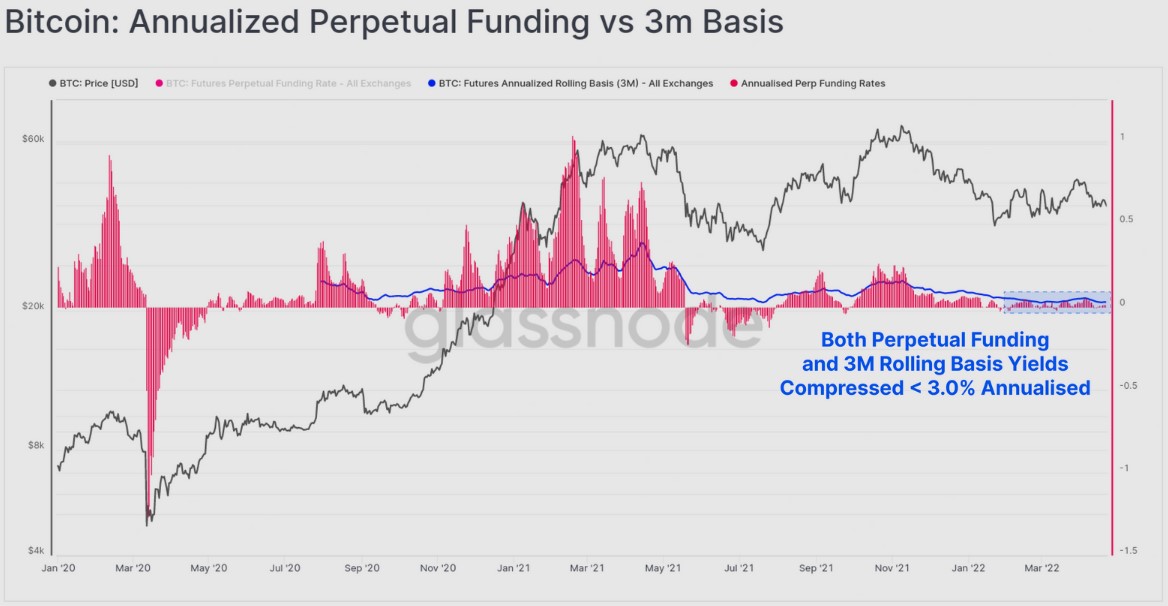

Based on Glassnode, “the current open curiosity about perpetual swaps is the same as 1.3% from the Bitcoin market cap, that is approaching in the past high levels.”

Regardless of this, the entire change in capital and leverage from calendar expiring futures has brought to some declining leverage ratio, which “suggests that the reasonable amount of capital is really departing the Bitcoin market.”

The reason with this capital rotation is probably related that the yields obtainable in futures financial markets are presently just above 3.%, that is only .1% greater compared to 2.9% yield on the ten-year U.S. Treasury Bond and well underneath the 8.5% U.S. Consumer Cost Index (CPI) inflation print.

Glassnode stated,

“It is probably that declining trade volumes minimizing aggregate open interest rates are an indicator of capital flowing from Bitcoin derivatives, and towards greater yield, and potentially lower perceived risk possibilities.”

Related: Trader flags BTC cost levels to look at as Bitcoin still risks $30K ‘ultimate bottom’

On-chain data suggests large entity adoption

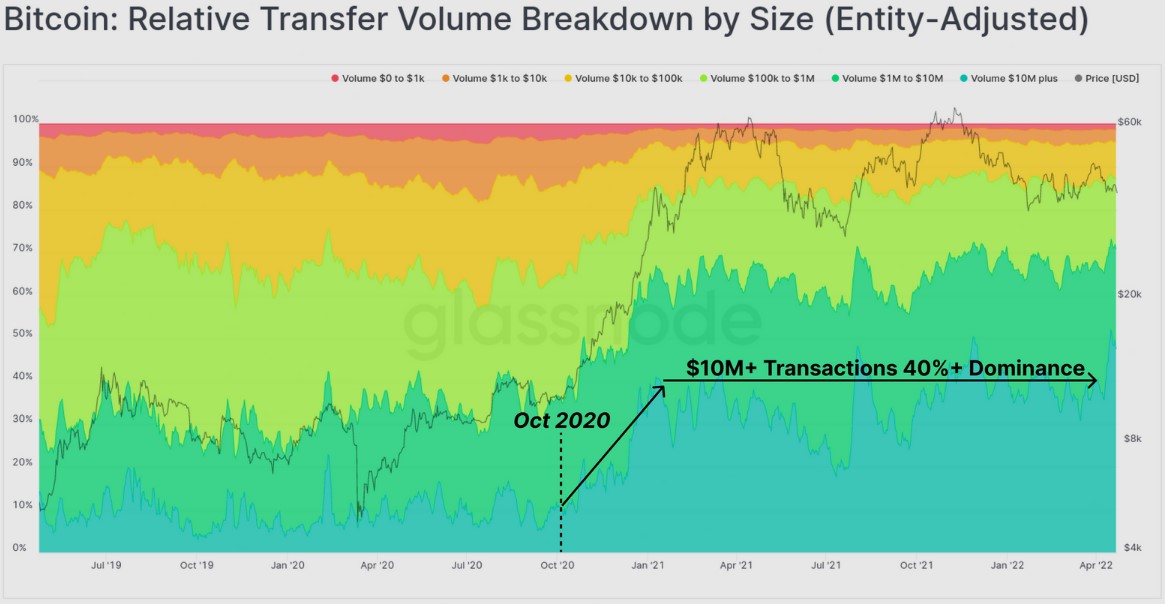

Leaving derivatives markets, positive signs for future years of Bitcoin are available by digging much deeper into on-chain volume data.

Starting in October 2020, the proportion of transactions more than $ten million has elevated from 10% of transfer volume on the good day to the present average daily dominance of 40%.

Based on Glassnode, this suggests significant growth “in value settlement by institutional sized investment/buying and selling entities, custodians and internet worth individuals.”

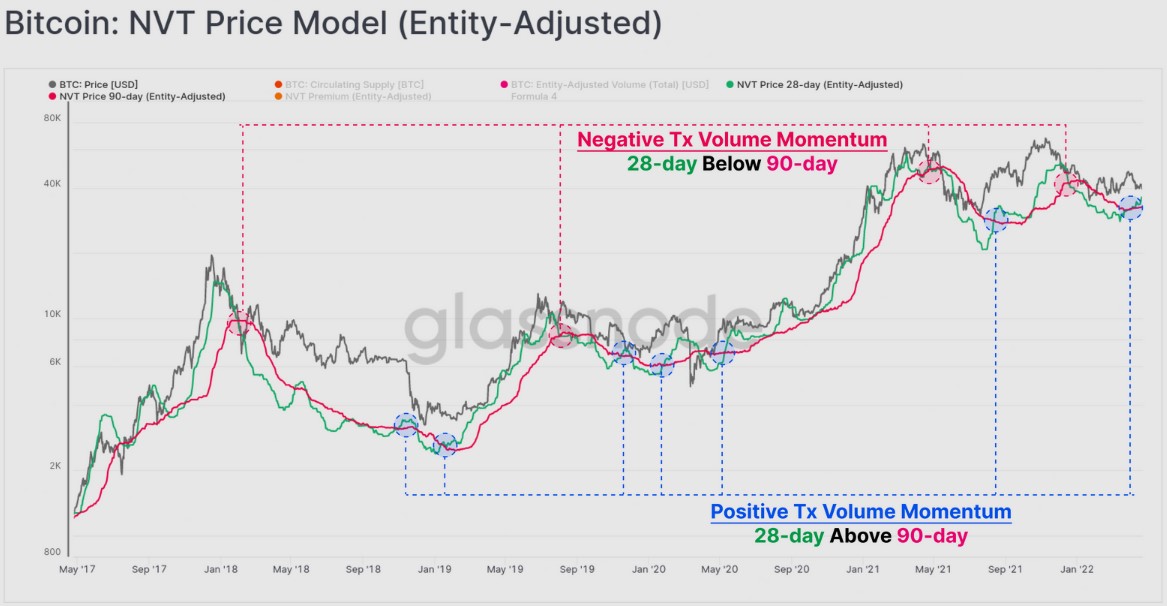

Using aggregate transaction volumes with the Network Value to Transactions (NVT) Ratio, the present worth of Bitcoin is between $32,500 and $36,100.

Based on Glassnode, both 28-day and 90-day NVT models are “starting to bottom out and potentially reverse” using the 28-day breaking over the 90-day, that has in the past “been a constructive medium to lengthy-term signal.”

The general cryptocurrency market cap now is $1.791 trillion and Bitcoin’s dominance rates are 41.5%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.