You will find early indications of the “dust settling” within the crypto market since investors think that the worst from the Terra (LUNA) collapse looks to become over. Viewing Bitcoin’s chart signifies that although the fallout was prevalent and quite devastating for altcoins, BItcoin (BTC) has really organized fairly well.

Despite the May 12 drop to $26,697 marking the cheapest cost level since 2020 multiple metrics claim that the present levels could represent a great admission to BTC.

The pullback for this level is notable in it had become a retest of Bitcoin’s 200-week exponential moving average (EMA) at $26,990. Based on cryptocurrency research firm Delphi Digital, this metric has in the past “served like a key position for prior cost bottoms.”

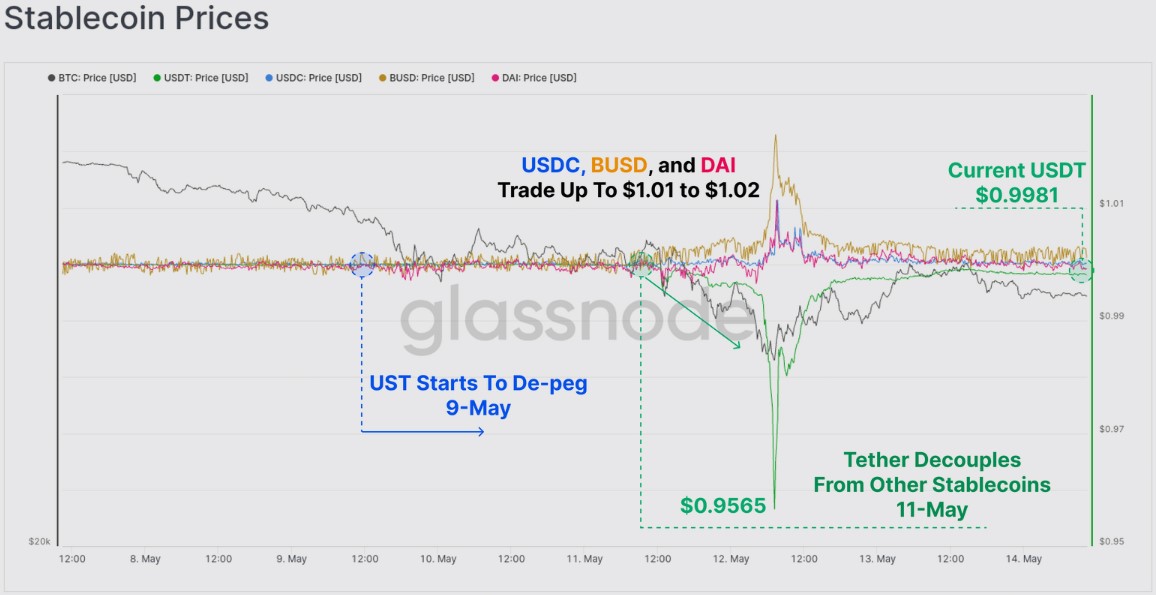

Also it wasn’t just Bitcoin which had a tough day on May 12. The stablecoin market also saw its greatest degree of volatility and deviation in the dollar peg since the beginning of the Terra saga, with Tether (USDT) experiencing and enjoying the largest deviation one of the major stablecoin projects as proven within the chart below from blockchain data provider Glassnode.

All from the top stablecoins by market cap have managed to go back to within $.001 of the dollar peg, however the confidence of crypto holders within their capability to hold has certainly been shaken through the occasions of history two days.

Related: Do Kwon called to parliamentary hearing following UST and LUNA crash

Bitcoin approaches its recognized cost

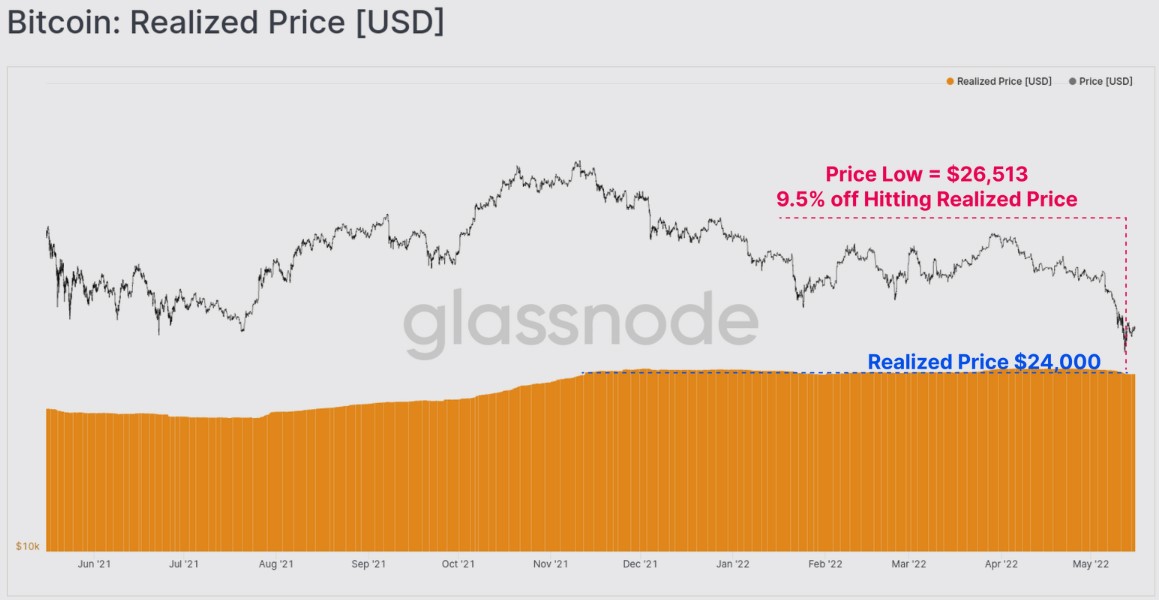

Because of the marketplace pullback, the cost of Bitcoin has become buying and selling the nearest it’s been to the recognized cost since 2020.

Based on Glassnode, the recognized cost has in the past “provided seem support during bear markets and it has provided signals of market bottom formation once the market cost trades below it.”

Previous bear markets saw the cost of BTC trade below its recognized cost for longer amounts of time, but how long has really decreased every cycle with Bitcoin only spending 7 days below its recognized cost throughout the bear market of 2019–2020.

It remains seen if BTC will fall underneath the recognized cost if the current bear market conditions persist, therefore, how lengthy it’ll last.

On-chain data shows that lots of crypto holders couldn’t subdue the longing of obtaining Bitcoin below $30,000, producing a spike in accumulation beginning on May 12 and ongoing through May 15, however, many analysts caution against using this like a sign that the rapid recovery will occur came from here.

If history is any suggestion, most #BTC Bear Market bottoms form rapidly, inside a volatile manner

However the accumulation ranges that form later on take some time

Odds are you will see the required time to amass at deeply great deals$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) May 13, 2022

This sentiment was echoed by Delphi Digital, which noted that “the longer we have seen cost build during these areas, further continuation gets to be more likely.”

Delphi Digital stated,

“In the big event this occurs, look for an additional levels: 1) Weekly structure and volume structure support at $22,000–$24,000 2) 2017 all-time high retests of $19,000–$20,000.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.