Bitcoin (BTC) crashed below $19,000 on Sept. 6, driving the cost to the cheapest level in 80 days. The movement not just completely erased the whole from the 32% gains accrued from This summer until August. 15, additionally, it easily wiped out $246 million price of leverage lengthy (buy) futures contracts.

Bitcoin cost is lower for that year but it’s vital that you compare its cost action against other assets. Oil costs are presently lower 23.5% since This summer, Palantir Technologies (PLTR) has dropped 36.4% in thirty days and Moderna (MRNA), a pharmaceutical and biotechnology company, is lower 30.4% within the same period.

Inflationary pressure and anxiety about a worldwide recession have driven investors from riskier assets. By seeking shelter in cash positions, mainly within the dollar itself, this protective movement is responsible for the U.S. Treasuries’ 5-year yield to achieve 3.38%, nearing its greatest level in fifteen years. By demanding a loftier premium to carry government debt, investors are signaling too little confidence in the present inflation controls.

Data released on Sept. 7 implies that China’s exports increased 7.1% in August from last year, after growing by 18% in This summer. In addition, Germany’s industrial orders data on Sept. 6 demonstrated a 13.6% contraction in This summer versus the year before. Thus, until there’s some decoupling from traditional markets, there isn’t much expect a sustainable Bitcoin bull run.

Bears were excessively positive

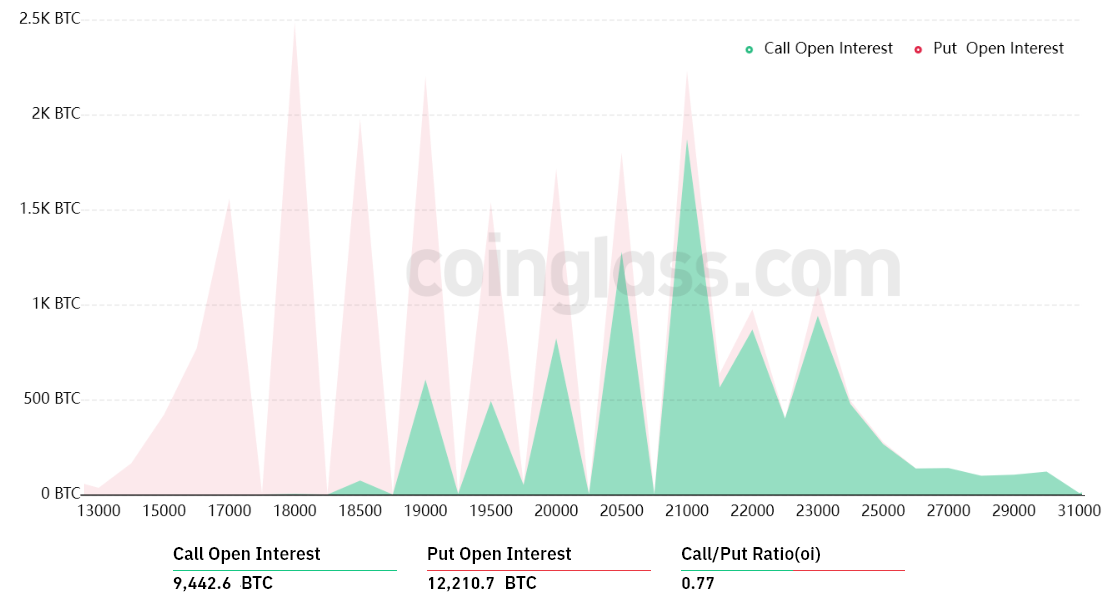

Outdoors interest for that Sept. 9 options expiry is $410 million, however the actual figure is going to be lower since bears grew to become too overconfident. These traders weren’t expecting $18,700 to carry as their bets targeted $18,500 and below.

The .77 call-to-put ratio reflects the imbalance between your $180 million call (buy) open interest and also the $230 million put (sell) options. Presently, Bitcoin stands near $18,900, meaning most bets from each side will probably become useless.

If Bitcoin’s cost remains below $20,000 at 8:00 am UTC on Sept. 9, only $13 million price of these call (buy) options is going to be available. This difference is really because the authority to buy Bitcoin at $20,000 is useless if BTC trades below that much cla on expiry.

Bears strive for $18,000 to have a $90 million profit

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on Sept. 9 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $17,000 and $18,000: calls versus. 4,300 puts. Bears completely dominate, profiting $130 million.

- Between $18,000 and $19,000: calls versus. 5,050 puts. The internet result favors the put (bear) instruments by $90 million.

- Between $19,000 and $20,000: 700 calls versus. 1,900 puts. The internet result favors the put (bear) instruments by $50 million.

- Between $20,000 and $21,000: 2,050 calls versus. 2,200 puts. The internet outcome is balanced between bulls and bears.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

Related: Bitcoin cost hits 10-week low among ‘painful’ U.S. dollar rally warning

Bulls have until Sept. 9 to help ease their discomfort

Bitcoin bulls have to push the cost above $20,000 on Sept. 9 to prevent a possible $130 million loss. However, the bears’ best-situation scenario needs a slight push below $18,000 to maximise their gains.

Bitcoin bulls just had $246 million leverage lengthy positions liquidated in 2 days, so that they may have less margin needed they are driving the cost greater. Quite simply, bears possess a jump to peg BTC below $19,000 in front of the weekly options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.