Bitcoin (BTC) bounced past $28,000 during May 12 after repeating a chart structure not seen since March 2020.

BTC seller losses spiral

Data from Cointelegraph Markets Pro and TradingView continued to trace BTC/USD because it briefly fell to simply under $24,000 on Bitstamp.

A powerful reversal then sent the happy couple several 1000 dollars greater within a few minutes, with consolidation then establishing itself to determine it trade around $27,000.

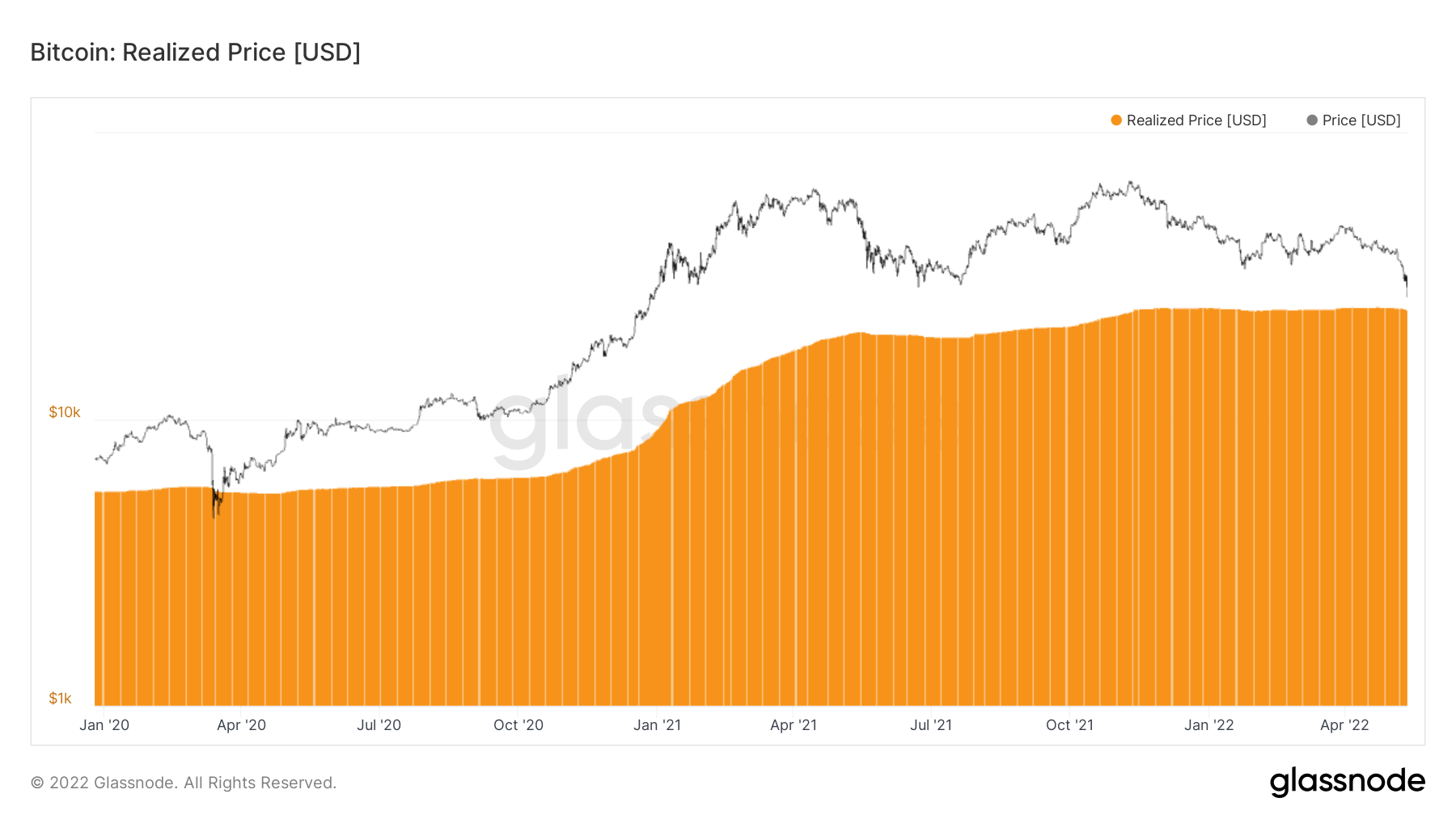

The bounce zone was significant, constituting Bitcoin’s so-known as recognized cost — the price tag of unspent transaction outputs (UTXOs).

The final time that BTC/USD tested recognized cost was throughout the COVID-19 mix-market crash in March 2020.

“Bitcoin essentially kissed the recognized cost ($24k). $BTC is affordable,” Checkmate, lead insights analyst at on-chain analytics firm Glassnode, noted on Twitter.

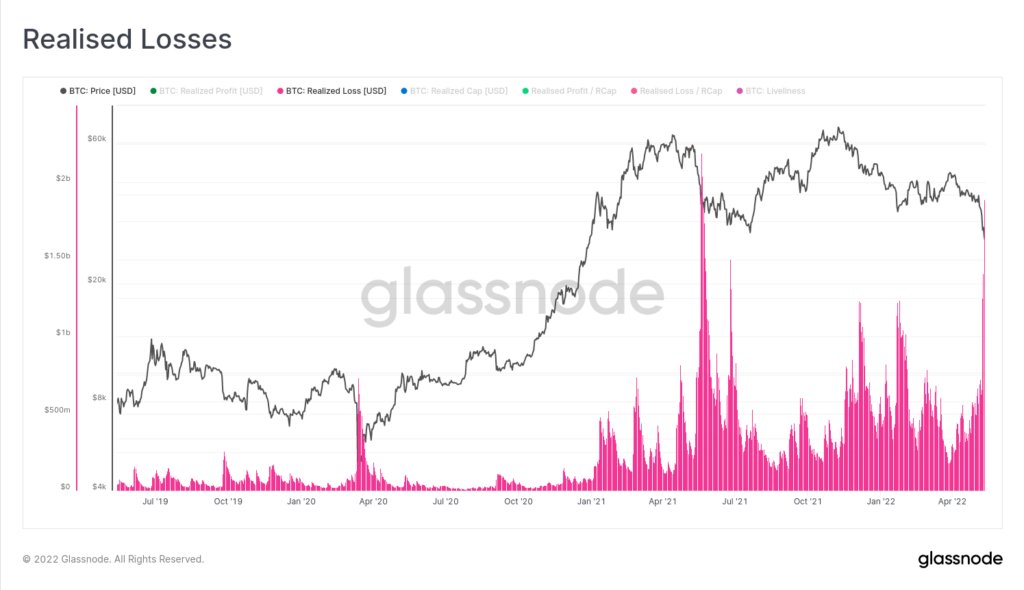

Checkmate added that recognized losses — investors selling BTC while being underwater versus their cost cost — had also spiked to the second greatest daily levels ever around $2 billion.

As Cointelegraph reported, liquidations had also mounted within the previous 24 hrs, passing $1.2 billion across crypto.

Tether peg crawls back to view

Another primary subject during the day, stablecoins, meanwhile started to split opinion around the outlook for Bitcoin itself.

Related: Avalanche drops 30% on fears Terra’s LFG will dump AVAX next

As largest stablecoin Tether (USDT) saw its U.S. dollar peg slip, two camps emerged, one accusing Tether of malpractice and the other certain that the peg would soon be restored — unlike those of imploded U.S. dollar stablecoin, TerraUSD (UST).

“The USDT peg is restoring already, that is a good sign,” Cointelegraph contributor Michaël van de Poppe authored in one of numerous tweets at the time.

“People should not compare $USDT with $UST as individuals are totally different, even though the reaction around the financial markets are due to tremendous fear levels. Still appears like capitulation in my experience.”

Commentator WhalePanda furthered the sentiment, warning of “peak FUD” from what he yet others known as “Tether truthers.”

People confusing $USDT and $UST and panicking.

Individuals don’t comprehend the distinction between an under collaterized algorithmic stablecoin along with a backed stablecoin.

Panic dumping $USDT for $USDC and common $USD.Peak fud time.

Warning: this publish will attract “Tether truthers”

— WhalePanda (@WhalePanda) May 12, 2022

USDT/USD traded at 2% below dollar parity during the time of writing.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.