Bitcoin (BTC) remained wedged inside a tight range on June 4 as traders’ calls for a brand new macro low endured.

Lengthy-term holders begin ‘distribution’

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD stuck between $29,000 and $30,000 in to the weekend.

The happy couple had managed a revival to near $31,000 the day before, however the last Wall Street buying and selling session each week put pay to bulls’ efforts.

As “out-of-hrs” markets offered thin volumes but little volatility, eyes were around the potential direction of the items could be an unavoidable breakout.

“The weekly chart on Bitcoin looks simply terrible so the trend continuation remains. I’m sure we consolidate longer within this range before shedding eventually,” Crypto Tony announced at the time in part of a number of tweets.

A further publish reiterated a target which is between $22,000 and $24,000 for Bitcoin once that forecast drop required hold.

“I’m searching for an additional drop lower to $24000 – $22000, however distribution needs time to work. Therefore we might be hovering for this support zones before any drops at this time,” it read.

Others planned to take full advantage of incoming weakness, including popular Twitter account Cryptotoad, which announced a method of accumulating at $27,000 and under with what will be a “swing low” for BTC/USD.

I do not understand what you’re gonna do, but My plan’s to begin accumulating my lengthy term position at 27k swing low completely lower towards the .382 fib at 21.5k.

#btc #bitcoin pic.twitter.com/JCdHv0pMdr

— Cryptotoad (@Mesawine1) June 4, 2022

As Cointelegraph reported, other sources acutely eyeing lower lows for Bitcoin vary from on-chain analysts to well-known pundits for example ex-BitMEX Chief executive officer, Arthur Hayes.

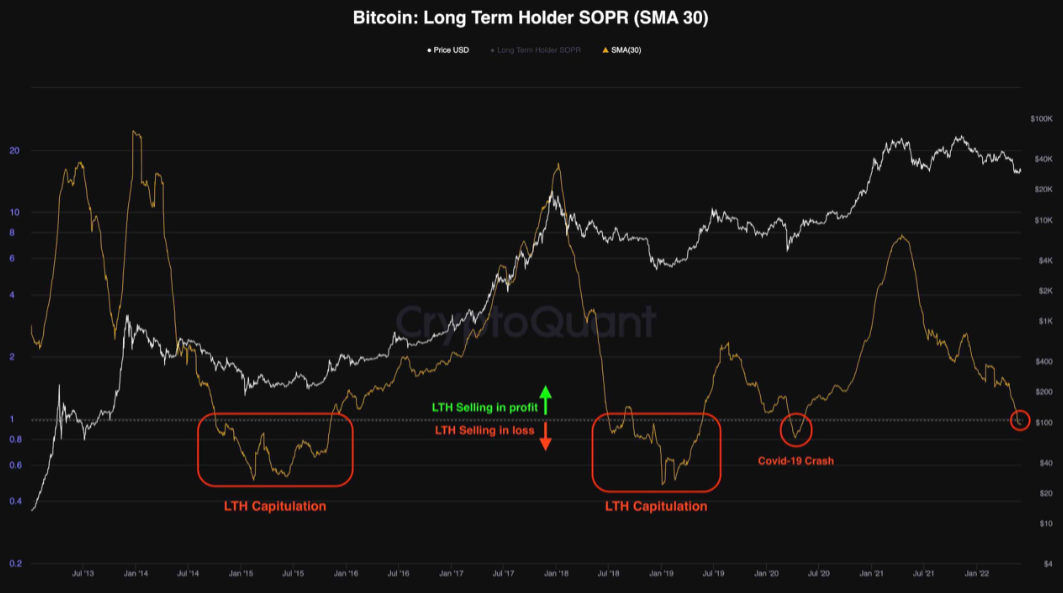

Adding fuel towards the fire was data from on-chain analytics platform CryptoQuant, which signaled that lengthy-term holders were beginning to divest themselves of the stash inside a classic bear market move.

“Lengthy-term holders capitulation phase has started,” adding analyst Edris summarized in a single the site’s QuickTake market updates released on June 3.

Commenting on the chart of lengthy-term holders’ Spent Output Profit Ratio (SOPR), Edris came comparisons to problems that preceded generational bottoms in Bitcoin’s history. These incorporated the 2014 and 2018 bear markets, along with the COVID-19 mix-market crash of March 2020.

“Presently, the lengthy-term holders are entering the capitulation phase and therefore are selling baffled, indicating the smart money accumulation phase has started, and subsequently couple of several weeks would present an excellent chance for lengthy-term investing on the market,” the publish read.

It noted that this type of capitulation event “usually marks a multi-year bottom.”

Exchanges still see big buys

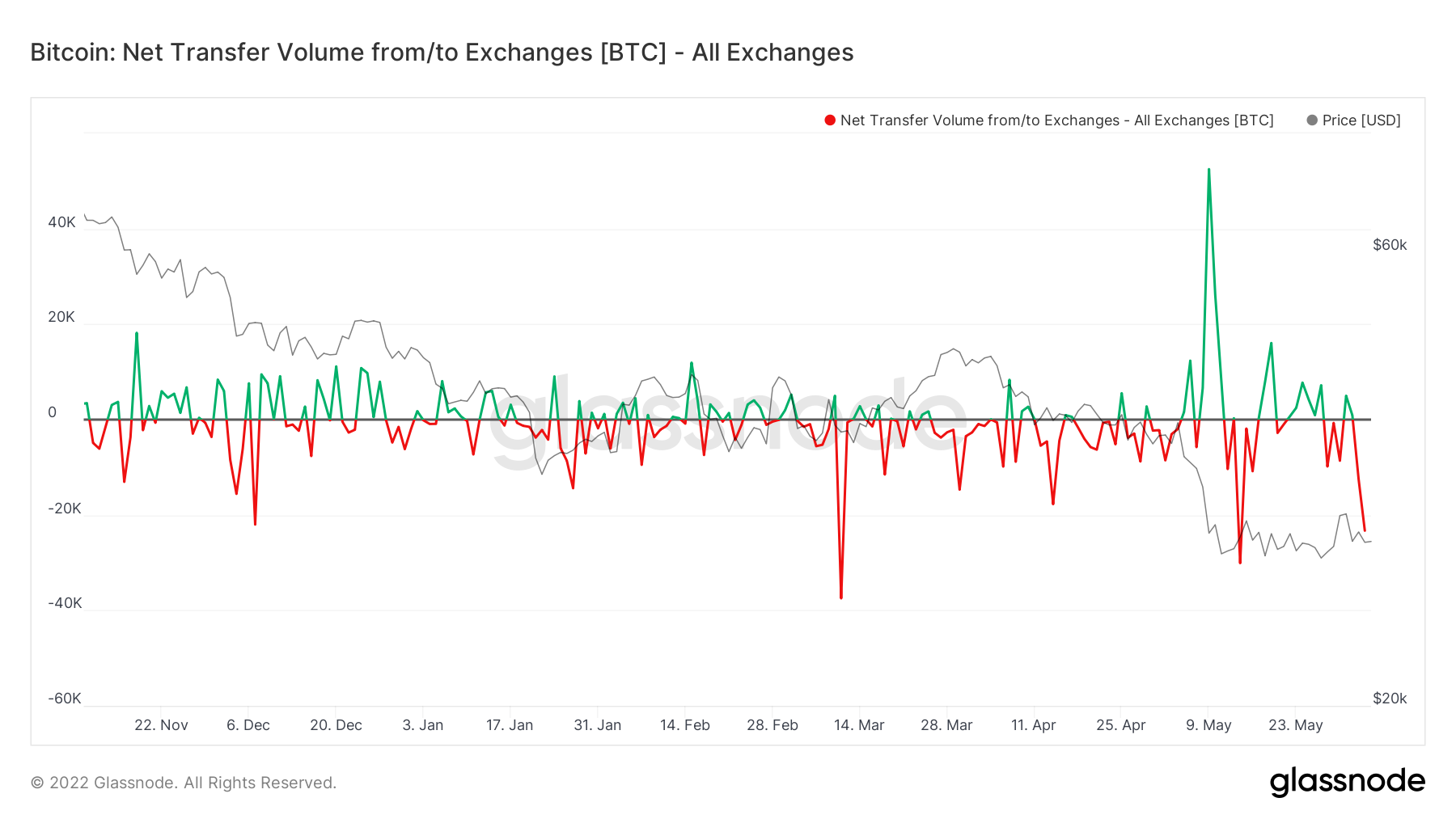

Inside a hint that some were already purchasing the dip, meanwhile, exchange data demonstrated that outflows were beating inflows markedly in recent days.

Related: Over 200K BTC now kept in Bitcoin ETFs along with other institutional products

Based on on-chain analytics firm Glassnode, on June 3, netflows from major exchanges totaled -23,286 BTC, probably the most since May 14.

Discussing lengthy-term holder behavior earlier within the week within the latest edition of their e-newsletter, “A Few Days On-Chain,” Glassnode add-chain analyst Checkmate furthermore delineated classes of investor presently least thinking about selling.

Specifcally, individuals who bought close to the November 2021 all-time highs “seem to be relatively cost insensitive,” he authored, adding the investor profile was more and more made up of such persistent hodlers.

“Despite ongoing drawdowns in cost, along with a major place liquidation event of 80k+ BTC, they continue to be reluctant to allow their coins go,” he added.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.