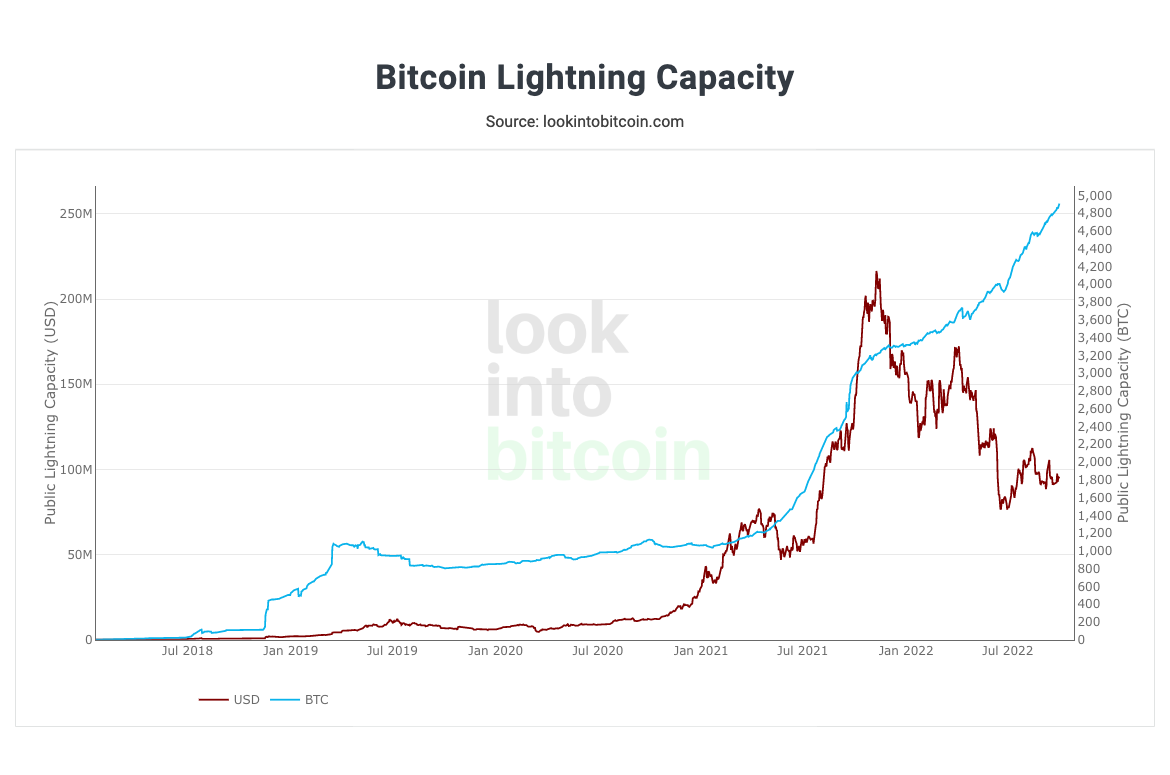

Bear financial markets are for building out capacity around the layer-2 Lightning Network. Despite macroeconomic headwinds and sluggish cost action, the Lightning Network, the layer-2 payments solution fo Bitcoin (BTC), is constantly on the flourish.

The Bitcoin Lightning Network arrived at a milestone capacity of 5,000 BTC ($96 million). Essentially, increasingly more Bitcoin has been brought to Lightning Network payment channels worldwide, as Bitcoiners still offer the development of the network.

The Lightning Network enables users to transmit Bitcoin (or satoshis, the tiniest quantity of a Bitcoin) to transmit or get money faster with lower charges. The greater capacity around the network, the greater liquidity is on hands. Consequently, users may feel faster payment speeds and potentially bigger transaction volumes.

First produced in 2018, the sunlight Network originates under fire lately. Bitcoin influencers for example Udi Wertheimer have discussed the network’s “failure,” claiming that nobody uses the network. Nevertheless, the network hit 4,000 BTC capacity in June and in the last 4 years, it is a dependable payment network and it is famous El Salvador, the Isle of individual and Gibraltar:

Nourou, of Bitcoin Senegal, explains why the LN is really important. He told Cointelegraph, “In Senegal, there’s an economy of fifty FCFA. In other words the Senegalese from the working and proletarian class, who represent a lot of the population, buy, for his or her breakfast, 50 FCFA (.07€) of milk, sugar, coffee, water, and lots of other fundamental products.”

“Microtransactions are our economic reality. For Bitcoin to get the conventional within the a long time, as well as in our economies, the lightning network would need to have sufficient ability to support these microtransactions.”

Nicolas Burtey, Chief executive officer at Galoy, was among the first to celebrate the five,000 Bitcoin achievement. Burtey told Cointelegraph the adoption of Bitcoin in El Salvador was the tipping point for that Lightning Network. This is when all metrics really began to consider off.” He joked, “The balance must have really been known as the Lightning Law!”

— Nicolas Burtey ⚡️⚡️ (@nicolasburtey) October 3, 2022

Burtey ongoing, explaining that although the five,000 BTC metric is essential, “Payment velocity per funnel keeps growing in an even faster rate. It is a more significant metric, only node operators can easily see it, therefore it is not too prominent in media.”

The Lightning Network, when a space for hobbyist Bitcoin enthusiasts, now attracts large corporations. MicroStrategy is now hiring for any Bitcoin Lightning Software engineer. MicroStrategy may be the largest holder of Bitcoin among openly traded companies, with 130,000 BTC on its balance sheet.

Related: Raise a glass to Satoshi’s Place: the task of running Bitcoin companies

Elsewhere, Strike, a Bitcoin Lightning company headed by Jack Mallers, elevated $80 million to “revolutionize payments” for retailers. Mallers and Strike spearheaded El Salvador’s Bitcoin adoption plans in 2021.

For Nourou, who’s hosting Dakar Bitcoin Days in December, the very first major Bitcoin conference in Senegal, the five,000 BTC milestone is monumental: “A rise in BTCs blocked within the network and the amount of channels opened up in parallel is really a further step for the democratization of Bitcoin transactions on the planet.”