Bitcoin funding rates on margin positions leaped for their greatest levels in over two days previously 2 days, based on data in the OKX and dYdX cryptocurrency exchanges and presented by crypto analytics website coinglass.com. Positive funding rates claim that speculators are bullish and claim that lengthy traders are having to pay funding to short traders.

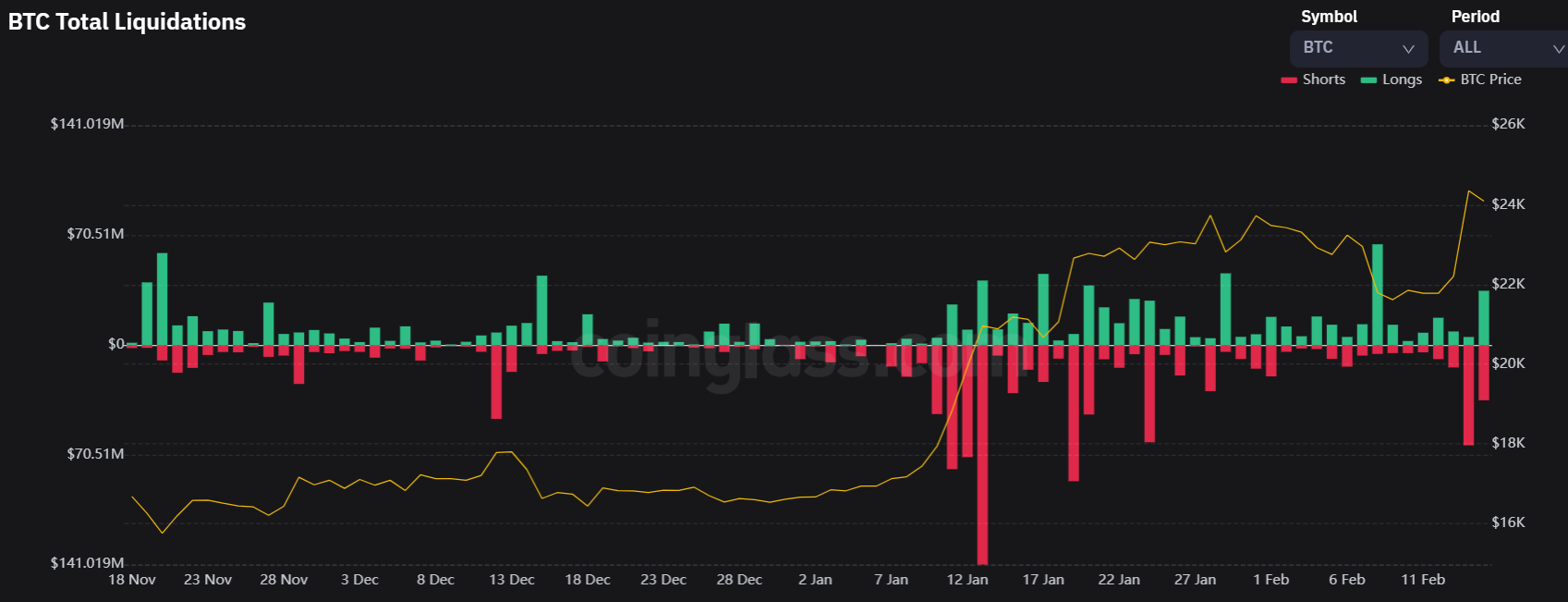

The spike in Bitcoin funding rates is available in wake from the cryptocurrency’s latest cost jump, which first viewed it print fresh eight-month highs at $25,270 on Thursday getting been as little as the $21,300s the 2009 week. Bitcoin has since retracted towards the upper $23,000s, but continues to be up over 8.5% now. The cost jump from the last couple of days has additionally led to an increase in liquidations of Bitcoin future short-positions, based on coinglass.com.

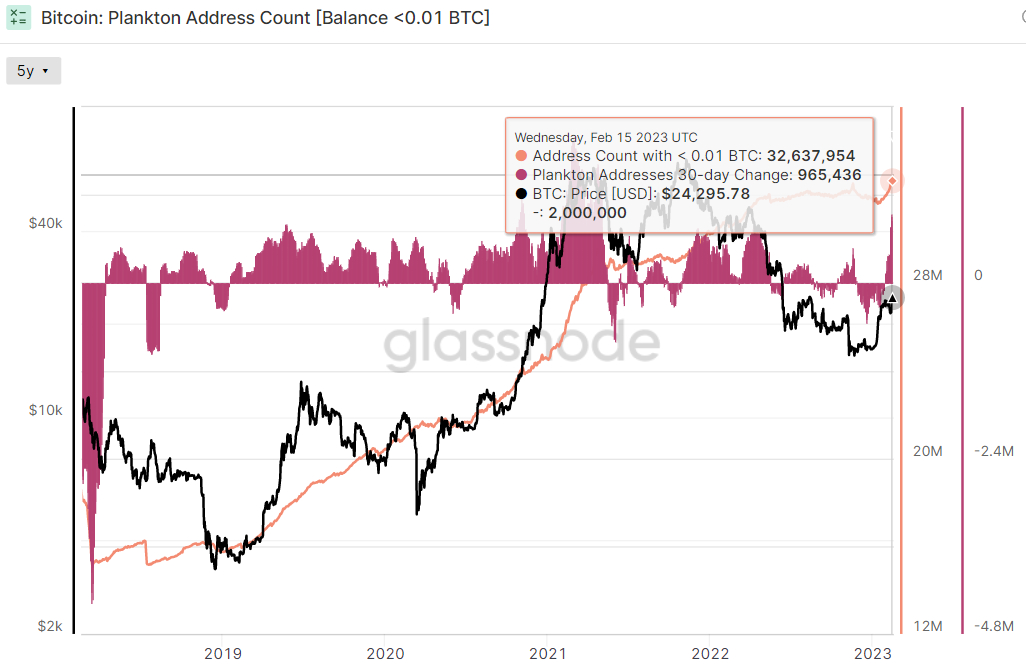

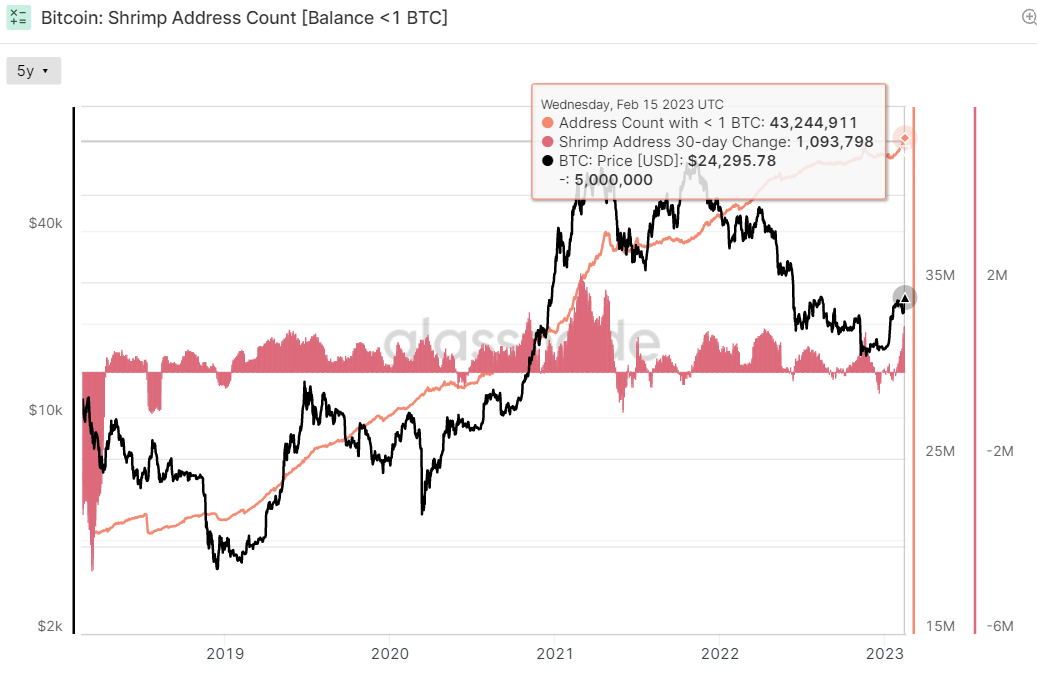

The current begin cost and also the subsequent spike within the margin funding rate come from the backdrop of the ongoing rush of new Bitcoin investors. A minimum of, that’s the conclusion that may be attracted from analyzing trends within the distribution of BTC possession among wallets, with the amount of wallets having a small BTC balance (presumably retail investors) expanding in a rapid clip.

Can New Investors Keep Pumping the Bitcoin Cost?

Based on crypto data analytics platform Glassnode, the amount of Bitcoin wallet addresses holding a non-zero balance lately surged above 44 million the very first time. This growth has unsurprisingly been driven with a boost in the amount of wallets holding a little BTC balance. So-known as “plankton” addresses with under .01 BTC lately hit all-time highs above 32.six million.

The amount of so-known as “shrimp” addresses, understood to be holding under 1 BTC, also lately hit a brand new all-time high above 43.two million. This means an increase of recent investors, that is likely helping drive the current gains observed in Bitcoin.

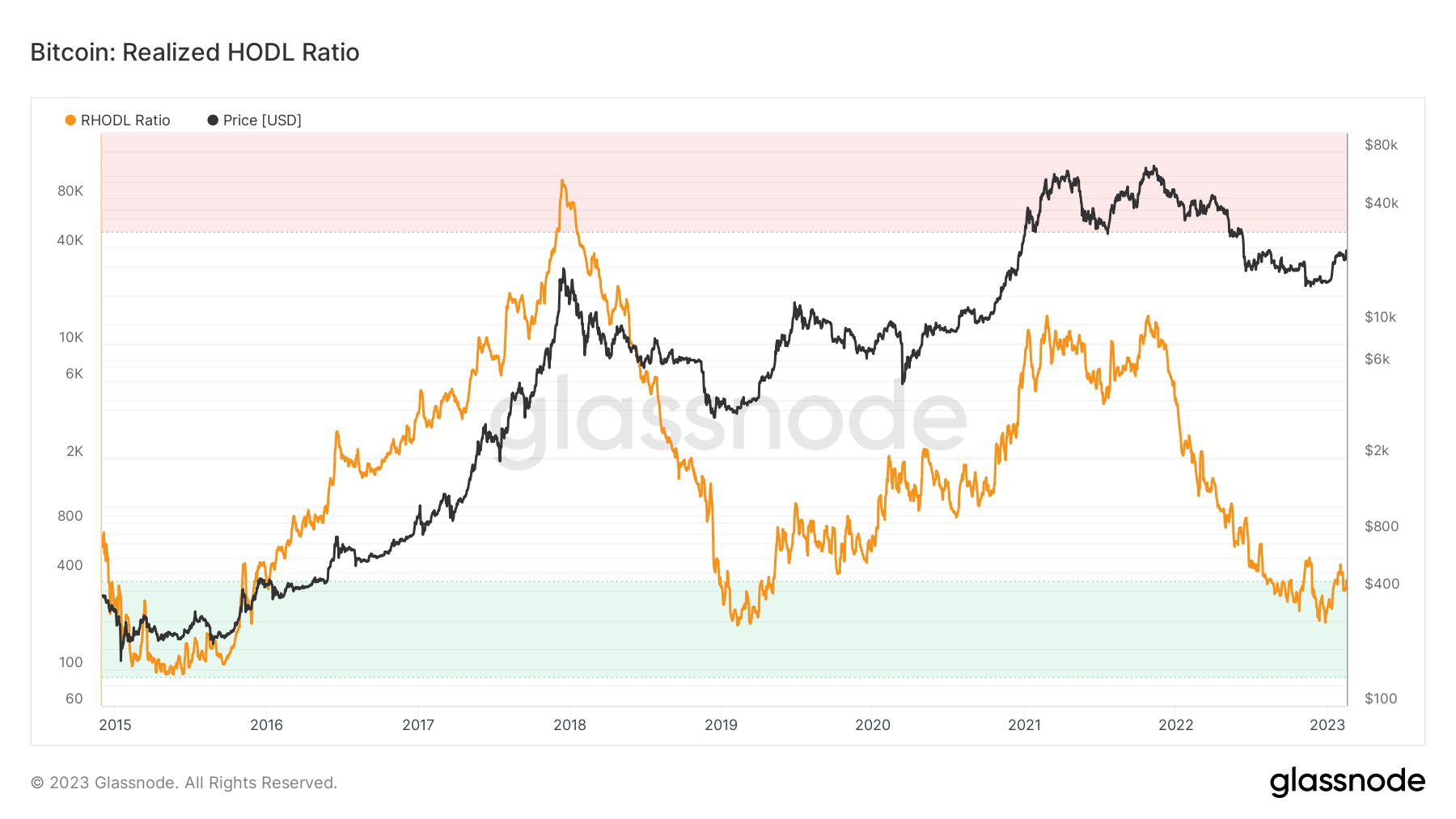

In the past, the total amount of BTC wealth concentrates at the disposal of presumably greater conviction investors throughout a Bitcoin bear market. If this BTC wealth concentration begins to reverse, it has classically been an earlier indicator that the new Bitcoin bull marketplace is beginning and new investors are coming back towards the market once more. This trend are visible in Glassnode’s Recognized HODL Ratio indicator.

The RHODL Ratio takes the ratio between your 7 days and also the 1-24 months old coins (i.e. once the coins last moved). If this increases, it suggests more coins are on the go, suggesting an increase of recent buyers. If this falls, it suggests coins are now being accrued in wallets that aren’t prepared to sell, which often occurs when weak-hands investors target more powerful-hands investors throughout a bear market.

As are visible in the above mentioned chart, the current bottoming and tentative reversal greater within the balance of BTC wealth is suggestive that Bitcoin’s bottom may be set for this cycle. Bitcoin bulls is going to be wishing that the increase of recent investors could pump the cost when confronted with growing macro headwinds.