Sept. 12 leaves an indication which will most likely stick for a long time. Traders in the Bitfinex exchange vastly reduced their leveraged bearish Bitcoin (BTC) bets and the lack of interest in shorts might have been brought on by the expectation of awesome inflation data.

Bears might have lacked confidence, but August’s U.S. Consumer Cost Index (CPI) arrived greater than market expectations and they seem like around the right side. The inflation index, which tracks an extensive basket of products or services, elevated 8.3% over the year before. More to the point, the power prices component fell 5% within the same period however it was greater than offset by increases in food and shelter costs.

Right after the more serious-than-expected macroeconomic data was launched, U.S. equity indices required a downturn, using the tech-heavy Nasdaq Composite Index futures sliding 3.6% in half an hour. Cryptocurrencies supported the worsening mood, and Bitcoin cost dropped 5.7% within the same period, erasing gains in the previous three days.

Pinpointing the marketplace downturn one inflationary metric could be naive. A Financial Institution of the usa survey with global fund managers had 62% of respondents saying that the recession is probably, the greatest estimate since May 2020. The study paper collected data around the week of Sept. 8 and it was brought by strategist Michael Hartnett.

Interestingly, as all this happens, Bitcoin margin traders haven’t been so bullish, based on one metric.

Margin traders travelled from bearish positions

Margin buying and selling enables investors to leverage their positions by borrowing stablecoins and taking advantage of the proceeds to purchase more cryptocurrency. However, when individuals traders borrow Bitcoin, they will use the coins as collateral for shorts, which ensures they are betting on the cost decrease.

That’s the reason some analysts monitor the entire lending levels of Bitcoin and stablecoins to know whether investors are leaning bullish or bearish. Interestingly, Bitfinex margin traders joined their greatest leverage lengthy/short ratio on Sept. 12.

Bitfinex margin traders are recognized for creating position contracts of 20,000 BTC or greater in an exceedingly small amount of time, indicating the participation of whales and enormous arbitrage desks.

Because the above chart signifies, on Sept. 12, the amount of BTC/USD lengthy margin contracts outpaced shorts by 86 occasions, at 104,000 BTC. For reference, the final time this indicator flipped above 75, and favored longs, was on November. 9, 2021. Regrettably, for bulls, the end result benefited bears as Bitcoin nosedived 18% within the next ten days.

Derivatives traders were excessively excited in November 2021

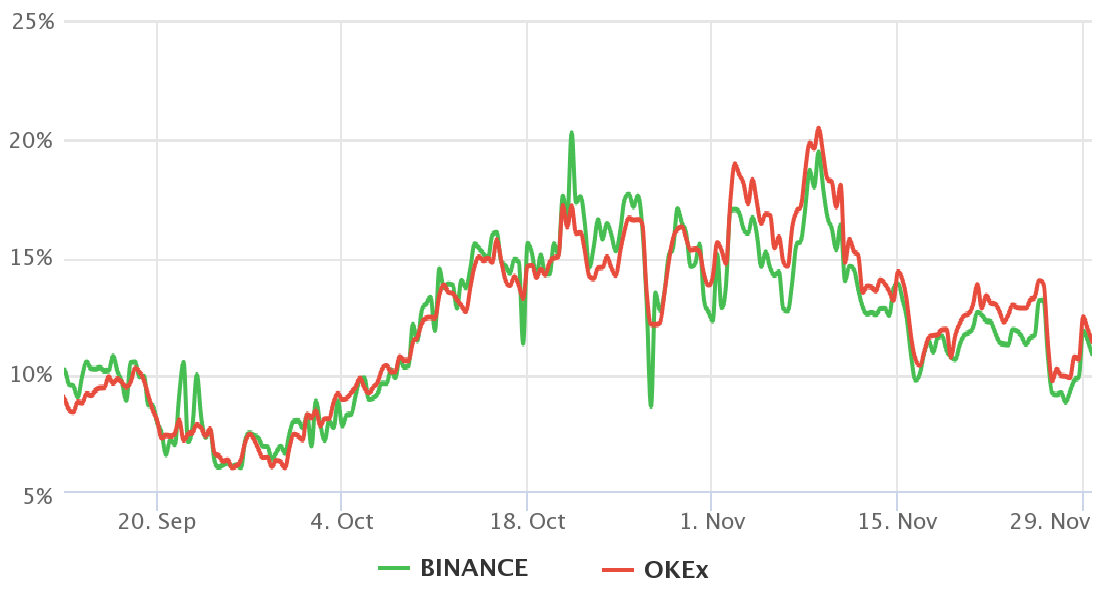

To know how bullish or bearish professional traders are situated, you ought to evaluate the futures basis rate. That indicator is also referred to as the futures premium, also it measures the main difference between futures contracts and also the current place market at regular exchanges.

The Three-month futures typically do business with a 5% to 10% annualized premium, that is considered an chance cost for arbitrage buying and selling. Notice how Bitcoin investors were having to pay excessive premiums for longs (buys) throughout the rally in November 2021, the the complete opposite of the present situation.

On Sept. 12, the Bitcoin futures contracts were buying and selling in a 1.2% premium versus regular place markets. This type of sub-2% level continues to be standard since August. 15, departing no doubts regarding traders’ insufficient leverage buying activity.

Related: This week’s Ethereum Merge may be the most critical transfer of crypto’s history

Possible reasons for the margin lending ratio spike

Something should have caused short-margin traders at Bitfinex to lower their positions, especially thinking about the longs (bulls) continued to be flat over the seven days resulting in Sept. 12. The very first probable cause is liquidations, meaning the sellers had inadequate margin as Bitcoin acquired 19% between Sept. 6 and 12.

Other catalysts may have brought for an unusual imbalance between longs and shorts. For example, investors might have shifted the collateral from Bitcoin margin trades to Ethereum, searching for many leverage because the Merge approaches.

Lastly, bears might have made the decision to momentarily close their margin positions because of the volatility all around the U.S. inflation data. Whatever the rationale behind the move, there’s pointless to think the market all of a sudden grew to become very positive because the futures markets’ premium paints a really different scenario from November 2021.

Bears have a glass-half-full studying as Bitfinex margin traders have room to include leverage short (sell) positions. Meanwhile, bulls can celebrate the apparent insufficient curiosity about betting on prices below $20,000 from individuals whales.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.