Bitcoin (BTC) hodlers might need to triple their on-chain losses for BTC cost to set up a macro low.

According to promote research firm Baro Virtual, the 2022 bear marketplace is not harsh enough to complement historic downtrends.

Bitcoin losses “only” total $671 million

With analysts predicting coming back to $14,000 or lower for BTC/USD, the issue of where Bitcoin will bottom is among the hottest topics within the space this month.

For Baro Virtual, which examined data from on-chain analytics platform Whalemap, it might be dependent on simple arithmetic.

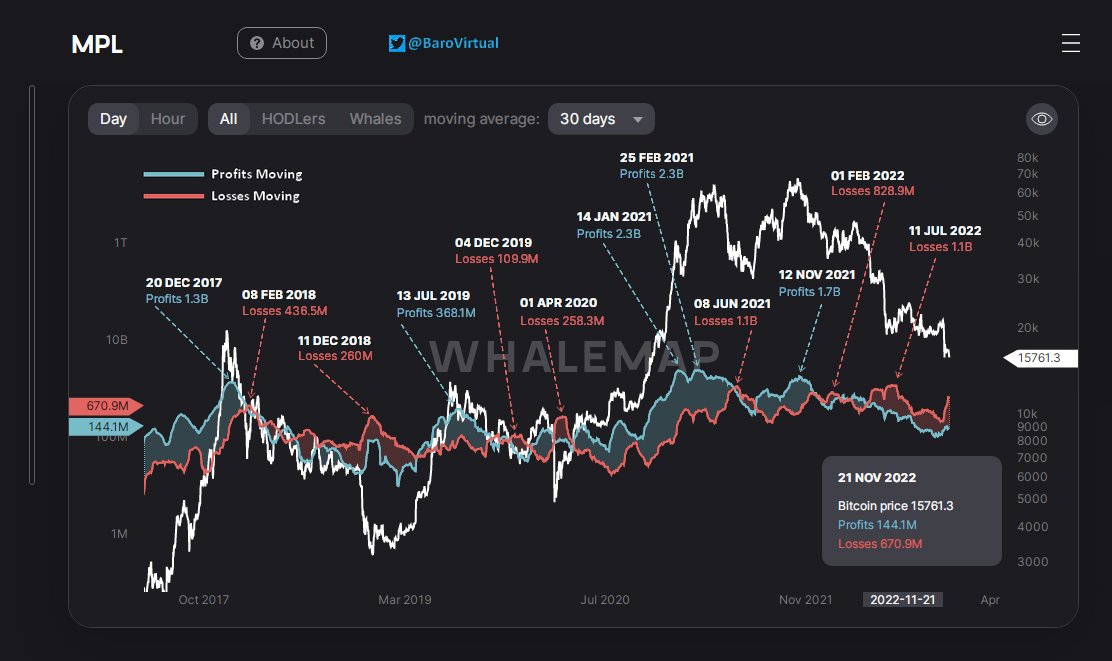

Taking Whalemap’s moving profit and loss (MPL) figures for on-chain BTC transactions, it noted that previously, macro BTC cost bottoms happened once individuals transactions’ losses were comparable to or even more compared to equivalent profits within the bull run which preceded them.

Quite simply, on-chain losses have to equal or exceed on-chain gains in the prior bull run. Otherwise, generally, Bitcoin has fallen further afterwards.

“Monthly MPL by Whalemap causes it to be almost sure, generally, to look for the global bottom of $BTC,” Baro Virtual authored in Twitter comments on November. 22:

“The condition would be that the current loss level should be comparable to or > compared to max profit degree of the prior bull run.”

Current recognized losses therefore are not huge enough to suit Bitcoin’s historic capitulation trend, it contended, departing the doorway available to further BTC cost capitulation.

Just how much is required, however, would mean that the best macro bottom for Bitcoin lies reduced than this week’s two-year low of $15,480.

“Now the losses are $671M, and also the previous max profit comes from $1.3B to at least oneDollar.7B,” the thread ongoing alongside an annotated chart:

“Thus, losses from $629M to $1.029B continue to be missing to verify complete capitulation.”

BTC targets 80% drawdown

The findings complement a story that likewise shows that the 2022 bear marketplace is yet to rival 2014 and 2018 — years which saw macro lows in BItcoin’s two prior halving cycles.

Related: GBTC next BTC cost black swan? — 5 items to know in Bitcoin now

In comparison to the latest all-time full of November 2021, BTC/USD has to date managed a 77% drawdown — under in prior bear markets.

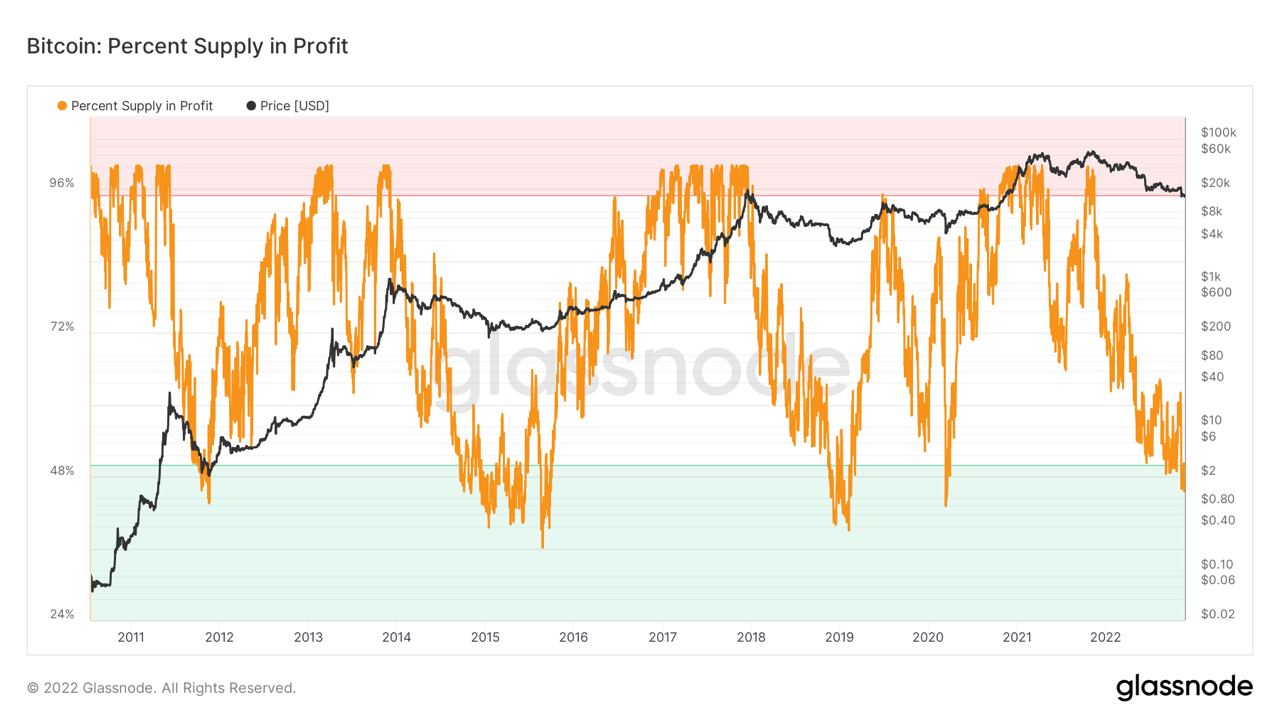

Data from on-chain analytics firm Glassnode nevertheless shows how Bitcoin is progressively homing in on the retest of maximum losses versus all-time highs.

Likewise, the proportion from the overall BTC presently locked in profit is nearly, although not quite, at lows symbolic of macro bottoms.

“Bitcoin’s 78% drawdown within the this past year is its largest since 2017-18 and also at 376 days has become the second longest, trailing just the 2013-15 decline of 410 days,” Charlie Bilello, founder and Chief executive officer of Compound Capital Advisors, additionally noted now.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.