Bitcoin (BTC) may cruise to almost $50,000 because the U . s . States okays the very first place cost exchange-traded fund (ETF).

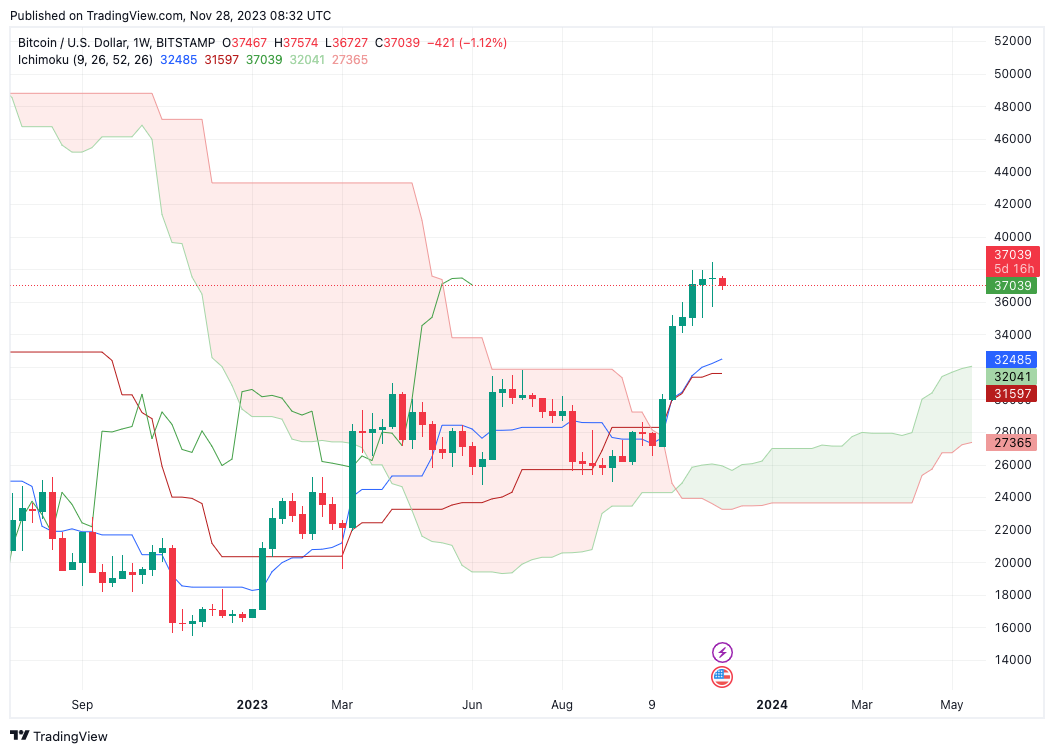

As flagged by popular analyst CryptoCon, the Ichimoku Cloud indicator is counting lower to upside BTC cost continuation.

Analysis: $43,000 BTC cost is “most conservative level”

Bitcoin is within an uncommon position on weekly timeframes with regards to Ichimoku Cloud signals.

As Cointelegraph reported, the indicator, which mixes past, present and future buying and selling cues, shows that the BTC cost gains only have just begun.

Inside a publish on X (formerly Twitter) on November. 27, CryptoCon could generate a specific target for which might happen next.

Ichimoku’s leading spans have entered, resulting in the development of the new upside cloud. Using the lagging span, Chikou, breaking from resistance, cost should now logically mind greater.

“The Weekly Ichimoku cloud known as our last Bitcoin rise to 38k 2 several weeks ahead of time using the mix forecasted later on,” he authored.

“Now we watch for it to fill its next calls, the conclusion in our rise and also the first target of 43k. It has taken between 7 to 11 days in the mix, typically 10 days means our move completes at the begining of The month of january.”

CryptoCon added that $43,200 was basically the “most conservative level,” which $48,000 would be a appropriate ceiling.

He concluded:

“Even with a few pause among, the indicator that appears to return states we’re not done!”

Bitcoin traded at $37,000 during the time of writing on November. 28, per data from Cointelegraph Markets Pro and TradingView.

A match produced in paradise?

Ichimoku’s timing is perhaps as interesting since it’s targets.

Related: $48K has become ‘reasonable’ BTC cost target — DecenTrader’s Filbfilb

Should traditional timing engage in, according to previous bull markets, the $48,000 move may come at the begining of The month of january — coinciding using the expected ETF approval date.

Little is famous by what U.S. regulators have available, or which specific ETF products, or no, can get the eco-friendly light first.

Meanwhile, the Registration (SEC), responsible for the ETFs visiting market, is constantly on the pressure crypto sentiment with enforcement actions against Binance, the world’s largest exchange.

A $4.3 billion fine and removing Changpeng Zhao, referred to as “CZ,” as Chief executive officer has meanwhile benefited the shares of rival exchange Coinbase, these up over 250% year-to-date.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.