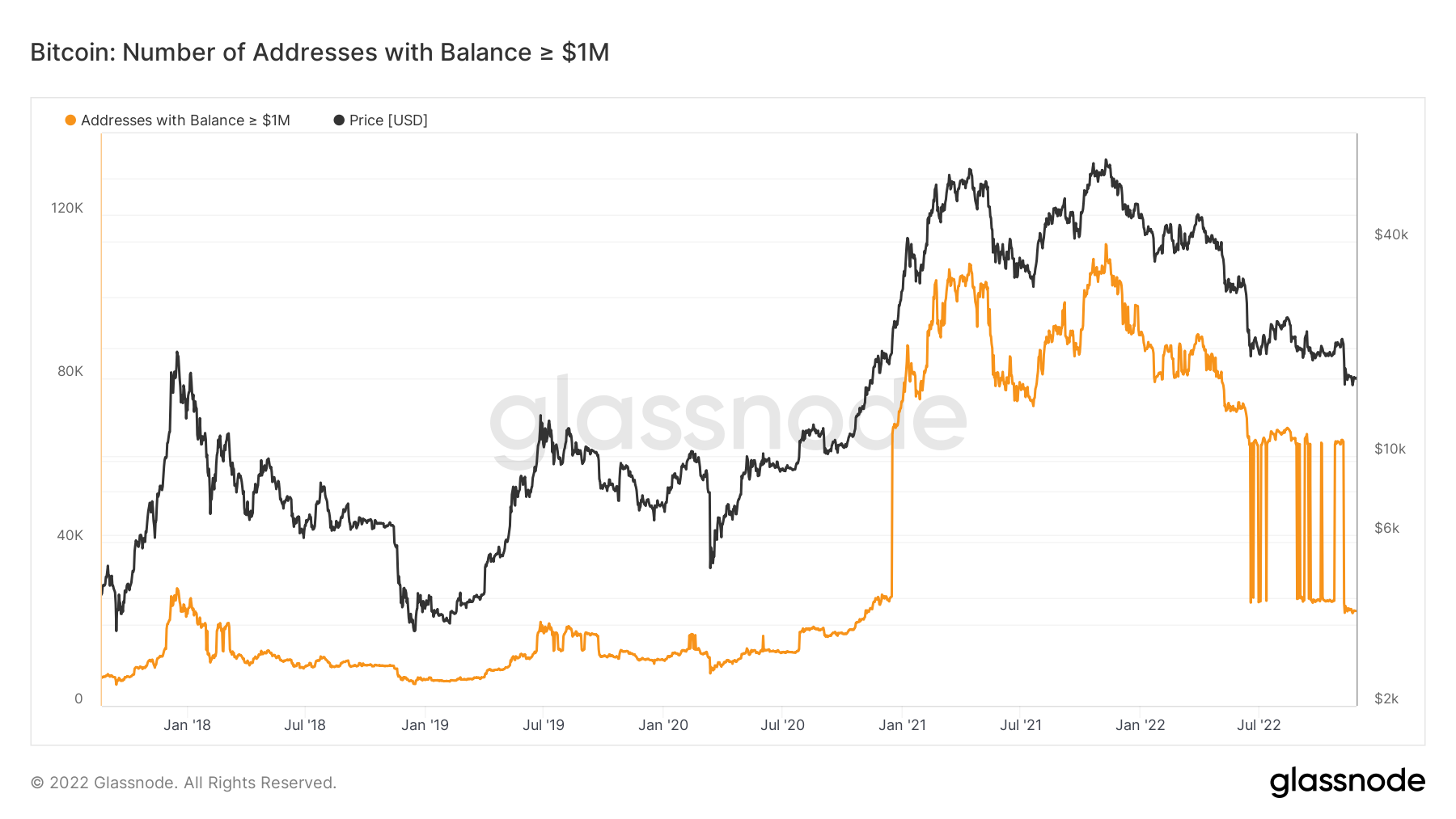

Bitcoin (BTC) millionaires have become an more and more rare breed as figures fall 80% each year.

According towards the latest data from on-chain analytics firm Glassnode, nowadays there are just 23,000 wallets having a BTC balance worth $a million or even more.

12 months, 90,000 less million-dollar BTC wallets

In another indication of methods far the crypto market has fallen since Bitcoin’s last all-time highs, Bitcoin millionaires happen to be seriously feeling the pinch.

Glassnode, which tracks multiple cohorts of BTC wallets, confirms that by November. 25, there have been 23,245 having a balance worth over $a million.

Contrast by using the scene from November. 8, 2021, once the tally hit its peak as BTC/USD contacted its latest $69,000 all-time high — then, there have been 112,898 “millionaire” wallets.

Such addresses have fallen consistent with place cost itself, susceptible to modest selling by proprietors at various points of Bitcoin’s year-lengthy bear market.

Uniform wallet figures are lower around 79% for the reason that period, while BTC/USD saw an optimum drawdown of 77% this month, data from Cointelegraph Markets Pro and TradingView shows.

Bitcoin address figures in “up only” mode

As Cointelegraph reported, meanwhile, the image looks somewhat different in BTC terms. Because the FTX implosion, certain classes of wallet happen to be accumulating.

Related: How low can the Bitcoin cost go?

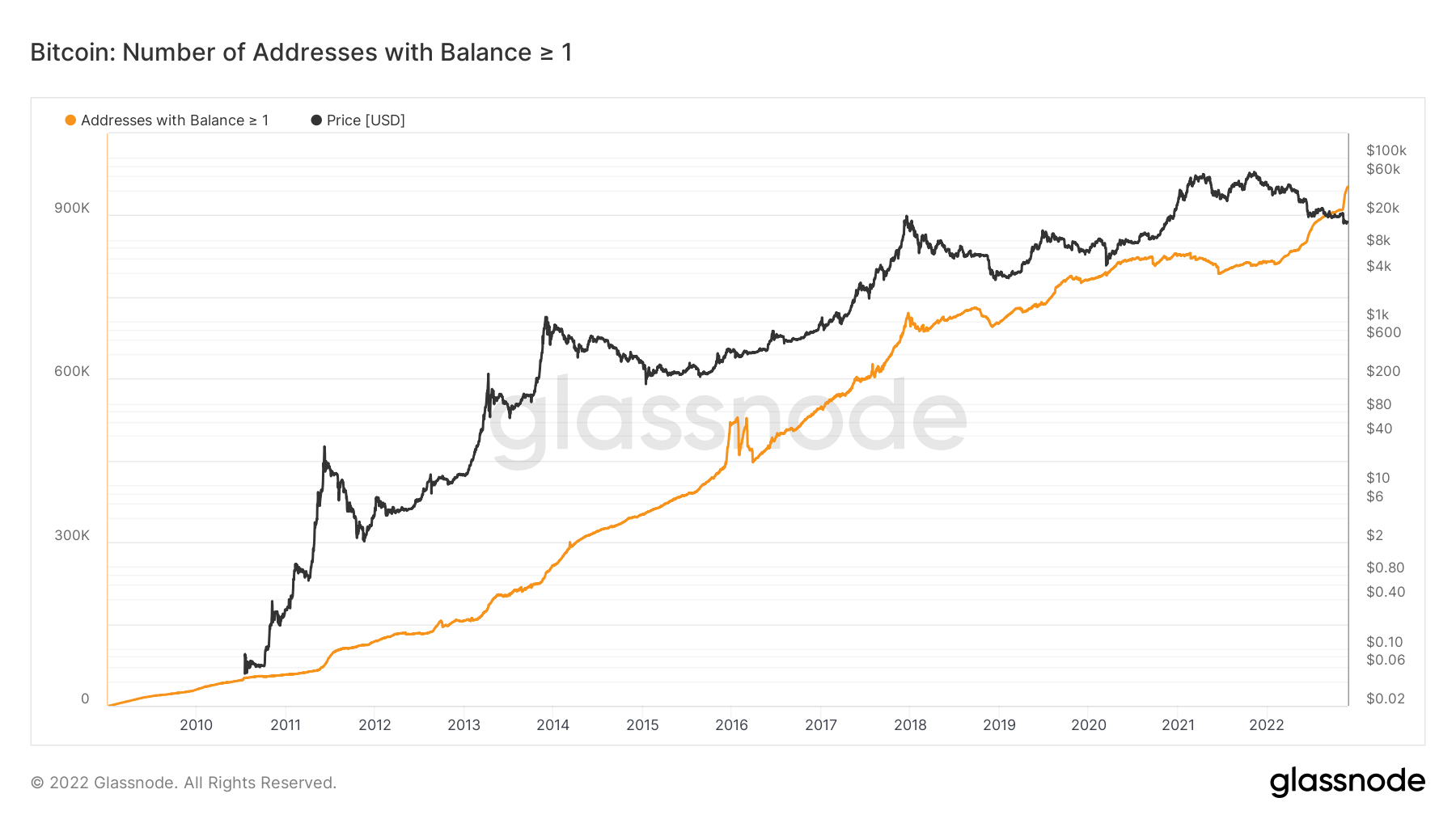

Additionally, as noted by co-founders of buying and selling suite Decentrader now, exchange users withdrawing funds to personal storage and consolidating wallets likely take into account the functional rise in wallets with 1 BTC or even more.

By November. 27, these totaled over 952,000 — an archive in Bitcoin’s history.

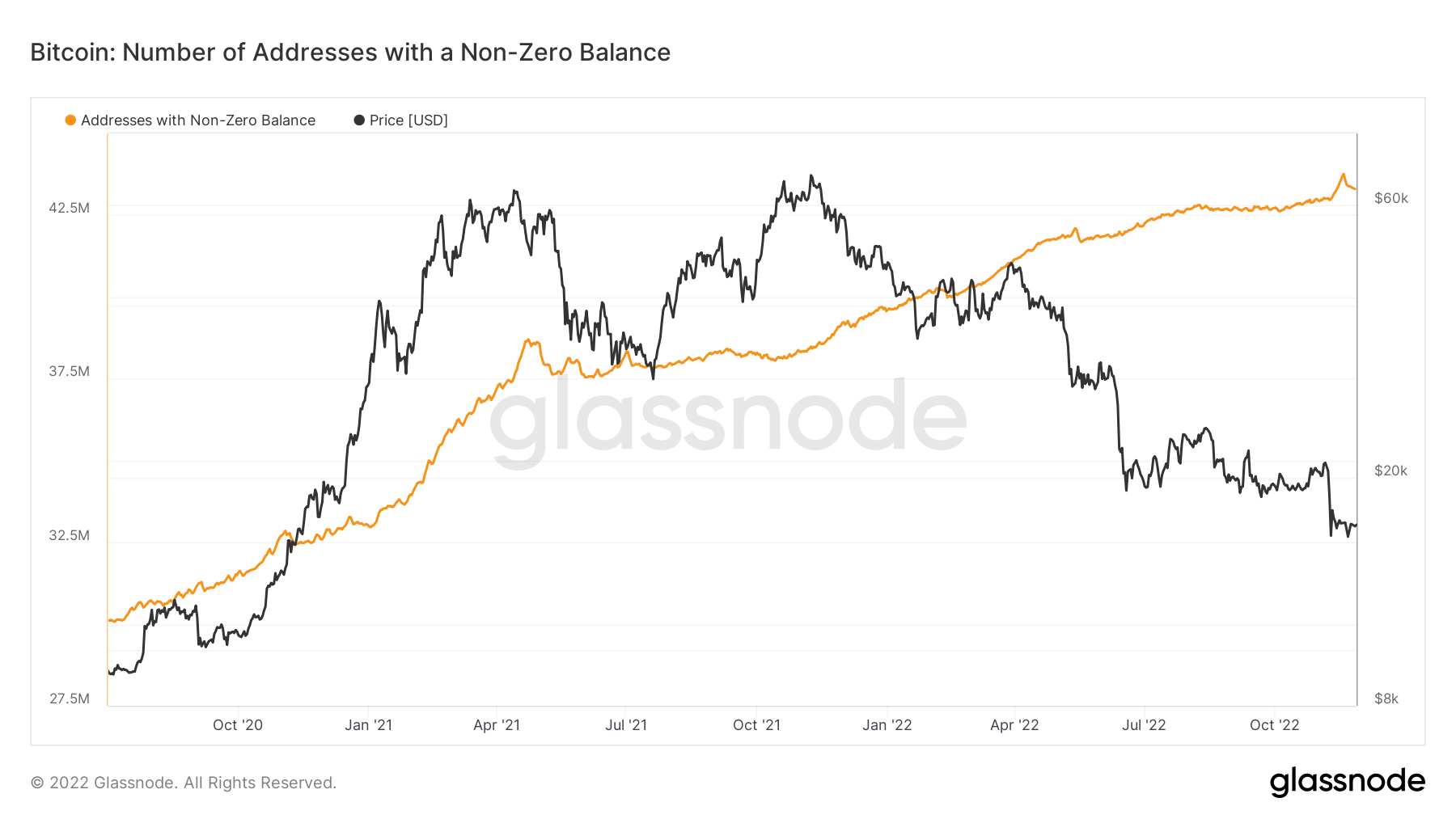

Glassnode nevertheless implies that the tiniest classes of investors — individuals with .01 BTC or even more within their wallets — also have grown in figures lately.

Overall, however, addresses having a non-zero balance will be in decline since November. 18, its data shows — a somewhat rare trend break last observed in April 2021.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.