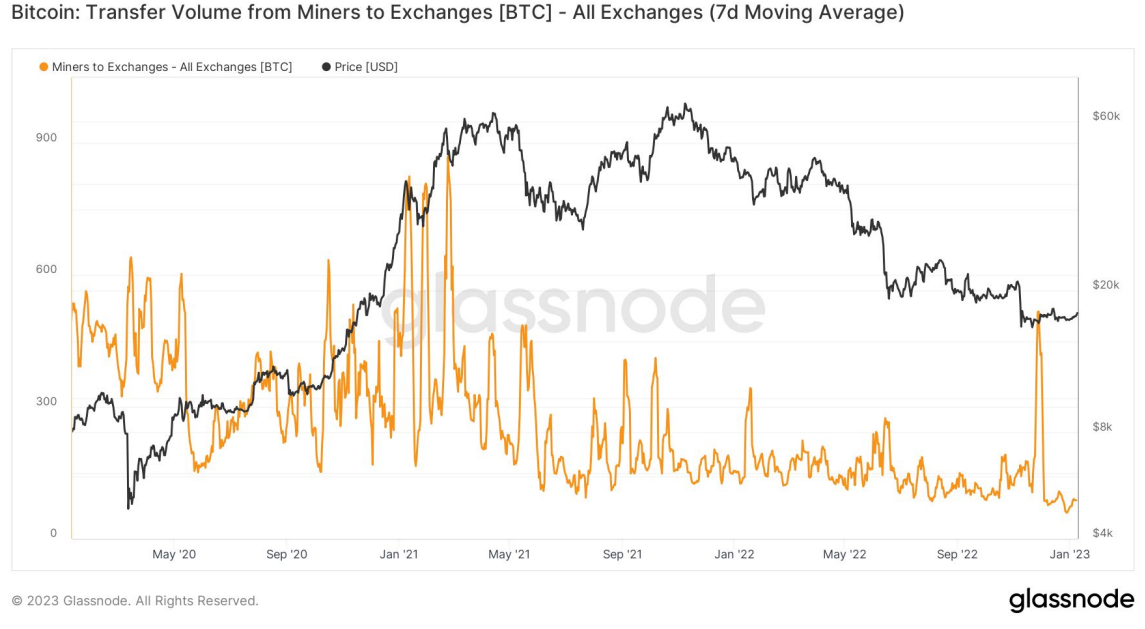

Based on data reported by Bitfinex analysts the 2009 week, Bitcoin miners are slowing the interest rate where they offer the world’s largest cryptocurrency by market capital. Bitfinex, citing on-chain data from crypto analytics platform Glassnode, stated that BTC flows from miner wallets to exchanges, stated “selling reaches a 3-year low”.

“It is really a potential indication that miners are actually either already transitioned or while transitioning to an origin of buying pressure,” the analysts ongoing, before adding that miners may be “hodling their bitcoin simply because they anticipate further (cost) rises”.

When Bitcoin miners move their BTC to exchanges, it’s generally assumed they’re doing this to be able to sell them eventually. So lower Miner to switch flows may very well be a proxy for lower Bitcoin miner BTC sales.

Bitcoin miners are given the job of supplying the computing oomph to power Bitcoin’s decentralized, permissionless, peer-to-peer and blockchain-based payments network. They’re rewarded for his or her efforts with recently minted Bitcoins. Miners are among the most significant Bitcoin market players, thus signs that sell pressure out of this market segment is usually considered a bullish indicator for that BTC cost.

Another Signal The Bitcoin Bear Marketplace is Over?

There’s been growing excitement in recent days considering the most recent Bitcoin rally (BTC expires near to 40% this month and during the $23,000 area) the bear market of 2022 might certainly be over. Certainly, using the majority of Given tightening getting apparently already happened, risks are tilted towards an easing of monetary conditions in 2023 as opposed to a repeat of 2022’s harsh tightening, a in the past bullish macro backdrop for cryptocurrencies.

And miner to switch flows at three-year lows is among many on-chain and technical indicators which have been flashing positive signs that Bitcoin might be entering a brand new Bitcoin market. As discussed inside a recent article, an growing confluence of technical as well as on-chain indicators tracked by Glassnode analysts within their “Recovering from the Bitcoin Bear” dashboard are flashing eco-friendly.

At the moment, six of eight indicators are in conjuction with the oncoming of an industry recovery, having a seventh likely and to soon start flashing positive signs. Elsewhere, Bitcoin is presently a “generational lengthy-term buying opportunity” based on six on-chain metrics reported by crypto research-focused Twitter account @GameofTrades_. These metrics range from the Accumulation trend score, Entity-adjusted dormancy flow, Reserve risk, Recognized cost, MVRV Z-score and Puell multiple.

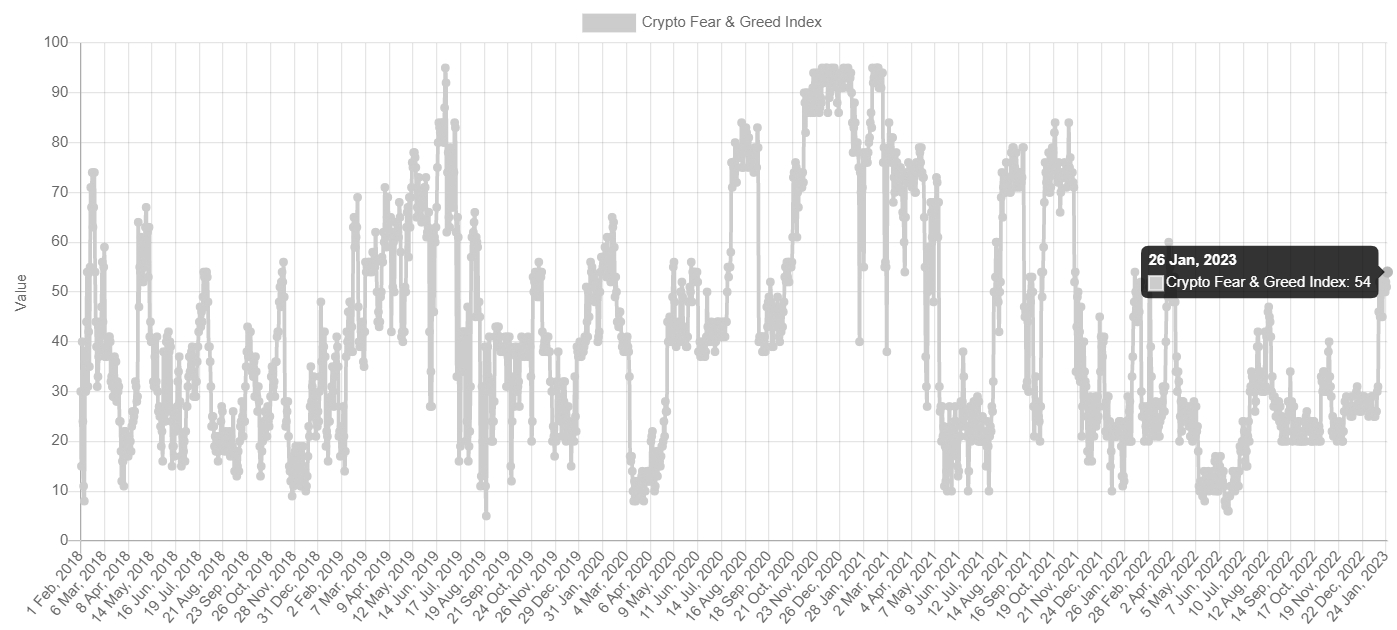

Elsewhere, the broadly adopted Bitcoin Fear & Avarice Index lately moved back to neutral territory (i.e. above 50) the very first time following a prolonged spell of Fear and Extreme Fear. An enduring recovery back to neutral frequently comes at the outset of the following Bitcoin bull market, for example at the begining of 2019 and on the other hand in mid-2020.

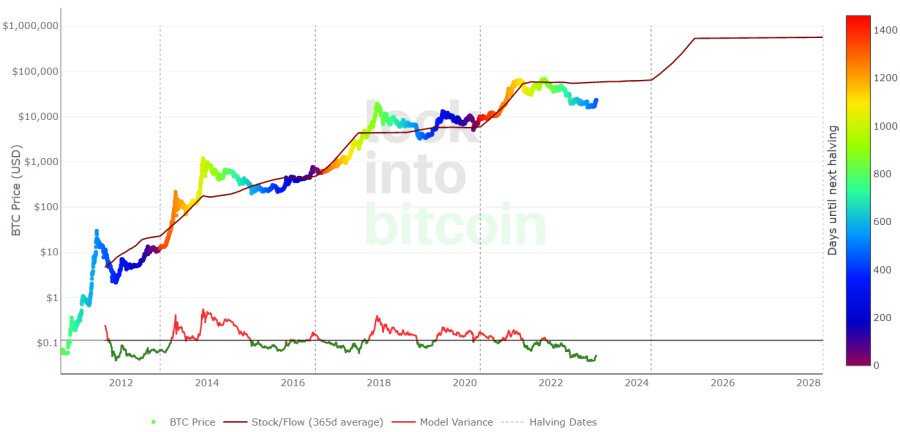

Analysis from crypto-focused Twitter account @CryptoHornHairs designed a jaw-shedding observation that Bitcoin is following almost exactly within the actions of the near-four-year market cycle that it’s been following within the last greater than eight years. After bottoming last November, Bitcoin may rally for an additional nearly 1000 days, case study suggests, before entering its next bear market in 2025.

Finally, a broadly adopted Bitcoin prices model is delivering an identical story. Based on the Bitcoin Stock-to-Flow prices model, the Bitcoin market cycle is roughly 4 years, with prices typically bottoming somewhere near to the center of the four-year gap between “halvings” – the Bitcoin halving is really a four-yearly phenomenon in which the mining reward will get halved, thus slowing the Bitcoin inflation rate. Past cost history shows that Bitcoin’s newest surge can come following the next halving in 2024.