Bitcoin’s (BTC) cost tanked to some 52-week low of $20,800 previously Wednesday, lower by over 70% from the all-time a lot of $68,788. Even though the cost has since retrieved above $21,000, key market indicators point toward bears getting a substantial hang on the present market.

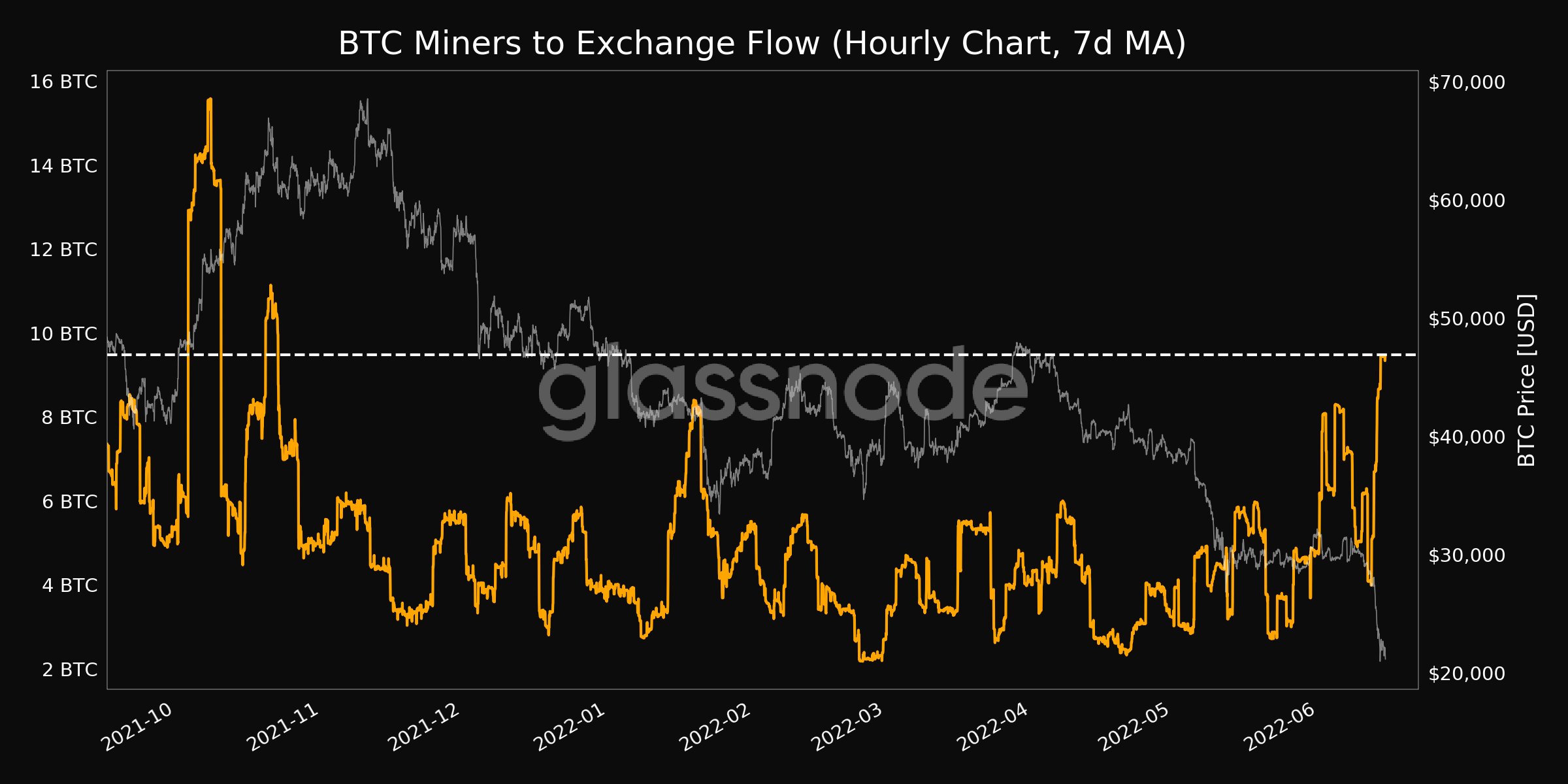

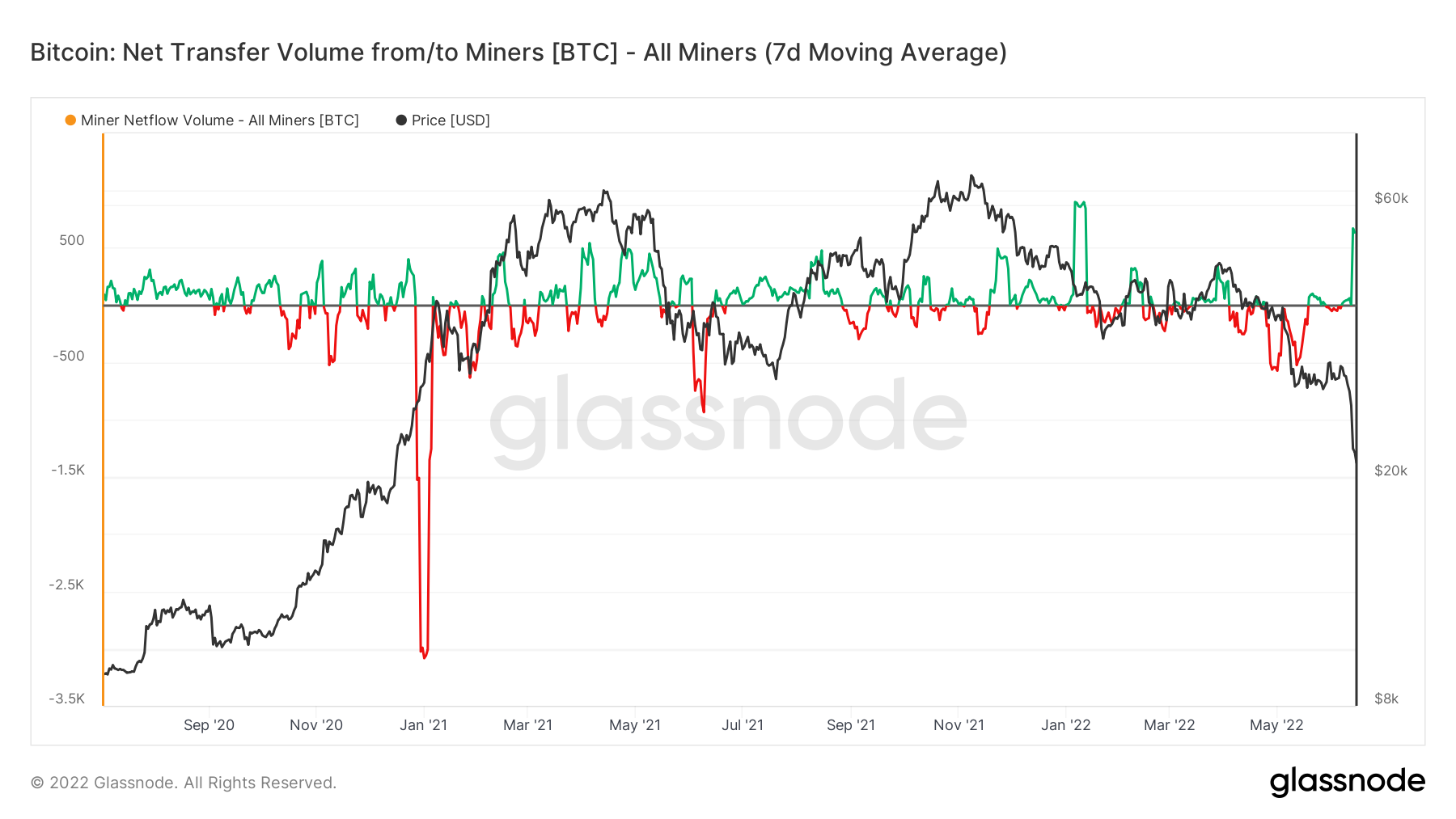

Bitcoin Miners to switch flow, a metric that signifies the level of BTC sent by miners to crypto exchanges, rose to some seven-month a lot of 9,476. The increase in exchange flows signifies miners are presently selling their BTC awaiting the cost going lower.

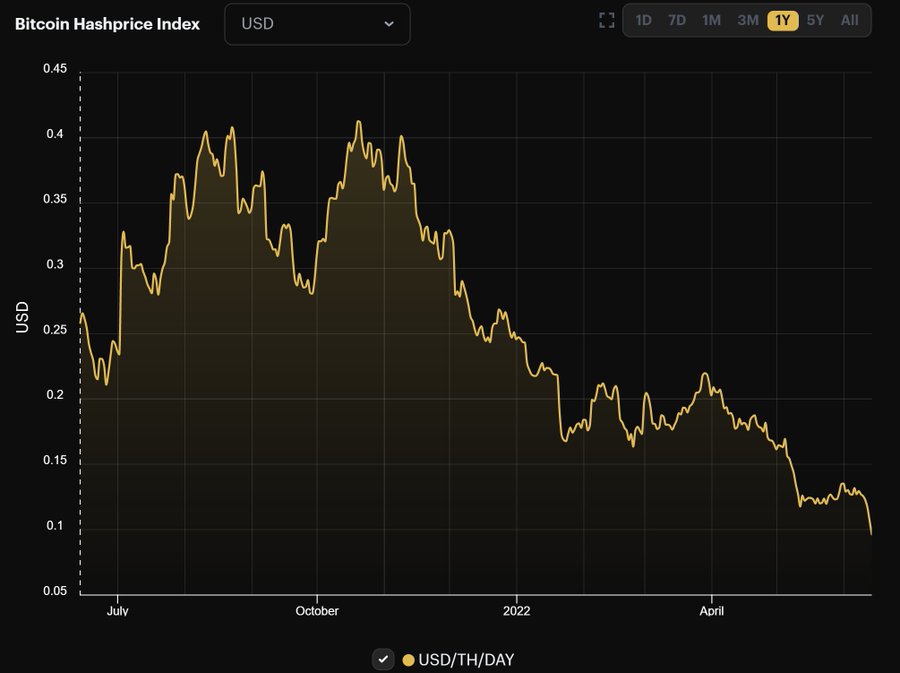

Those things from the BTC miners frequently reflect the bigger market sentiment because they mostly sell BTC to make sure it normally won’t incur losses on their own mining rewards. The increase in Bitcoin miners selling activity is supported by the functional loss of mining profitability.

Related: Greatest Bitcoin exchange inflows since 2018 put potential $20K bottom in danger

Mining profitability has dropped over 75% in the top, and Bitcoin’s hash cost presently sits at $.0950/TH/day, the cheapest point since October 2020.

The miner netflow to exchanges has additionally switched positive. Once the miner netflow is positive, it ensures that more coins are now being delivered to exchanges than are now being delivered to personal wallets. Such behavior would indicate that miners are bearish around the cost and therefore are pressurized to market.

Many BTC mining rigs have switched unprofitable using the cost shedding below $21,000 and risk being shut lower when the cost doesn’t recover. All of those other crypto market adopted BTC in the cost action because the overall market cap dipped below $1 trillion.

During the period of yesteryear decade, BTC has witnessed numerous bull cycles adopted by an 80%-90% decline in the top, however, the BTC cost hasn’t fallen underneath the all-time-a lot of the prior cycle. Presently, BTC is buying and selling not far from its 2017 a lot of $19,783, and then any possible sell-removed from here could push it to 2017 territory.