Based on a brand new conjecture from crypto analysis firm Arcane Research, miners will continue money Bitcoin (BTC) compared to what they earn.

Miners offered nearly 30% of record BTC stash since May

The visit to $25,000 this month decreased pressure on the Bitcoin mining sector that has battled throughout 2022.

At some point, fears abounded that miners’ production cost was far greater compared to Bitcoin place cost, which heavy sales would result to ensure that miners in which to stay business. Even worse, many might have to retire altogether because of their activities no more being financially viable.

Data in the period since May made an appearance to verify that major upheaval was happening. As Arcane notes, one public miner alone — Core Scientific — offered around 12,000 BTC at that time from May to This summer.

As the trend demonstrated indications of reversing recently, it will require even greater BTC prices to permit the largest mining operators to hodl again.

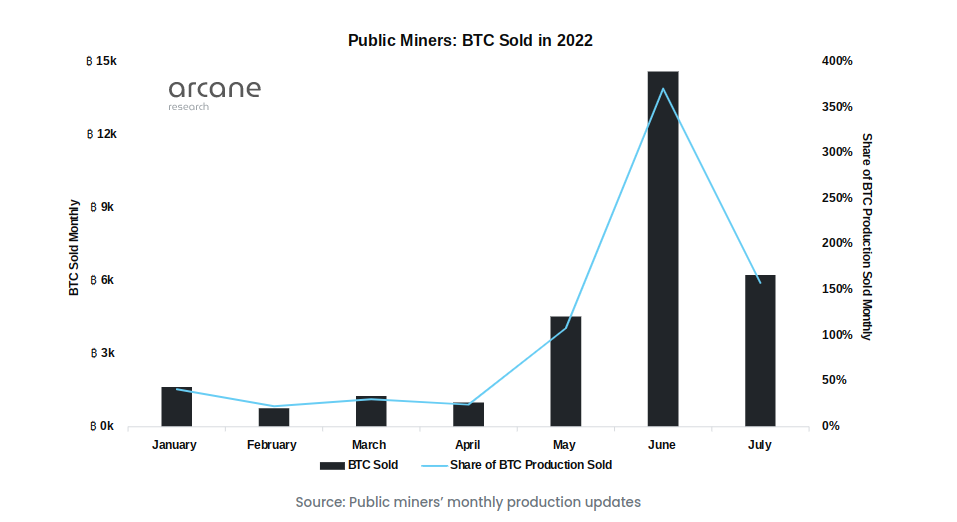

“Even although the public miners offered under half the quantity in This summer as with June, we still see that they’re draining their holdings when we consider the number of the bitcoin production offered,” Arcane analyst Jaran Mellerud described:

“The public miners offered 158% of the bitcoin production in This summer, which makes it the 3rd month consecutively where they offered greater than 100% of production.”

For context, in April 2022, miners’ hodled coins were in an all-time high, because of many years of saving a minimum of 60% of BTC received via block subsidies every month.

After subsequent sales, however, their balance is trending toward 30% lower, and can only mind greater before the monthly expense equilibrium is restored.

“I expect the selling pressure to carry on at between 100% and 150% of production unless of course something significant transpires with the bitcoin cost. This is the same as between 4,000 and 6,000 BTC monthly,” Mellerud added.

Bitcoin might have elevated 36% from the June lows, however for miners, the discomfort continues.

Light in the finish from the tunnel

As Cointelegraph reported, a much-needed go back to better days for miners might be closer of computer appears.

Related: BTC mining stocks double inside a month as production ramps

Revenue leaped nearly 70% in August, while proof-of-work (Bang) mining, generally, is growing in prominence past the crypto sphere.

Ecological concerns aren’t holding back big bucks, as evidenced through the world’s largest asset manager, BlackRock, praising the sphere this month.

Continuously growing Bitcoin fundamentals meanwhile provide real-time proof that everything is stabilizing for that backbone from the Bitcoin network. Data from BTC.com estimates that difficulty is placed to improve by around .7% now.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.