Bitcoin (BTC) miners might be delivering more BTC to exchanges this month — but overall, their sales have crashed since 2020.

Data from on-chain analytics platform CryptoQuant confirms that daily miner gets in exchanges have decreased by sixty-six per cent or even more.

Miners awesome BTC exchange sales after FTX spike

After BTC/USD lost 25% in days a week ago, existing concerns over miner solvency have increased.

Given their cost basis and rising hash rate, commentators cautioned that lots of mining participants may be unable to pay the bills — block subsidies and charges wouldn’t be enough to block out expenses, chiefly electricity.

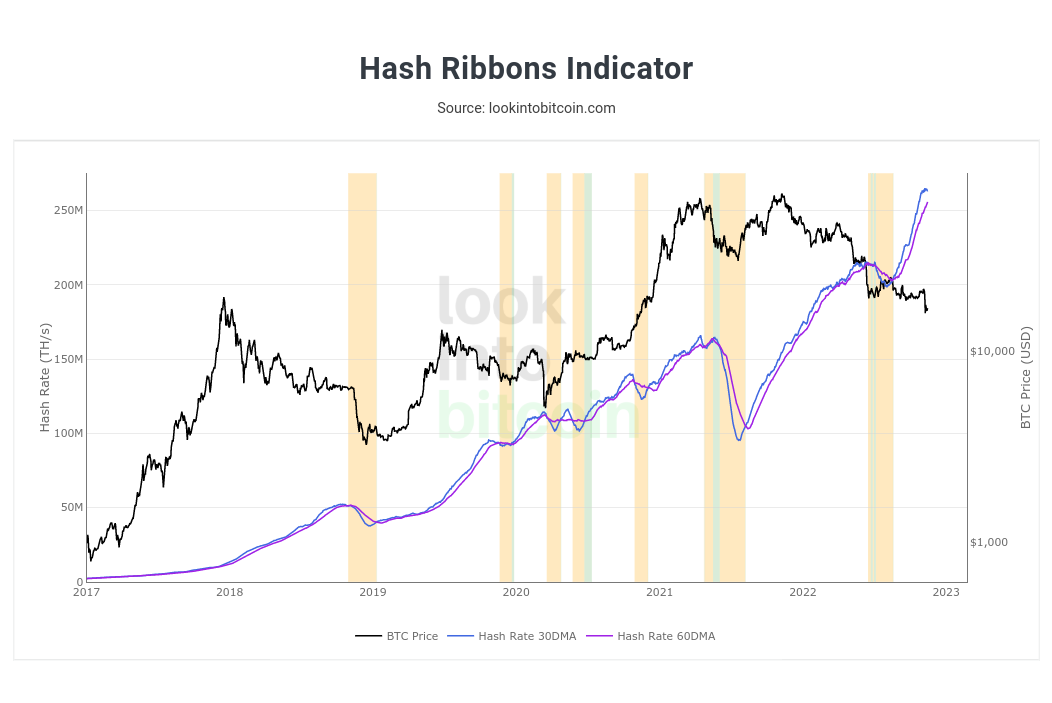

Network fundamentals, however, tell an inquisitive story — hash rate is constantly on the circle all-time highs and never fall considerably, indicating that a minimum of certain miners are maintaining network hashing power, not shutting lower operations en masse.

CryptoQuant meanwhile implies that every day, miners aren’t anxiously selling coins to pay for the shortfall in revenue.

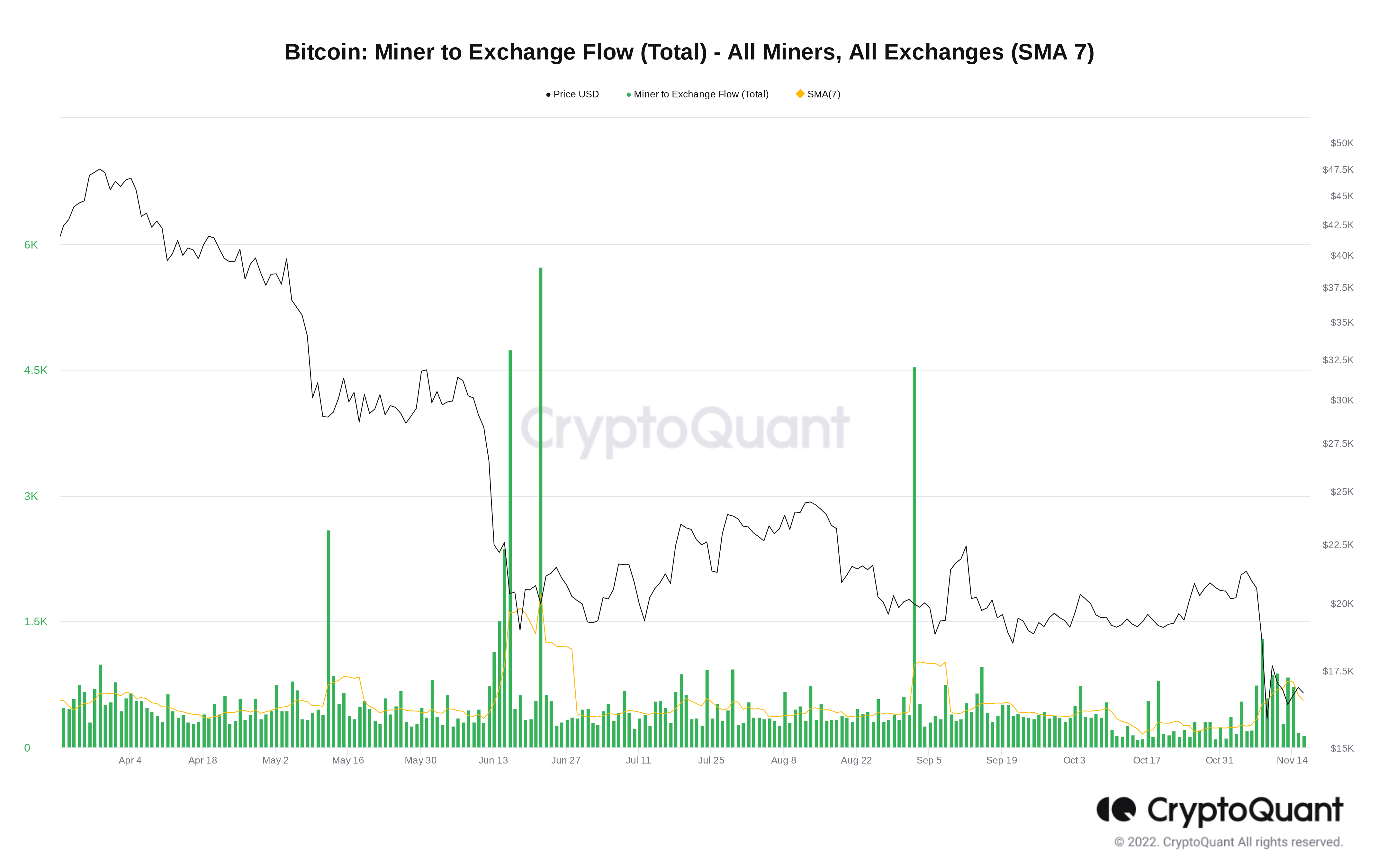

On November. 8, your day from the FTX blowout, flows from miner wallets to exchanges totaled 1,300 BTC. It was the biggest single-day tally since September.

Overall, the time from the FTX debacle has witnessed comparatively modest rise in selling when compared with other spikes this season. Miners sent 4,540 BTC to exchanges on Sep. 2, during June 22, at about the time that BTC/USD dipped to then two-year lows of $17,600, the day’s total was 5,729 BTC.

Zooming out, the image becomes much more nuanced.

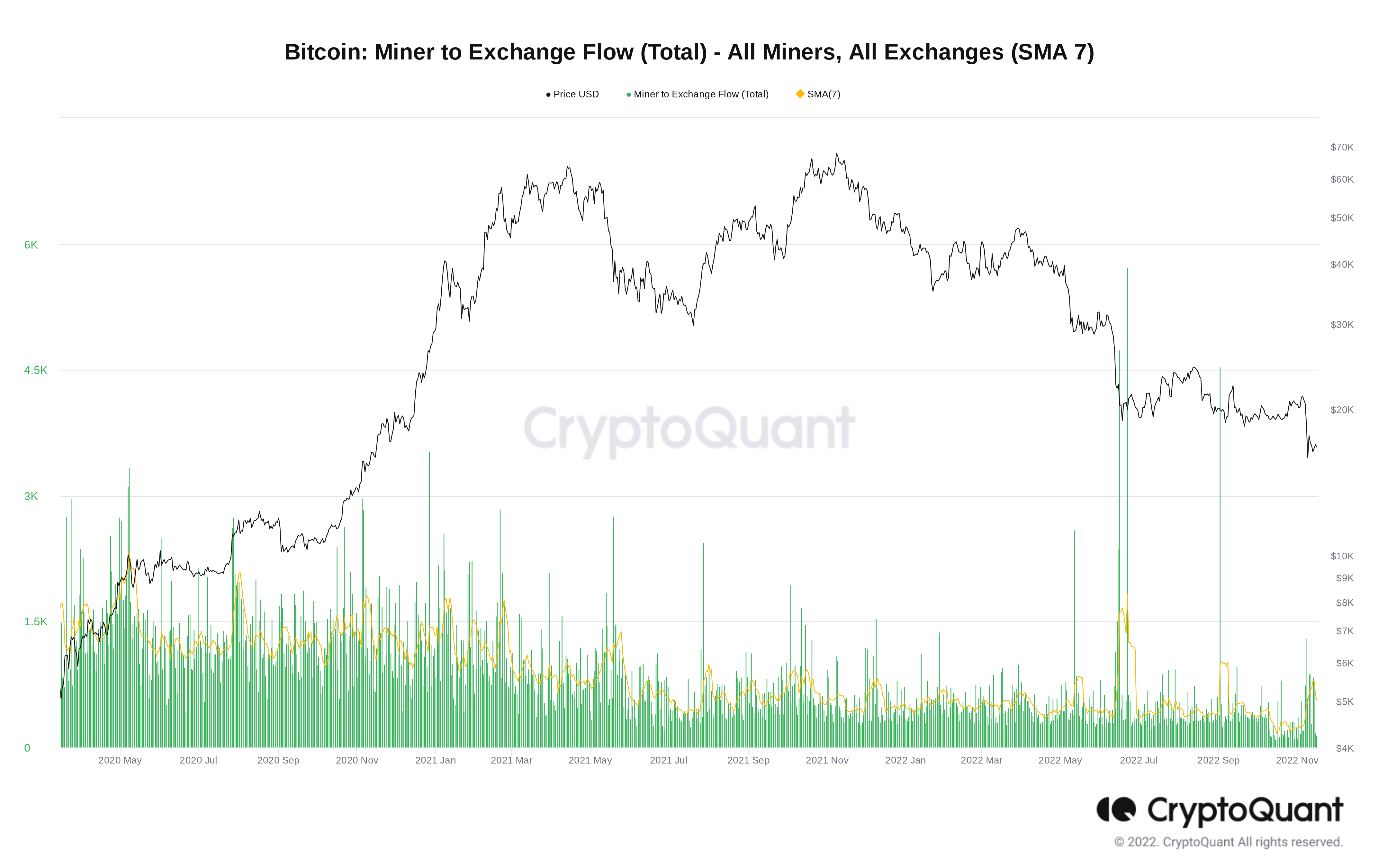

Since Bitcoin’s last block subsidy halving event in May 2020, miners have considerably reduced their daily exchange sales.

At about the time from the halving, the seven-day moving average of miner exchange deposits was around 1,200 BTC each day.

The amount varied considerably every day, but overall, what’s considered an increase in November 2022 was standard practice at that time.

Go forward to October this season, as well as on at times, miners sent under 100 BTC to exchanges.

The block subsidy might have halved and charges may take into account less revenue in USD terms, but nonetheless, a obvious trend is apparent with regards to exchange sales.

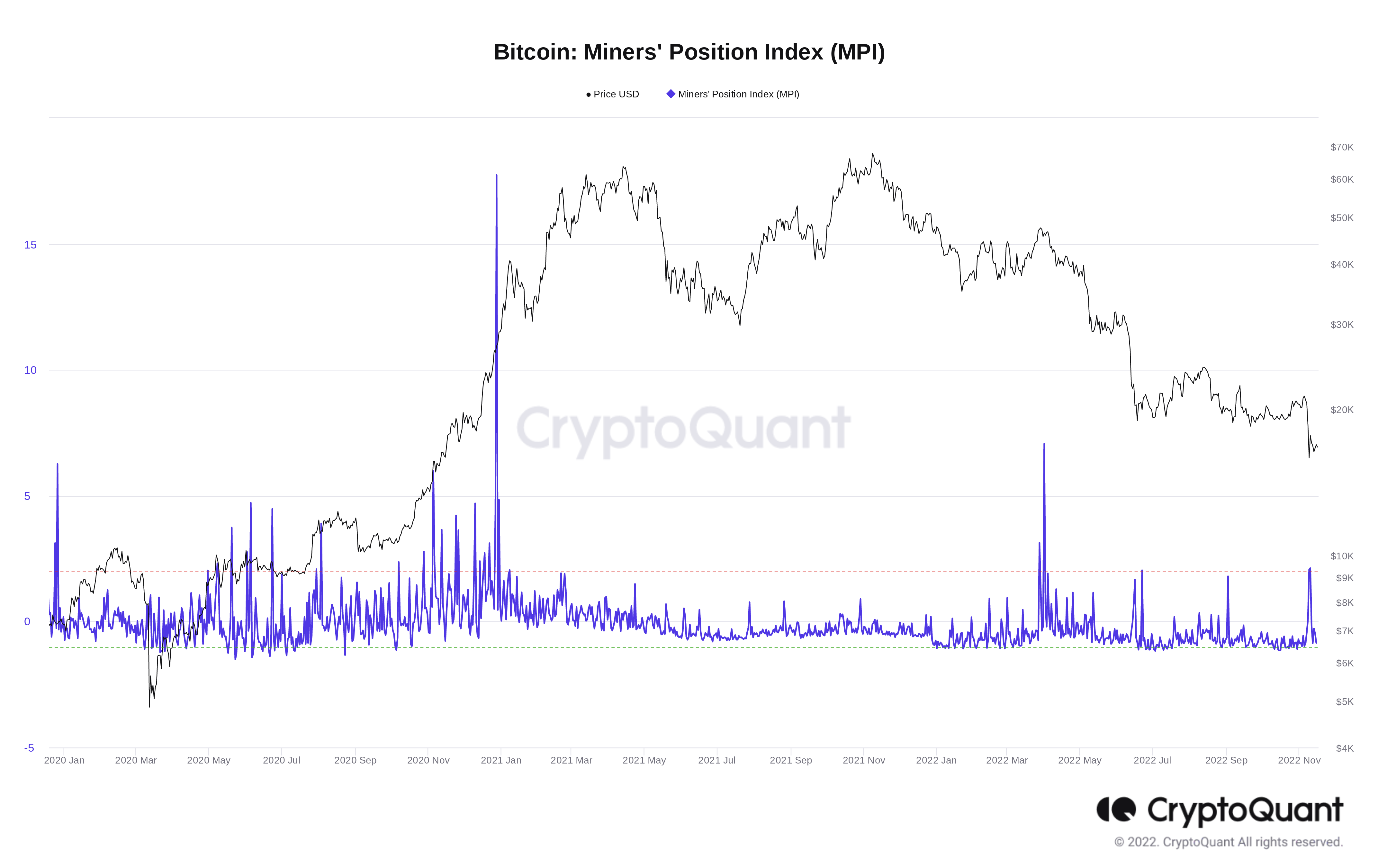

Put one other way, the FTX episode has created merely a brief divergence in miner outflows in accordance with their one-year moving average. This really is summarized in CryptoQuant’s Miner Position Index (MPI).

An idea of products in the future?

As Cointelegraph reported, Bitcoin miners last experienced “distress” — when it comes to on-chain data — in August.

Related: Elon Musk states BTC ‘will make it’ — 5 items to know in Bitcoin now

The Hash Ribbons indicator, that is particularly made to track miner capitulation, continues to be from its red zone since that time.

To date, nothing has were able to pressure coming back to mass exiting by miners. This might yet change, because the latest Hash Ribbons chart data shows hash rate habits flattening out after several several weeks of growth.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.