Get the daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the tales flying individually distinct of today’s crypto news.

__________

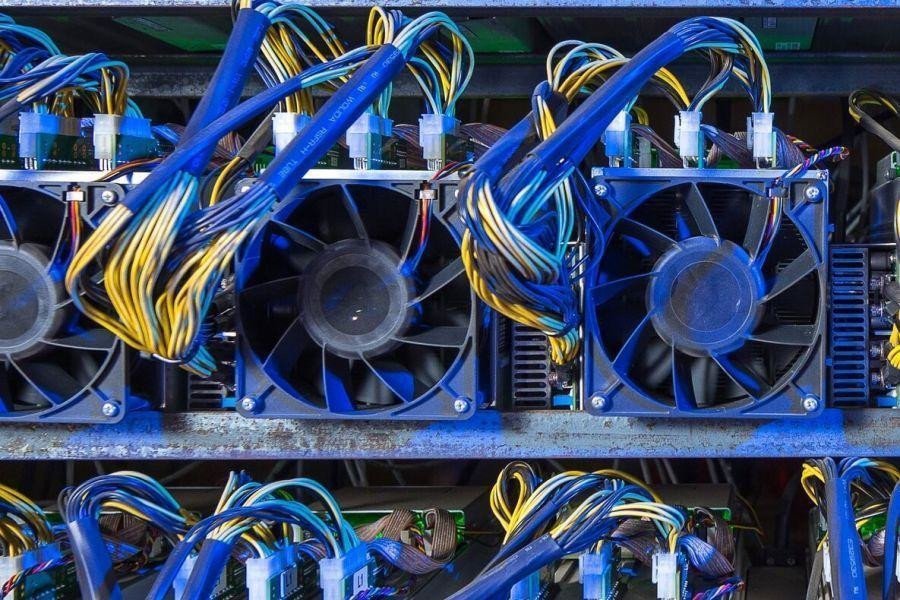

Mining news

- You will find “lots of indications of stress” within the Bitcoin (BTC) mining industry at this time because the cost of BTC dropped and also the cost of electricity elevated, Alex Brammer, V . P . for Business Development at Luxor Mining, told Wired. “Within the next 12 to 18 several weeks, there’s likely to be evidence being released which information mill run very well and therefore are operationally efficient and also have healthy amounts of debt,” he was quoted as saying. Meanwhile, based on him, openly-traded mining information mill now selling their ASICs below book value.

Financial aspects news

- The annual inflation for that Euro position for May 2022 is anticipated to be with 8.1%, that is up from 7.4% in April, according to some flash estimate from Eurostat, the record office from the Eu.

Career news

- Fidelity Digital Asset Services, a subsidiary of investment planning services firm Fidelity Investments, intends to hire 110 tech workers to construct digital infrastructure to aid services for cryptoassets beyond bitcoin, per the Wall Street Journal. The subsidiary also intends to add 100 customer-service specialists, they stated.

- Digital asset and crypto technology provider Fireblocks hired the previous Mind of Fintech in the Bank of England, Varun Paul, since it’s new Central Banking Digital Currency (CBDC) and Market Infrastructure Director.

Regulation news

- The Basel Committee, the main global standard-setter for that prudential regulating banks, stated it intends to publish another consultation paper around the prudential management of banks’ cryptoasset exposures within the coming month, having a view to finalizing the prudential treatment round the finish of the year. “Recent developments have further highlighted the significance of getting a worldwide minimum prudential framework to mitigate risks from cryptoassets,” they stated.

Stablecoins news

- Stablecoin issuer Tether (USDT) has held a number of its reserves in a small Bahamas bank known as Capital Union, Financial Occasions reported, citing undisclosed people acquainted with the problem. The organization formerly declined to show where exactly it supports the assets that back USDT, stating that they’re not obliged to show info on their financial partners.

- The United kingdom government printed an appointment paper that outlines an approach to lessen the risk for investors holding stablecoins, recommending altering existing legislation to own Bank of England capacity to appoint managers to supervise insolvency plans with unsuccessful stablecoin issuers.

Investments news

- In May 2022, BTC’s assets under management (AUM) across all digital asset investment products fell 27% to USD 24bn, while slightly gaining share of the market, presently at 70% of total AUM, up from 68% in April, according to analyze firm CryptoCompare. Meanwhile, ethereums’s (ETH) AUM fell 34% to USD 8.52bn.

- Instant settlement network First Digital elevated USD 20m inside a round brought by Nogle and Kenetic Capital. Area of the funding round goes towards their global expansion to Singapore, the United kingdom, and Canada, in addition to towards the introduction of another marketplace for private equity finance and digital assets, they added.

Adoption news

- The Financial Authority of Singapore (MAS) announced that it’s beginning Project Protector which seeks look around the potential behind asset tokenization, together with banking institutions DBS Bank Limited and JPMorgan, and digital markets infrastructure operator Marketnode. Participation is susceptible to requisite regulatory approvals. The pilot aims to handle guaranteed borrowing and lending on the public blockchain-based network with the execution of smart contracts.

- The Bank of the usa (BoA) will not be getting into the crypto sector soon because the bank’s Chief executive officer John T. Moynihan finds that they’re not really missing out by opting from the industry, per Yahoo Finance. He was quoted as stating that the financial institution is heavily controlled which that stops an exciting-in maneuver into crypto.

- Institutional digital asset child custody and buying and selling solutions provider Copper.co announced that it’s been approved for membership within the Swiss Financial Services Standard Association (VQF) through its Swiss entity in Zug.

CBDCs news

- The Chinese town of Shenzhen will hands out e-CNY vouchers worth CNY 30m (USD 4.5m) via local service giant Meituan. The registered citizens is going to be attracted through a kind of lottery using the leads to be announced on Thursday, according towards the south China Morning Publish.

Exchange news

- Gate.io announced that it’s celebrating its ninth birthday with a brand new brand identity, together with a new slogan that is “Gateway to Crypto”, a brand new color plan, along with a new emblem, plus a lite form of its mobile application, in addition to a Small Application.

DeFi news

- DeFi project Kava announced that it’s joining forces with DeFi project Sushi (SUSHI), that will begin to see the two allocate as much as USD 7m over 3 months for any combined USD 14m in incentives.

NFTs news

- Luxury brand Prada announced their first solo NFT drop known as the Timecapsule NFT Collection, that is a monthly online event which will run every first Thursday from the month for twenty-four hrs and can make a unique item available online in limited quantities as well as in selected markets.

Gaming news

- Lympo announced the launch from the SPORT token, a brand new ERC-20 token designed to switch the old Lympo utility token LMT following a burglar incident captured, and SPORT token integration in to the approaching basketball manager and spell chess games in cooperation with chess giant Magnus Carlsen and the team.