Bitcoin (BTC) unsuccessful to interrupt $20,000 despite a brand new weekly at the top of March. 18 as market watchers anxiously waited for doing things.

Bitcoin meanders as stocks climb

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD defying volatility once more at the time.

The happy couple remained noticeably stable despite more powerful moves for U . s . States equities in the Wall Street open. During the time of writing, the S&P 500 and Nasdaq Composite Index were up 1.5% and 1.2%, correspondingly.

“We are actually witnessing another well past due relief rally in stocks,” financial commentary resource the Kobeissi Letter told Twitter supporters.

“After more than a month of near straight-line lower cost action, a bounce was needed.”

The publish ongoing having a warning within the approaching meeting from the Fed where an additional rate hike could be announced.

“However, as Q3 earnings begin and subsequently Given meeting approaches, we’re not even close to the obvious. Use stops out on another get trapped,” it advised.

Using the mood still uncertain, crypto commentators thus largely stuck to existing predictions if this found short-term cost moves.

“The area surrounding $19.3K is essential to carry therefore we can expand to $22.2K,” Michaël van de Poppe, founder and Chief executive officer of buying and selling platform Eight, authored partly of the tweet at the time.

Popular trader Il Capo of Crypto declared Bitcoin “ready to function to 20k+,” getting already given a target of $21,000 for that relief rally.

Fellow trader Crypto Tony was more conservative around the potential range for BTC/USD within the coming week, flagging the region around $20,000 like a likely place for an extended-term trajectory decision to make.

Exchange activity reminiscent recently 2020

Case study of exchange order books meanwhile created interesting conclusions concerning the nature of the present cost setup.

Related: Bitcoin cost ‘easily’ because of hit $2M in six years — Ray Lepard

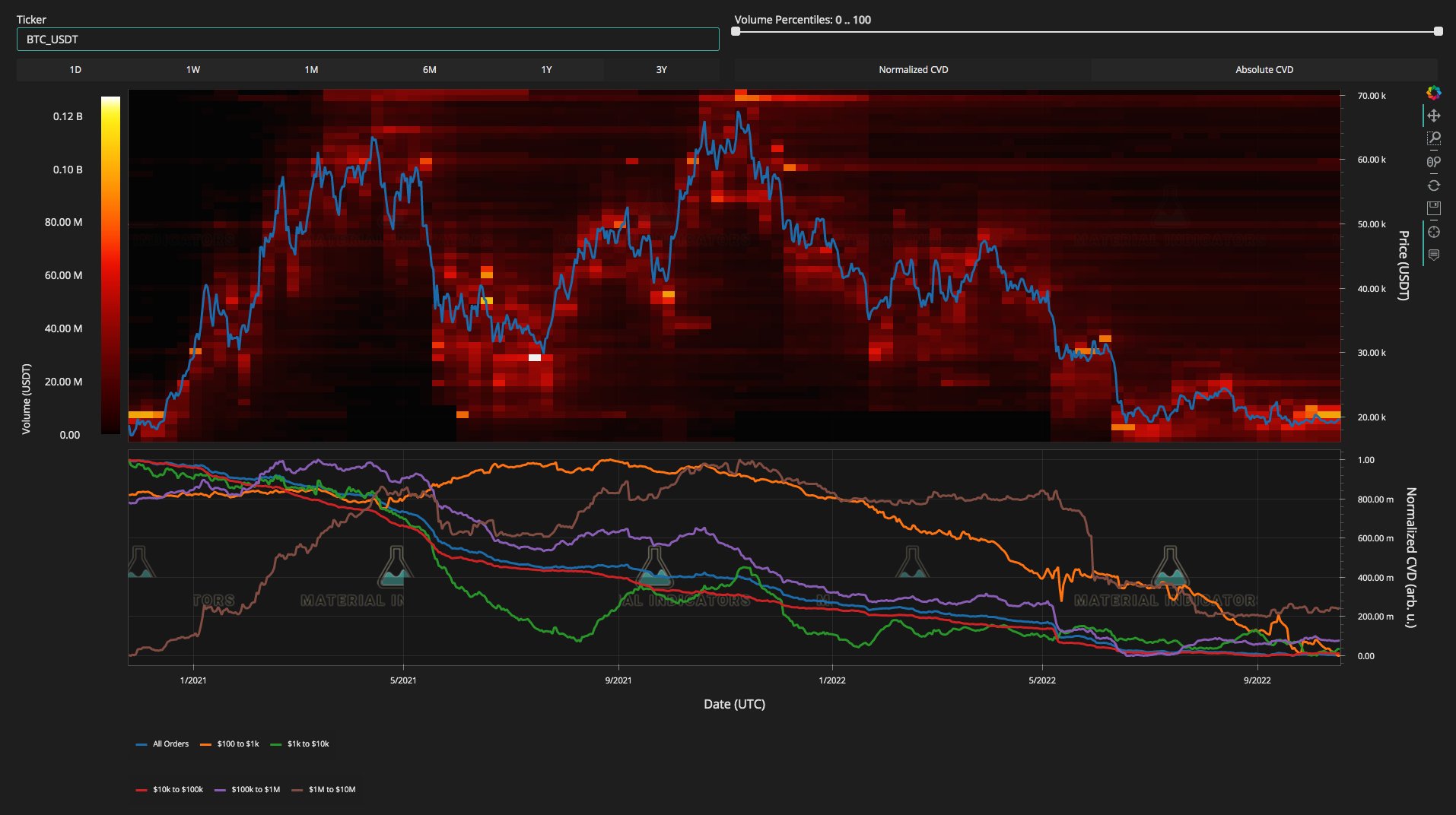

On Binance, the biggest exchange by volume, a substantial wall of resistance was active at $20,000, something which on-chain analytics resource Material Indicators likened to November 2020.

In those days, Bitcoin abruptly broke with the $20,000 barrier to start several weeks of upside to new all-time highs near $60,000.

“The before BTC were built with a sell wall this huge directly over the active buying and selling range was November 2020,” Material Indicators commented.

“It was literally exactly the same amount in the same cost level. Over $100M in ask liquidity was eaten to start the bull run. Don’t believe an outbreak came from here is going to do exactly the same, but…”

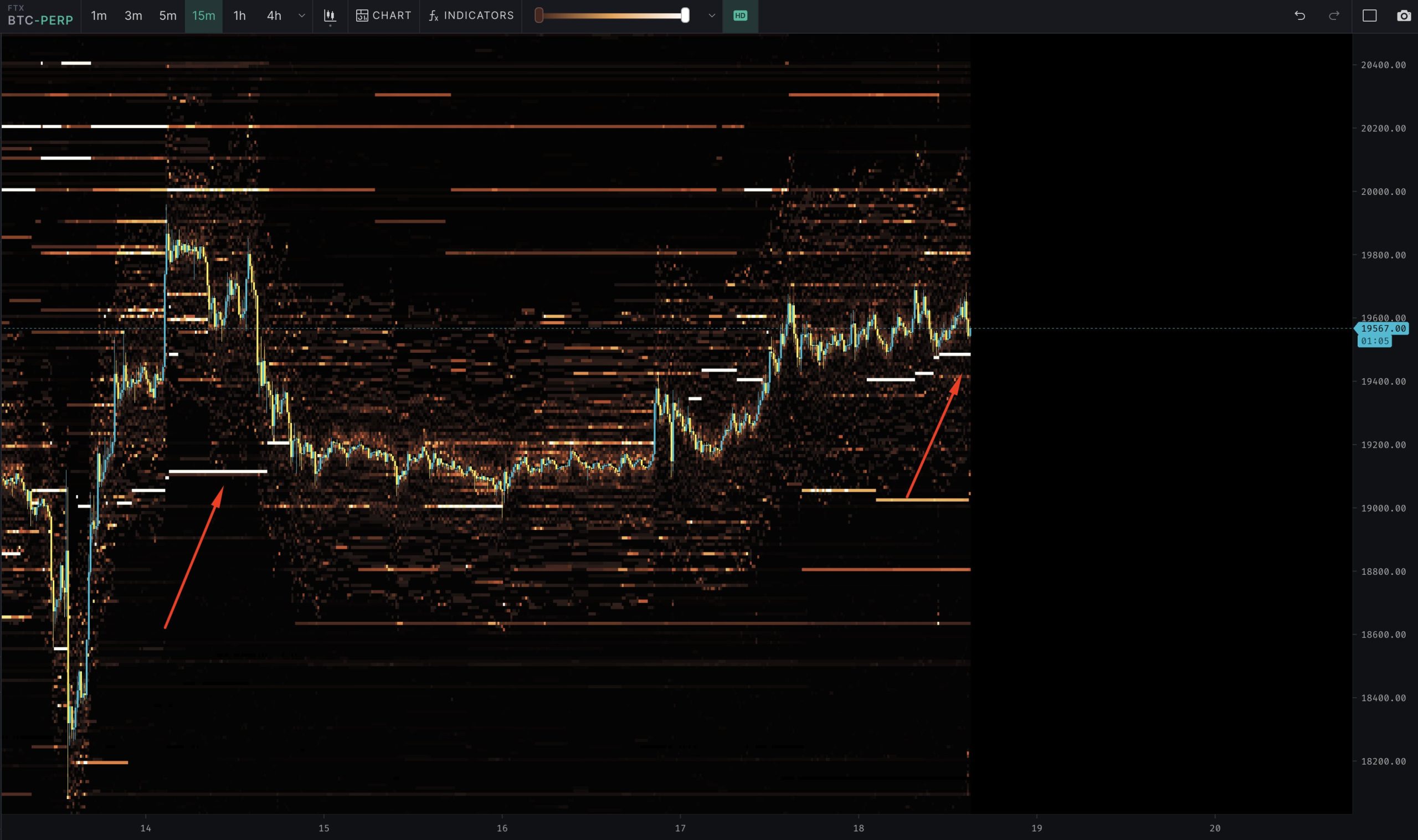

Il Capo of Crypto furthermore highlighted activity around the derivatives platform FTX. Traders there had place in strong support, he noted, quarrelling this was “pushing the cost up.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.