Bitcoin (BTC) found strength at $22,000 into This summer 24 with bulls still targeting a good eco-friendly weekly close.

Classic levels for finish-of-week cost focus

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD halting a weekend drop at $21,900 to come back for the $23,000 at the time.

The happy couple held a buying and selling range carefully centered on key lengthy-term trendlines, which analysts had formerly referred to as necessary to reclaim.

These incorporated the 50-day and 200-week moving averages (MAs), the second particularly significant as support during bear markets but which in fact had acted as resistance since May.

“Bullish that people perfectly held the 13d ema + horizontal 21.9k,” popular Twitter buying and selling account CryptoMellany contended partly of her latest update at the time.

“I think we’ll hold off 22.5k for today’s weekly close, new week beginning with action lower to 21-21.6k after which up throughout a few days, developing a bull flag.”

The 50-day and 200-week MAs was at $22,370 and $22,690, correspondingly, during the time of writing, with place cost at $22,670.

Ongoing, fellow trader and analyst Jibon described the approaching weekly close as “very essential.” An associated chart designated $21,944 and $22,401 because the lines within the sand for any “bad” or “good” close.

Earlier within the week, Jibon had cautioned that this type of “bad” result may be the oncoming of a retracement to new macro lows for Bitcoin — as little as $12,000 — which ongoing strength could fuel a relief rally up to $40,000.

Whether it would close at current levels, BTC/USD would seal its greatest levels since mid-June.

Ethereum, Cardano lead altcoins as ETH outlows rise

On altcoins, Ether (ETH) and Cardano (ADA) were the standout weekend performers as both rejected ‘abnormal’ amounts.

Related: Ethereum cost ‘cup and handle’ pattern shows potential breakout versus Bitcoin

ETH/USD came back to $1,600 at the time, while ADA/USD likewise looked to challenge its $.548 peak from throughout the week, this marking its best performance since June 12.

Analyzing the present atmosphere, traders noted the value of Ethereum’s 2018 a lot of $1,530, an amount which grew to become lengthy-term resistance and which came back as resistance again in June.

$ETH

after working couple of days below 2017 ATH level #ethereum is attempting to shut above it

continues to have a couple of days left for that weekly close though

close above which pushes till 2300 imo

close below which keeps chopping and even perhaps make new lows..you never know pic.twitter.com/EGsvpyTB6T— White-colored Master (@cryptowhitewalk) This summer 23, 2022

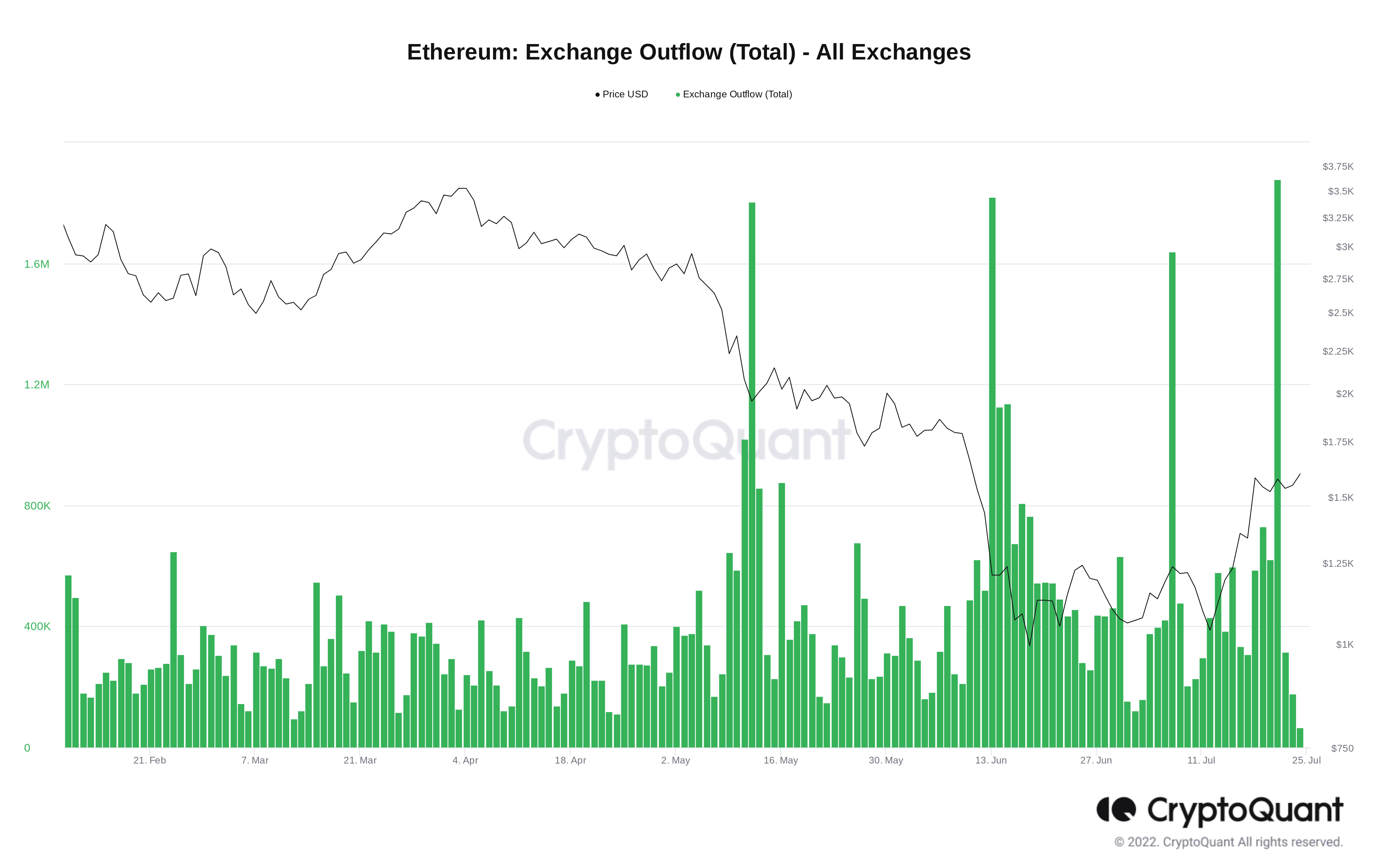

As cost action strengthened, meanwhile, outflows of ETH from major exchanges intensified. On This summer 22, based on data from on-chain analytics firm CryptoQuant, individuals flows totaled 1.87 million coins.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.