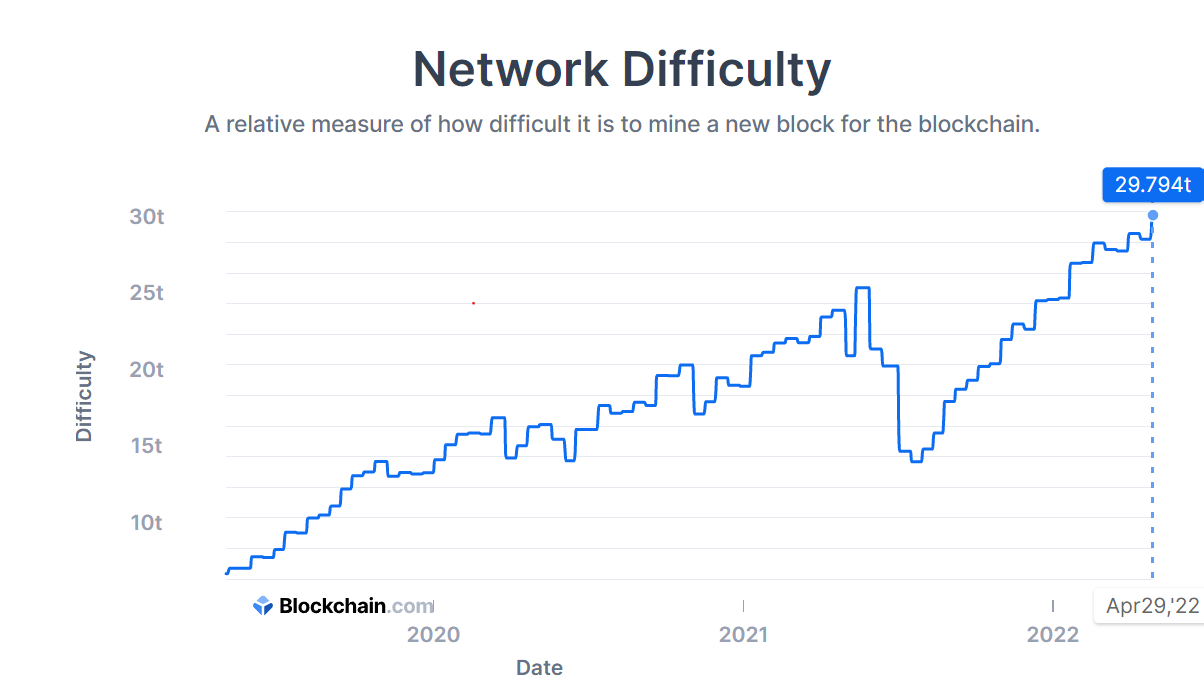

Reassuring its position because the most resilient blockchain network against attacks, the Bitcoin (BTC) network recorded a brand new all-time high network difficulty for that second time this month in April — jumping from the previous all-time a lot of 28.587 trillion to 29.794 trillion.

Greater network difficulty demands greater computational capacity to effectively mine a BTC block, which prevents bad actors from overtaking the network and manipulating transactions, also referred to as double-spending.

As evidenced by data from blockchain.com, Bitcoin’s network difficulty has witnessed several months-lengthy upward trend since August 1, 2021. Before that, between May and This summer 2021, would be a timeline when BTC network difficulty fell nearly 45.5% from 25.046 trillion to 13.673 trillion — at that time raising momentary concerns concerning the network’s vulnerability.

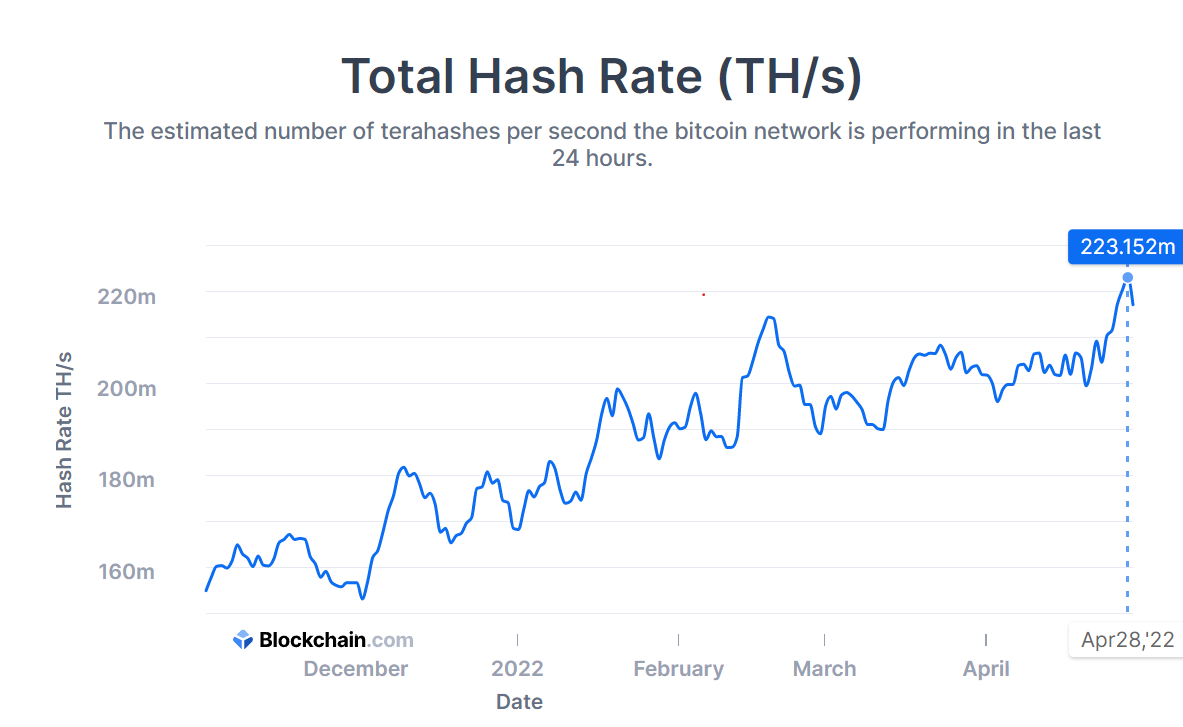

Further cementing Bitcoin’s resilience against 51% attacks, on April 28, the Bitcoin network hash rate too recorded a brand new ATH of 258 EH/s. As proven below, the network hash rate eased lower towards the 220 EH/s mark through the finish from the month without any visible negative effect on the BTC network difficulty.

The month of April also was witness to among the cheapest average transaction charges around the Bitcoin network — the price connected with transferring BTC. The very first time in 2 years, on April 18, the average BTC transaction fee fell lower to $1.039, which at its greatest was $62.788 in April 2021.

While Bitcoin miners still pursue the final two million BTC into circulation, the network is well-positioned to achieve a more recent all-time high regarding overall security and cost.

Related: Bitcoin hodlers targeting $100K is what’s stopping 40% cost drawdown, data suggests

New information paints an positive picture about BTC, underscoring the effectiveness of hodlers wishing for those-time highs.

As Cointelegraph reported, on-chain indicators suggest bullish momentum because of too little short-term holders (STHs), as noted by popular analyst “Root”:

“Since we did not achieve prices above 100K, which a lot of expected, many still believe this can eventually happen and can therefore keep their coins.”