The amount of transactions around the Bitcoin network has spiked in the last week, which blockchain analysis firm Glassnode suggests are ‘urgent’ transactions because of investors de-risking.

An abrupt increase of 42,800 transactions hit the mempool on Bitcoin (BTC) a week ago. Glassnode’s chief analyst states they were likely “urgent” transactions because of the large quantities of charges compensated per transaction. The typical fee rose to $2.72 a week ago, about 15% greater compared to typical average based on bitinfocharts, an on-chain data tracker. The findings were reported within the Glassnode “Week On-chain” report on May 9.

The #Bitcoin market saw and very volatile week, with prices buying and selling lower to $33.8k, as well as an additional 10% from the network falling into loss.

We analyse the marketplace reaction over the mempool, exchanges, derivatives and stablecoin supply contractions.https://t.co/WDuzlObVxK

— glassnode (@glassnode) May 9, 2022

The mempool on the blockchain network is how transactions are sent prior to being confirmed inside a block. The greater the charge compensated on the transaction, the greater the chance it will likely be selected in front of others.

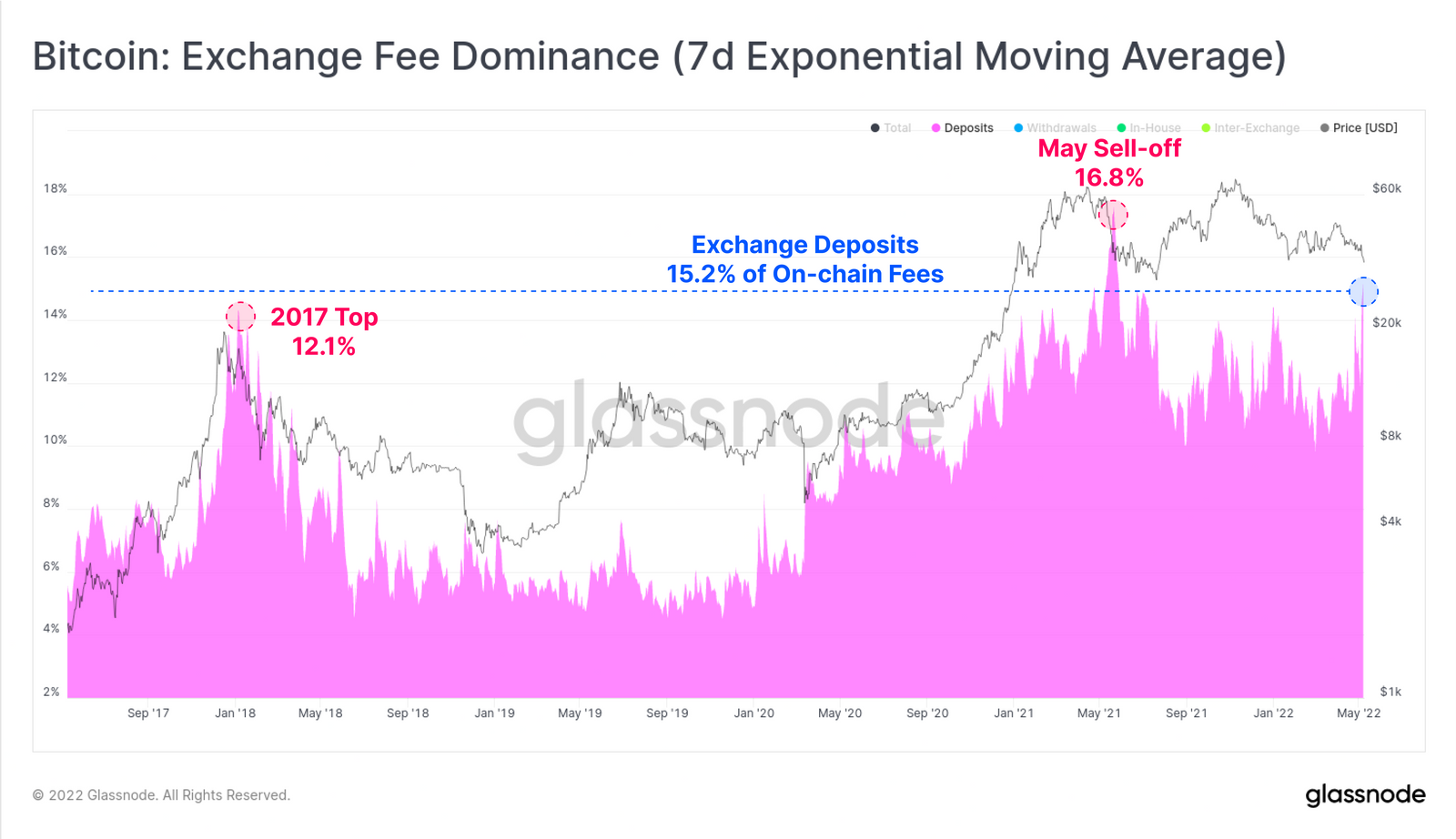

Glassnode authored that investors compensated greater-than-average charges likely to be able to prioritize their bids to de-risk their portfolio or add collateral for their margin positions as BTC cost has fallen 19% in the last 7 days. Approximately 15% of charges compensated for on-chain transactions correlated with exchange deposit rates, which were only greater in May 2021 during another duration of heavy sell-offs.

BTC inflows to exchanges outpaced inflows for many of 2022, however that altered a week ago because there was greater than $50 million more price of inflows than outflows. Glassnode stated the quantity of exchange-related volume was just surpassed last October and November and matched the height from the 2017 bull market at the end of December, and early The month of january of 2018.

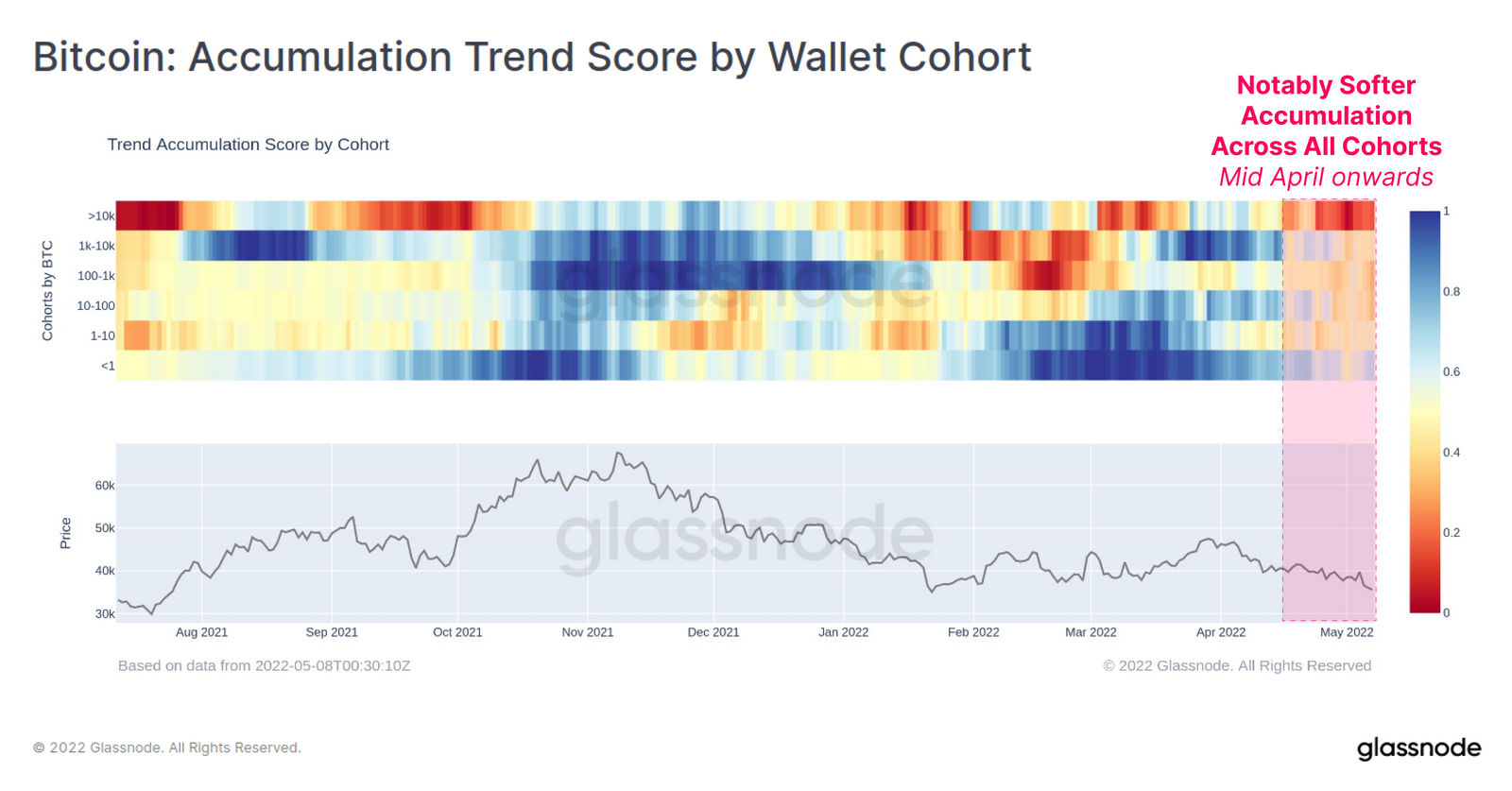

Glassnode also noted that BTC accumulation continues to be on the low trend since the center of April. “Shrimps” who hold under a whole Bitcoin were the biggest accumulators associated with a cohort of wallets as much as whales with the past week, but their accumulative strength was weak when compared with previous several weeks this season.

Related: Bitcoin retests key $30K support zone as data highlights BTC whale accumulation

The biggest distributors, or sellers, were individuals within the greatest cohort who hold a minimum of 10,000 coins. Based on Glassnode, distribution continues to be greater than accumulation through the majority of 2022, however, the biggest accumulators happen to be individuals holding under one BTC as much as individuals holding 10.

With total charges spent in a local high as investors urgently attempt to exit more volatile positions, it seems that Bitcoin markets may continue lower their “rocky road” to capitulation, as Cointelegraph reported on May 10.