Bitcoin (BTC) went through an inadequate rebound on Sep. 21, and also the U.S. dollar leaped to a different yearly high as investors await today’s Federal Open Market Committee’s rate of interest decision.

BTC cost hold $19K in front of Given decision

BTC’s cost has were able to cling onto $19,000 having a modest daily gain of just one.33% . Meanwhile, the U.S. dollar index (DXY), which measures the greenback’s strength versus a swimming pool of top foreign currency, rose to 110.86, the greatest level in two decades.

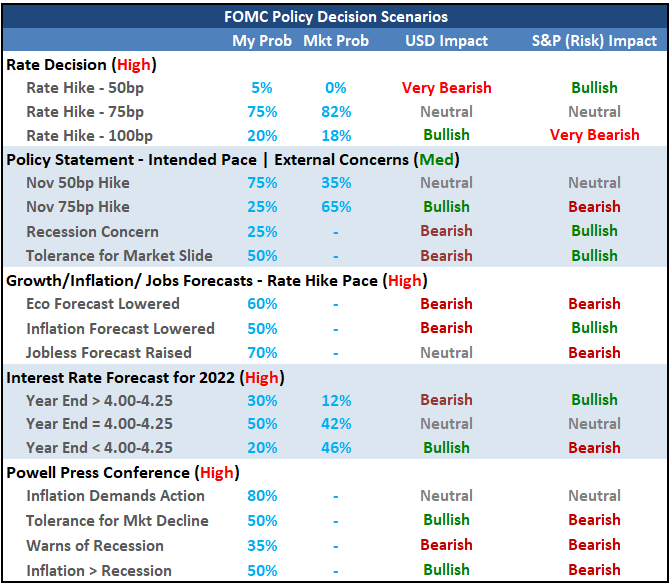

FOMC rate hike scenarios

The Fed is poised to go over what lengths it might raise its benchmark lending rates to curb record inflation. Interestingly, the marketplace expects the U.S. central bank to hike rates by 75 or 100 basis points (bps).

The ramification of greater rates of interest will probably result in lower appetite for riskier assets like stocks and cryptocurrencies. On the other hand, the U.S. dollar assists because the go-to safe place for investors getting away risk-on assets.

“There appears pointless for that Given to melt the hawkishness proven in the recent Jackson Hole symposium, along with a [.75 percentage point] ‘hawkish hike’ ought to keep the dollar near its highs of the season,” analysts at ING told the Financial Occasions.

Independent market analyst PostyXBT argues that the 100 bps rate can “nuke” Bitcoin below its current tech support team of $18,800. Also, he shows that BTC has a high probability of recovery when the rate hike happens to be less than expected, or 50 bps.

$BTC 1D

As us FOMC experts knows, today is a huge day!

100bps likely nukes support permanently?

50bps likely pumps and provides bulls some space?Likely to be a really interesting daily close https://t.co/C5ClM436N6 pic.twitter.com/mJP7qpGEv1

— Posty (@PostyXBT) September 21, 2022

These speculations echo general rate hike expectations. John Kicklighter, the main strategist at DailyFX, notes that the 50 bps rate hike could be bullish for that U.S. benchmark stock exchange index.

Nevertheless, one hundred bps rate hike could be very bearish for that S&P 500. This may be equally problematic for Bitcoin, whose correlation with stocks has been consistently positive since December 2021.

Polls expect a 75 bps rate hike

The U.S. economy endured two back-to-back quarters of negative growth. Furthermore, its manufacturing PMI pointed towards the slowest development in factory activity since This summer 2020. Meanwhile, the 2-year U.S.Treasury returns have entered over the 10-year U.S. Treasury returns, plotting a yield curve.

Related: What’s next for Bitcoin and also the crypto market since the Ethereum Merge has ended?

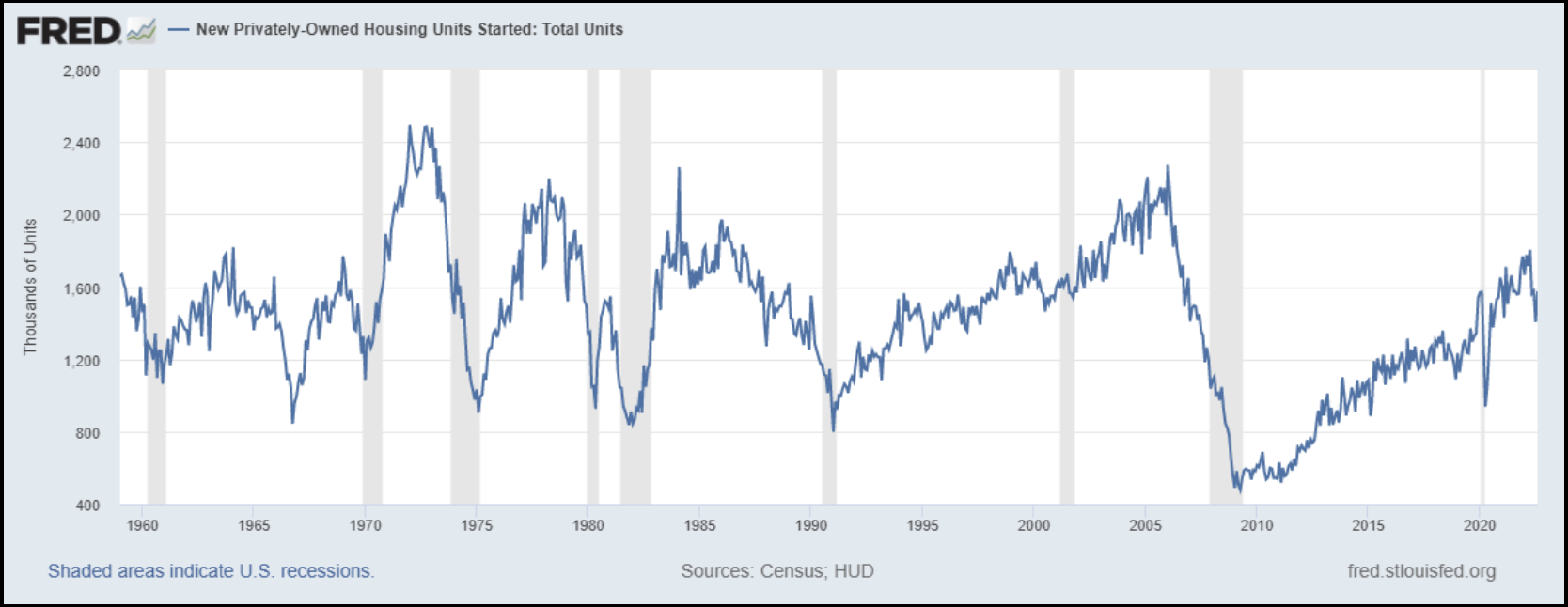

These metrics enhance the alarm a good impending recession. But offsetting individuals are unemployment data at its record low and housing starter rates still above their danger zone of $1.35 million, according to data presented by Charles Edwards, founding father of Capriole Investments.

Normally, recession warnings prompt the Given to pivot. Quite simply, to lessen or pause hiking rates. But Edwards notes the central bank won’t pivot because the U.S. economy is technically not in recession.

“Until major concerns of recession appear, until it hurts where it counts — employment — there’s pointless to anticipate a sudden alternation in Given policy here,” he authored, adding:

“So it’s business as always until we’ve evidence that inflation is in check.”

Most economists, or 44 from the 72 polled by Reuters, also predict that Given would raise rates by 75 bps within their September meeting. Therefore, Bitcoin could avoid a much deeper correction whether it maintains its correlation using the S&P 500, based on Kicklighter’s outlook.

Bitcoin to $14K next?

Theoretically speaking, Bitcoin could drop to $14,000 in 2022 if your drop below its current support degree of around $18,800 triggers a “mind-and-shoulders” breakdown.

On the other hand, a rebound in the $18,800-support might have BTC’s cost eye $22,500 since it’s interim upside target, or perhaps a 16.5% rise from today’s cost

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.