While Bitcoin (BTC) cost support might be mental for many traders, the data behind BTC remaining over $20,000 for any week are strong indicators of cost support or quite simply, a brand new bear market floor. Multiple Bitcoin data points could possibly set up a $20,000 support level.

A week ago Bitcoin arrived at a higher of $20,961. However, it never sustained its upward momentum because the rally fizzled out, neglecting to break $21,000 support. Because of the rally along with the rejection, Glassnode, in the newest report, analyzes if Bitcoin is hammering out a bear market floor.

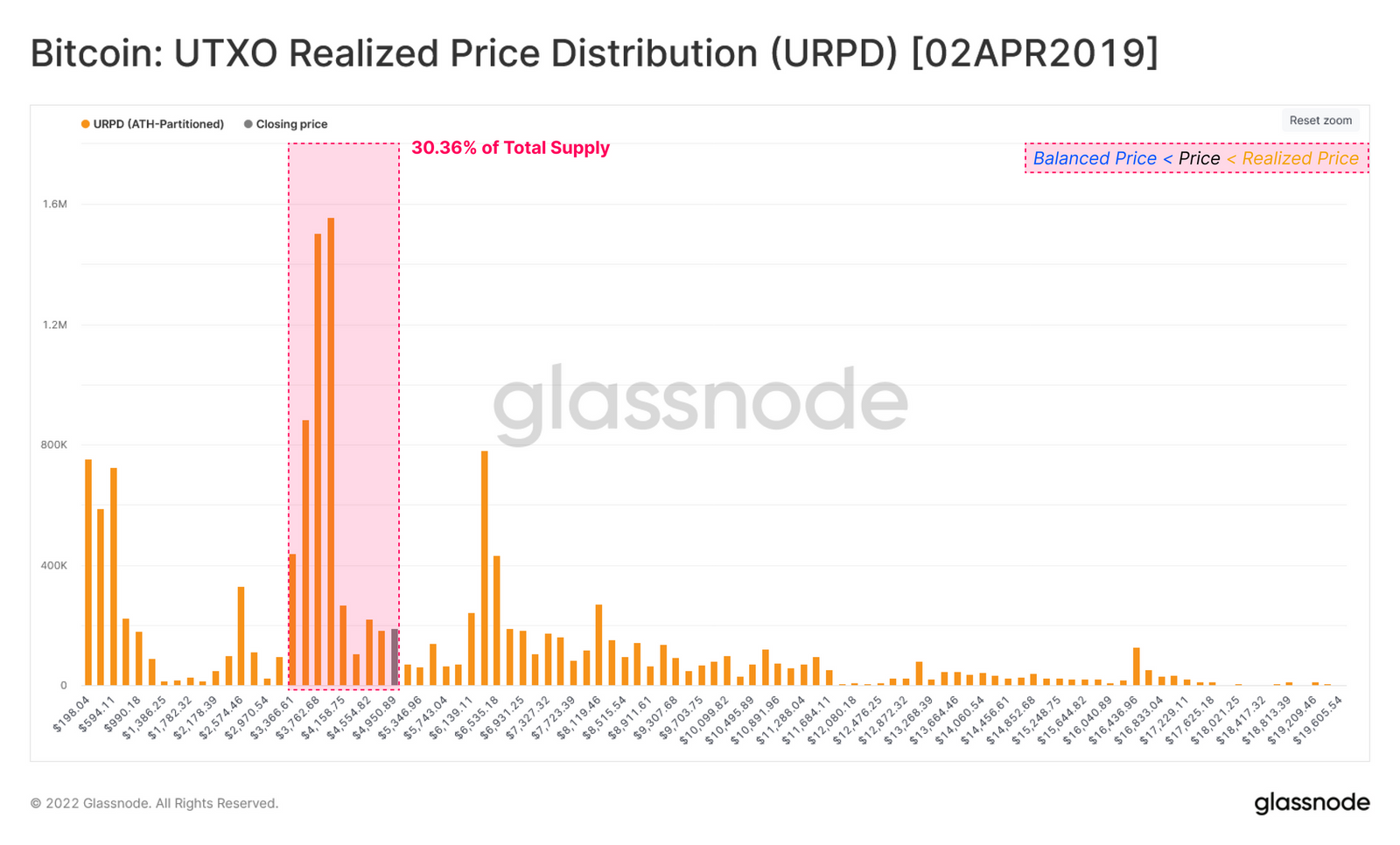

Recognized cost distribution

Bitcoin’s recognized cost charts the typical cost buyers compensated for his or her BTC holdings. When the cost of Bitcoin goes below a user’s recognized cost, they’re technically experiencing an unrealized loss. For visual effect, the UTXO Recognized Cost Distribution shows the proportion of supply distributed over the acquisition cost.

The 2019 bear market implies that 30% of BTC’s total supply was concentrated inside the recognized cost range. In April 2019, the cost started over the recognized cost, signaling the beginning of a brand new bull market.

Searching in the market and using the same methodology, Bitcoin’s recognized cost is concentrating 20% of supply between $17,000 and $22,000. Although this shows that more redistribution might need to occur, the consolidation is important and highlights a resilient holder base.

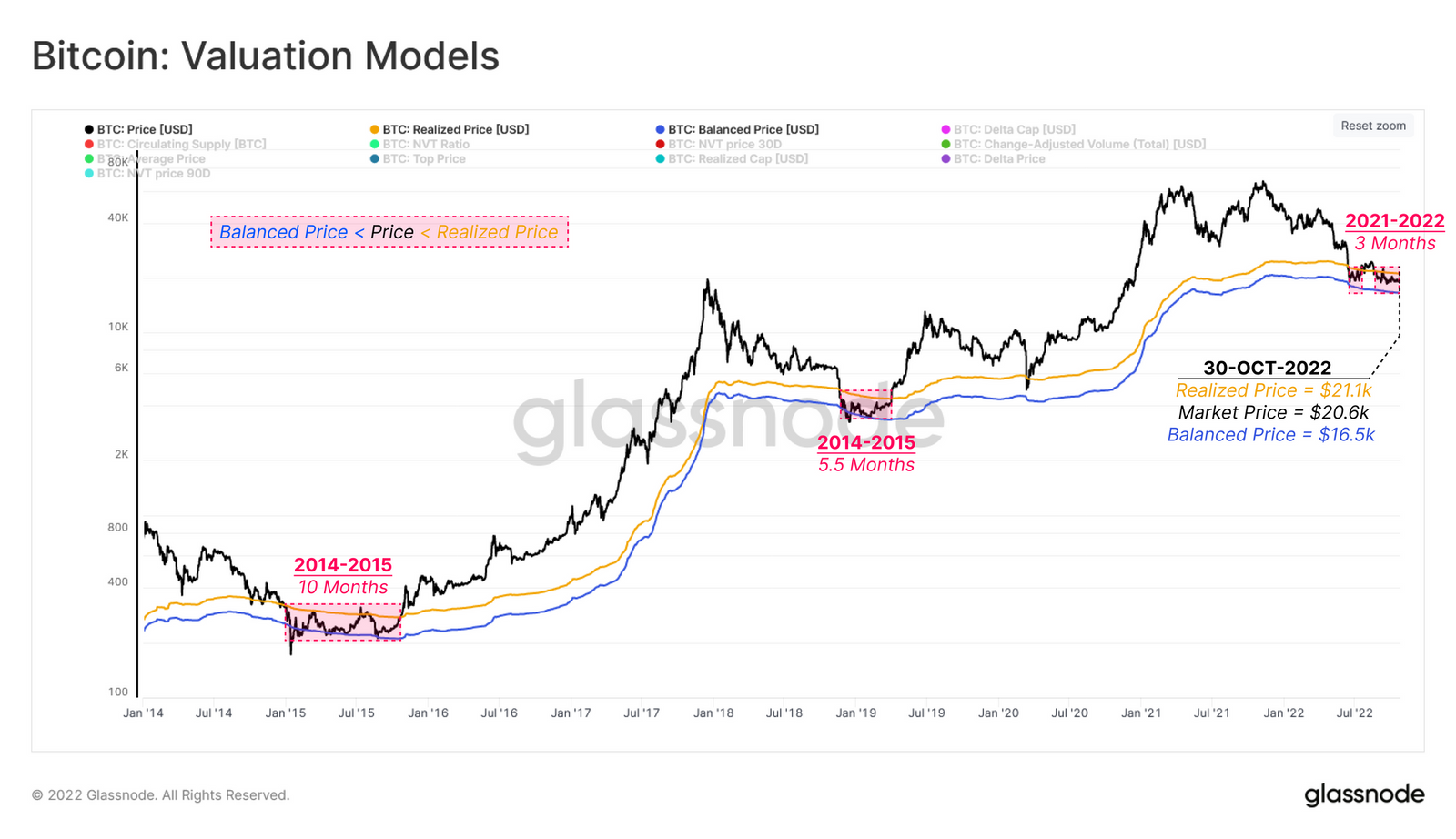

How lengthy before the breakout?

Bitcoin’s valuation model may suggest how lengthy until an outbreak as with April 2019. According to historic data, prior cycles have observed the recognized cost range lasting between 5.5 and 10 several weeks. In the present cycle, Bitcoin only has been within range for ~3 several weeks, meaning the following breakout may happen after more several weeks of sideways buying and selling.

Related: BTC cost sees ‘double top’ before FOMC

Lengthy term holders continue to be in profit

Using the recognized cost distribution when it comes to lengthy term holders versus temporary holders might also provide insight. Presently, lengthy term holders are a lot of the supply in profit meaning they’ve less anxiety to market and when they did, they’re in profit. The quantity of supply in profit is 56% whereas for lengthy term holders, it’s at 60%.

While previous market cycles have lasted more than the present cycle, signs are positive for any repeat breakout. With lengthy term holders becoming an overwhelming most of the supply in profit, sell pressure might be minimized in case of approaching sell-off occasions.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.