Following a whirlwind November for Bitcoin (BTC), certain on-chain and Bitcoin cost metrics are suggesting that BTC’s bottom could exist in December. In Capriole Investments’ latest report, they offer analysis on Bitcoin locating the bottom. When taking into recognized value, miner capitulation, mining electrical costs, downdraw and record hodler figures, a BTC floor of $16,600 – $16,950 appears created.

Listed here are five explanations why Edwards believes Bitcoin cost is originating nearer to a cycle bottom.

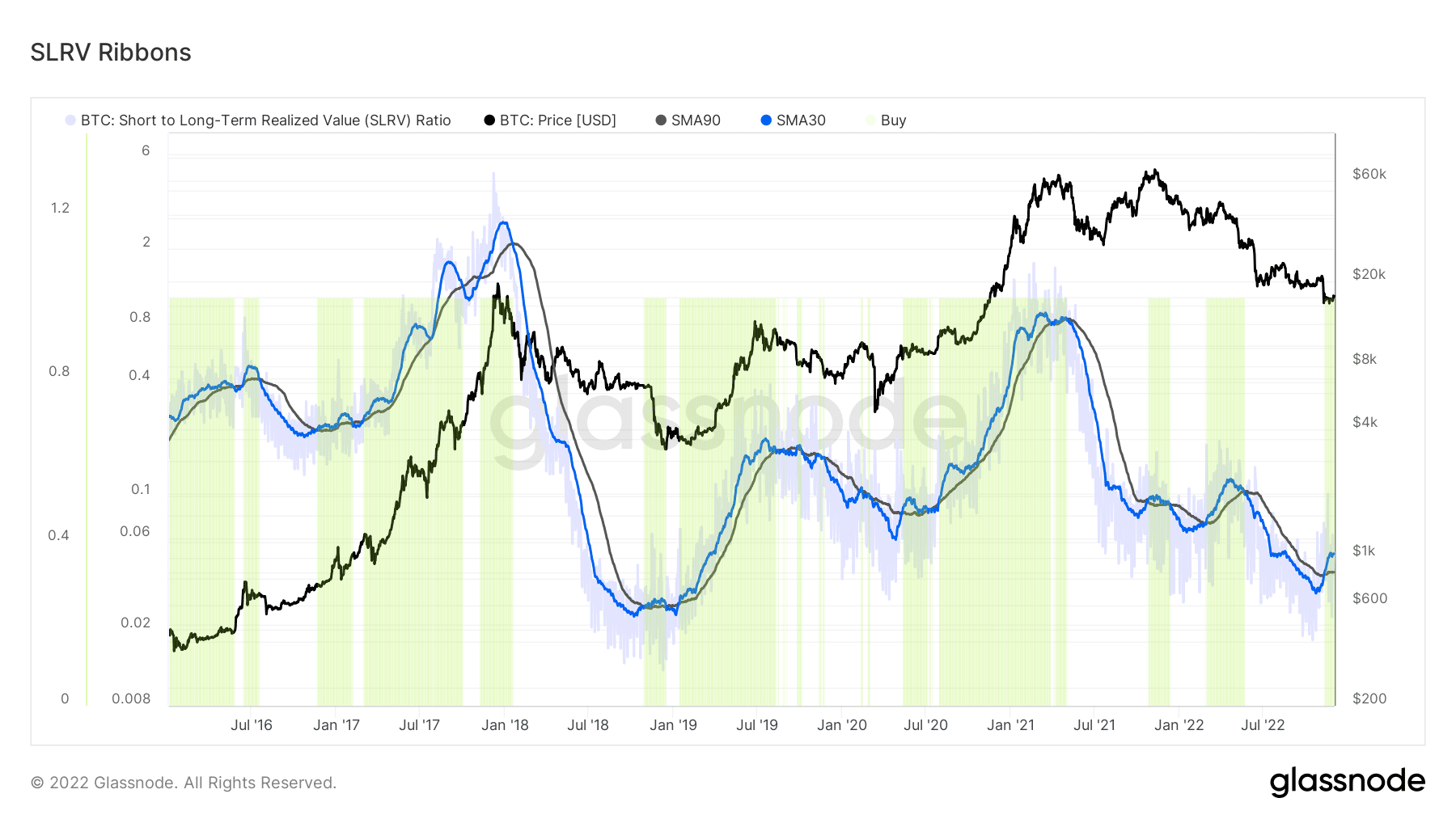

SLRV Ribbons flash a buy signal

The SLRV Ribbons track investment flows by mixing the 30-day and 150-day moving averages towards the SLRV Ratio that is a number of the Bitcoin moved in 24 hrs divided by BTC held for six-12 several weeks.

Based on Charles Edwards, the SLRV Ribbons outshine the BTC HODL strategy, which makes it a powerful indicator of where BTC cost may be headed.

As the SLRV Ribbons happen to be bearish throughout 2022, the current proceed to $16,600 flipped the indicator to bullish. Based on Edwards, the modification results in a buy signal for investors and institutional funds still on the market, thus creating a strong situation for Bitcoin’s cost floor.

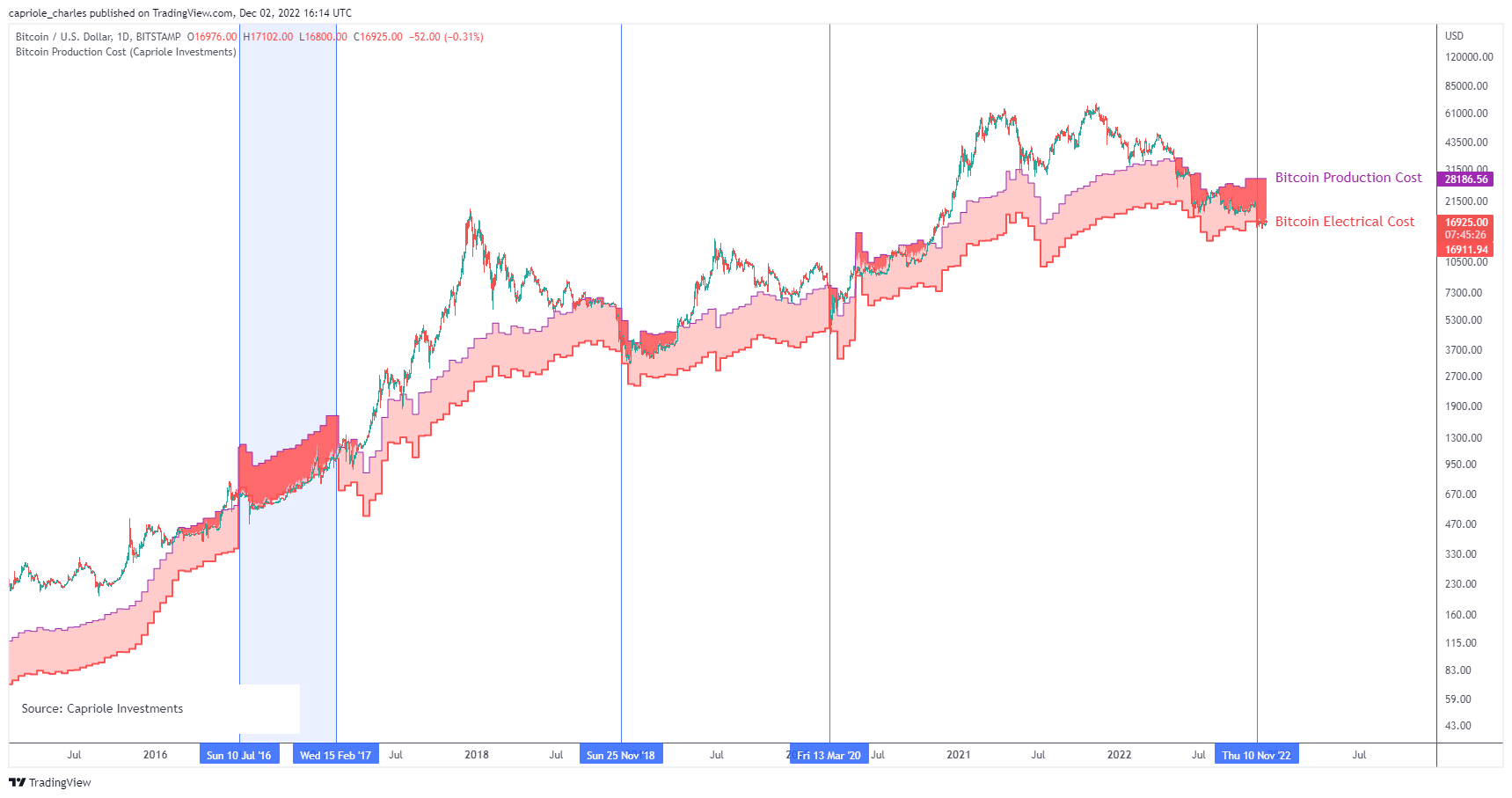

BTC cost slips under its global electrical cost

Even though it is well-known that the large swath of Bitcoin miners are presently operating baffled, this isn’t an uncommon phenomenon throughout BTC’s history.

Bitcoin miners’ total production cost includes mining hardware, operational costs, capital costs, variable-rate power contracts along with other factors, whereas the electrical cost views just the raw electricity accustomed to mine BTC.

The raw electrical cost has in the past been a Bitcoin floor since it is rare for BTC to trade below this cost point. In the past, Bitcoin only has traded underneath the electrical cost four occasions, the newest being November. 10 when Bitcoin’s electrical cost hit $16,925.

BTC miner selling hits an optimum

Miners continue to be taking a loss with production costs over the place cost of Bitcoin. This dichotomy forces miners to market Bitcoin to remain afloat.

The present degree of Bitcoin miner selling may be the third largest ever, using the other two occasions happening when BTC was $2.10 this year and $290 in 2015.

In hindsight, investors would like to have individuals prices back and Edward’s shows that the present BTC cost may represent an identical value.

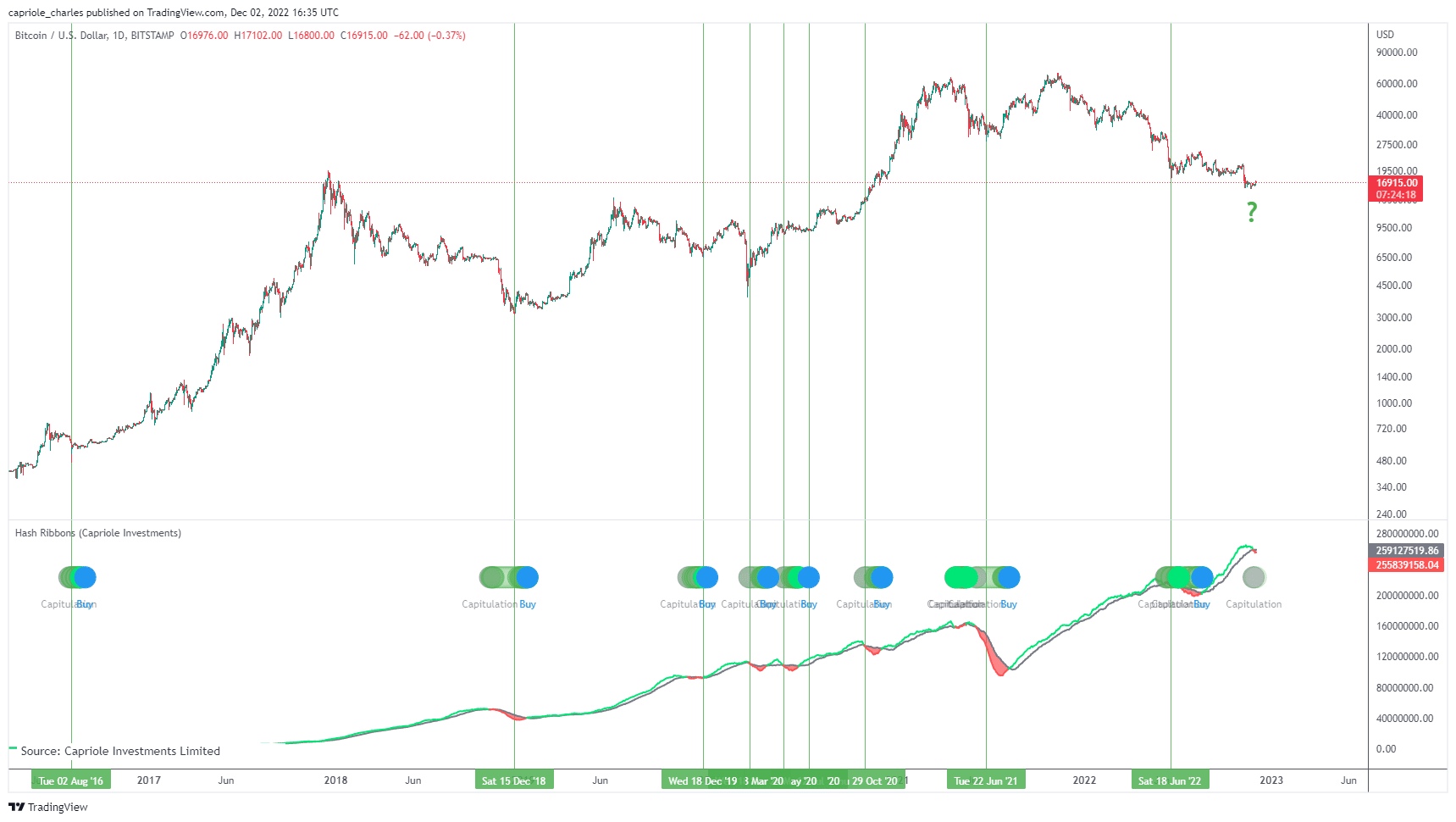

Bitcoin Hash Ribbons confirm another miner capitulation

Bitcoin miner capitulation involves miners switching off their ASICs which aren’t lucrative, and selling servings of their Bitcoin reserves to pay for expenses.

Based on Capriole Investments, during miner capitulations, the ground cost forms prior to the hash rate begins to improve. As noted within the chart below, another miner capitulation happened on November. 28 and when case study is true, this could put Bitcoin’s bottom around $16,915 because the hash rate has started rising following the November. 28 date.

Related: Bitcoin clings to $17K as ARK flags ‘historically significant capitulation’

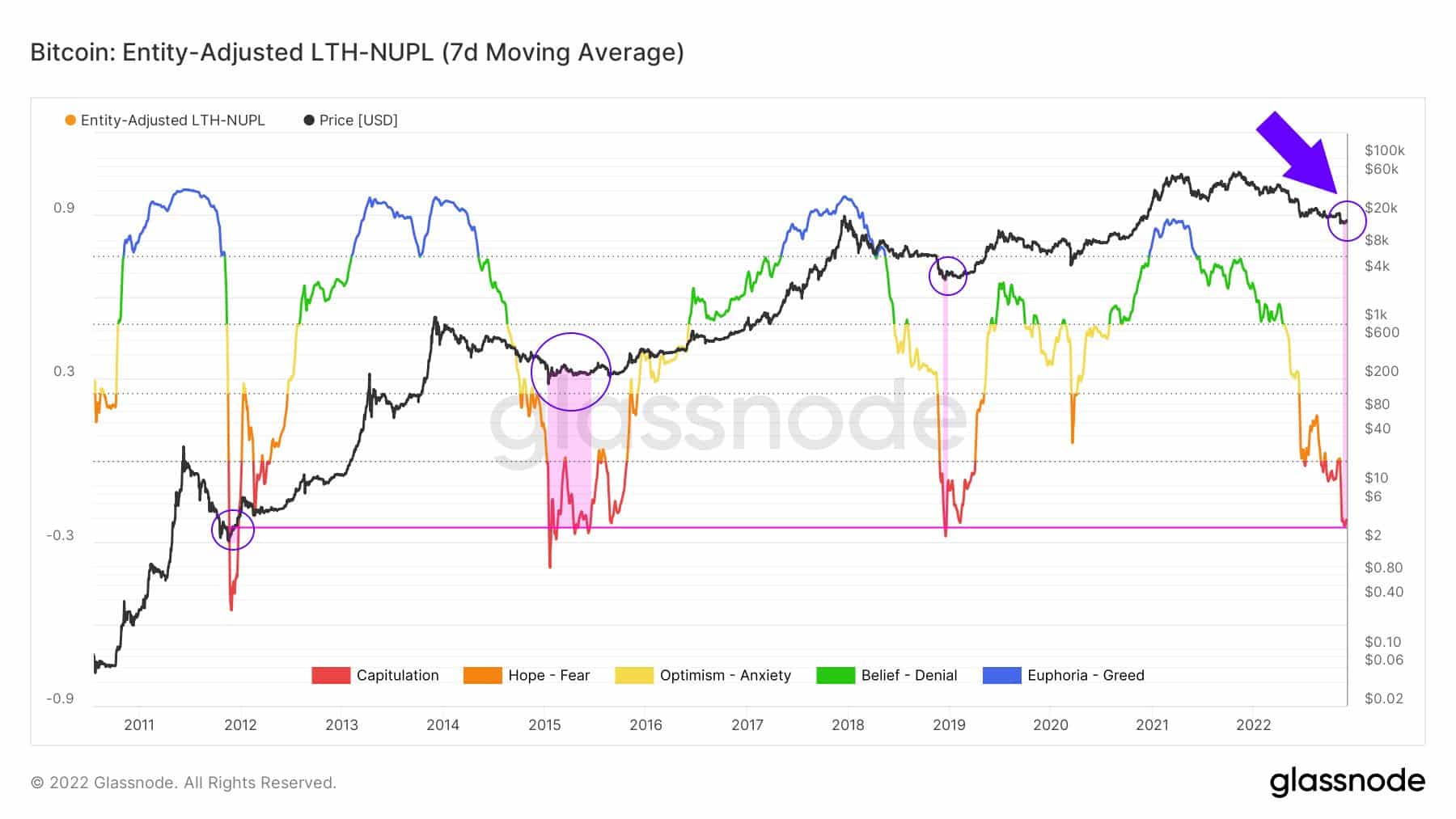

All-time high Bitcoin hodling despite a historic cost drawdown

One metric accustomed to evaluate Bitcoin hodler behavior may be the Lengthy-term Holder Internet Unrealized Profit and Loss (NUPL) tracker.

Throughout Bitcoin’s history, the NUPL metric only has proven this type of large downdraw on four occasions.

The prior occasions that observed such large downdraws symbolized value Bitcoin purchases for investors. Edwards shows that if investors view BTC cost as undervalued, their option to accumulate could further solidify Bitcoin’s floor.

Another trend is developing because the lengthy-term hodlers metric hits peak figures. Presently, 66% of Bitcoin’s supply is at the disposal of lengthy-term hodlers, meaning they’ve held their Bitcoin for more than twelve months.

Based on Edwards, this behavior is aligned with shifting macro markets.

There’s an all-time-full of lengthy-term hodling. Individuals keeping Bitcoin a minimum of 12 months now represent a lot of network than in the past, 66%. Prior peaks of lengthy-term holding all aligned with bear market toughs. pic.twitter.com/4IXnUg5f3S

— Charles Edwards (@caprioleio) December 6, 2022

As the financial markets are still heavily correlated to equities and susceptible to macro market shifts, multiple data points hint that Bitcoin might be within the final stages of the bottoming process.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.