Bitcoin, the world’s first and largest cryptocurrency by market capital, is going to close out its best quarter in precisely 2 yrs.

Presuming Bitcoin has the capacity to close Friday’s session at or over current levels within the $28,200s, the cryptocurrency might have acquired an enormous 70% since the beginning of the entire year.

In Q1 2021, Bitcoin bending in cost from slightly above current levels to shut to $59,000. Indeed, the finish of Q1 2021 marked Bitcoin’s best-ever quarterly closing level.

Bitcoin’s sudden go back to form in 2023 comes among a far more favorable macro backdrop.

Given tightening bets have eased in recent days among concerns about weakness staying with you sector, that has itself also spurred a safe-haven bid for “hard money” like gold and silver and proven cryptocurrencies like Bitcoin (which many describe as digital gold).

Bitcoin’s 2023 rally has additionally likely been driven by mean reversion and enhancements in Bitcoin’s on-chain health – various technical as well as on-chain indicators happen to be flashing within the last couple of several weeks that Bitcoin became oversold this past year which the bear market bottom has become likely in.

Find Out More:

Using the world’s largest cryptocurrency getting defied the bears in Q1 2023, investors are pondering what Q2 might hold for Bitcoin.

Everything has been searching great for the medium-term technical outlook since Bitcoin’s hugely important bounce from the 200-Day Moving Average and Realized Cost under $20,000 earlier this year, that also became of coincide with another retest from the downtrend in the Q4 2021 and finish-Q1 2022 highs.

All Bitcoin’s major moving averages point greater and all sorts of have entered one another inside a bullish fashion – the 21DMA is over the 50DMA, that is over the 100DMA, that is over the 200DMA).

Which means the doorway seems to become open for any rally above $30,000 in Q2 along with a retest from the key $32,500-$33,000 resistance area.

But because all traders know, technicals aren’t all things in markets. Numerous important fundamental styles will probably get this amazing effect on Bitcoin’s cost in Q2. Let’s check out the most crucial styles.

Will the financial institution Crisis Worsen and Spur Fresh Safe-haven Interest in Bitcoin?

In wake of small-bank runs because of concerns about poor balance sheet management, three crypto/tech/start-up friendly banks (Silvergate, SVB and Personal Bank) collapsed or were shuttered by regulators earlier this year.

This sparked concerns in regards to a broader US (and global) bank crisis that may threaten the whole economic climate.

For the time being, the response from policymakers has avoided a wider bank operate on US banking institutions – government bodies ensured that depositors at these 3 banks didn’t lose any funds, reassuring deposits at other banks, going far above the government Deposit Insurance Fund’s usual $250,000 per account protection pledge.

Furthermore, government bodies introduced new liquidity programs to help ease balance sheet pressures being felt at other vulnerable banks, in addition to bolstering USD liquidity swap programs along with other major central banks.

Individuals liquidity programs imply that the Fed’s balance sheet has increased from under $8.35 trillion at the begining of March to almost $8.75 trillion by the finish of March.

That’s roughly $400 million in liquidity injections, undoing the liquidity withdrawals from the last four several weeks that saw the Given allowing $95 billion monthly in treasuries and mortgage-backed securities to roll of their balance sheet without reinvestment.

Elsewhere, a consortium of huge US banks even joined together to assist save vulnerable bank First Republic, injecting it with $30 billion in deposits.

While concerns in regards to a full-blown banking crisis have eased somewhat now, helped also by an agreed buyout of SVB’s assets, the problem remains fragile and, for the time being, Bitcoin is retaining its “safe-haven” bid.

Bitcoin is observed by its proponents and lots of investors like a secure option to fiat currency, which isn’t considered as 100% safe stored in a bank because of the fractional reserve banking system.

If Q2 sees a resurfacing of bank crisis concerns, this will underpin the Bitcoin cost, even when a positive response from policymakers is constantly on the have a lid on things and battle a complete-blow economic crisis.

Will the Given Keep Tightening and may This Derail the Bitcoin Bulls?

Under 30 days ago, US money markets participants were prices inside a strong likelihood the US Fed lifts rates of interest close to or over 5.5% through the finish of Q2.

In wake from the emergence of bank crisis concerns, individuals tightening expectations have experienced an enormous drop.

Alongside safe-haven interest in hard currency, easing tightening bets continues to be an essential tailwind for Bitcoin, which has a tendency to perform better when financial conditions ease.

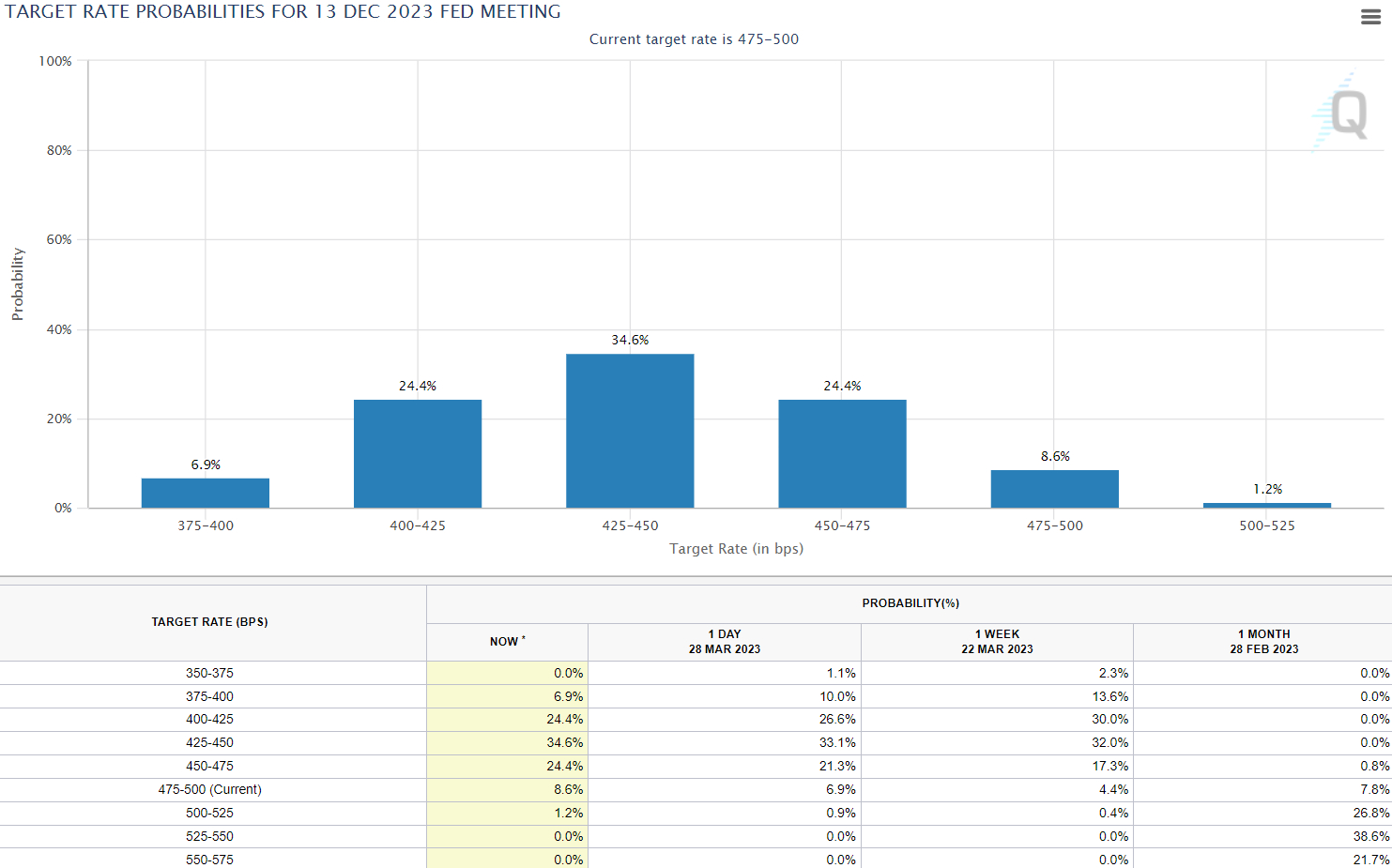

Based on the CME’s Given Watch Tool, which supplies implied odds regarding in which the Fed’s rate of interest may be later on according to money market prices, the Fed’s tightening cycle has become probably over.

In addition to this, a hostile tightening cycle has become being priced in, with money market’s betting rates will drop towards the low-4.% area by December, versus expectations 30 days ago that rates would be within the mid-5.% area.

The Given a week ago lifted rates of interest by 25 bps to some 4.75-5.% range.

The narrative driving the aggressive repricing seems to become that 1) further tightening would boost the risk the bank crisis worsens and a pair of) the US will probably enter an economic depression later this season as banks withdraw on lending and concentrate on strengthening their balance sheets.

These two are noticed as strongly deflationary, and therefore markets have the symptoms of arrived at the final outcome that US inflation (which remains well over the Fed’s target) will drop quickly later this season, giving the Given room to chop rates of interest.

While money markets could be to bet with an aggressive incoming rate-cutting cycle, there’s no guarantee things go lower by doing this.

Various inflation metrics surprised towards the upside in Q1 2023 and also the US economy, particularly its labor market, remains remarkably resilient.

In the event that continues to be the situation in Q2, money markets might have to pare their bets on Given rate of interest cuts.

That may be a headwind for Bitcoin and also the broader crypto market.

On the other hand, when the lagged results of 2022’s aggressive tightening finally begin to lead to labor market weakness and inflation resumes its downward trend, this might further feed into rate-cut bets, adding further fuel towards the Bitcoin bull market.

US Crypto Attack Broadens as SEC and CFTC Fight For Regulatory Authority

Crypto regulation in america (and elsewhere) might be a answer to cost action in Q2. In america, regulatory agencies such as the US Registration (SEC) and Commodity Futures and Buying and selling Commission (CFTC) happen to be pursuing major centralized crypto players.

A week ago the SEC issued a Wells Notice to Coinbase warning the crypto exchange that it’s facing a suit over 1) its various staking programs (that the SEC thinks about as unregistered securities) and a pair of) its report on tokens, most of which the SEC considered to become securities, meaning Coinbase would then be an unregistered securities exchange.

Elsewhere, the SEC’s ongoing suit versus Ripple, the creator of XRP and also the XRP Ledger, will come to some mind next quarter – XRP continues to be rallying lately on optimism the SEC will forfeit its bid to label XRP being an unregistered security from Ripple.

Meanwhile, the CFTC announced now that it’s pursuing Binance over operating under-the-table being an unregistered US digital commodity exchange and getting a sham AML/KYC compliance program.

Individuals are only a couple of from the greatest-profile cases, however they demonstrate how, in 2023, US government bodies are trying to find to depart their mark around the crypto market via regulation via enforcement.

The 2 cases also highlight a clash of visions between your SEC and CFTC. The previous has mentioned it views almost all cryptocurrencies as securities.

The second deems many as goods. Indeed, in the latest suit versus Binance, it named Bitcoin, Ether, Litecoin, Tether and Binance USD as goods.

The SEC has labeled Binance USD like a peace of mind in a suit against its issuer Paxos, and it has hinted it views other stablecoins and Ether as securities too.

The way the SEC versus CFTC Fight Could Impact Crypto/Bitcoin

Within the crypto space, it’s broadly considered positive when the CFTC’s point of view wins and broadly considered negative may be the SEC’s vision wins, because the latter means an infinitely more arduous regulatory regime, in addition to a mountain of potential fines and penalties for industry players over past discretions.

More particularly, when the SEC’s argument on most cryptocurrencies being securities gains ground, this is viewed as likely throttling the introduction of the crypto industry in america.

It might likely also create a big rise in barriers to purchase of crypto for all of us-based retail traders and institutions.

That might be a catastrophe for cryptocurrencies called a burglar, or vulnerable to being labeled. However the effect on Bitcoin is unclear.

Counterintuitively, it might benefit Bitcoin if there’s a considerable flight to haven inside the crypto space, with Bitcoin the only real cryptocurrency the SEC has outright stated it doesn’t view like a security.

Traders is going to be carefully monitoring a look and feel by SEC Chair Gary Gensler before Congress around the 19th of April for just about any more assistance with the SEC’s regulatory plans for that crypto sector.

Can the Asia Adoption Narrative Gain Further Ground?

Other regulation-related styles to watch range from the policy pivot being observed in Hong Kong.

The 2009 quarter, Hong Kong announced that it might be making sure blue-nick cryptocurrencies legal to trade once more, and announced a brand new licensing regime for crypto firms.

Crypto investors viewed this because the China government, who directs policy in Hong Kong, “testing the waters” for any potential reintroduction of crypto in China.

Crypto was banned outright in China in September 2021 and legalization, even of just a small amount of well-known cryptocurrencies, could spark huge investment inflows.

Further indications of China’s growing curiosity about coming back towards the global crypto market could thus give a strong tailwind to Bitcoin within the coming quarter as traders front-run expected Chinese inflows.

Meanwhile, another regulatory story to look at may be the progress of regulation within the United kingdom and Europe. The United kingdom has mentioned a wish to become major global crypto hub, while lawmakers within the EU and presently debating the bloc’s Markets in Crypto Assets (MiCA) bill.