Bitcoin (BTC) crashed below $16,000 on November. 9, driving the cost to the cheapest level in 2 years. The 2-day correction totaled a 27% downtrend and easily wiped out $352 million price of leverage lengthy (buy) futures contracts.

Up to now, Bitcoin cost is lower 65% for 2022, but it’s important to compare its cost action from the world’s greatest tech companies. For example, Meta Platforms (META) is lower 70% year-to-date, and Snap Corporation. (SNAP) has dropped 80%. In addition, Cloudflare (Internet) lost 71% in 2022, adopted by Roblox Corporation (RBLX), lower 70%.

Inflationary pressure and anxiety about a worldwide recession have driven investors from riskier assets. This protective movement is responsible for the U.S. Treasuries’ five-year yield to achieve 4.33% earlier in November, its greatest level in fifteen years. Investors have to have a greater premium to carry government debt, signaling too little confidence within the Federal Reserve’s capability to curb inflation.

Contagion risks from FTX and Alameda Research’s insolvency would be the most pressing issues. The buying and selling group managed multiple cryptocurrency project funds called the second-largest buying and selling exchange for Bitcoin derivatives.

Bulls were excessively positive and can suffer the effects

Outdoors interest for that November. 11 options expiry is $710 million, however the actual figure is going to be lower since bulls were ill-ready for prices below $19,000. These traders were overconfident after Bitcoin sustained above $20,000 for nearly two days.

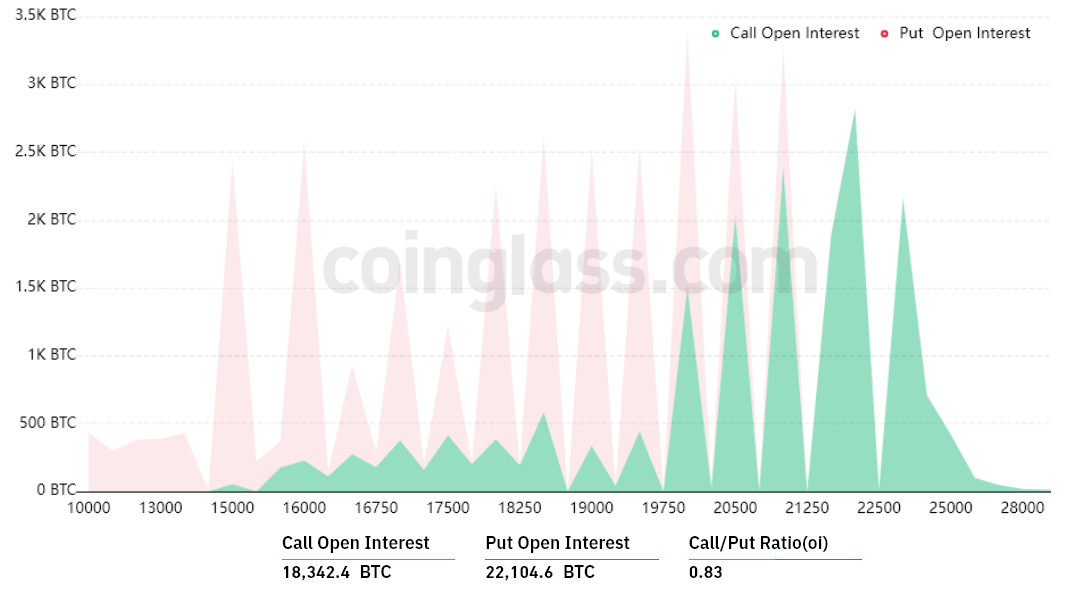

The .83 call-to-put ratio reflects the imbalance between your $320 million call (buy) open interest and also the $390 million put (sell) options. Presently, Bitcoin stands near $17,500, meaning most bullish bets will probably become useless.

If Bitcoin’s cost remains below $18,000 at 8:00 am UTC on November. 11, only $45 million price of these call (buy) options is going to be available. This difference is really because the authority to buy Bitcoin at $18,000 or $19,000 is useless if BTC trades below that much cla on expiry.

Bears strive for sub-$17k to have a $200 million profit

Here are the 3 probably scenarios in line with the current cost action. The amount of options contracts on November. 11 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $16,000 and $18,000: 1,300 calls versus. 12,900 puts. Bears dominate, profiting $200 million.

- Between $18,000 and $19,000: 2,500 calls versus. 10,200 puts. The internet result favors the put (bear) instruments by $140 million.

- Between $19,000 and $20,000: 3,600 calls versus. 5,900 puts. The internet result favors the put (bear) instruments by $40 million.

This crude estimate views the phone call options utilized in bullish bets and also the put options solely in neutral-to-bearish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a phone call option, effectively gaining negative contact with Bitcoin over a specific cost but, regrettably, there is no good way to estimate this effect.

Related: Grayscale Bitcoin Trust records a 41% discount among FTX meltdown

Bulls most likely tight on margin to aid the cost

Bitcoin bulls have to push the cost above $19,000 on November. 11 to prevent a possible $140 million loss. However, the bears’ best-situation scenario needs a slight push below $17,000 to maximise their gains.

Bitcoin bulls just had $352 million leverage lengthy positions liquidated in 2 days, so that they may have less margin needed to aid the cost. Quite simply, bears possess a jump to pin BTC below $17,000 in front of the weekly options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.