Outflows from investment funds supported by Bitcoin (BTC) rose dramatically a week ago, despite an enormous rise in the place cost from the cryptocurrency.

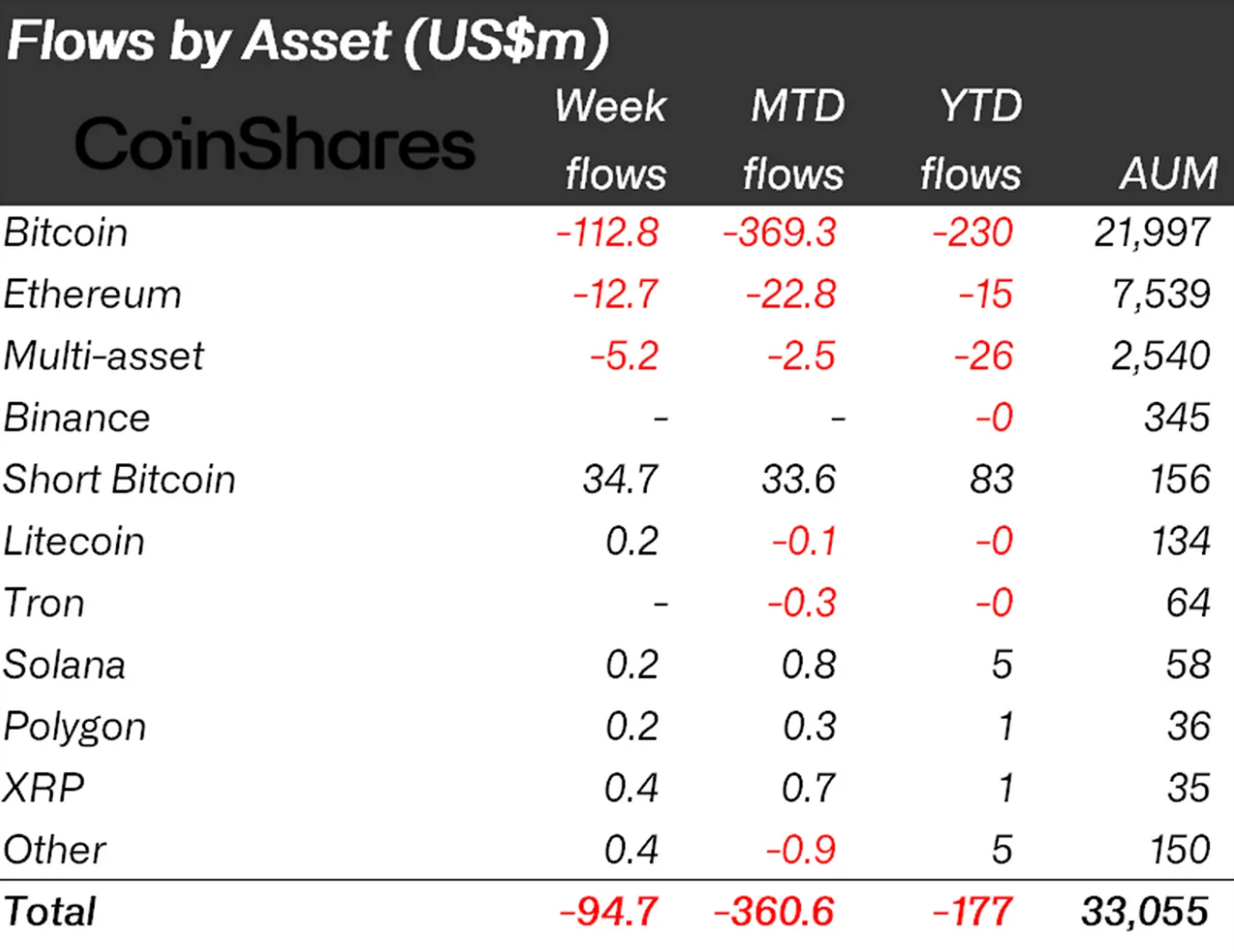

The outflows from bitcoin funds for that week arrived at $112.8 million, marking slightly improved investor sentiment when compared to week before when $243.5 million left BTC-backed funds, based on new report from CoinShares.

Interestingly, the outflows from bitcoin funds happened as short-bitcoin funds – funds which make money when bitcoin prices fall – saw record inflows of $35 million for that week.

Meanwhile, funds supported by Ethereum’s native token ETH saw outflows of $12.seven million a week ago, a small worsening in the $11 million of outflows seen a few days before.

As a whole for that digital asset space, the internet outflows arrived at $95 million, helped by inflows in to the pointed out short-bitcoin funds and money supported by other altcoins, including Litecoin (LTC), Solana (SOL), Polygon (MATIC) and XRP.

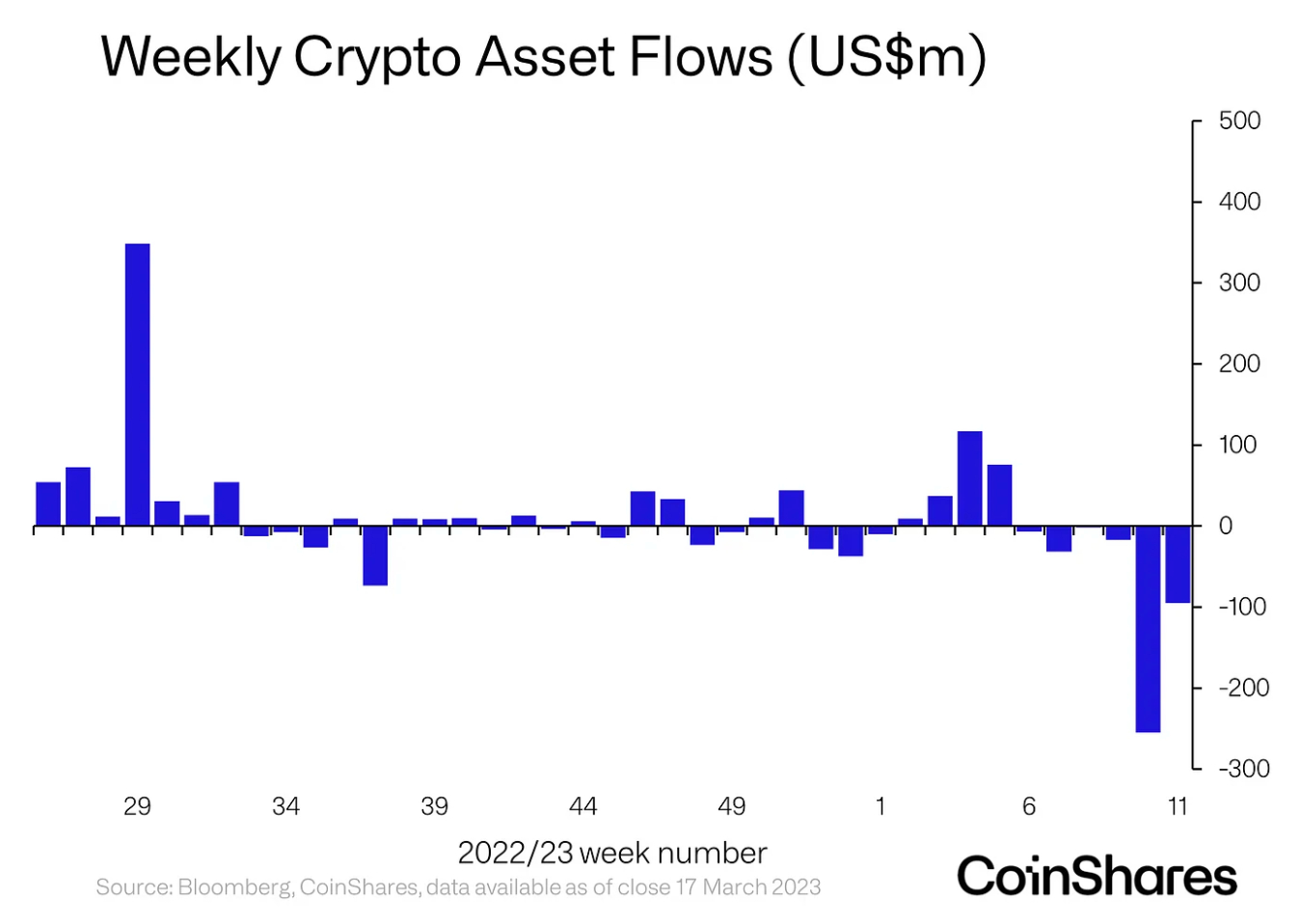

A few days marked the sixth consecutive week of outflows from both bitcoin funds particularly and from crypto funds more broadly.

Explaining the outflows, which was in sharp contrast towards the generally bullish sentiment within the crypto market, CoinShares recommended that could be as a result of requirement for liquidity by large market players.

“It is apparent this sentiment is contrarian in accordance with all of those other crypto market, but it might be driven, partly, by the requirement for liquidity in this banking crisis, an identical situation was seen once the COVID panic first hit in March 2020,” the report stated.

It added that inflows into altcoin-backed funds gives “further credence to the concept the output within the bigger crypto assets was driven by the requirement for liquidity.”

The place Vitcoin cost rose with a respectable 27% a week ago, ending a few days in a cost of $27,973.