Bitcoin (BTC) cost continues to be stuck inside a falling wedge pattern within the last two several weeks and during this period it’s tested the $37,600 support on multiple instances.

Contributing to this “bearish” cost action, BTC is lower 16% year-to-date, that is using the Russell 2000s performance.

The actual driver of Bitcoin’s current cost action is investors’ concerns about worsening macroeconomic conditions. Professional investors are involved concerning the impact from the U.S. Federal Reserve’s tightening economic policies as well as on May 3, millionaire hedge fund manager Paul Tudor Johnson stated the atmosphere for investors is worse than ever before since the financial authority is raising rates of interest when financial the weather is already worsening.

On May 4, CNBC reported the Eu implemented new sanctions to phase out Russian oil imports within six several weeks and European Commission President Ursula von der Leyen stated, “This is an entire import ban on all Russian oil, seaborne and pipeline, crude and delicate.”

Therefore, traders are more and more worried about the possibility impact of the global macroeconomic crisis on cryptocurrency markets. If global economies enter an economic depression, investors will seek protection by leaving risk-on asset classes like Bitcoin.

Bulls didn’t expect prices below $40,000

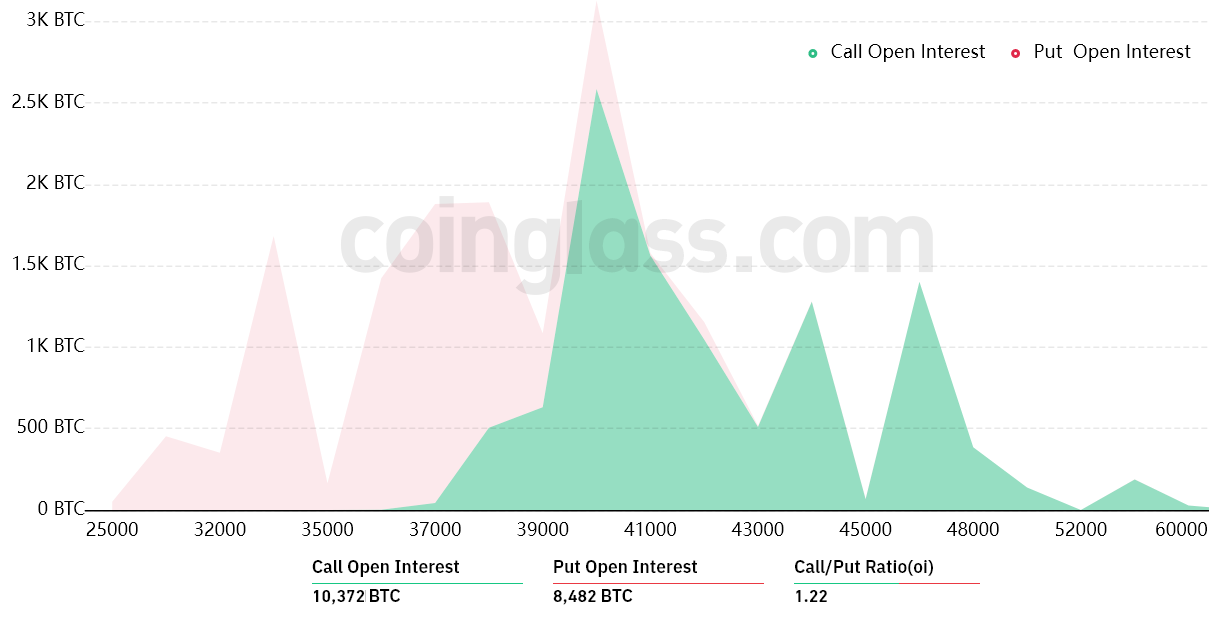

Outdoors interest for that May 6 options expiry in Bitcoin is $735 million, however the actual figure is going to be lower since bulls were caught unexpectedly as BTC moved below $40,000.

The Fir.22 call-to-put ratio reflects the $405 million call (buy) open interest from the $330 million put (sell) options. Nonetheless, as Bitcoin stands near $39,000, 89% from the bullish bets will probably become useless.

Meanwhile, if Bitcoin’s cost remains below $39,000 on May 6, bears may have $100 million price of these put (sell) possibilities. This difference is really because there’s no use within the right to market Bitcoin at $36,000 whether it trades above that much cla on expiry.

Related: BTC cost gains 4% pre-Given as MicroStrategy vows to safeguard Bitcoin from $21K crash

Bears can secure a $145 million profit on Friday

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on May 6 for call (buy) and set (sell) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $37,000 and $39,000: 500 calls (buy) versus. 4,300 puts (sell). The internet result favors bears by $145 million.

- Between $39,000 and $40,000: 1,200 calls (buy) versus. 2,500 puts (sell). Bears possess a $50 million advantage.

- Between $40,000 and $41,000: 3,800 calls (buy) versus. 1,100 puts (sell). The internet result favors bulls by $105 million.

- Between $41,000 and $42,000: 5,300 calls (buy) versus. 700 puts (sell). Bulls grow their gains to $190 million.

This crude estimate views the phone call options utilized in bullish bets and also the put options solely in neutral-to-bearish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a phone call option, effectively gaining negative contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

Bitcoin bears have to sustain the cost below $39,000 on May 6 to have a $145 million profit. However, bulls can avoid a loss of revenue by pushing BTC above $40,000, enough to internet them $100 million in gains. Thinking about the bearish macroeconomic conditions, bears appear better positioned for May 6’s expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.