Bitcoin (BTC) has become beyond ever from the target cost based on the Stock-to-Flow (S2F) model.

The latest data implies that BTC/USD has deviated from planned cost growth for an extent never witnessed before.

Stock-to-Flow sets harsh new record

With BTC cost suppression ongoing considering the FTX scandal, a previously bearish trend only has strengthened.

It has implications for a lot of core facets of the Bitcoin network, particularly miners, however, many of their best-known metrics will also be feeling heat.

Included in this is S2F, that is seeing its cost forecasts belong to growing strain — and critique.

Enjoying great recognition until Bitcoin’s last all-time full of November 2021, the model uses block subsidy halving occasions because the central aspect in plotting exponential cost growth over time.

S2F enables for significant cost deviations and isn’t “up only” — but comprising these, current targets are far greater than place cost.

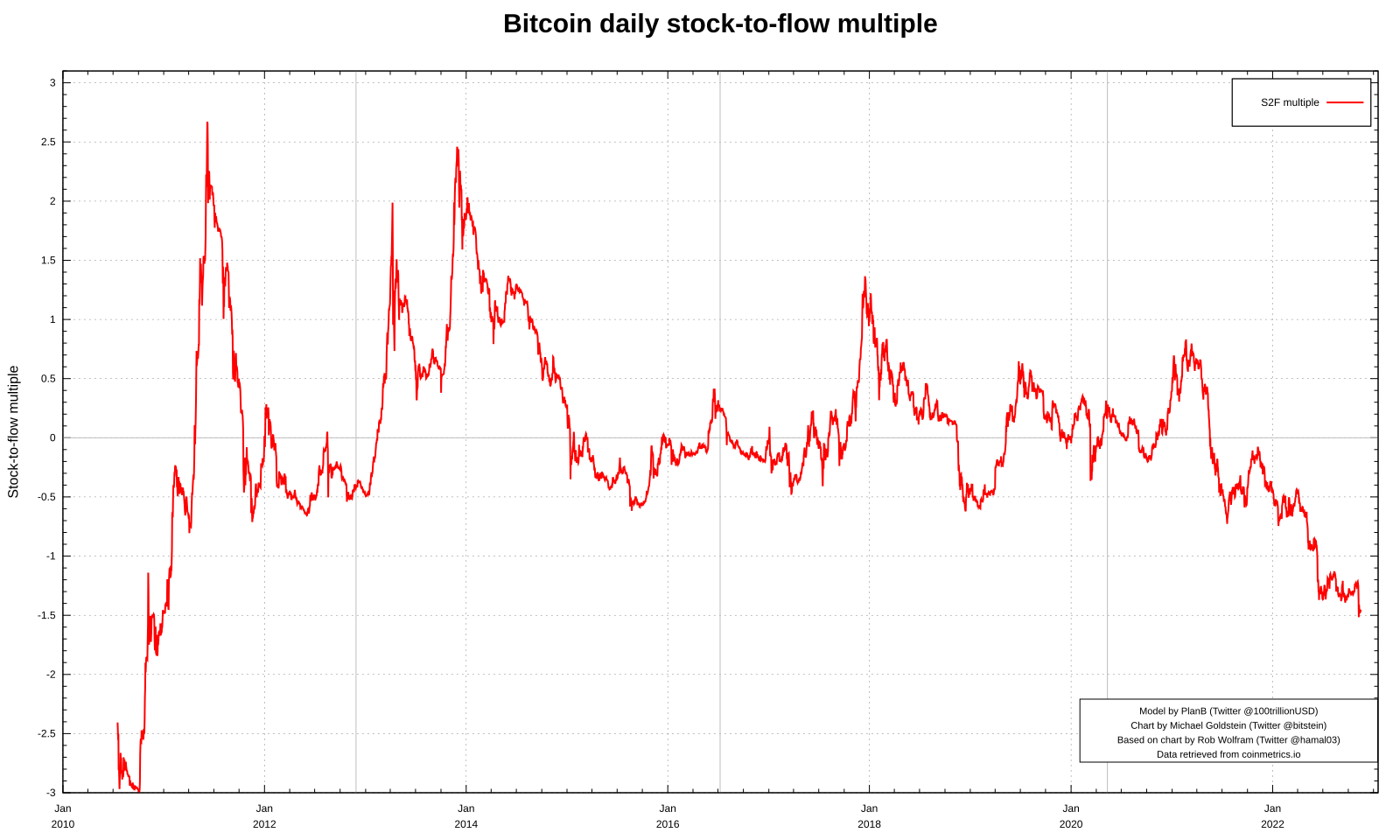

Based on dedicated monitoring resource S2F Multiple, Bitcoin should trade just over $72,000 on November. 19, giving a multiple of -1.47.

On November. 10, the multiple arrived at -1.5 — an archive negative studying in S2F’s lifetime — because the FTX impact hit the industry.

PlanB: “Seems like the earth has ended”

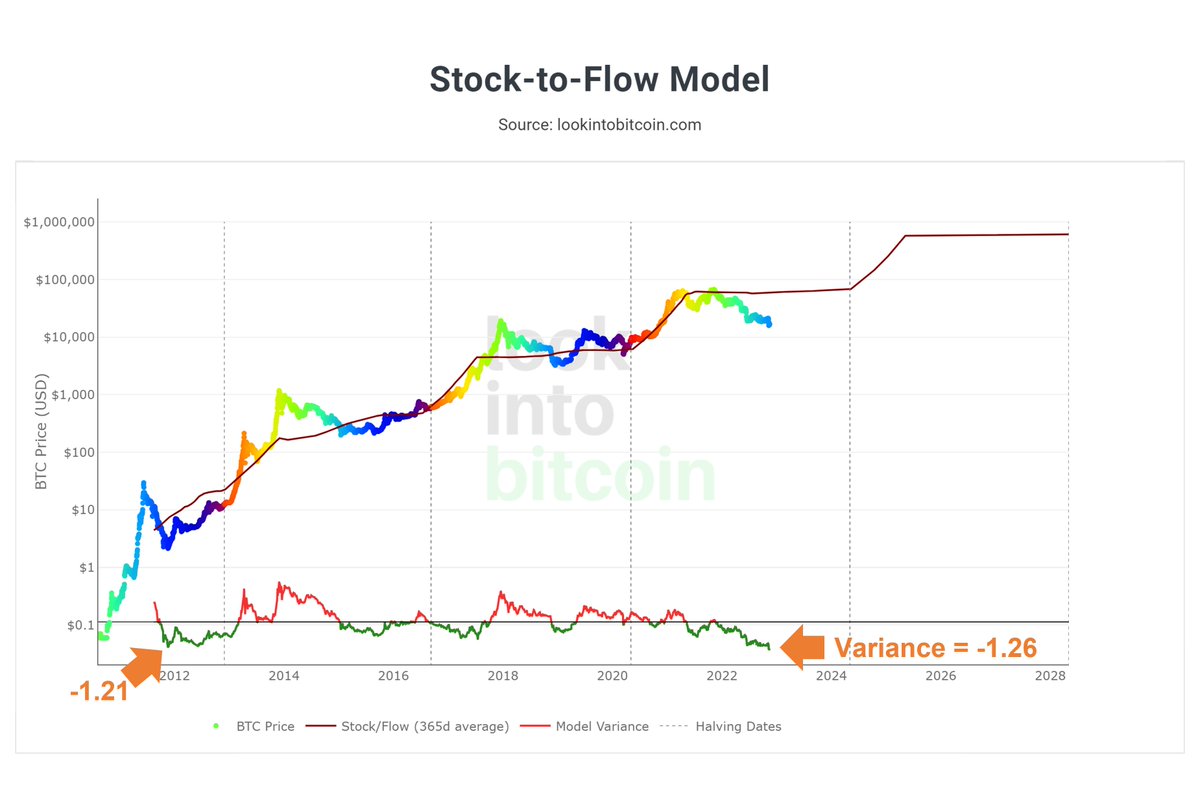

An alternate iteration of S2F model deviation from analytics platform LookIntoBitcoin created similar conclusions relating to this month’s cost action.

Related: Bitcoin cost can always drop 40% after FTX ‘Lehman moment’ — Analysis

“Price has strayed further underneath the S2F line than in the past,” its creator, Philip Quick, authored partly of the associated Twitter publish.

“Currently a variance of -1.26 versus. the prior all-time low of -1.21 in 2011.”

Nevertheless, PlanB, the pseudonymous analyst accountable for the creation — and today, defense — of S2F, remains awesome on its utility.

“It seems like the planet ended, but FTX will most likely be only a small blip around the lengthy term radar,” he contended in the own tweet.

PlanB has fielded more and more strong accusations within the model in 2022, these including claims that it is basis is fraudulent.

As a result of the growing deviation between target and place cost, he maintained that a comparatively wide selection for cost to do something within but still keep your model valid was still being more helpful than no insight whatsoever.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.