Bitcoin (BTC) remained greater in to the Sep. 10 weekly close as positive forecasts favored $23,000 next.

$23,000 targets stay in place

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD hitting $21,730 on Bitstamp overnight — probably the most since August. 26.

The happy couple were able to conserve its prior gains despite low-volume weekend buying and selling conditions being likely to amplify any weakness.

Among analysts, excitement was palpable entering the brand new week, the one that should prove pivotal for brief-term crypto cost action.

The Ethereum (ETH) Merge and fresh U . s . States inflation data were the very best catalysts likely to influence the marketplace.

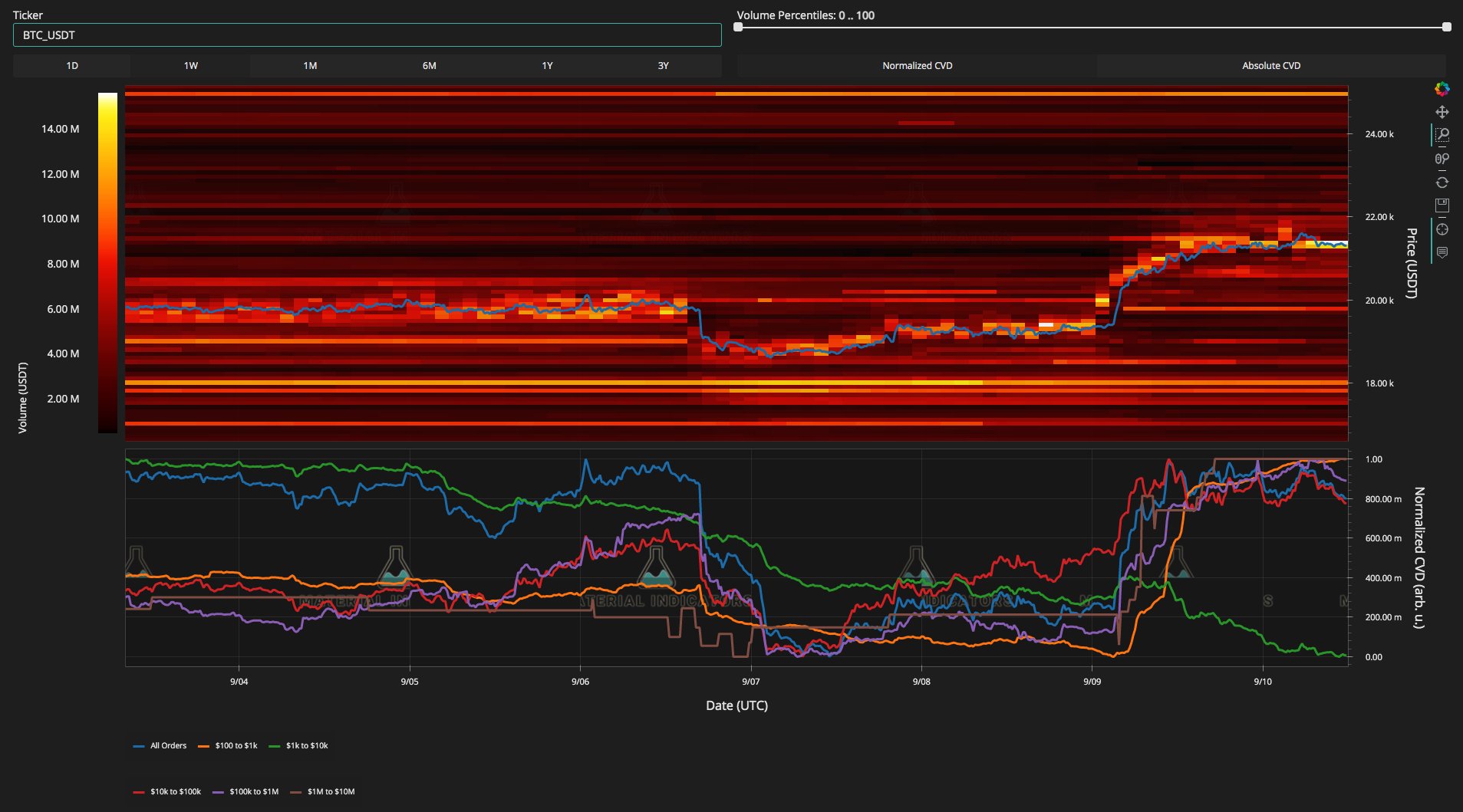

“Expect volatility to get around next week’s economic data,” on-chain monitoring resource Material Indicators authored partly of the tweet over the past weekend.

“In the meantime, remember…This can be a rally. If you do not take profit on the way, you risk passing on all back.”

An associated chart demonstrated the Binance BTC/USD order book supplying solid resistance near $21,500, a zone which bulls subsequently made an appearance to beat.

For popular account Il Capo of Crypto, meanwhile, there is room for further upside.

Short squeeze isn’t over. 22500-23000 ought to be next.

— il Capo Of Crypto (@CryptoCapo_) September 11, 2022

He added, however, there would be a “90% chance” that BTC cost action would go back under $20,000 later on.

$23,200 seemed to be a target for trader CJ, who eyed various short-term levels for clues regarding lengthy and short entry positions.

– Sweep equal highs at 21.9k and shut back below This summer mid and I will be searching for any short individuals monthly open.

– Reclaim the mid or hold as support so we likely visit a fast transfer to 23.2k pic.twitter.com/xv9oarffsA

— CJ (@IrnCrypt) September 10, 2022

“Septembears” have a beating

The weekly close thus looked set to become a three-week high, Bitcoin already buying and selling above closing prices in the other half of August.

Related: Bitcoin analyst who known as 2018 bottom warns ‘bad winter’ could see $10K BTC

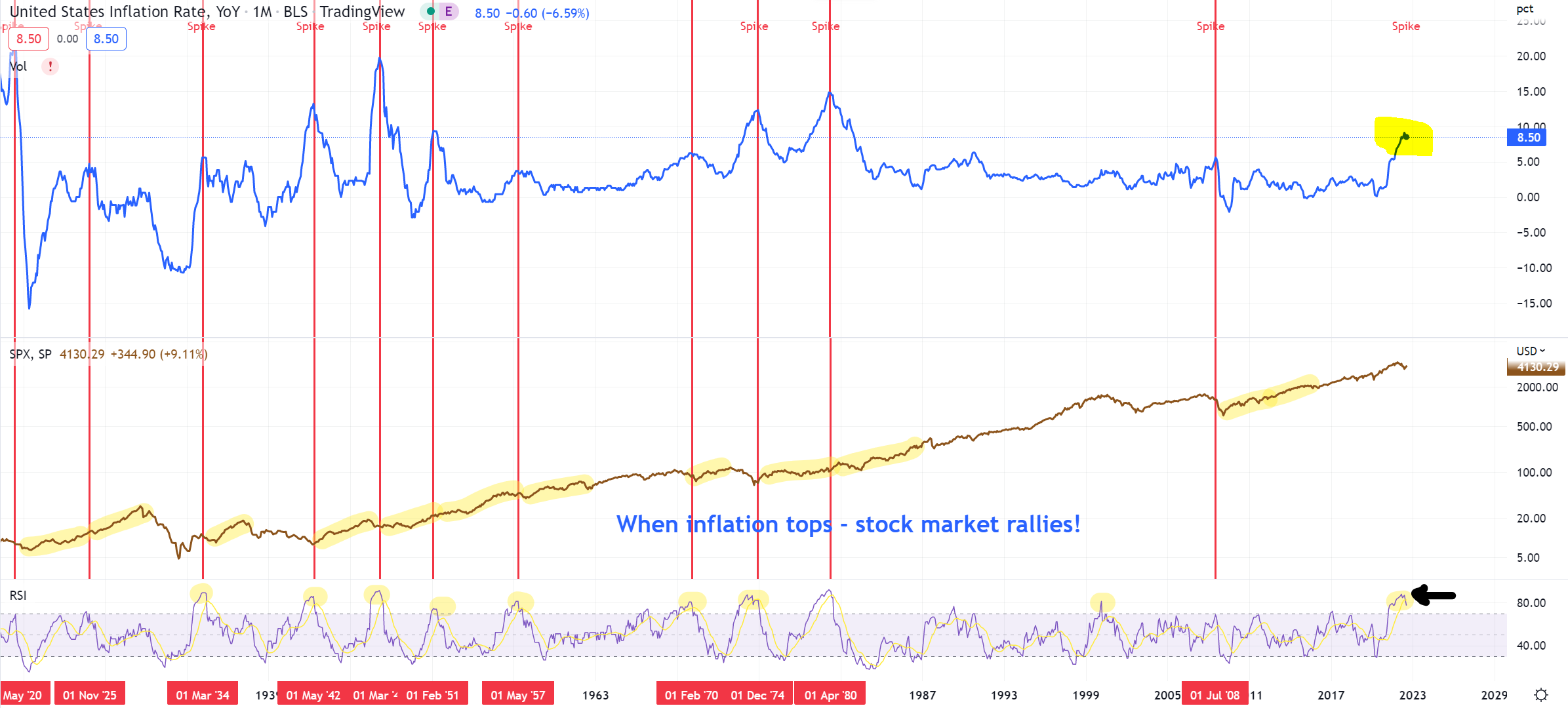

On macro, hopes that the sustained risk asset rally would ensue grew to become more vocal, with analyst Hernik Zeberg particularly confident.

“Each time Inflation tops — Stock exchange rallies! Each Time! And RSI (momentum) — is within turning area,” he contended at the time.

“US CPI being released on Tuesday. This time around won’t be different!”

This summer CPI data demonstrated the U.S. might have already seen peak inflation.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.