Bitcoin short-sellers took a battering previously 2 days. That’s based on data presented by crypto derivative analytics website coinglass.com, which shows liquidations in a nutshell Bitcoin future positions worth around $100 million across major exchanges in the last two sessions, where Bitcoin has acquired a remarkable 8.5%.

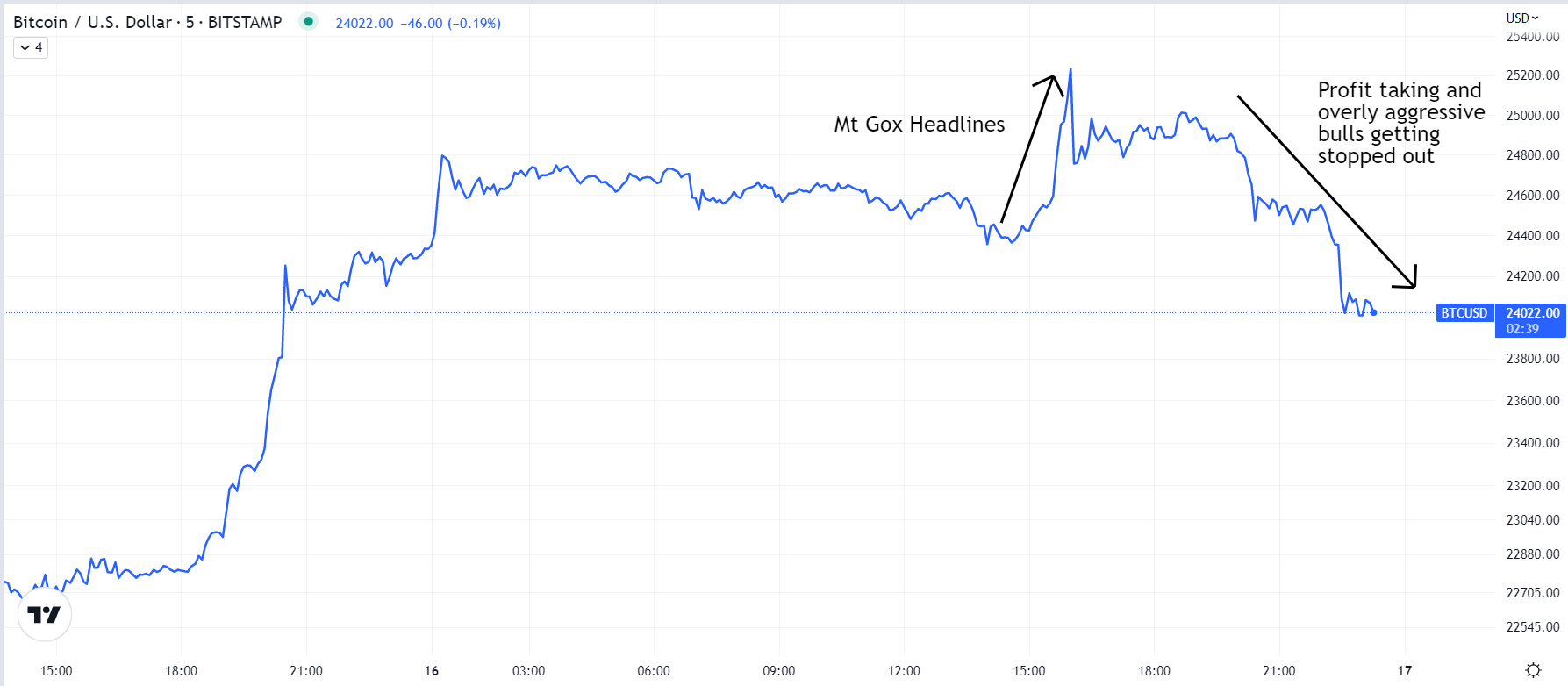

At current levels within the $24,100 region, Bitcoin is buying and selling just below 13% above earlier monthly lows within the low $21,000s. Bearish calls a week ago for Bitcoin to fall back for the $20,000 level ultimately demonstrated wrong, with Bitcoin rather managing to notch a brand new high since June 2022 on Thursday at $25,270. News that two largest Mt Gox creditors will get many of their payout in BTC, instead of fiat, helped spur Thursday’s spike.

Mt Gox was among the earliest Bitcoin exchanges, but lost the majority of its funds as a result of hack in 2014 that caused the exchange to fold, with creditors involved in extended asset recovery proceedings since. The Mt Gox-fuelled intra-day rally was, however, short-resided and appears to possess trapped some short-term bullish speculators betting on the push towards the upper $25,000s, as evidenced with a spike in lengthy position liquidations on Thursday.

Based on coinglass.com, lengthy positions worth around $35 million happen to be liquidated on Thursday, following lengthy position liquidations of just around $5 million on Wednesday. Profit-consuming wake from the recent rally along with a stop-operate on individuals who’d become excessively aggressive chasing the upside could send Bitcoin back below $24,000.

Bulls Stay in Control within the Near-Term

However the recent resurgence from earlier weekly lows implies that Bitcoin continues to be up around 45% this season, despite getting now retracted around 5.% from earlier session highs. Bulls stay in the driving seat, regardless of the rally in recent days in america dollar and US bond yields on expectations for further rate of interest hikes in the Given this season in wake of the string of great importance and more powerful/hotter-than-expected major US data releases.

Some analysts say that Bitcoin has performed very well in 2023 since it got so oversold this past year in wake from the collapse of FTX. Others state that Bitcoin does mainly because, although more Given rate of interest hikes are anticipated, the finish from the hiking cycle along with a better macro atmosphere is within sight. Others indicate various technical and on-chain metrics, for example Bitcoins recent rally above its 200DMA and Recognized Cost, improving network activity, improving Bitcoin market profitability and “weak hand” seller exhaustion as all suggestive the worst from the 2022 bear marketplace is now behind us.

Upside Cost Risks Remains Despite Incoming Macro Risks

Traders is going to be monitoring the discharge people flash Services PMI data, GDP figures and Core PCE inflation data, along with the minutes from the Fed’s latest meeting in a few days, with macro traders monitoring the outlook for all of us growth, inflation and financial policy. But Bitcoin and also the broader crypto market continues to be remarkably resilient as to the would normally be construed as macro headwinds.

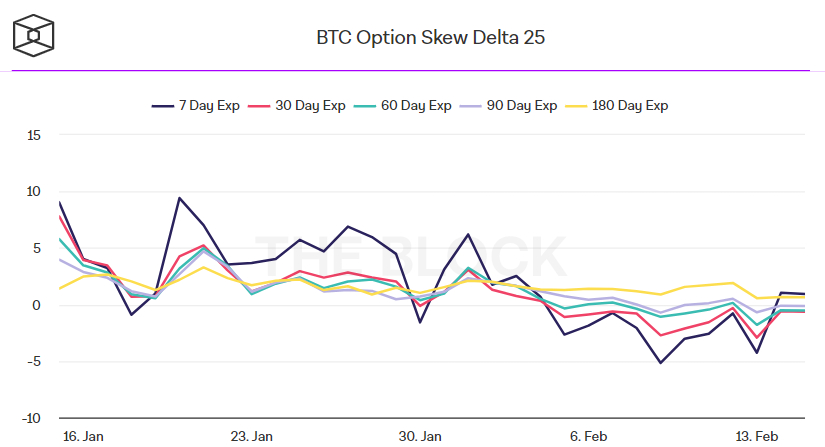

Cost risks may remain tilted for the upside for the short term, though, to be fair, this isn’t the content being sent by Bitcoin options markets. Based on the Block, the Bitcoin 25% delta skew of options expiring in 7, 30, 60, 90 and 180 days are presently around zero, suggesting investors are placing a roughly equal premium on particular put and call options.