Bitcoin (BTC) only needs yet another key on-chain signal for any classic bull sell to begin, analyst David Puell states.

Inside a tweet on 12 ,. 17, the Puell Multiple creator contended the stage is nearly looking for the finish from the BTC cost bear market.

Puell: Bitcoin network activity “underwhelming”

Despite many with new BTC/USD lows of $12,000 or fewer this cycle, not everybody is wholly bearish around the outlook for Bitcoin.

For Puell, two essential on-chain phenomena essential for BTC cost recovery happen to be in evidence.

Lengthy-term holders (LTHs) are fighting off the need to market despite Bitcoin being lower over 70% from the last all-time high.

Simultaneously, short-term “speculators” feel acute discomfort from recent cost action. As Cointelegraph reported, these “tourists” are most likely already mostly gone in the market.

Everything is missing, Puell believes, is a boost in network activity all participants.

“On-chain, three factors are essential for any bull: 1. Holding behavior from lengthy-term investors. 2. Painful losses from short-term speculators. 3. Network activity overall,” he summarized.

“Personally seeing 1 and a pair of. 3 continues to be underwhelming.”

He added that “favorable” macro conditions would aid the turnaround, in addition to crypto increasingly resilient to “contagion” by means of “exogenous and endogenous ‘swans.’”

BTC/USD traded around $16,700 during the time of writing, data from Cointelegraph Markets Pro and TradingView demonstrated.

A Bitcoin halving cycle like every other?

That perspective chimes with other people with calm over current BTC cost performance.

Related: Bitcoin targets $16.7K among fear BNB may ‘drag whole crypto market down’

Included in this is popular analytics account Dilution-proof, which at the time came focus on BTC/USD simply copying previous bear market behavior.

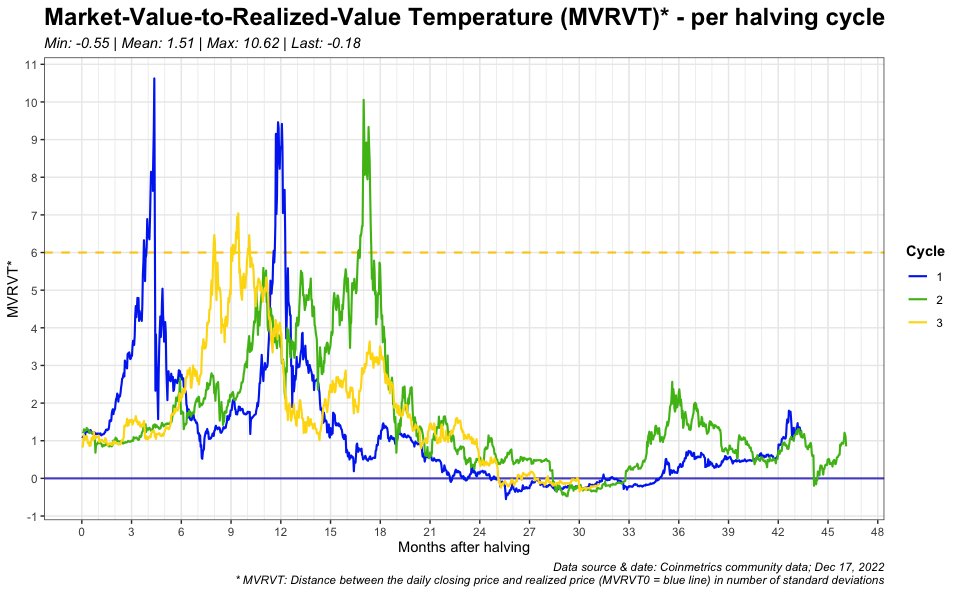

Evidence came by means of Bitcoin’s MVRV-z score — a manifestation of market cap to recognized cap in standard deviations. Dilution-proof initially known as the metric “Market-Value-to-Recognized-Value Temperature (MVRVT).”

Presently, associated charts demonstrated, signs indicate a vintage bear market bottom formation, Dilution-proof stating that Bitcoin “is just doing what it really does only at that publish-halving date literally every cycle.”

Cointelegraph formerly incorporated MVRV-z in a summary of “striking similarities” between 2022 and past cost cycles.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.