Bitcoin (BTC) rallied on the rear of the U . s . States Federal Reserve’s decision to hike rates of interest on This summer 27. Investors construed Fed chairman Jeremy Powell’s statement as increasing numbers of dovish compared to previous FOMC committee meeting, suggesting the worst moment of tight economic policies is behind us.

Another positive news for risk assets originated from the U.S. personal consumption expenses cost (PCE) index, which rose 6.8% in June. The move was the greatest since The month of january 1982, reducing incentives for fixed earnings investments. The Fed concentrates on the PCE because of its broader way of measuring inflation pressures, calculating the cost changes of products or services consumed by everyone.

Additional positive news originated from Amazon . com following the e-commerce giant reported that it is quarterly financial results beat the $119.5 billion believed revenue by 1.4%. Furthermore, Apple released its 2Q results on the day that, matching analyst revenue estimates, while presenting earnings 3.4% over the market consensus.

Top traders have elevated their bullish bets

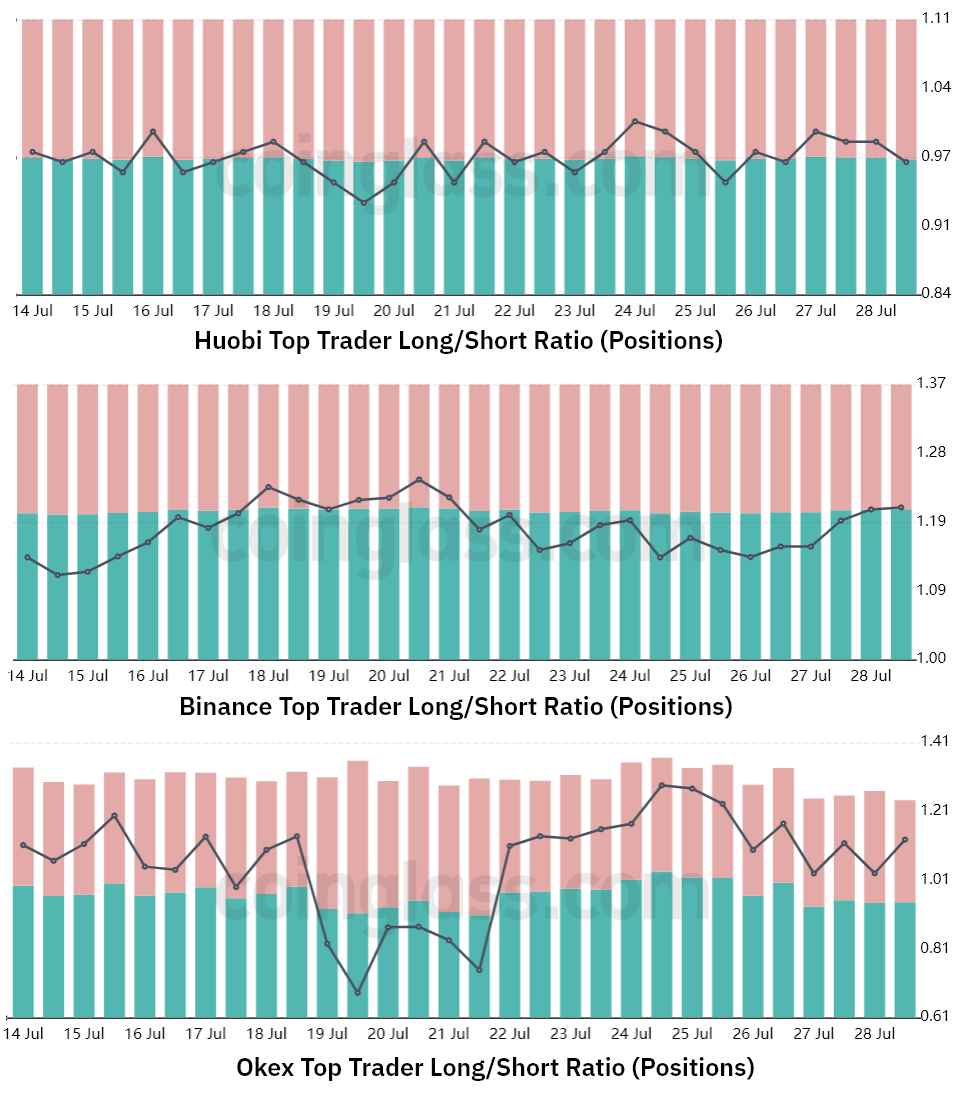

Exchange-provided data highlights traders’ lengthy-to-short internet positioning. By analyzing every client’s position around the place, perpetual and futures contracts, it’s possible to better understand whether professional traders are leaning bullish or bearish.

You will find periodic discrepancies within the methodologies between different exchanges, so viewers should monitor changes rather of absolute figures.

Despite Bitcoin’s 14% correction from This summer 20 to This summer 26, top traders on Binance, Huobi and OKEx have elevated their leverage longs. To become more precise, Binance was the only real exchange facing a modest decrease in the very best traders’ lengthy-to-short ratio, moving from 1.22 to at least one.20.

However, this impact was greater than compensated by OKEx traders growing their bullish bets from .66 to at least one.17 in six days. The lack of panic selling after Bitcoin unsuccessful to interrupt the $24,000 support on This summer 20 ought to be construed as bullish.

Had buyers used excessive leverage or distrustful of the potential upside, the cost movement might have caused much grea harm to the lengthy-to-short ratio.

Related: 3 Bitcoin buying and selling behaviors hint that BTC’s rebound to $24K is really a ‘fakeout’

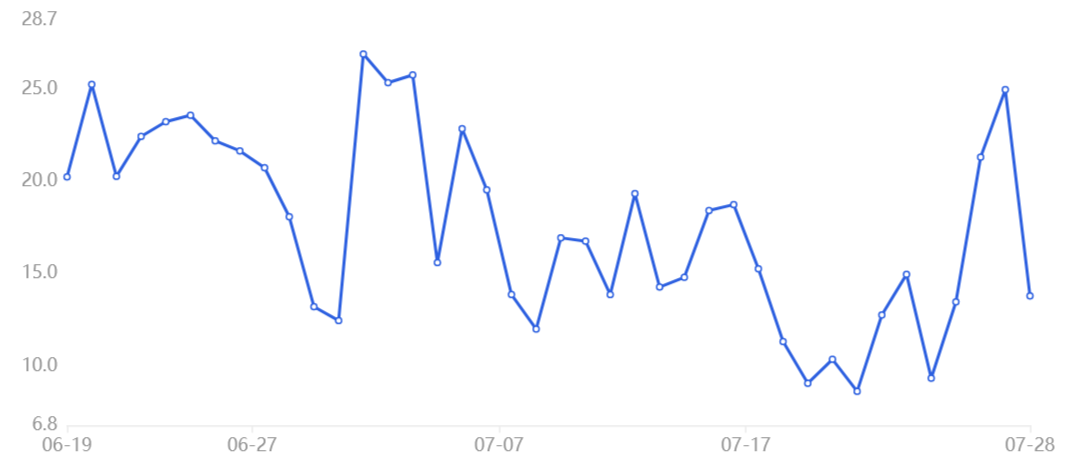

Margin traders are reluctant to put bearish bets

Margin buying and selling enables investors to gain access to cryptocurrency to leverage their buying and selling position, therefore growing the returns. For instance, it’s possible to buy Bitcoin by borrowing Tether (USDT), thus growing their crypto exposure. However, borrowing Bitcoin are only able to be employed to short it—betting around the cost decrease.

Unlike futures contracts, the total amount between margin longs and shorts isn’t always matched. Once the margin lending ratio is high, it signifies the marketplace is bullish—the opposite, a minimal lending ratio, signals the marketplace is bearish.

The chart above implies that investors’ morale bottomed on This summer 21 because the ratio arrived at its cheapest level in four several weeks at 8.6. From there forward, OKX traders presented less demand to gain access to Bitcoin, solely accustomed to bet around the cost downtrend. The ratio presently is 13.8, which leans bullish in absolute terms because it favors stablecoin borrowing with a wide margin.

Derivatives data shows no stress from pro traders even while Bitcoin traded below $21,000 on This summer 26. Unlike retail traders, these experienced whales know when you should keep their conviction which attitude was clearly reflected within the healthy derivatives data. The information shows that traders who expect a powerful market correction if Bitcoin does not break the $24,000 resistance is going to be disappointed.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.